Crypto is crashing right now… and it’s my job to keep you informed. Here’s the deal. The owner of Binance and the owner of FTX are frenemies. The Binance guy invested in FTX, and he cashed out last year.

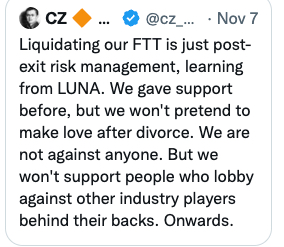

He’s been holding 2.1 billion worth of FTX and he announced that he’d be market-selling them (certain to crash the price)

In other words he intentionally set off a wave of panic selling in his competitors token.

Why?

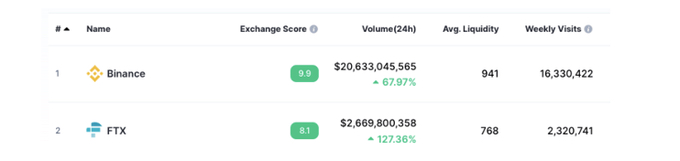

Well… FTX is still way smaller than Binance… but it is growing faster

And the FTX owner is one of the biggest donors in US politics… trying to get his exchange legalized (which will probably make it the biggest in the world).

CZ is actively starting rumors of FTX insolvency…

How rude… 😉

Now, here’s the deal.

If FTX goes broke it would hurt both of them immeasurably. Neither exchange would ever be legal in the USA (which is what they both dearly want).

And it would CRASH the bitcoin price well below 10K.

So it’s highly unlikely anybody lets it go that far.

CZ wants to wound FTX and damage trust, get users to withdraw their coins…

But he doesn’t want to kill them.

The price would be too high for the whole crypto industry.

It would literally cost Cz half of his net worth.

Game theory tells me this is something else.

Remember I’ve been warning you that the artificially low volatility in markets meant that a massive move was about to happen?

The highest probability is a crash in crypto markets to below the June lows, then a strong recovery.

But enough about crypto, let’s move on…

In my last email I talked about how the central banks are in a pickle…

They can’t raise rates without hurting everyone… and they can’t NOT RAISE rates without potentially doing even more damage.

Today I’d like to explore exactly how that happened and what’s likely to happen next…

You remember 2008, right?

Sucky time to be an investor.

It really looked like the financial system could collapse.

The insiders at the time say that if drastic action wasn’t taken that we were days away from money not coming out of ATM’s anymore…

And if that happened, the whole guns-n-gold Mad Max prepper fantasy would have been in full effect.

Nobody wants to live in a post-apocalyptic wasteland.

