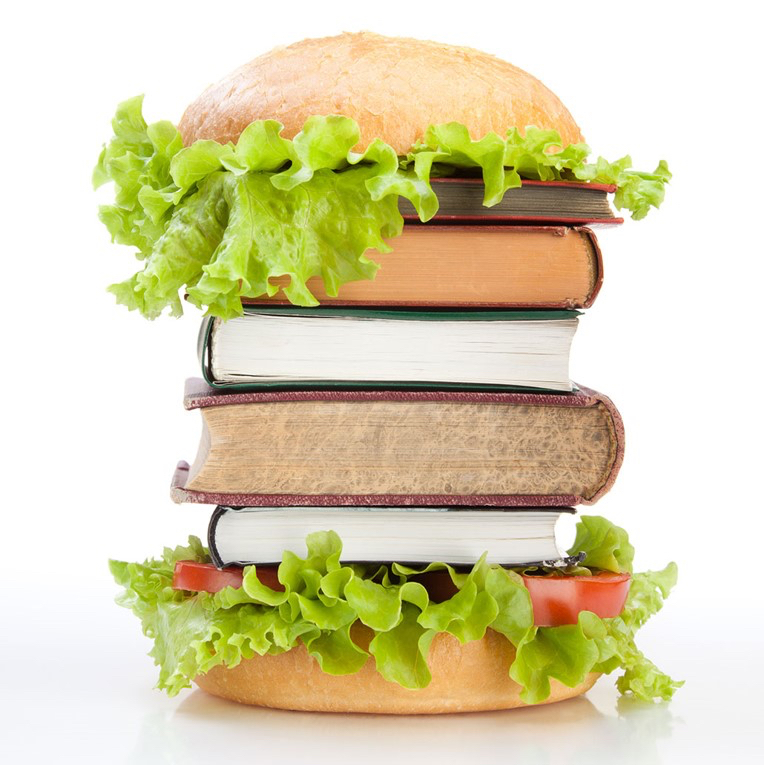

Here’s a crazy statistic: The average person alive today absorbs as much information in a single week as someone only a century ago encountered in an entire year. Think about the implications and you’ll quickly realize why developing your personal information diet is key for turning your brain into one lean mean thinking machine.

The basic idea behind reducing your intake of information is nothing new and I first encountered it way back during my trend trading years.

It is one thing for a trader to say that the news doesn’t matter and to simply attempt to limit one’s consumption. However it is quite another to consciously develop a systematic approach for consuming information and to extract only what is needed for achieving optimal results in the shortest amount of time.

As you can tell I have given the subject matter much consideration and over time I developed principles which slowly became core tenets of my trading career.

I am going to share some of them with you today in the hopes that you may be able to incorporate some of those ideas into your own trading activities, and decide on how you process the daily torrent of information you are sure to encounter.

Tenet #1: Cui Bono

Latin for “To whose benefit?” – literally “as a benefit to whom?”.

Over time I have learned one simple fact the hard way: Whenever anyone tells you anything it is for a reason. Either they want to impress you, manipulate you, extract information, or lead you toward a certain way (intellectually or emotionally).

Whenever a person tells me anything about any topic it now has become my habit to immediately question the motive of the piece of information or inquiry I just have received.

Ask yourself: Why is this person telling or asking me this and who benefits? Cui bono, right?

The simple act of doing that will often provide you with important clues that allow you to challenge what’s being presented, or at least dismiss it altogether.

By the way some of this is directly derived from Neuro Linguistic Programming (NLP) – a psychological approach that involves analyzing strategies used by successful or influential individuals and applying them to reach a personal goal.

For examples just check out any of the more popular ‘social media influencers’ and you’ll quickly see NLP at work. Most of them are not only skilled at how they present information but also know how to press your buttons and make you come back for more.

Once you understand how people or the media are trying to manipulate you it’s a lot easier to avoid a whole minefield of mental traps.

Caveat: even knowing how it works does not make you completely impervious to it. That’s how powerful NLP can be.

Tenet #2: Less Is More

Flash back to a 100 years ago when people only had to learn what they needed to know to survive. Information that was irrelevant to a person’s work or one’s well being was neither needed nor was it readily available to anyone but the most privileged in society.

But as time progressed and we slowly transformed into an information society, those who had the opportunity to expand their knowledge base were presented with greater economic and financial prospects – and thus the quest for knowledge became a means of getting ahead.

