For anyone who’s been active in the markets back in 2008 this is probably deja vu all over again. Over the weekend bank regulators seized Silicon Valley Bank as well as Signature Bank in New York, which represents the largest bank failure since the 2008 recession.

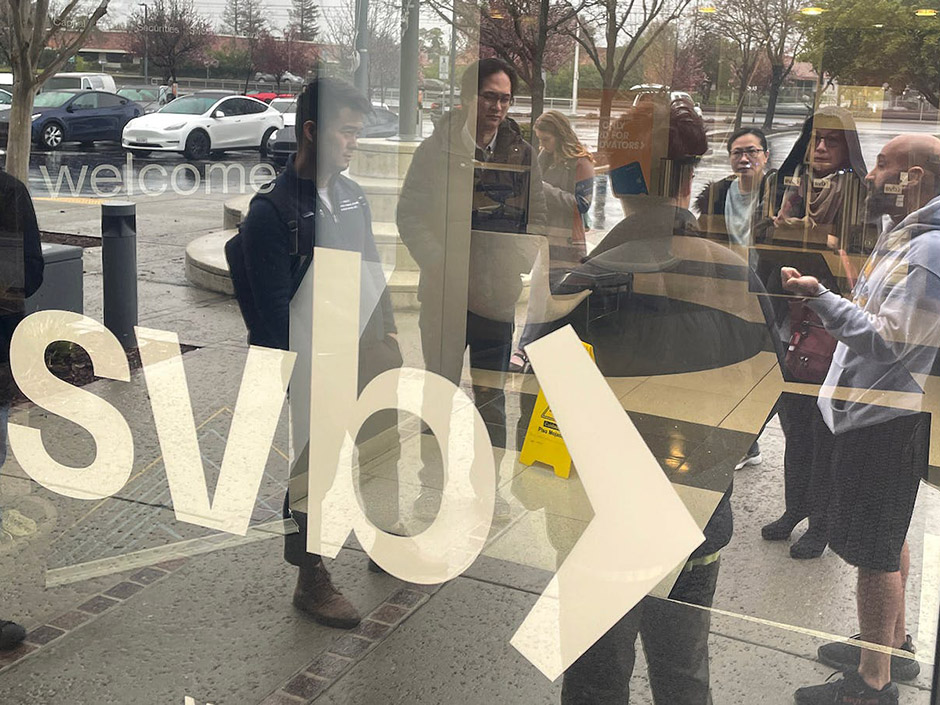

Customers were rushing to take their money out, and while few managed to get out the majority is now hoping that the FDIC and by extension the US treasury will make them whole again.

There’s actually news on that end but let’s cover that a bit later.

Now, I have to say this all sounds eerily familiar, cause I vividly remember Lehman Bros. getting wiped out back in 2008.

That’s actually the time I decided to trade for a living and the experience really stuck with me from that time forward.

It completely eviscerated my trust in the financial system and if nothing else it taught me that staying ahead of the curve, especially the narrative, and only relying on facts is essential to surviving any financial crisis.

So is this 2008 all over again or is this going to be even worse?

What makes this so much worse is that even though it might seem like an isolated event, once you begin to dig deeper, you’ll quickly to realize that we soon may seen contagion across the entire banking industry.

I’m sure you all remember the saying too big to fail – and although Janet Yellen stated over the weekend that only depositors would be made whole, forgive me for being a bit cynical about the notion that the treasury or the Fed would just watch the entire financial system burn to the ground.

So it’s quite possible that SVB is in fact Lehman Bos. 2.0 – meaning that it may be the first in line and thus not lucky enough to benefit from yet another Fed sponsored (and by that I mean tax payer sponsored) bailout facility..

Now before we go on it’s important to understand what’s happening, if your money is safe, and how the entire banking system could be vulnerable if a ton people begin to withdraw their money all at the exact same time.

And then finally, what you actually can do about this to make sure you’re best protected.

For starters we got to talk about Silicon Valley Bank. You better strap in for this one.

The company was founded in 1982 and quickly became a prominent lender throughout Silicon Valley and was almost exclusively catering to venture capital firms.

So if you drove up and down Sand Hill Road, especially the patch between Stanford University and the 280 freeway, that’s basically who’s been funding a majority of tech startups in the United States, but also abroad, even all the way over in China.

I actually did my own VC tour there during my Silicon Valley days, and even back then – we’re talking late 1990s before the dotcom bubble burst – the place was flush with cash.

