The past four sessions turned into a wild ride but as of the Friday open the SPX has been getting nowhere fast and finds itself almost exactly where it started the week. This puts us in a very interesting situation for one main reason: With a monthly and a weekly contract expiring this morning, a 70 handle EM range, and quite a bit of gamma risk there is potential for a significant move today.

Plus let’s not forget that we are in one of the most volatile weeks of the year. So please take fasten your seat belt and make sure your folding trays are in their full upright position.

Now beside the potential for a squeeze in either direction the one thing I want you to pay close attention to is the IVZ-Score in the bottom panel of the chart above. If you don’t know what a Z-Score is and how it relates to implied volatility then please point your browser to my seminal post on the subject. I’d say you’ll thank me later but nobody ever does! 😉

Assuming you grasp at least the underlying concept take a glance at the Z-Score on the Spiders which have been scraping the bottom of the barrel for quite some time now.

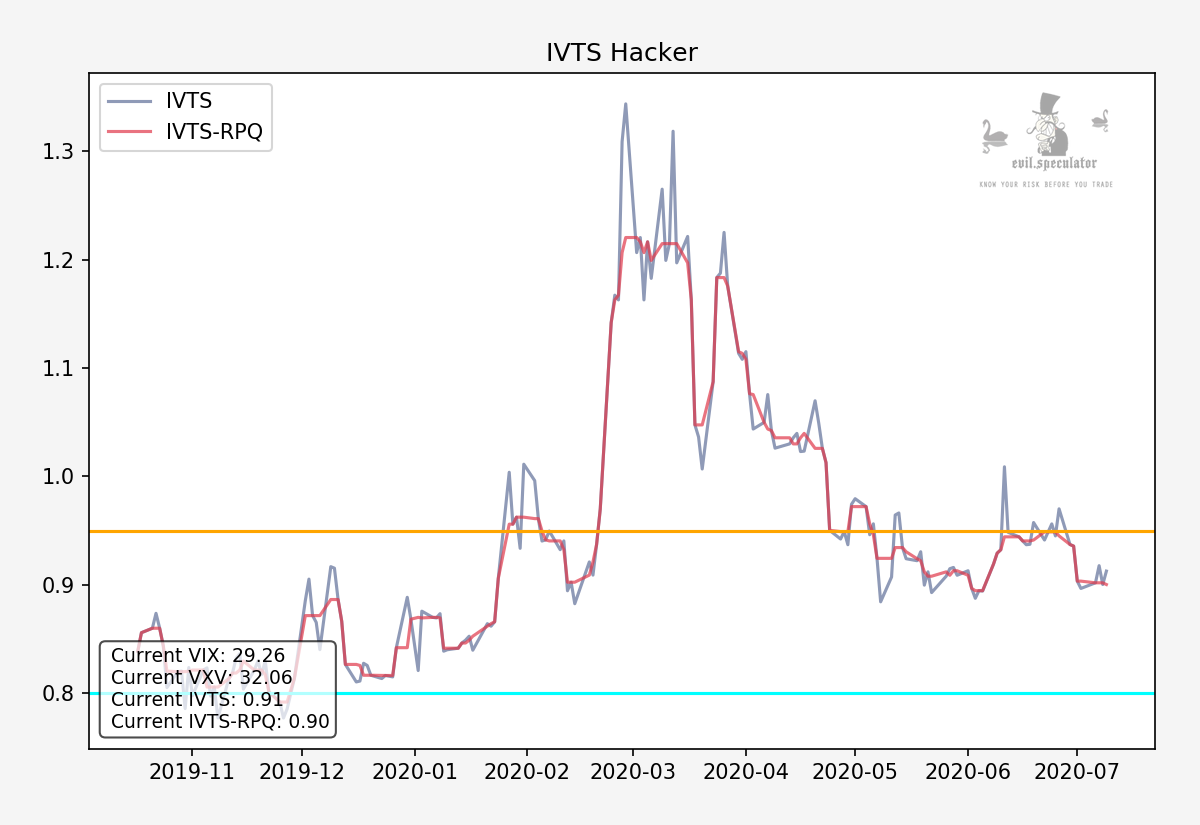

This is something I’m actually all across the board as is evidenced by the VIX, which is elevated by historical standards but rather chill in the context of what we’ve been through over the past 7 months.

The IVTS also has been running in what I would call moderate bullish mode since last May now. As we are heading straight into a presidential election the potential for much monkey business is growing by the day.

Which of course opens up an awesome trading opportunity ahead of November 3rd – if you are a sub join me below for more:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.