Today we are exposed to tens of thousands of pieces of information each waking hour. The amount of data we consume has steadily increased over the last century and can be thought of as an exponential curve that keeps pushing upwards steadily.

I believe we have long crossed the human brain’s ability to properly process and analyze all of this data. Let me ask you this: Do you experience brain fog every once in a while?

If so it may be partially related to your eating habits but most likely your brain is simply overloaded with the thousands of tidbits of useless information you are trying to squeeze through it every day.

We are simply not built to process this much information on a daily basis and there is much research that shows that the way our brains are wired and the way we perceive things are vastly different from that of our grandparents.

Whether that is a good or bad thing is up for debate – I think there may be good aspects but yet we should be careful about the flood of information we expose ourselves to.

Tenet #3: Embrace The Silence

Not only has the amount of information we consume increased exponentially – in my estimate the vast majority (i.e. 95% +) of what you encounter is completely useless.

It does not help you succeed, it does not help you survive, and it does not educate you in any meaningful fashion. I’m sure farmers in the 17th century enjoyed a good gossip as much as us contemporaries, but Abigail’s exploits with the village mailman can’t be compared with spending several hours a day consuming social media mind trash.

Even worse – quite a lot of it is actually harmful to your ability to arrive at a decision. Imagine a menu with 1000 dishes and 200 deserts. We all like options but that would clearly be overkill.

Once you embrace an aggressive approach to consuming information it is rather easy and actually enjoyable to reduce your intake.

I guess this implicitly correlates with Cui Bono and Less Is More. And again some of this is actually a product of studying NLP.

Tenet #4: What Everyone Knows Is Not Worth Knowing

Almost self explanatory I guess. If you really want to trade on information or the news then you obviously need to dig up something the rest of the schmucks are not privy of.

And unless you happen to work at Goldman odds are you are just like the rest of us – out of the loop and not part of the insider information circle jerk.

Ask yourself this: Why would any news item instantly accessible by hundreds of thousands of traders provide you with any trading advantage?

Very doubtful and instead you should spend your time reading tutorials or books on trading.

Incorporating this simple tenet into the way you process information will literally save you hours of wasted time every week.

Tenet #5: Verify The Quality Of The Source

I might as well have titled this post with ‘Most People Talk Out Of Their Asses’ – and unfortunately in my experience this is the sad truth.

Just log into your average online forum or comment section and randomly pick the load of crap that comes out of most people’s mouth about things they have no single clue about.

When someone tells you something – no matter the topic – always question the quality of the source. For instance someone is trying to give you trading advice then ask how long they have been trading and if they are profitable on a consistent basis.

I know this sounds pretty basic but you would be surprised about how many purported ‘experts’ have little or no background in the subject matter they are advising you on.

In case you wonder – I post all my trading results live in the open in my online trading floor. I also regularly publish P&L graphs of all my running systems.

Conclusion:

I probably could go on but these five principles are really all you need in order to slowly start reprogramming and optimizing your information processing habits.

Next time you come across a headline in the financial media the first question you should be asking yourself is: Why am I reading or hearing this? And by that I mean ‘what is the source’s motive of providing me with this information?’

Chances are the information is not presented for you to be more profitable, it is most likely the exact opposite.

Always ask yourself this:

- Who is providing me with this information?

- Does this person know what he or she is talking about? What are his/her credentials?

- And most important of all – do I really need to waste my precious time absorbing this information?

Chances are you can safely skip this one over and devote your time to more productive matters.

I strongly recommend you start developing your own information diet. What works for me most likely won’t work for you – it’s up to you to decide what is valuable and what is not.

That is the beauty of your brain – you have complete control over what to do with your gray matter – no matter how high your IQ or your level of knowledge.

And as the saying goes: program your mind or someone else is going to do it for you 😉

Before you run: the new year has arrived and it’s time to put yourself on the fast track to building your own trading business.

With RPQ Unlimited, you’ll receive all the trading education you will ever need to be a successful trader.

We believe it is crucial to immediately start growing your trading account just like a professional: slowly and consistently.

Which is why we’ll be spoon feeding you live quant trades that you’ll place alongside us. Trades from proven market specific strategies, with a proven track record that institutional firms keep under lock and key.

A LIVE cumulative P&L with all trades over the past year can be found here.

You can sign up right here.

See you on the other side.