And until recently it still it was, and most of that was held at Silicon Valley Bank.

Which means essentially, SVB became the premiere bank where CEOs and businesses go for funding.

And for the last several decades, this has worked out incredibly well.

Until recently.

So what happened?

Well you probably remember a few years back during the epidemic in 2020, the Federal Reserve made a drastic u-turn and once again began to drop interest rates back down to zero.

Not just that – other stimulus measures were also put in place, and suddenly both banks and people were once again flush with cash.

And quite a bit of that funneled back into the banking system, which is where things begin to go wrong.

See, banks all over the world operate on what’s called fractional reserve banking.

This means that banks are required to keep at least 10% of their customers’ deposits available at all times for withdrawals.

So imagine you give me $1,000 to hold on to for safekeeping.

But I could turn around to give 900 – which is 90% – of that to somebody else.

And that somebody else could give $810 – again 90% – to somebody else – and she may decide to give $729 – yes that’s right 90% – to someone else.

Of course every bank operates on the assumption that enough people give them a deposit, so that if the first person wants their money back, they’ll have enough cash on hand to process that withdrawal.

Well, when the pandemic hit, obviously, there were a lot of issues going on in the financial markets, to put it mildly.

As a response the Federal Reserve Bank eliminated the reserve requirement.

Effectively the reserve requirement went to zero, which meant the banks no longer had to keep any cash in reserves, they basically could lend up 100% of their money.

But towards the end of 2022, the Fed essentially announced that banks needed to start working to build the reserve requirements.

And then in February, just last month, the Federal Reserve Bank again, said the banks need to start issuing the reserve requirements, although then there was still a 0% reserve requirement, which meant the banks didn’t have to keep any cash in reserves.

And if you’re a bank, and you’re investing or lending money to things that are now underwater, well, that’s not good news.

Because back in 2021 and early 2022, SVB took roughly $100 billion and invested most of that into government backed bonds with a significant portion of that tucked away for three to four years at an interest rate of just 1.79%.

Essentially, what this means is that Silicon Valley Bank took a massive bet that the Fed under Jerome Powell wasn’t going to raise interest rates as fast as they did.

But to everyone’s chagrin – Jerome channeled his inner Paul Volcker and announced aggressive rate hikes sometime last year.

Despite what you may have been told, the reasons for that have actually a lot less to do with the U.S. economy or rampant inflation, but rather with the fact that the U.S. dollar is increasingly being sidelined as a global reserve currency, which has massive long term implications on the U.S. economy over the long term.

Which may be the reason why SVB – a U.S. managed bank – misjudged the situation and under estimated the Fed’s own survival instinct.

Again, that’s a topic for another day, that deserves its own post.

Anyway, when SVB’s bet turned out to be wrong, it opened the floodgates and put them in a very dangerous position.

You see, bonds are valued based on their yield.

And because of their giant exposure to bonds, Silicon Valley Bank found itself on the wrong side of the transaction and started to lose a lot of money.

All this may sound a bit academic, so let me give you an example:

SVB takes $100 and buys a 2% interest rate for a term of four years. And as long as they can hold it for the full term, they’ll receive back the principal plus $8.24 in full, no problem whatsoever.

But what happens if interest rates suddenly increase right after you make your investment, and all of a sudden, you can buy that exact same $100 at a 7% return and make a profit of $31 over this exact same four year term?

In that case, a $100 – 2% bond would have to drop to $77 to be worth what you could buy at today’s prices.

And that’s no bueno!

And if – whatever reason – you can’t afford to hold the bonds for the full four year term and get your money back, then guess what – you’re going to be forced to take a loss.

And that is exactly what is starting to happen.

Under normal circumstances banks would have enough capital coming in from a whole bunch of sources to cover customer withdrawals.

But remember, Silicon Valley Bank’s customer base is mainly comprised of technology companies, which due to rising interest rates, have seen significantly less funding as of late.

And that means that companies are forced to take more money out of the bank to pay for their operating expenses. You know payroll, equipment purchases, marketing, fancy symposiums they can post on social media and their brand, etc. etc.

Essentially SVB severely misjudged not just the size but also the pace of the Fed’s rate hikes.

While also assuming that the VC market would continue to stay strong.

And all left them with too much money locked away in one specific asset that yielded too little of a return.

And following Murphy’s Law, that occurred at the exact same time their own clients began withdrawing more money than anticipated.

And this right here where the dominoes began to fall.

