Last week I posted a veritable PhD dissertation on the VXX (j/k) which, despite my efforts to spiff it up with my notorious teutonic humor, remained relatively unnoticed. With retail gobbling up put positions with both hands as usual, it appears the most important volatility event of the quarter once again has been largely ignored. Fortunately a handful of intrepid IV aficionados (a.k.a. option traders) managed to take full advantage of the situation.

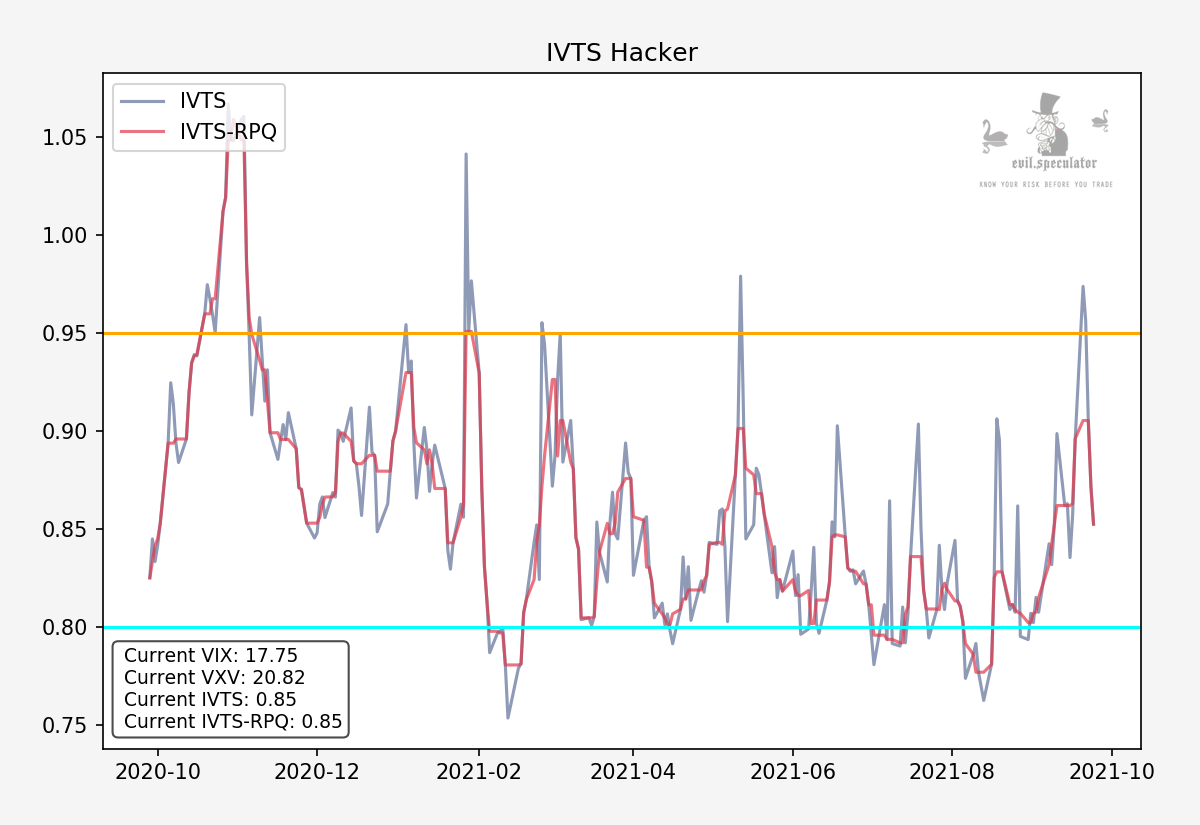

I’ve reported on the implied volatility term structure (IVTS) here in numerous occasions and if you’re a noob here then Google is your friend.

In a nutshell the IVTS tells us how short term volatility (30-days) measures up against medium term volatility (3-months). What we glean from this simple algebraic exercise is shown above on my IVTS Hacker graph which incidentally is available to all Evil Speculator and RPQ subscribers.

As a stationary series (meaning it does not follow a random walk pattern like stocks) the VIX as well as it’s lazy cousin the VIX3M have a tendency to mean revert. WHEN of course is the question and that’s where the IVTS comes in, among many other things I may add.

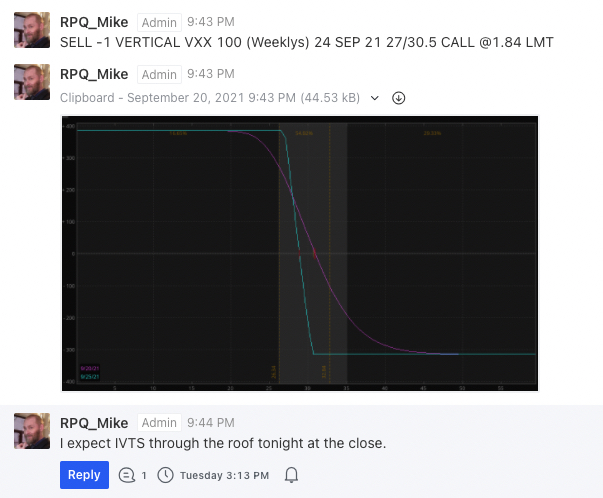

That spike above the 0.95 mark was a prime candidate which is why I sold an ITM VXX spread on Tuesday and posted my nefarious plan over in the RPQ trading floor.