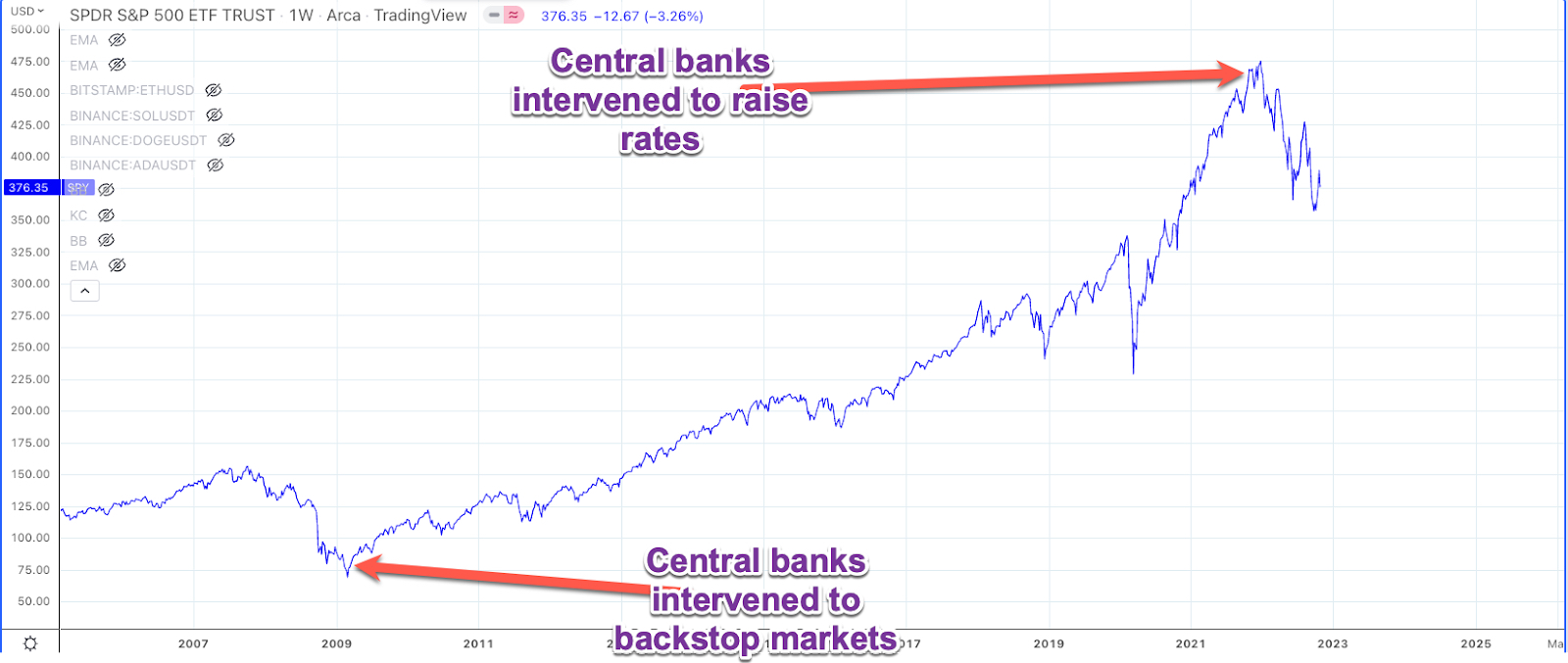

So the powers that be instituted the “Bernanke Put”… an implicit guarantee that they weren’t gonna let bad things happen to the stock markets on their watch…

And if you can imagine a casino where you can never lose… that’s what the stock market became.

But nothing lasts forever…

And it all ended when the central banks took the money printer away.

Let’s examine for a moment HOW we got addicted to endless GDP growth in the first place…

And the extraordinary tailwinds we have had…

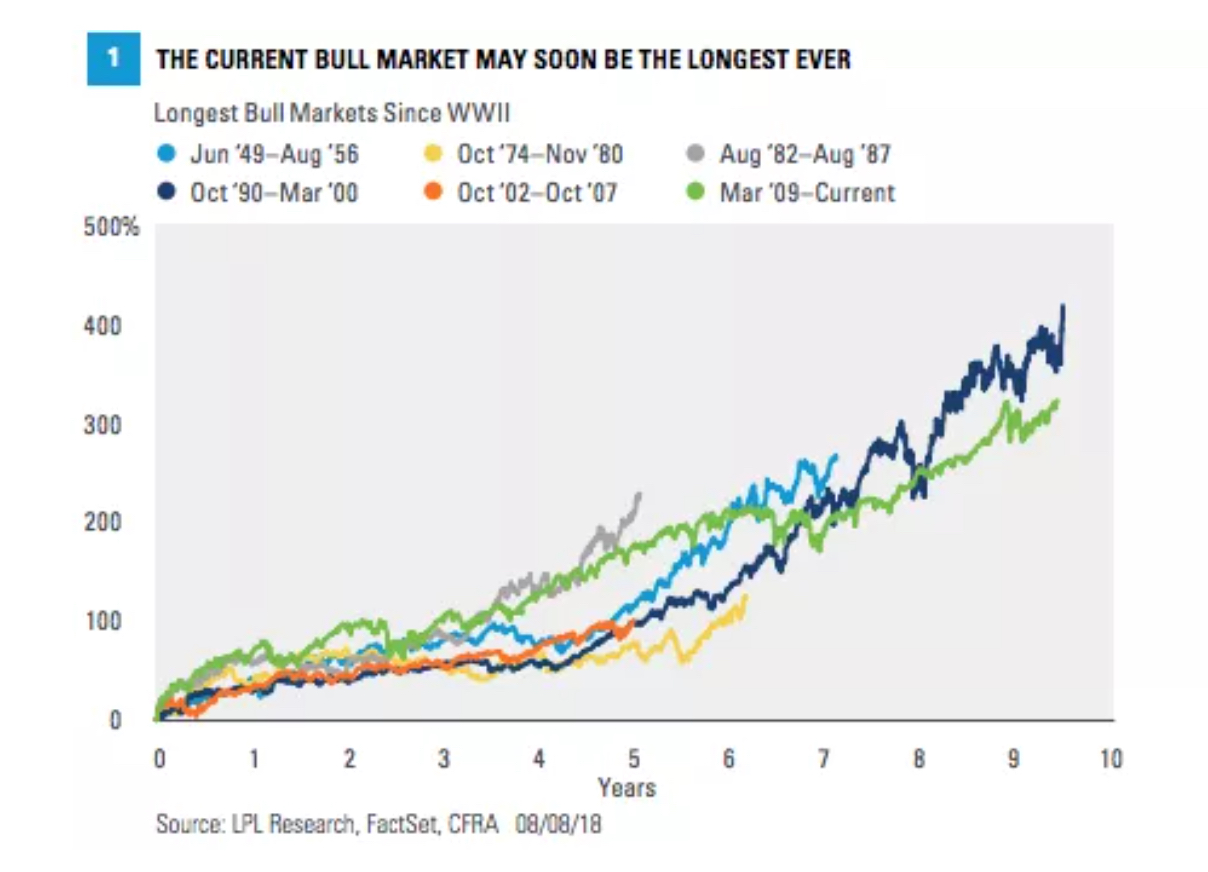

It all starts with WW2.