Last week, on Wednesday, March 8, the SVB announced that they would be selling off a third of their ownership in an effort to raise $2.25 billion.

This was done in response to having taken a $1.5 billion loss liquidating one of their bond positions, in the hopes of bringing enough money back to the bank to be able to continue processing all those withdrawals.

The real problem, however, arrived on March 9, when word got out that the company could potentially be facing insolvency.

Nor surprisingly, as a result, SVB’s stock price plummeted more than 60%, making it highly unlikely that the company would be able to raise additional capital to help offset the losses.

And just like back in 2008, at that point, the entire situation devolved into a full scale panic.

Reports claim that SVB’s CEO had been calling clients to assure them that their money with the bank is safe.

Just for the record: If you ever get a phone call from your bank assuring you that your money is safe, well – make your own conclusions 😉

And if you know anything about Silicon Valley, then you know that everyone who really matters is connected to everyone else.

So when word got out on Thursday a bunch of tech founders in the Bay Area immediately canceled all their meetings and then scrambled to get their money out of SVB.

And then overnight, things got even worse.

On the morning of March 10, Silicon Valley Bank announced that they had failed to raise capital and instead were looking for a buyer.

Meaning they quite literally had run out of money and were facing more withdrawals than they had cash on hand.

The only remaining option was to look for anyone who could potentially buy them out and take them over.

Unfortunately, though, that seems to have been too little too late.

Because just a few hours after that Silicon Valley Bank was shut down and closed by regulators with the message that all of the bank’s deposits had been transferred to a new bank.

Of course, as you probably know, FDIC insurance exists for a reason, and they should be able to recover up to $250,000 almost immediately.

Except, there’s a problem.

Anytime you make a deposit with a bank, you’re protected by what’s called FDIC insurance, which protects you up to the first $250,000 you deposited.

This was created after the bank runs in the 1920s Great Depression as a way to incentivize people to once again trust the banking system, and it largely worked.

Since then, FDIC insurance has continued to be effective for any bank that wants to legally operate in the United States.

And to be quite honest, it’s a good and efficient system.

If you go to the FDIC website you’ll read that in most cases you will get access to your money within a few days after the bank’s closing.

However, in this case, the bad news is that as only 2.7% of Silicon Valley’s bank deposits are under $250,000, meaning 97.3% of the money held in Silicon Valley Bank is not FDIC insured.

