As a new trader, you can save yourself from shooting yourself in the foot simply by trading stock options instead of stocks or any other financial instrument for that matter. Of course learning how to trade options properly and consistently is the key to achieving long term success.

Which is exactly why we put a lot of stock (pun intended) into combining step-by-step education with actual hands on trading.

That means placing actual trades – for real money – from day one and building up your account principal slowly and consistently in the process.

At the same time, we teach the fundamentals of options and various spreads the way ‘old school’ floor traders used to learn them.

That is by simply looking at and understanding the option chain, which allows you to immediately assess the risk and profit potential for each of your trades.

We don’t waste time on Black-Scholes calculators, binomial models, or option profit-loss diagrams, all of which may seem a bit counterintuitive for purported ‘quant traders’.

You see, trading options, and trading in general, is by no means an academic or theoretical skill.

To put it more bluntly, if you really think that you can learn how to trade options by reading books or attending seminars then you must be smoking crack.

Trading options has a lot less in common with applied mathematics or statistics than it does with learning how to play the piano or the guitar. Sans the groupies of course.

Think about it, In order to become a skilled pianist you’ll probably spend very little time studying music theory in comparison with the countless hours you’ll have to invest in practicing the scales.

The same applies to learning how to ride a bike, learning how to swim, mastering a new language, and even figuring out how to ask a girl out on a date without getting your face slapped.

So what makes you think that learning how to trade stock options is any different?

It isn’t – because becoming an experienced trader is the end result of having developed the long term muscle memory of what truly works and what really matters when it comes to assessing and taking advantage of potential profit opportunities.

That sounds like a mouthful but ask yourself this: When you’re going bumper to bumper on the freeway whilst having a chat with your spouse/girlfriend, sipping a cup of coffee, and listening to your favorite song on the radio…. how much analysis and thinking is actually involved?

A lot actually, but over 90% of that is muscle memory and learned positive habits. The same applies to shooting hoops and yes – even to trading options for money.

Once you understand how the game works, what to do at the right time, as well as what NOT to do, then you are in a position to take advantage.

Admittedly all that may sound a bit theoretical, so let me outline the top advantages of trading options as well as what’s required to secure a seat at the table.

Why Should You Trade Options?

There are six key advantages (in no particular order) of trading options:

1) Options offer superior cost-efficiency due to their leveraging power.

A trader can obtain an option position similar to a stock position but at huge cost savings.

For example, if you purchase 100 shares of a $100 stock, you will have to plunk down a whopping $10,000.

If you instead purchase a $20 in-the-money call (representing 100 shares) then the total outlay would be only $2,000. Which means you have an additional $8,000 to use at your discretion.

That’s a good thing! More money allows you to deploy funds toward a more diversified and market independent portfolio.

2) Options Are Less Risky (if used properly).

Yes, admittedly there are situations in which options can actually be riskier to holding stocks.

But if used properly options are ideal to reduce your risk whilst maximizing your profit potential. It really depends on how you use them.

In general options can be a lot less risky simply because they require less financial commitment than equities, plus they are a lot less affected by the potential of catastrophic opening gaps.

Which is why options are a time-tested, dependable, and frequently used form of hedging one’s stock portfolio, which obviously makes them safer than stocks.

For example when purchasing a stock, a stop-loss order is frequently placed to protect your investment. So far so good, you sleep a lot better believing that you are protected from a catastrophic sell off.

But there’s a problem with that. Ever heard of NYSE trading hours? A stop order is designed to become market order the very moment its stop price has been touched. So if you bought your stock at $100 then you may have placed a stop order at – let’s say – $80.

So what happens when there’s a really disappointing after hours earnings report and the stock you’re holding opens at $75 or perhaps even lower?

You may have guessed it. The stop loss order immediately converts into a market order and that’s where you’ll probably be filled – if you’re lucky that is. If there’s a lack of liquidity your stop-loss may get filled even lower.

Had you instead purchased a put option for protection you would not have suffered any catastrophic loss. Unlike stop-loss orders options don’t care about trading hours.

If your $100 put opens the next day at $75 you will be $25 in-the-money (ITM) which you can claim at your convenience.

3) Options Offer Higher Potential Returns

Frankly you don’t need an advanced degree in mathematics to figure out that spending less money in order to make more represents a better profit potential and offers more flexibility.

Admittedly many options placed by inexperienced traders expire worthless, but when they pay off, they really pay off BIG.

Let’s compare the returns of our $100 stock to that of an ITM option purchased for $10. We assume the option has a delta of 80, which means the option’s price will follow 80% of the underlying stock’s price change.