At the end of it, America was largely intact, but Europe and Japan were wriggity-wrecked.

This wholesale destruction left a generational scar on the European psyche, which largely explains why to this day European countries have a larger social safety net than America does.

America financed the rebuilding of the world, in exchange for being the world’s currency.

Great deal for everyone.

The US got to be the richest country in the history of the world… Japan became an ally and not an enemy, and Europe became a partner in global trade and prosperity.

Fine, as long as there were no big wars.

That’s the key thing to understand here. Wrecking a whole continent every 20 years costs a lot of money, and people were scared of it happening again.

Having no truly global wars saved a lot of blood and treasure. Remember the German ‘Wirtschaftswunder’ of the 1950s?

Huge tailwind which translated to an even bigger “peace dividend” at the end of the cold war.

Now this is important.

That “peace dividend” is being reversed… The US is planning for war with either or all of Russia/China/Iran… which costs money.

China is militarizing as fast as it can, seeking to challenge the US in every area it can.

Historically this has led to trade wars, currency wars, and eventually shooting wars.

Right now we have trade wars (Sanctions on Russia and Chinese tech firms), we have currency wars (the US Dollar is the strongest it has been in decades – that is, against other currencies)

If we get an actual shooting war (small or big)… everything is going to change.

That peace dividend is gone and never coming back.

The next big tailwind is that at the end of WW2 people did what people do when they’ve been fighting for years and survive.

They celebrated. In the finest way known to humanity.

They copulated like bunnies on steroids.

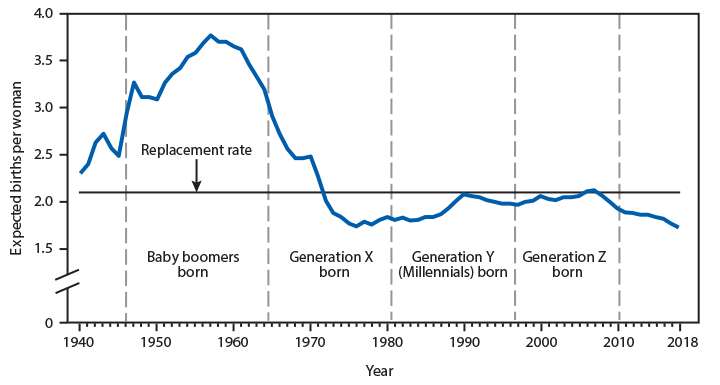

And birth rates exploded like never before.

In a few years these new babies had passed through the excellent US school system and had become productive workers.

And let’s not forget… the older generation had been significantly culled in the big war, so there weren’t as many of them to take care of.

More prime working age people paying taxes and less older people using social security… it was a recipe for prosperity.

The sexual revolution of the 1960’s threw fuel on this fire when all of a sudden we had an enormous pool of women who now were able to contribute productively to the economy.

I hope you can see how demographics ARE DESTINY.

In the long run, a country can only be wealthy from an increase in the productivity of its people.

And adding more productive workers did exactly that.

But unfortunately… those baby boomers are retiring now.

