All Insane On The Western Front

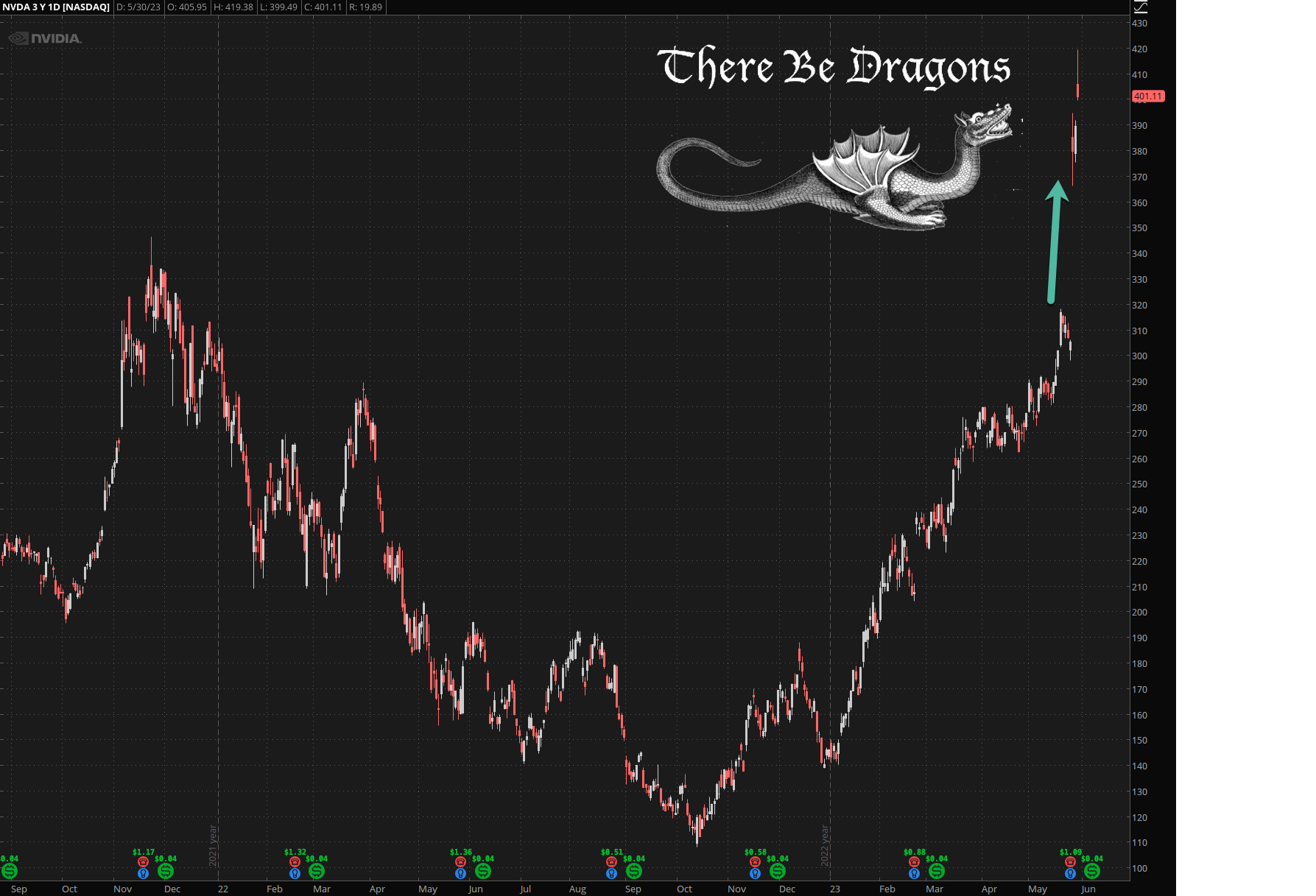

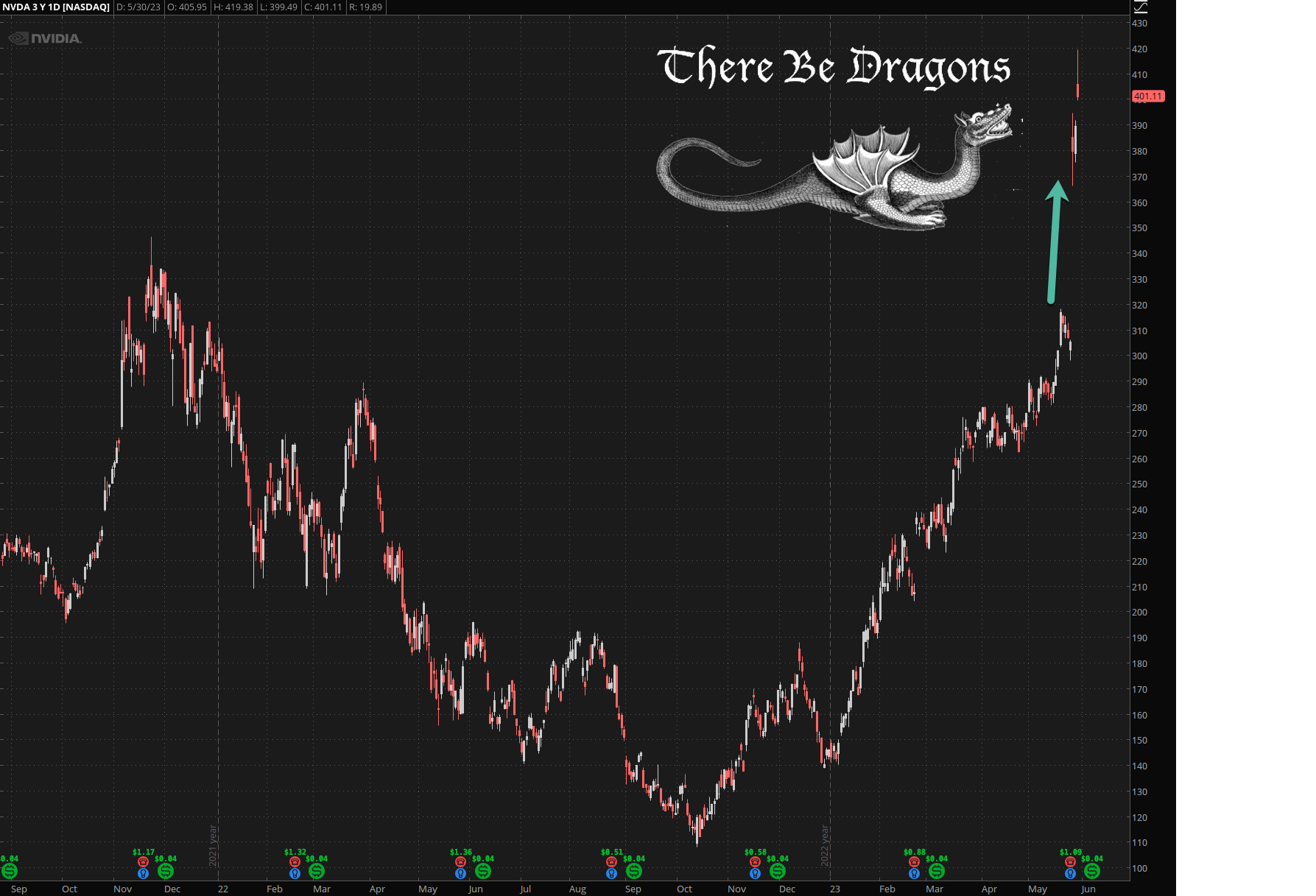

Last Friday NVDA managed to single handedly crush the hobby bears, collectively driving them out their positions, and taking much delight in their anguished lamentations.

Profit taking encouraged.

Last Friday NVDA managed to single handedly crush the hobby bears, collectively driving them out their positions, and taking much delight in their anguished lamentations.

Profit taking encouraged.

The time has FINALLY come!! Today is launch day for GRAVITAS – my revolutionary trend trading system which will allow you to DOUBLE your money this year from crypto.

A bunch of people emailed in asking about my recent GRAVITAS post where I showed this chart of my systems performance over the past 6 years…

Okay, so yesterday I told you about GRAVITAS and why I decided to build a trend trading signal for crypto in the first place. You don’t exactly have to be a trading genius to realize that something that calls big market swings in crypto can easily bank you a juicy fortune, given enough time. Continue reading

Since I posted a quick video update on GRAVITAS last week, my inbox has literally been blowing up with messages from people begging for access to the system. Now, as much as I enjoy watching you squirm in eager anticipation, here’s a quick update to keep all you crypto degenerates in the loop 😉

Bitcoin just touched the $30k mark, proving once again that bull markets seem have a tendency to sneak up on you. I know that may sound a bit hare brained, but please raise your hand if you managed to catch merely half of BTC’s 95% monster ramp off the Nov 22nd lows.

The great bank wipeout of 2023 seems to be picking up pace. And it’s causing collateral damage in a few unexpected places.

Credit Suisse just got bailed out by the Swiss National Bank (SNB) to the tune of CHF 50 Billion. WHO IS NEXT?

For anyone who’s been active in the markets back in 2008 this is probably deja vu all over again. Over the weekend bank regulators seized Silicon Valley Bank as well as Signature Bank in New York, which represents the largest bank failure since the 2008 recession.

If the current market gyrations are making you want to step out into the yard and kick a tree or two, then you’re not alone.