Sounds complicated but it really isn’t. If the stock were to go up by $5 then your stock position will have given you a 5% return (105/100 – 1 = .05). Woohoooo!!

Meanwhile your option position will have gained 80% of the stock’s movement (remember that 80 delta) or in other words $4. A gain of $4 on a $10 option amounts to a 40% return – quite a bit better than the measly 5% return you got on your stock.

Of course when the trade does not go your way your stock option can lose a big chunk of its premium, but that actually brings me to another advantage of trading options.

4) Options Allow You To Clearly Define Your Max Loss

Full disclaimer: Selling an option (i.e. being short) exposes you to potentially unlimited risk. However the vast majority of traders do not start selling options until they have acquired several years of hands-on experience.

When buying an option you can sleep soundly at night knowing that the option you purchased for a $10 debit can never lose you a single cent more than what you paid for it. It’s that simple and there are no ifs or buts.

But there’s actually another hidden benefit that may not immediately be apparent. And it relates to an option’s ability to weather out large swings of volatility.

Let’s say you bought a call option for $10 and the underlying stock drops from $100 to e.g. $80 due to some accusations of mismanagement.

Most likely that call you’re holding will have lost most if not all of its premium. Not a happy moment but heck – you lost $10 and live to trade another day.

But wait. The very next day it turns out that the sell-off in the underlying stock was actually triggered by a false rumor, so price immediately snaps back and pushes way past the strike price of your call option.

Meaning you’re now sitting on juicy profits. That’s the power of holding an option or an option spread (topic for another day) during big market swings.

Think about what would have occurred had you traded with a stop-loss instead. If your stop was sitting at or above $80 it will have invariably converted into a market order and been filled.

Which means instead of a big juicy gain a few days later you would have lost a good chunk of your portfolio simply over an unconfirmed rumor.

Fortunately false rumors or outright fake information rarely if ever happen in the financial media.

J/K – of course they happen all the time!

5) Options Offer Many Strategic Alternatives

In order to keep things simple I’ve mainly talked about trading ‘naked’ options, which simply means holding one or more options of the same strike price and expiration.

But there is actually a long laundry list of option spreads and other option strategies that can be employed to take advantage of specific market movements.

Think of it as using a scalpel instead of an ax. If I have an inkling that the price of a stock may go from $100 to $110 because of [reasons] then I could for example place a butterfly instead, which massively boosts my profit to risk potential.

Similarly if I suspect that price will drop 10% next week then I have a choice to either sell an out-of-the money call, buy myself a put, or perhaps place a vertical put spread.

That may sound like Chinese to the uninitiated but once you’ve gone through my Options 101 and Options 201 training you’ll be more than prepared to take full advantage of all market conditions.

Or just follow my trade alerts, which teaches you how to trade options in a more organic and gradual fashion. While you grow your trading account, thus combining the best of both worlds – education and hands-on practice.

6) Options Are Market Direction Independent

That’s a simple one. No matter where the market may swing tomorrow, there’s always an option out there that allows you to take full advantage.

The long side is a no-brainer – a simple call option or a vertical call spread will do the trick. Here you have a simple choice between buying a stock or some call options.

Trading the down side is a bit more tricky. If a stock is expected to drop significantly lower you could always sell – i.e. go short – the stock in order to benefit. Assuming of course you are actually able to borrow the stock first.

Which in many cases is tricky or near to impossible, especially if you are a retail investor with a small account principal and little room for margin.

Buying a put however is almost trivial in comparison and accessible to everyone. There are literally hundreds of stocks out there that offer not just monthly but also quarterly and weekly options across a wide range of strikes. So take your pick!

But what happens if a stock is expected to do absolutely nothing for a few weeks or perhaps even months? What then?

You may be surprised to learn that statistically speaking 87% of market advances or declines in the stock market occur in only about 11% of the time.

Which means over 80% of the time the market is going exactly nowhere, all the while retail traders waste time and money guessing as to where it may be heading next.

So what to do?

I’m glad you asked because there are literally dozens of ‘neutral option strategies’ at hand to take advantage of a sideways market phase.

In fact options are ideally suited for trading ‘boring’ range bound markets, which is why they have become a preferred profit opportunity for institutional traders and account for much of our monthly option trading profits.

The Bottom Line

I could go on here but I am confident that I have given you a basic understanding of why trading options is far superior to trading options or any other financial instrument you will come across.

With brokerages providing direct access to options markets and insanely low commission costs, the average retail trader now has the ability to use the most powerful tool in the industry just like the pros do.

