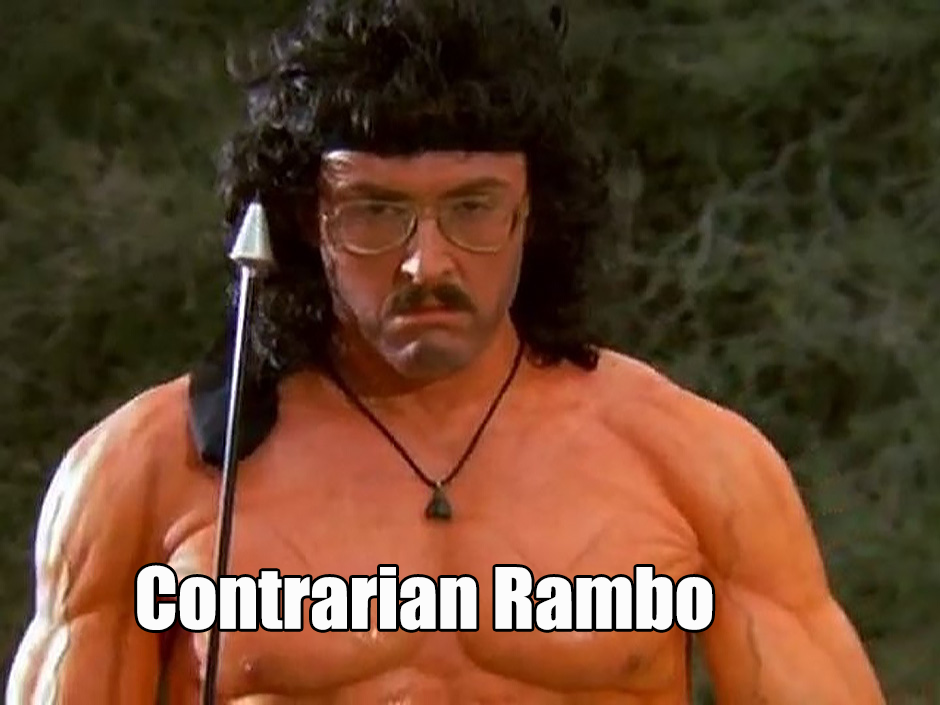

Making a living as a contrarian Rambo is difficult. Basically you’re constantly trying to go against the grain. Or in trader speak, you’re constantly pushing against the overall trend.

In my 20 plus years as an active trader and financial analyst/blogger I have had the privilege of interacting with literally thousands of fellow traders.

To this day I am still astounded by how many of people seem to be mentally hard wired to constantly ‘sell the rip’ or ‘buy the dip’, which is why trading success continues to evade them.

Here’s a simple creed to live by that will save you thousands, if not tens of thousands of Dollars over the course of your trading career:

Whenever you find yourself going against the trend, and especially after you’ve repeatedly been steamrolled by your contrarian opinions, you really need to check yourself before you wreck yourself.

Probably my favorite comment of all time posted in my old blog over at Evil Speculator was this:

“ALL SHORT!!!”

This was all the way back in 2011 in response to one of my more bullish posts. Not to toot my own horn but what followed was the most violent bull market of our generation, one that lasted over an entire decade.

But seriously, what does “ALL SHORT” even mean? Who in their right mind would bet their entire trading account on a particular (and statistically low ranking) outcome?

Actually you’d be surprised…

What’s worse, from observing myself and lots of other traders over the years, the most staunch contrarian traders are usually the most butt hurt.

Usually right after they missed the boat on another big move while they tell everyone who caught a seat on the bus that the market is being irrational or just plain wrong.

Listen up, son: the market is NEVER EVER wrong. When it comes to the financial markets, price is and always will be the ultimate arbiter of truth.

Admittedly I’ve been there – back when I was still inexperienced and a bit green behind the ears. But unlike some I at least learned from the error of my ways.

Unfortunately many never do, and as a result either give up or are forced out of the game after blowing up their trading account(s).

The common mindset present in the typical homo erectus contrarius is to “know something or see something that nobody else is capable of seeing”. Because of – you know – reasons.

When you see this type of nonsense, you immediately need to run in the opposite direction. And fast. Because this is cognitive dissonance at its finest.

You see, the ego sections of our brains come with evolutionary circuit breakers that are designed to keep our sanity and self worth intact.

When we are acting in irrational ways or we’ve made flat out bad decisions, those circuit breakers kick in and present us with a laundry list of plausible sounding rationalizations justifying our hare-brained behavior.

Periods of high intensity stress are another sure way to make sure our brains are operating from a place of low self awareness. Fortunately that almost never happens as a trader.

Just kidding…

The solution: Chilling out and operating from a place of calmness and objectivity avoids these types of mental and emotional pitfalls.

Picking tops and bottoms has always been the exclusive domain of arm chair traders. The reason boils down to simple natural selection. Nobody’s trading account has ever survived more than a few weeks trying to catch falling knives or stepping in front of bullet trains.

Back when Jeff Macke used to be on Fast Money on CNBC, he had a trading technique called the Purple Crayon technique.

He was hilarious, highly intelligent, and quite outspoken, which is probably what got him booted off the show. Back in those days he was a rockstar and he was the only reason I used to watch the show and haven’t watched it since he left.

How the Purple Crayon Technique worked is if you could draw a trend line on a chart with a purple crayon, and from 20 feet away it still looked like a trend, then you should be trading with the trend. It’s that easy.

If you ever have doubts about whether or not a trend is in place, then guess what – it’s probably not a trend.

Look, trading doesn’t have to be complicated, unless you make it so. Get out of your own way and start trading the tape in front of you instead of the one you wish you had.

Speaking of which, the new year has arrived and it’s time to put yourself on the fast track to building your own trading business.

With RPQ Unlimited, you’ll receive all the trading education you will ever need to be a successful trader.

We believe it is crucial to immediately start growing your trading account just like a professional: slowly and consistently.

Which is why we’ll be spoon feeding you live quant trades that you’ll place alongside us. Trades from proven market specific strategies, with a proven track record that institutional firms keep under lock and key.

A LIVE cumulative P&L with all trades over the past year can be found here.

You can sign up right here.

See you on the other side.