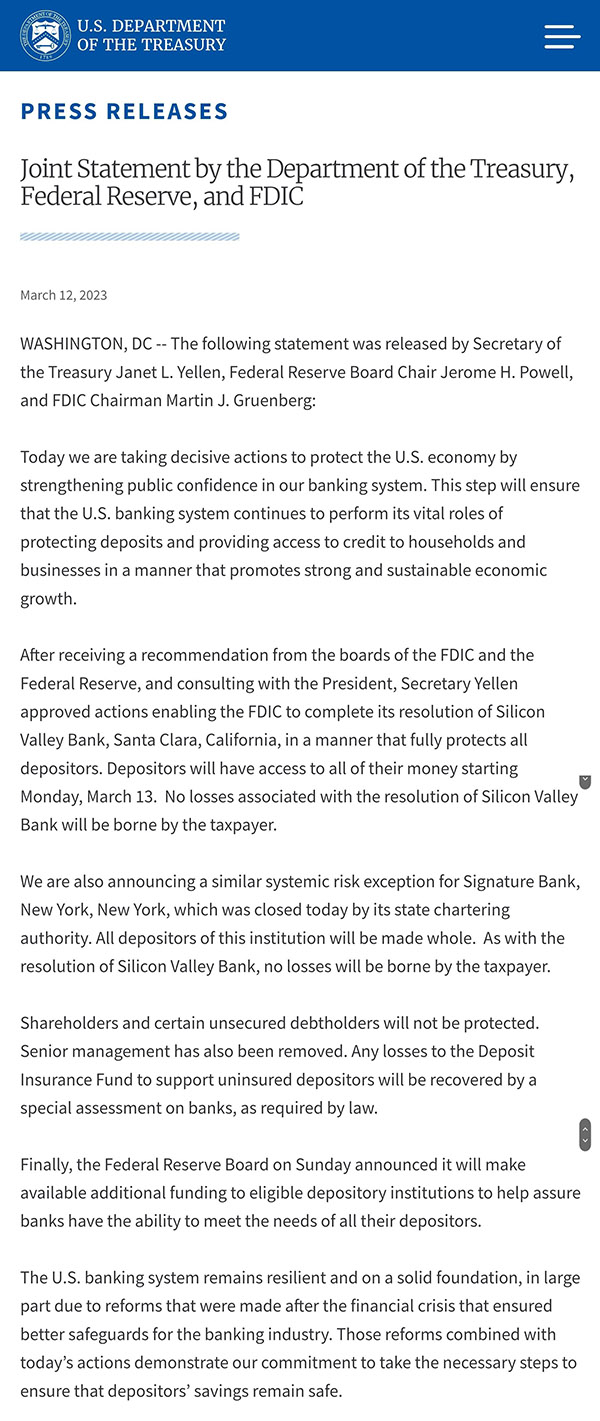

Then yesterday, after some emergency meetings, Treasury Secretary Janet Yellen in collaboration with the Federal Reserve Bank issued a joint press statement.

Okay, that’s nice.

Let’s see, according to the latest data, Silicon Valley Bank had about $174 billion in deposits in their account, that means people’s cash in their bank accounts.

A lot of people or businesses that holding assets in excess of $250,000, are worried that this money was going to be gone.

But now what the Treasury secretary and Federal Reserve Bank is saying is that they’re going to make all the depositors whole, so no money will be lost.

What they said, is that after receiving a recommendation from the FDIC, they decided that depositors will have access to ALL of their money, meaning no money will be lost, starting today Monday, March 13.

But they also said that no losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

Say WHAT?

If you’re like me, you might be wondering, wait, if the FDIC is a part of the government, and they’re going to pay back these billions of dollars, where are they going to get all this money from, especially if it’s not the taxpayer.

The government doesn’t have just billions of extra dollars sitting around. In case you haven’t heard – last year, for example, the government spent $1.5 trillion more than what they brought in.

So where are they going to get all this money? Well, your guess is as good as mine but I have an inkling inflation is just abouto to pick significantly.

Now what they’re saying is they’re also going to create a levee that they’re going to essentially put a fee on banks, a special assessment on banks, that way, they can gather some more money, but how much?

Well, that’s not very clear here as to how much money they’re gonna get from banks versus how much money might have to be printed.

Now, another thing that happened today was a second bank failed.

This was a Signature bank, out of New York.

And because of that, obviously, people are worried that what happened with Silicon Valley Bank may be spreading to other banks.

Which may trigger a panic, and our banking system is not designed to support a lot people pulling their money out.

Now call me a cynic, but to me this looks like SVB may have only been the first dominoe to fall, that it’s really only the tip of the iceberg.

So that then of course begs the question, could the same thing happened to your bank?

The answer – based on what I learned back in 2008 – yes, it’s possible. But if it happens it won’t happen in the near term future.

The treasury in collaboration with the Federal Reserve is going to pull out all the stops to prevent this from happening.

Also remember, the issue with Silicon Valley Bank was that they were in a niche market servicing startups and were funded by venture capital which was drying up.

That meant that very little money was flowing in, and a lot of money kept flowing out, while the majority of the bank’s capital was locked away in bonds for the next four years at a low interest rates that had declined in value.

Eessentially this meant that if the bank were to wait long enough, they would have enough cash on hand to in potentially absorb the short term losses.

But when everyone begins withdrawing all of their money all at the exact same time, the bank is left with no other choice other than to shut down.

That’s why I think in order to best protect yourself, you should never keep more than what’s insured from the FDIC, which is typically $250,000 for an individual bank.

I would venture to say that it’s probably not going to make any difference whatsoever, because most people don’t keep more than $250,000 in cash in any given bank.

But in the big picture, it’s very good example that you should never keep all of your eggs in one basket, you should always have multiple accounts in good standing with other banks just as something to fall back on.

And at the end of the day, sometimes things can happen that are completely outside of your control.

Even if you do everything right.

Anyway, if you’re tired of losing and want to learn how to trade like a pro then here’s your chance.

With RPQ Unlimited, you’ll receive all the trading education you will ever need to be a successful options trader on a long term basis.

We believe it is crucial to immediately start growing your trading account just like a professional: slowly and consistently.

Which is why we are spoon feeding you live quant trades that you’ll place alongside us. Trades from proven market specific strategies, with a proven track record that institutional firms keep under lock and key.

A LIVE cumulative P&L with all trades over the past year can be found here.

You can sign up right here.

See you on the other side.

Michael