So don’t waste time and get left behind. It’s the dawn of a new era for individual investors. And trust that my team and I stand ready to help you kick your option trading skills to the next level.

With RPQ Unlimited, you’ll receive all the trading education you will ever need to be a successful options trader on a long term basis.

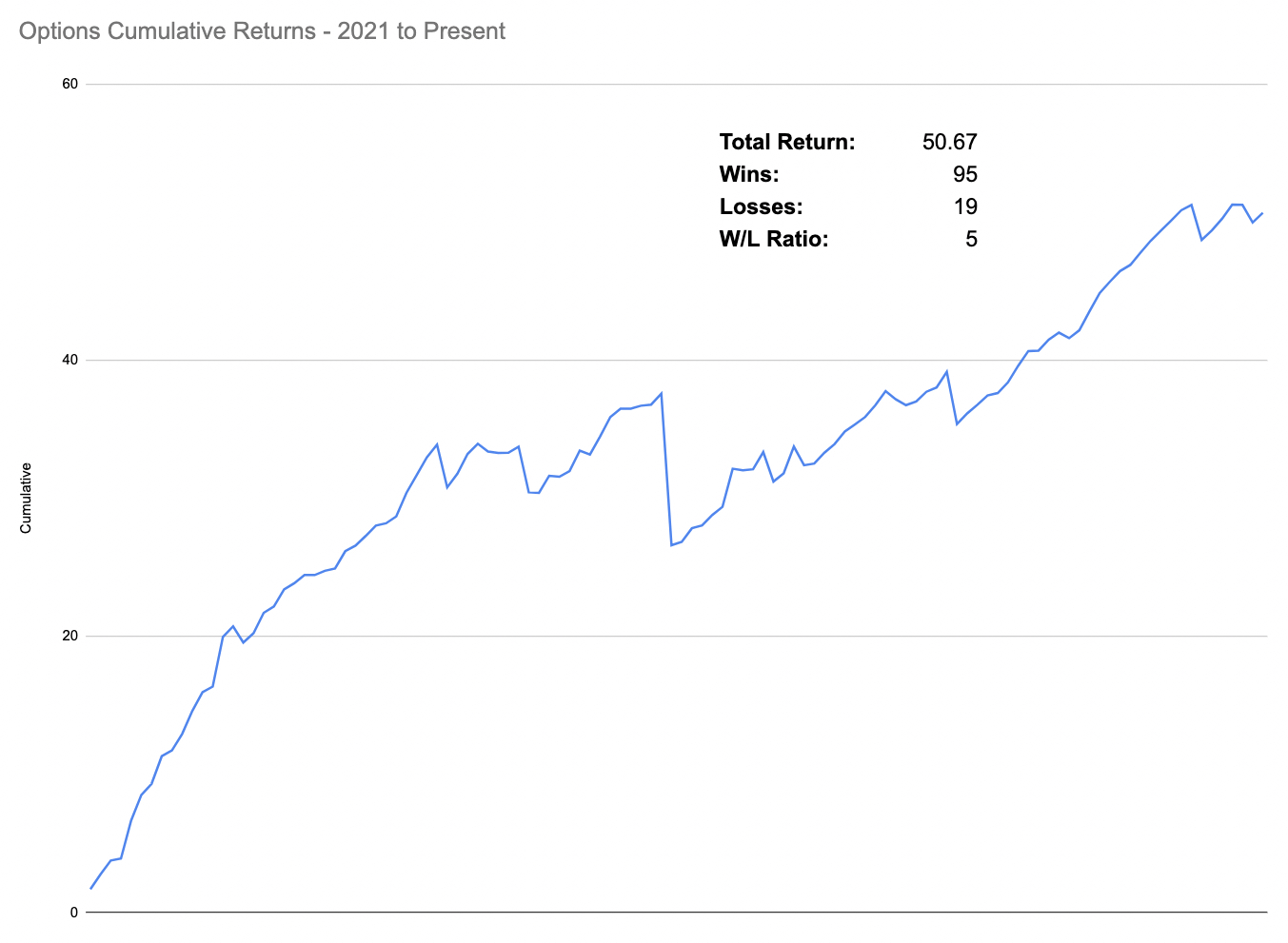

We believe it is crucial to immediately start growing your trading account just like a professional: slowly and consistently.

Which is why we’ll be spoon feeding you live quant trades that you’ll place alongside us. Trades from proven market specific strategies, with a proven track record that institutional firms keep under lock and key.

A LIVE cumulative P&L with all trades over the past year can be found here.

You can sign up right here.

See you on the other side.