0DTE has become all the rage among retail traders for one simple reason: There’s a ton of money to be made if you happen to find yourself on the right side of the the trade.

For the uninitiated – 0DTE stands for 0 days until expiration – and it basically refers to an option contract which is on the brink of running out of time.

Meaning there are only a few hours or perhaps only minutes left until the contract’s time runs out and it either becomes worthless (90% of the time) or banks you a penny or more.

It’s a black and white equation and there are no ifs, no buts, and no exceptions.

Just the way I like it.

I just wish my wife would agree…

Anyway, I could go into detail here as to why trading 0DTE contracts can be extremely profitable and why it’s a losing proposition to most.

I leave that for another day, because before considering to adopt a particular trading style or system it’s important to understand why people trade this way and – most importantly – if that particular edge is going to hold up in the future.

Otherwise it would be like a holding a seminar on flipping low income sub-prime mortgage houses back in early 2008.

Sorry pal, but you’re a bit late to the party…

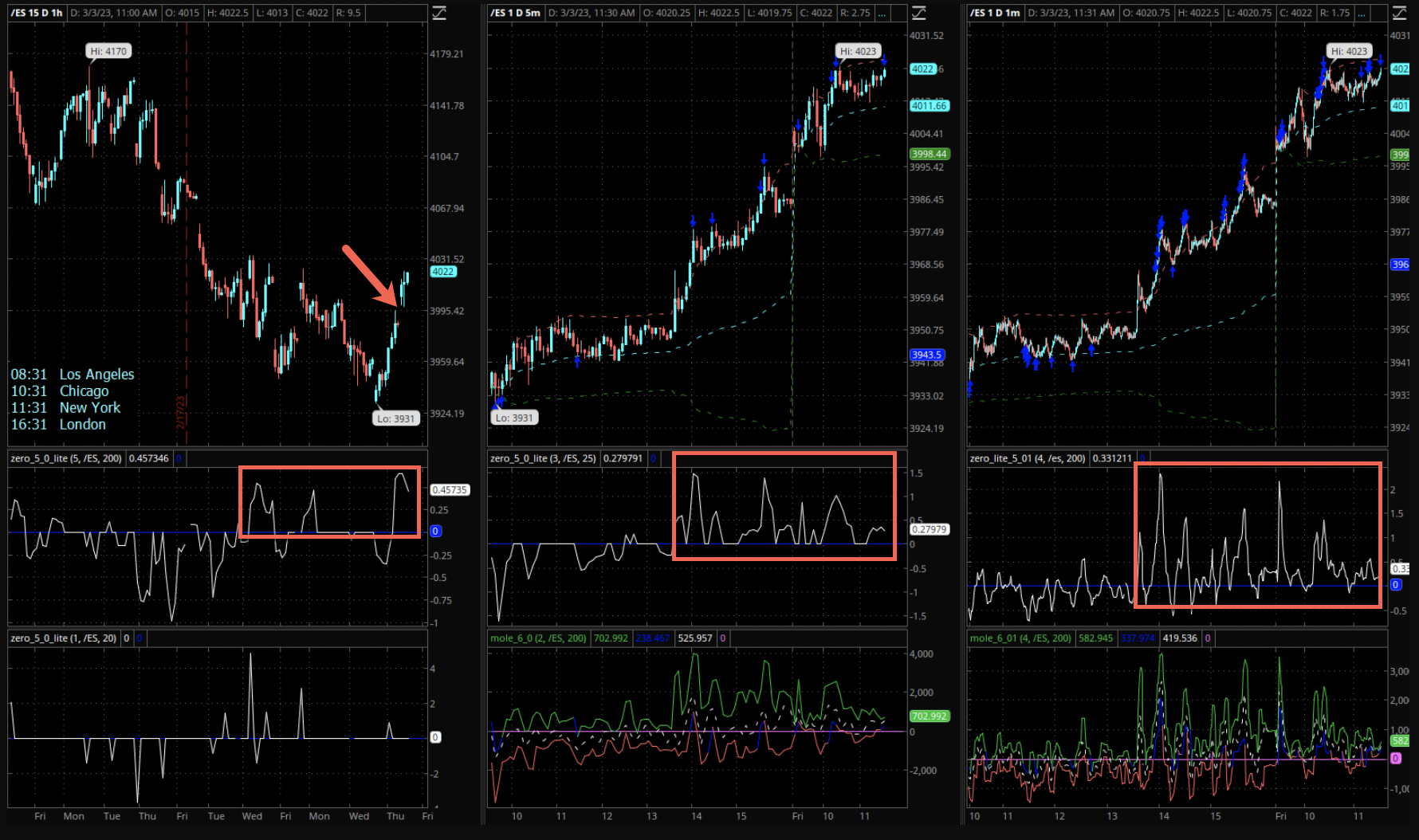

Now right here’s the reason why more and more traders have adopted trading 0DTE options into their trading arsenal. I took this snapshot of our Zero indicator during the Friday session and shared it with my crew.

You don’t need to be a charting expert to realize that momentum and participation on the E-Mini futures picked up significantly on Thursday and Friday.

We’ve seen this in the past but late day jumps in volatility are becoming increasingly common, up to the point where a lot of option traders are shifting their focus toward trading 0DTE contracts.

If you for example would have bought the March 3rd 400 or 402 call on Friday afternoon for a song then you would have made out like a bandit.

The reason for that is that 0DTE contracts act a lot more like mini futures than they act like options. For one there’s almost no extrinsic (time) value left to worry about and all that matters is an option’s intrinsic (real) value at the time of expiration.

Volatility also has only limited impact on a 0DTE option, and since most option traders have a very limited understanding of how IV works it simplifies matters even further.

In a way trading 0DTE options is similar to trading mini futures without having to put up significant margin, at least if you’re on the buying side.

Now if Trader Joe is buying a 0DTE option then who’s taking the other side of that trade?

The market maker of course and, believe me, those cats are the smartest and most nimble players in the room.

Which means they’re not selling you an option contract – that could possibly paint a 3-sigma or 4-sigma move within a single day – without hedging themselves by selling E-Mini futures.

Delta neutrality is a thing, you know. And unlike the modern Swiss any self respecting market maker takes this shit seriously.

What this does on a grand scale over millions of transaction is that it is funneling good old fashioned intra-week volatility into expiration day volatility.