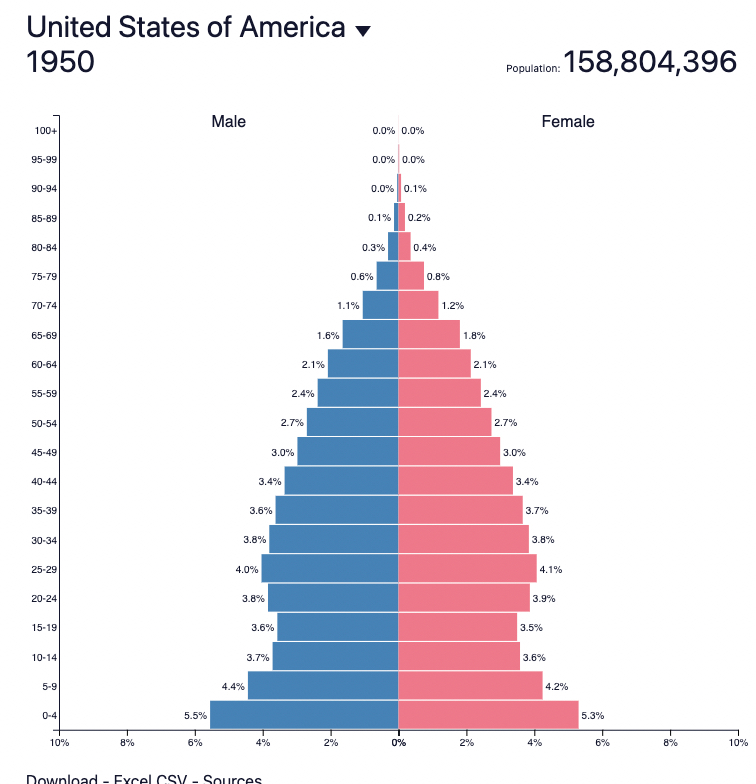

The population has gone from looking like this (hardly any old people)

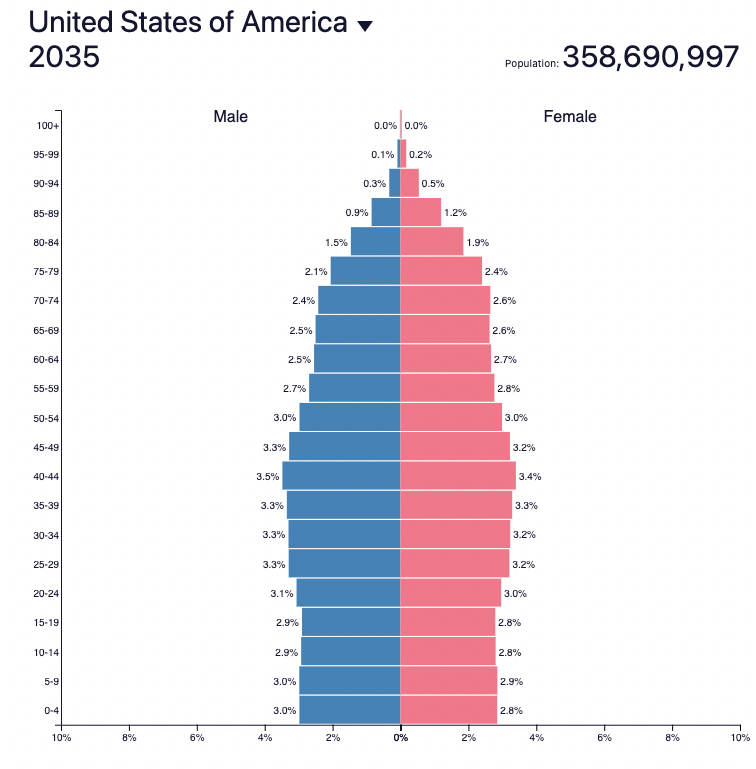

To a projection like this in 2035

The important thing to note here is that old people aren’t just a larger part of the population than ever…

They are living LONGER THAN EVER, and needing more healthcare than ever.

This demographic tailwind has become a headwind… and it’s actually worse in China, Japan and Europe than over in the U.S.!

So let’s summarize the complicated stuff we’ve just covered.

The enormous wealth creation of the last few decades was largely a result of megatrends…

The peace dividend…

The demographic tailwinds…

And a few others which I’ll be covering tomorrow… so watch out for my “part 2” email tomorrow.

Those trends have now not just stopped but REVERSED.

And the central banks were so scarred by the memory of 2008 that they left the money printer run too hot.

Which caused distortions in the economy.

Capital went into the dumbest things… NFT’s instead of cold fusion..

And not just capital either.

The finest minds in the 1950’s went into hard sciences… developing vaccines, medicine, space travel, theoretical physics, the internet…

These great advances in technology underpinned the whole bubble.

The greatest minds of the last 20 years have gone to work developing better advertising targeting for facebook and google… or trading algorithms for hedge funds and banks.

This is a big mistake, and the chicken are coming home to roost.

Tomorrow we are going to cover the other massive trends of our time… globalization, taxes, interest rates.

This is all leading up to our WEALTH CREATION SUMMIT on Thursday 17th November at 6pm EST.

I’ll be hosting a roundtable discussion with the very best traders I know.

I’m especially delighted to get hedge fund legend, regular presenter at Quant-con, and noted author Laurent Bernut onboard.

If you haven’t seen Laurent before, he is one of the smartest and funniest people I know.

It’s going to be a real treat.

Register HERE. Places are limited to 1000 and it WILL fill up so get in quick

Mike

P.s. If you want a sneaky-peek of our New Economy Bootcamp program… you can’t buy it yet (I’m going to release it for Black Friday with a huge discount) but shoot me an email to mikesneweconomybootcamp@gmail.com and I’ll give you a sneak preview.