As you can see from the profit graph the vertical collected $1.84 in premium, all of which we ended up keeping when both calls expired worthless after a sharp reversal in equities.

The moral of the story is two-fold:

- While price has proven to be largely unpredictable “we find that not only the S&P 500 implied volatility surface can be success- fully modeled, but also that its movements over time are highly predictable in a statistical sense.”

- All that dry theory about implied volatility continues to pay off in spades for us. So if you’re still trading as if it’s 1999 then you may want to consider joining us here on RPQ. Or keep losing money selling us naked puts – either way works for me.

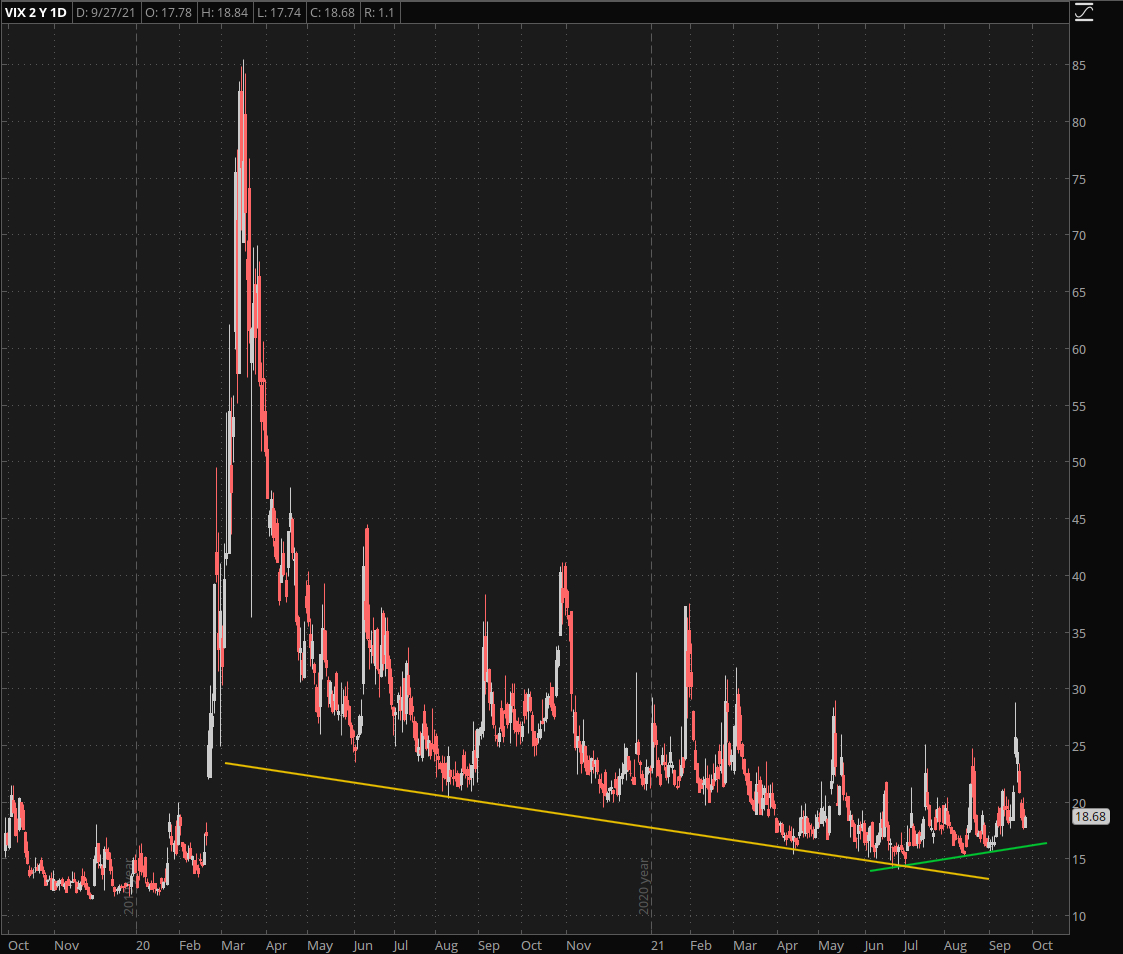

Now with the VIX having descended back to earth the question for the unfolding week is whether or not we’ll see further upside, given how quickly price snapped back after touching SPX 4306.

And in a nutshell I would very much caution you from jumping on the bullish bandwagon and here is why:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.