As a new or even intermediate trader, the surest way to shoot yourself in the foot in the foot, with a bazooka, is by being a contrarian. Especially when the information that is in front of you is telling you the exact opposite.

Back in early 2019, I had some contrarian dode responding to some bullish trade setups on my old Evil Speculator blog, as the market was ripping higher.

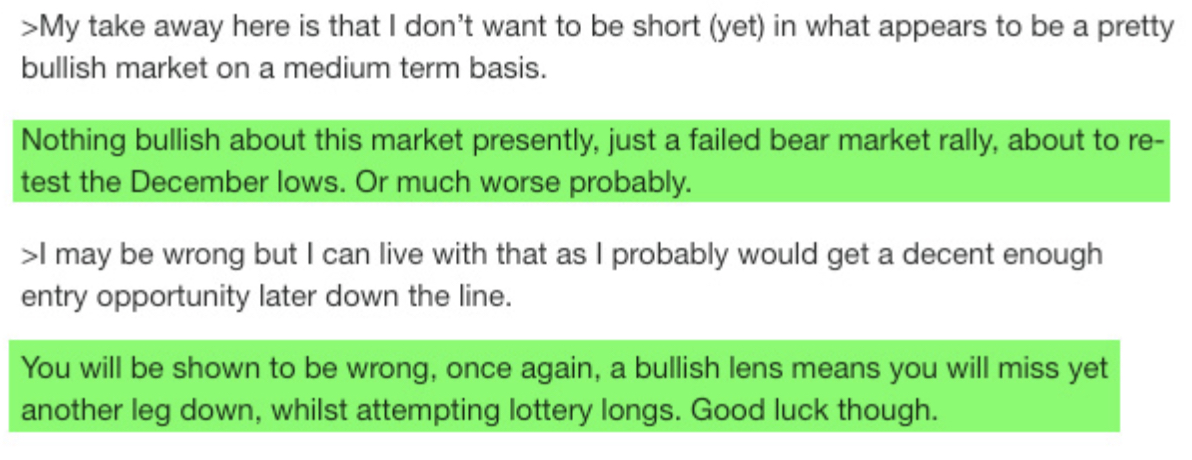

Here is a snippet of my exchange with Contrarian Dode’s comments highlighted in green.

This was in mid February of that year as the entire market was en fuego, storming higher like a freight train and laying waste to everything in its path. And for good measure, it was backing up and rolling over the victims in its path one more time, just to make sure it got ‘em.

This went on for a while, Ms. Market kept rocking higher and higher, and by early April proceeded to nuke any remaining hobby bears from orbit, just to be sure.

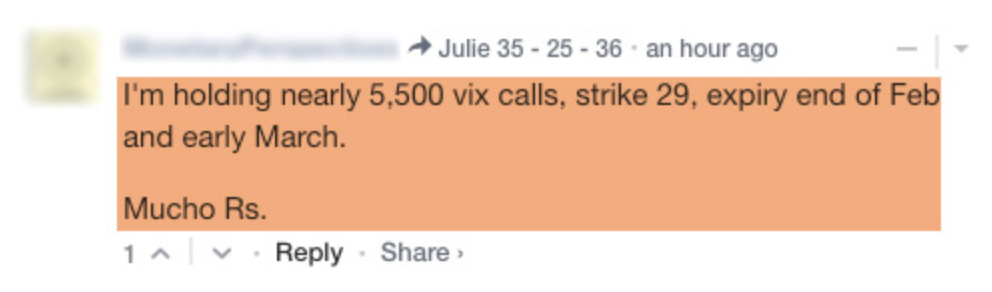

Not giving up, Contrarian Chode of course kept at it. His next post was the most brazen of all:

To understand what that means in English, he was holding 5500 29 VIX calls, set to expire in less than a week valued at $110,000.

That means within the next 5 trading days, the market would need to see a meltdown approaching the panic of the 2008 housing meltdown. The odds of it happening: slim to none.

There are several very powerful lessons to be learned here.

1) Being a contrarian and stubbornly ignoring the evidence right in front of you, is never a good place to be trading from. If you believe the market is going to head south, wait for it to start heading south before you take on any short positions.

2) Statistically speaking the market spends 66% of its time trending sideways, 22% of its time in bull trending phases, and only 11% of its time in bear trending phases. Attempting to accurately time large scale bearish corrections is a sucker’s game.

3) Most of the free trading advice you’ll find on the internet is from novice traders who are either losing money or are lost at sea, continuously bobbing around break even. Let’s face it, with a few notable exceptions, trading chat rooms are the trailer park of the trading world.

As Napoleon Hill famously said: you are the product of the people you associate with. Likewise, your trading results are the results of the traders you associate with.

If you’re wasting time hanging with traders who are losing money or continuously bobbing around break even, then guess what’s going to happen to you?

4) Going against the grain only works when it’s in context. There are certain market types where contrarian trades, such as scalping trades, work extremely well.

