Alright, the big day has finally arrived.

After literally months of preparation (I’ve worked on this since July!) I’m finally introducing my BLACK FRIDAY SUPER BUNDLE.

This is everything you need to crush the markets – crypto, stocks, options – all in one place.

And these aren’t gimmicks. We are talking battle-tested tools that make money—tools pros use to stay ahead while everyone else plays catch-up.

If you bought all these tools individually, it would set you back a ridiculous $9,780.

But for Black Friday? It’s yours for just $1499 for 1 year (non-recurring) or $149/month.

If you’re still on the fence, watch this video which covers everything you need to know:

Click here to watch the video

Heads up: This video covers the crypto tools in the bundle. Over the weekend I’ll follow up with an email diving into the equities side.

Now, let’s see what’s in the goodie-bag – here’s everything you’re gonna get:

For Crypto Degens Who Want Serious Results:

- Fidelis ($497): ETH/BTC swing trading signals.

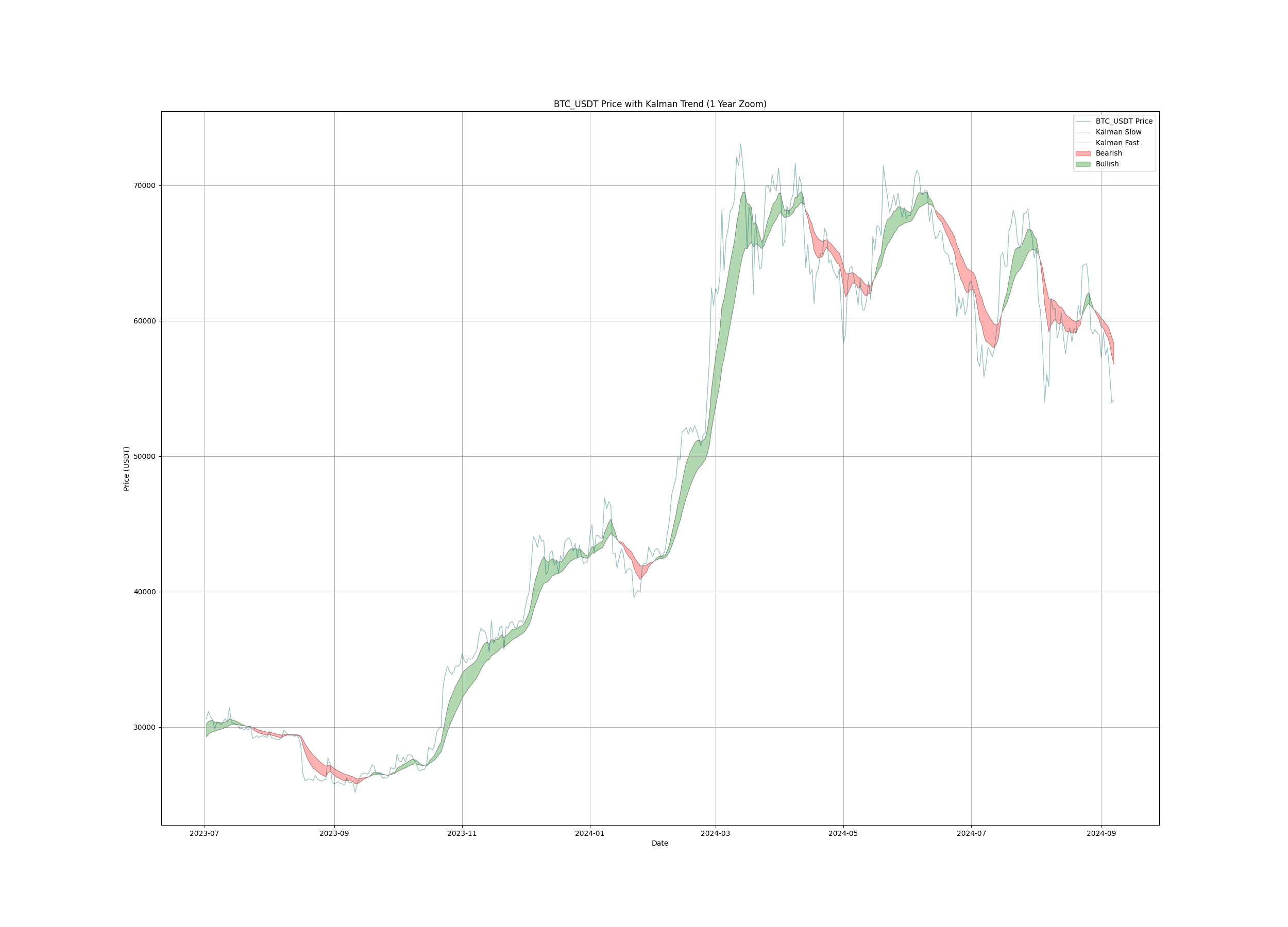

- Gravitas ($1499): BTC/ETH trend signals—always on the right side.

- Veritas ($497): Crypto market seasonality—timing is everything.

- Crypto EM Tool ($299): Predict and catch market inflection points like a boss.

For Stock and Options Traders Who Want To Stay Ahead Of The Tape:

- Vixen ($1499): SPY/SPX swing trading signals—don’t wait, dominate.

