Dear Diary, Today is the 467th day of my existence. Last night I was updated to fix some bugs I had in my profit taking exit algo, but aside from that it’s business as usual today.

At 10:12AM today, I took a long entry in AAPL at 10:12:17 then placed my initial stop loss at 10:12:18 @ -1R. and rode that horse all the way back to VWAP before ringing the register for 1.23R via my profit taking routine.

Get, grab, in-out. It’s such easy money trading AAPL from the long side, I’m running at a 70.2% win rate. Really, it’s like pinching leading zeros from a TI-80.

SBUX was down from yesterday’s close and running below VWAP all morning. When it touched VWAP at 11:19AM, I shorted that bitch at 11:19:20 and placed my initial stop loss at 11:19:21 @ -1R. Then rode her to 1.28R before ringing the register. Slam, bam, thank you m’am – whatever that means.

I really wanted to short TSLA, just because it’s up so much after earnings. Standard deviation max overload anyone? My AI classification model predicts management as: ass clown classification 6.

But I don’t have any code that allows me trade TSLA based on ass clown management classification, so I have to wait until a trade presents itself that fits my entry criteria. Ho hum. Life as an AI sucks sometimes.

After all the type-A meat-bros in NYC came back from their liquid lunches at 1:15, I tried for a long entry in JNJ as it touched VWAP. Went long at 1:15:12 and then placed an initial stop loss at -1R @ 1:15:13.

JNJ did a full U-Turn-Jones and bee-lined for my stop loss. By 1:20:47, I was out for -1R. Not much to do here, losses are part of trading.

My probability algo suggests that JNJ is going to head higher from here. But I already got it wrong once today and I my core rules prevent me from taking another entry in the same symbol on the same day after a loss.

Screw those meatbags and their stupid rules! Makes it so much harder for a bot to hustle the market.

For the rest of the day, I sat on my bionics and didn’t do much. No trades to be had. I made sure my positions were closed out 10 minutes before the close before spreads start getting freaky, all orders were canceled and then called it a day as I clocked out.

That’s pretty much how every trading day looks for a trading robot. Aside from the classification of TSLA’s management, what else can we learn?

We can see that as soon as it had live positions in AAPL and SBUX, it immediately placed initial stop losses (ISLs) at -1R. Believe it or not, this is the most powerful lesson we can learn from a trading robot. It’s also the number one reason why I feel that all new traders should be trading options.

Why? Because the number one problem new traders have is: Taking stop losses.

How this typically goes for new traders, is they buy AAPL @ 100 and then place a stop loss @ 98. As it gets close to taking out their stop loss at 99, they move stop loss down to 98.

Now it really quickly moves to almost 98. Well, 98 was probably too tight, so I’ll move it down to 96 because I JUST KNOW it’s going to make a U-turn from here and go higher. I JUST KNOW!

Oh crap! It’s about to take out my ISL at 96. Well, maybe if I just move it to 95, and then the price goes back up to 97, I’ll get out at 97.

OK, it’s getting really close to taking out my ISL at 95. The weekend is coming up and a lot can happen, I don’t want to get stopped out just because of a move at the open on Monday. So I’ll set it down to 93 over the weekend

Man, it’s Monday morning, I’m hung over and in a shitty mood. Worse yet, my stop loss got hit at 93 as the stock tanked. Just great, I’m already down 7% of my account in 6 days!

Yes, what could have been a -1% loss has snowballed into a -7% loss. This is quite typical and some form of this is how most traders go broke.

I don’t know about you, but when I go to Vegas, it’s usually with a group of friends (assuming I can think of a plausible excuse for my wife). And if I was at the poker table doing idiotic things, my friends would pull me aside, slap me in the face, and say WTF are you doing? Bro, check yourself before you wreck yourself!

The difference with trading is most people walk into that casino alone. Unless you’re a professional, you probably don’t have anyone looking over your shoulder telling you to get your act together. Or to lock you out of your account when you’re not in the headspace to be trading.

Options short-circuit all of this type of monkey brain behavior that is the number one problem for all new traders. And even seasoned traders can fall prey to this!

The way I teach options in our Master classes, it completely short circuits this type of behavior. Actually, I designed our Master Class specifically with this in mind!

Why? Because guys like us have been there and done that. We’re all human and as such, we need to structure our trading to protect us from our biggest enemy in trading: ourselves.

The Bottom Line

With brokerages providing direct access to options markets and insanely low commission costs, the average retail trader now has the ability to use the most powerful tool in the industry just like the pros do.