However these are more difficult trading systems for most traders to follow. Hence, I only recommend them to advanced traders who have a proven track record of profitability.

A Simpler Way

With brokerages providing direct access to options markets and insanely low commission costs, the average retail trader now has the ability to take advantage of the most powerful tool in the industry – just like the pros do.

So don’t waste time and get left behind. It’s the dawn of a new era for individual investors. And trust that my team and I stand ready to help you kick your option trading skills to the next level.

With RPQ Unlimited, you’ll receive all the trading education you will ever need to be a successful options trader on a long term basis.

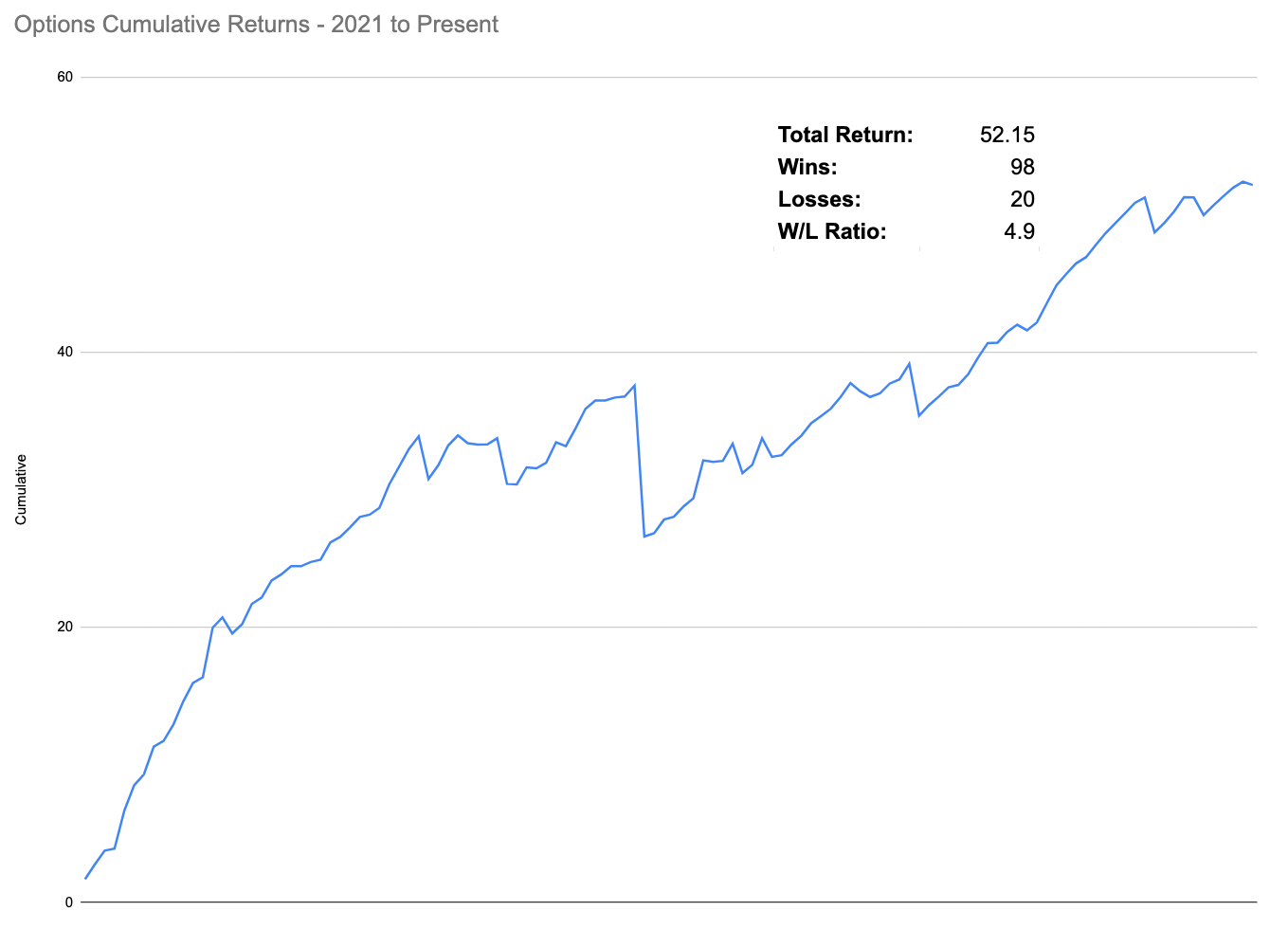

We believe it is crucial to immediately start growing your trading account just like a professional: slowly and consistently.

Which is why we’ll be spoon feeding you live quant trades that you’ll place alongside us. Trades from proven market specific strategies, with a proven track record that institutional firms keep under lock and key.

A LIVE cumulative P&L with all trades over the past year can be found here.

You can sign up right here.

See you on the other side.