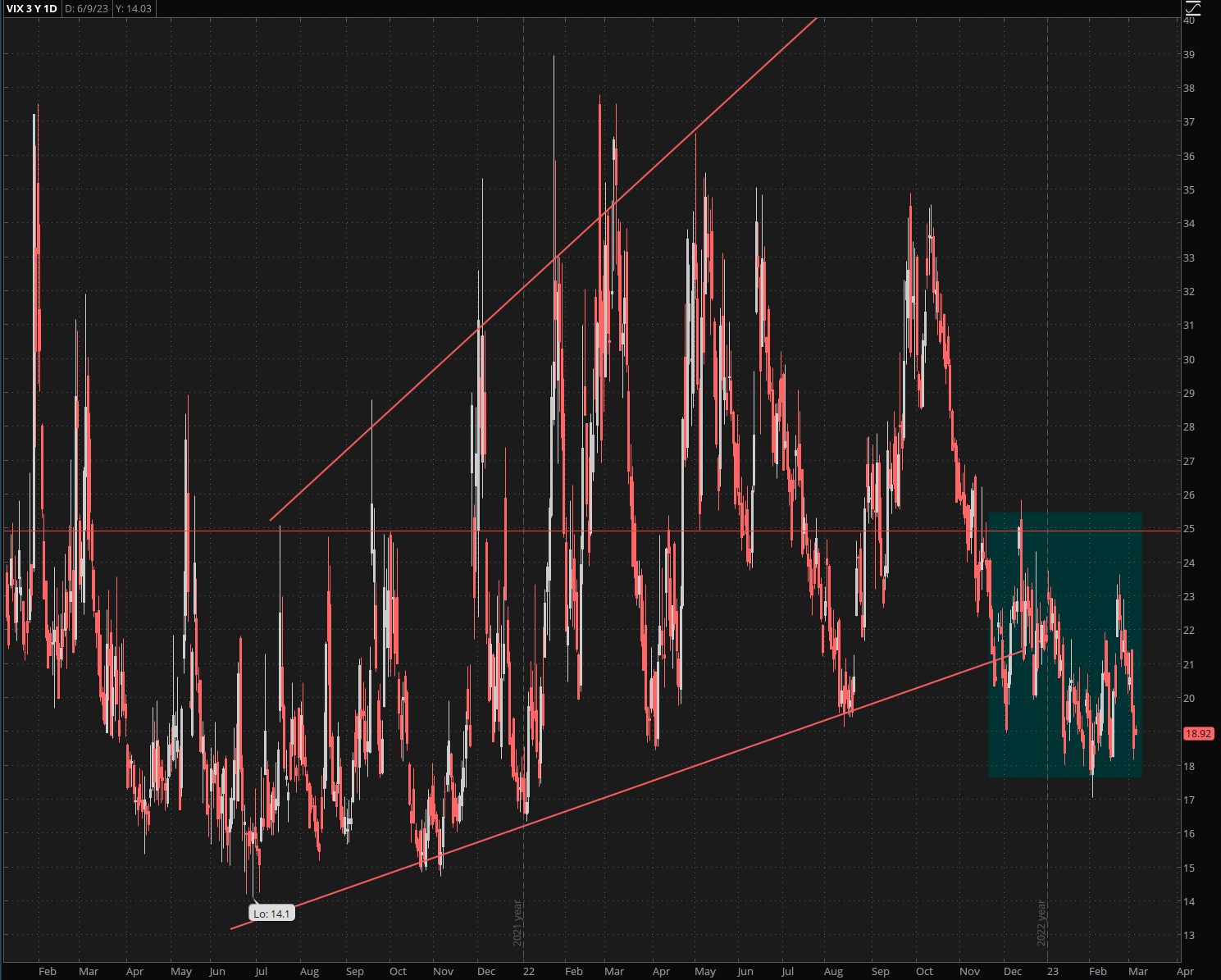

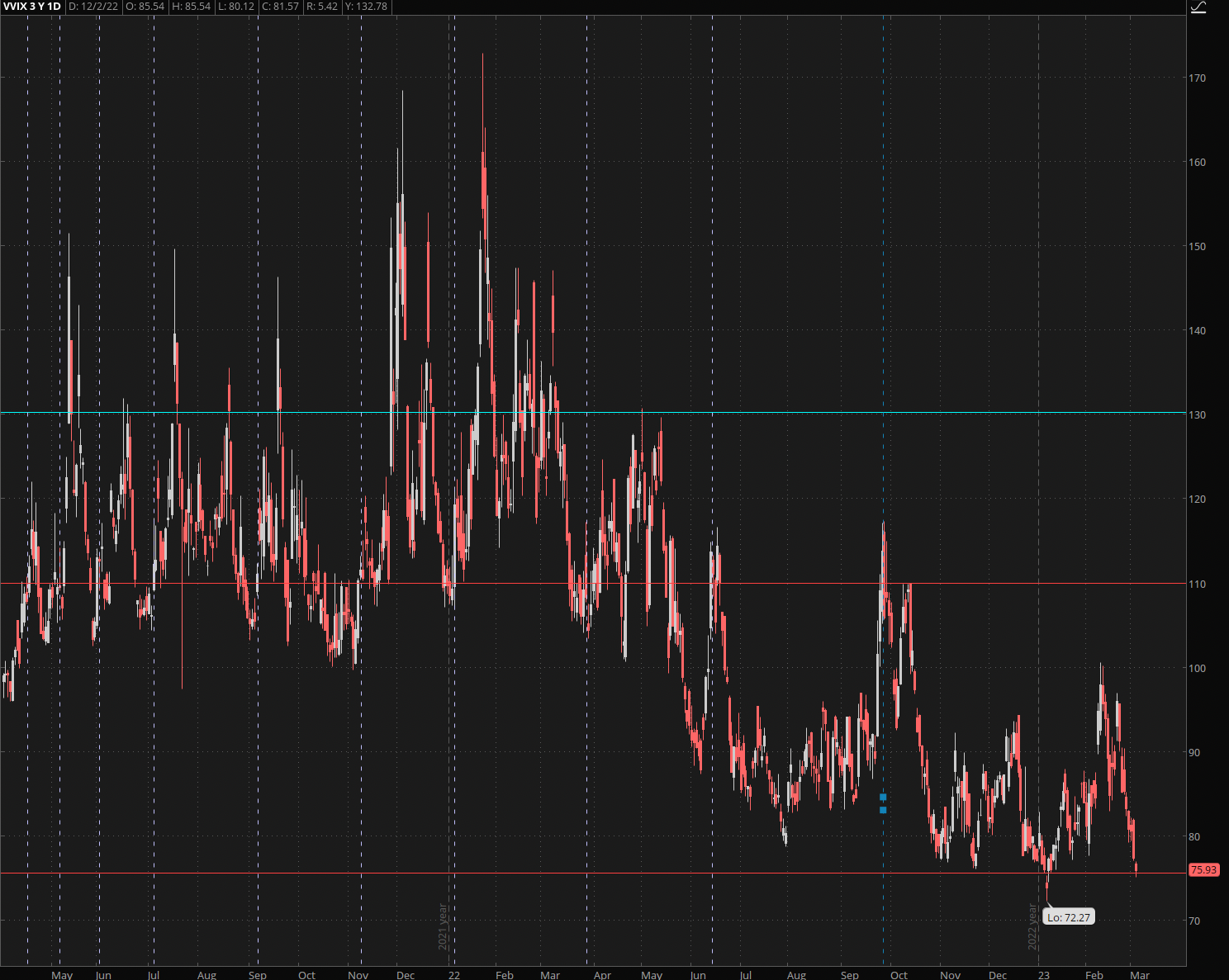

The VIX makes this abundantly clear as it has transitioned from large multi-week gyrations to a much smaller range which on the surface looks rather innocuous.

Even the VVIX is dropping like a rock (again) indicating that – as a whole – volatility of IV (yes it’s a derivative) is at record lows, trending even lower.

But no-one in their right mind would point at the current stock market and label it as tranquil or easy to trade. Quite on the contrary.

Reason being that much of the action has now been relegated to expiration days or days which promise big policy shifts by our friends over at the Federal Reserve.

And here’s the major take away from all this: The current move toward trading 0DTE options is a direct result of the economic, political, and financial chaos that has developed over the past few years.

It’s basically the ugly step child of a decade plus of quantitative easing courtesy of our friends at the Federal Reserve.

In a time when economic forecasts, P/E ratios, or corporate earnings lost all meaning and handicapping even short term risk is going the way of the dodo, the investing class has become conditioned to mainly focus on volatility generating events.

Most of all anything related to changes in central bank monetary policies, which is known to significantly move markets, even if it’s only temporary (until Powell changes his mind again).

And with Western central banks squarely having painted themselves in a corner even that has now become a coin toss.

Is it going to be a 50 bps hike – or a 75 bps hike?

Or perhaps no change at all?

More QE anyone? Or some other creative machination?

Getting it right has become the difference between wiping out your trading account or banking a fortune.

So what’s a trader to do?

Gambling with low cost lottery tickets, that’s what.

Not that it’s a bad thing – quite to the contrary.

If there’s an edge to be had – heck, I’m all for it.

But you better know what you’re doing. And we’ll cover that topic on another day.

A little hint: gamma is your friend 😉

Anyway, if you want learn how to trade like a pro and become consistently profitable then don’t waste time and get left behind.

With RPQ Unlimited, you’ll receive all the trading education you will ever need to be a successful options trader on a long term basis.

However we believe it is crucial to immediately start growing your trading account just like a professional: slowly and consistently.

Which is why we are spoon feeding you live quant trades that you’ll place alongside us. Trades from proven market specific strategies, with a proven track record that institutional firms keep under lock and key.

A LIVE cumulative P&L with all trades over the past year can be found here.

You can sign up right here.

See you on the other side.

Michael