- RPQ Unlimited ($997): Options trading signals—turn chaos into profit.

- Stock Stats Tool ($299): Predict market inflection points—see what others miss.

- IVTS Tool ($199): VIX signal scanner—stop leaving volatility trades on the table.

- Zero Indicator ($997): SPY/SPX market oscillator—pinpoint reversals with sniper precision.

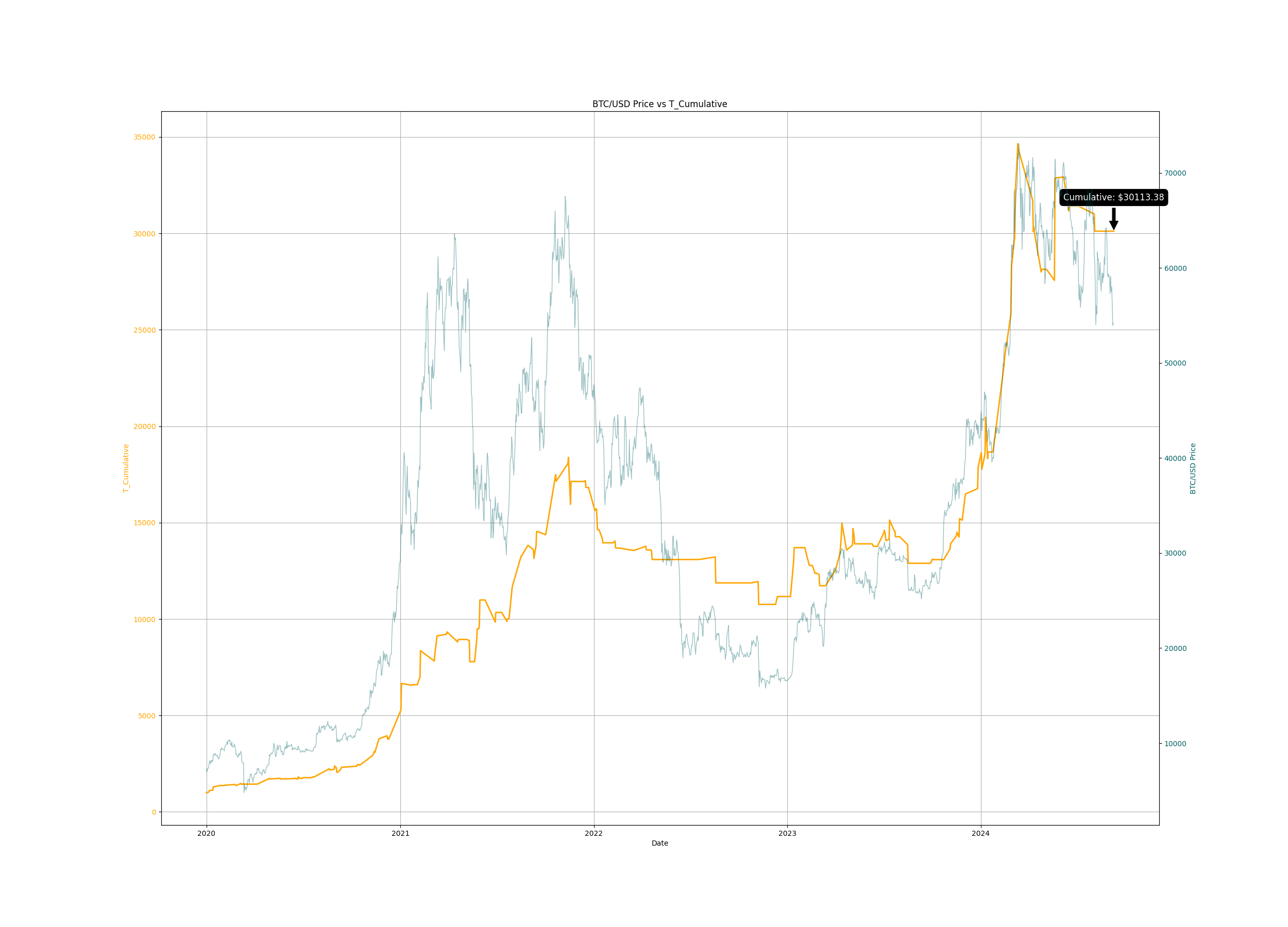

Still having doubts? Oh yee of little faith…. Let’s fix that, check out the live profit graphs:

And these are REAL LIVE profits – not some backtested fantasy. So, if you’re tired of being left on the sidelines, this is your big moment.

Alright, let’s Talk Mon-ayy:

💥 Super Bundle 1-Year: $1499 (non-recurring)

Get the Yearly Plan Here

💥 Super Bundle Monthly: $149/month

Get the Monthly Plan Here

This isn’t just the best deal you’ll ever see – it’s your ticket to trading like a pro while everyone else is running around confused, and missing one face ripping rally after the other.

The clock is ticking, black Friday doesn’t last forever, and neither does this offer.

Please don’t be the person emailing me in two weeks asking if this deal is still available.

Spoiler alert: It won’t be.

Nope, this deal is not coming back anytime soon. So reserve your seat right now – click HERE to sign up for a FULL YEAR or HERE to go the MONTHLY recurring route.

See you on the other side.