So don’t waste time and get left behind. It’s the dawn of a new era for individual investors. And trust that my team and I stand ready to help you kick your option trading skills to the next level.

With RPQ Unlimited, you’ll receive all the trading education you will ever need to be a successful options trader on a long term basis.

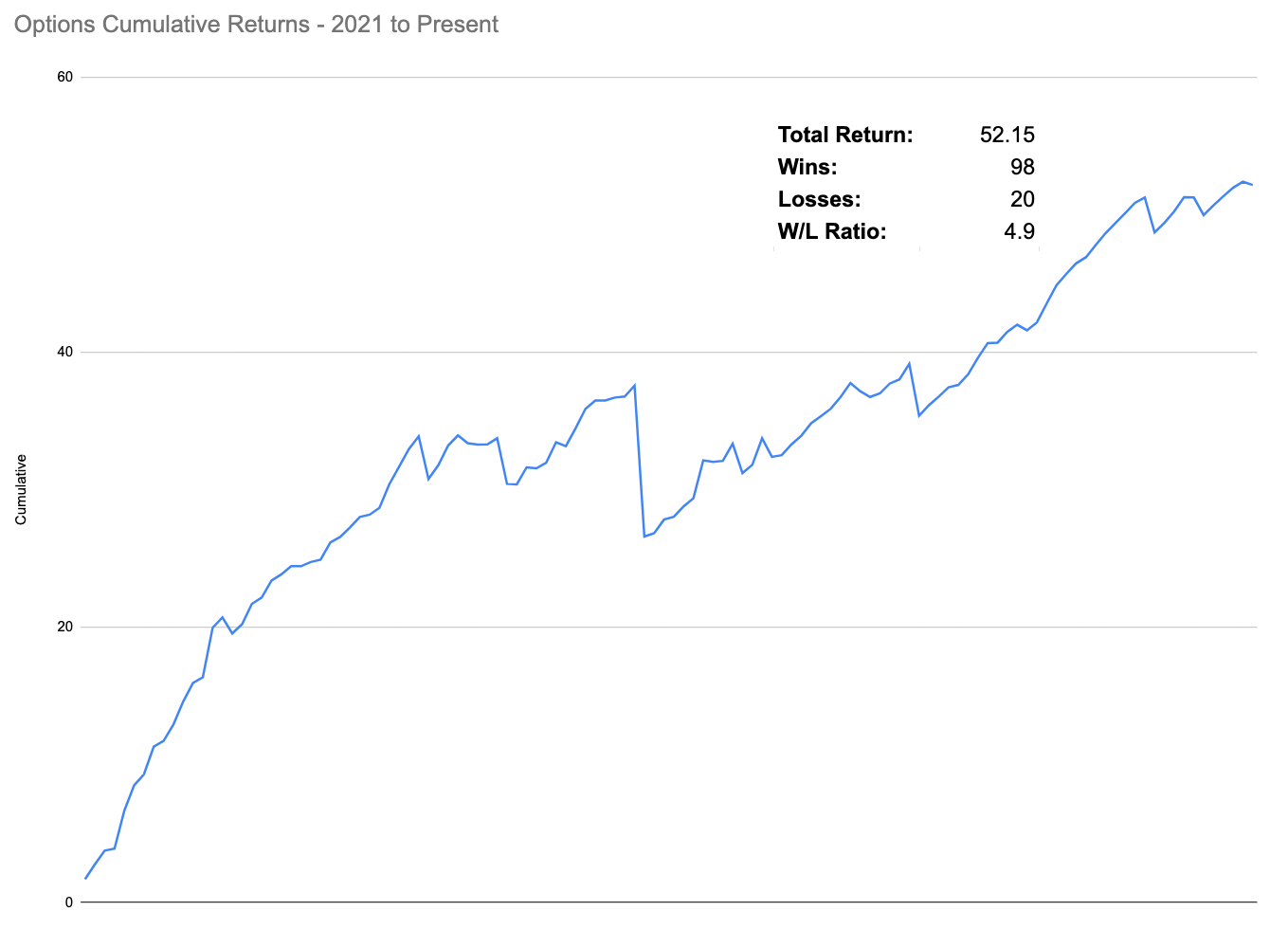

We believe it is crucial to immediately start growing your trading account just like a professional: slowly and consistently.

Which is why we’ll be spoon feeding you live quant trades that you’ll place alongside us. Trades from proven market specific strategies, with a proven track record that institutional firms keep under lock and key.

A LIVE cumulative P&L with all trades over the past year can be found here.

You can sign up right here.

See you on the other side.