Once upon a time I used to be an active stock and options trader. But then I discovered crypto currencies and never looked back… NOT!!! Actually trading stock options still is my bread & butter up to this day and I just so happen to be good at it.

In the context of immersing myself into the subject matter I also became quite an ‘implied volatility disciple’, which is a sacred order of traders comprised of a few hundred math and quant trading nerds scattered all over the planet.

We all meet once a year in a secret location and perform unholy rituals involving the sigma symbol. Well… I wish, it’s actually quite a boring affair, but you get to learn a lot.

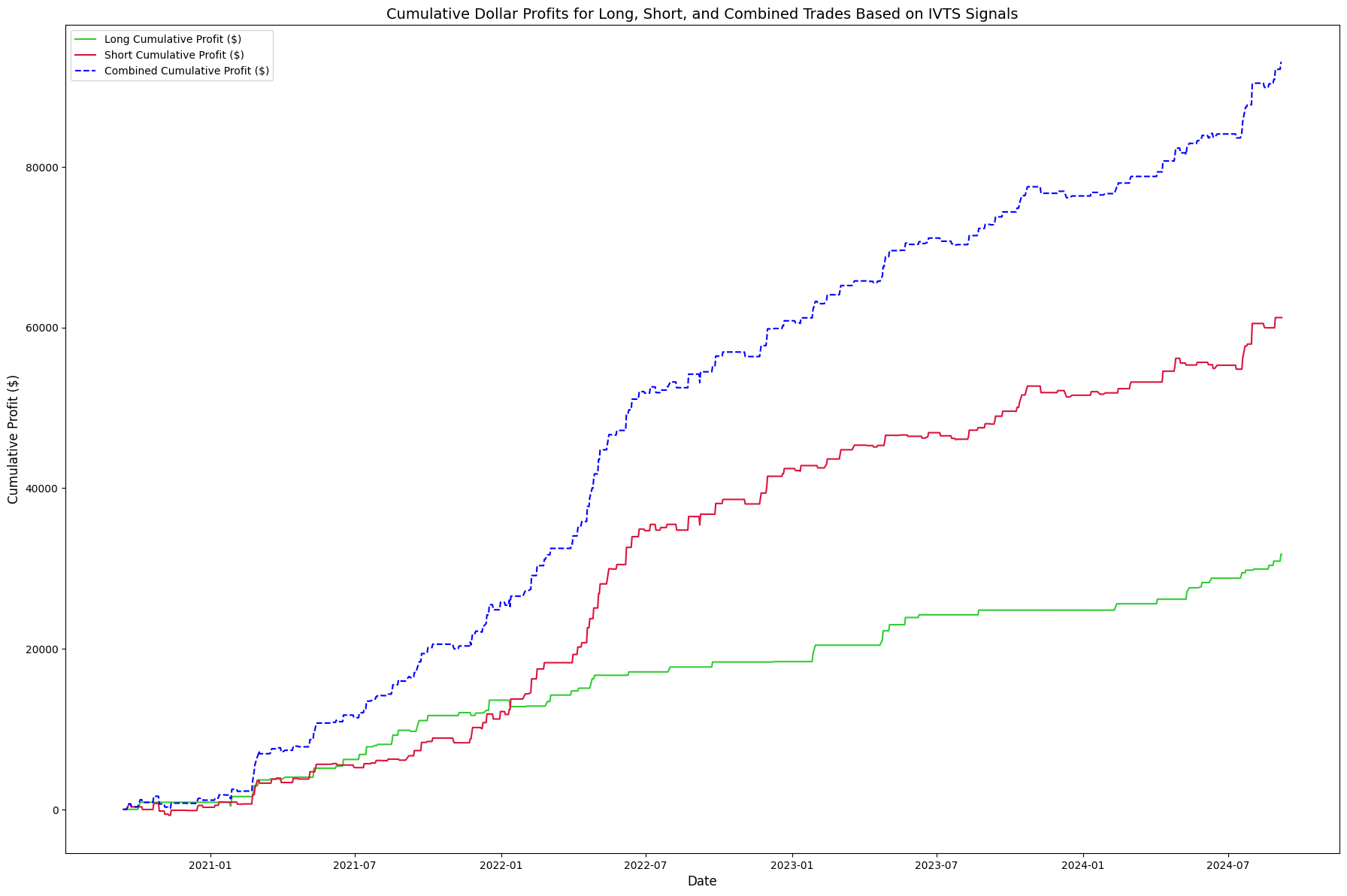

So let’s set the stage. The graph above shows what can happen when you gain a deeper understanding of what actually moves equities markets, and in particular the SPX and by extension the SPY.

The video below will give you a brief introduction into the IVTS – the Implied Volatility Term Structure, which odds have it you’ve never heard about.

Link: https://youtu.be/ZpKZRuU0gIM

But that’s how it goes, the best edges are somewhat obscure and driven by observations made – often by accident – whilst digging deep into what actually drives the stock market.

VIXen is a trading system I recently put together that is the outcome of nearly a decade of continued research I’ve poured into implied volatility in the equities market.

In this introduction you’ll discover how profitable VIXen has been over the years and – most importantly how you can ride the coat tails of such a juicy and consistent long term edge.

In case you wonder: I’m working on implementing a live signal that allows you to catch swing trades just like these on the Spiders.

So keep an eye out for a pertinent announcement in the near future. In the interim feel free to contact me here if you have any questions or are interested in joining the early beta.