Long term I’m red hot on the future of cryptocurrencies…. Yes, despite yesterday’s crash. Which was truly awful and I expect the DOJ and SEC will go medieval on SBF and anyone else responsible. That said, I think that in the next few years we will see some cryptos trading 10x higher than now, and others at 100x what we do now.

Hard to believe – I know – but that’s the age old psychology of secular bear markets. They only truly end when everyone has walked away in disgust.

Think the stock market in late 2008…

Did you back up the truck that year? I for sure didn’t. And most of you probably neither.

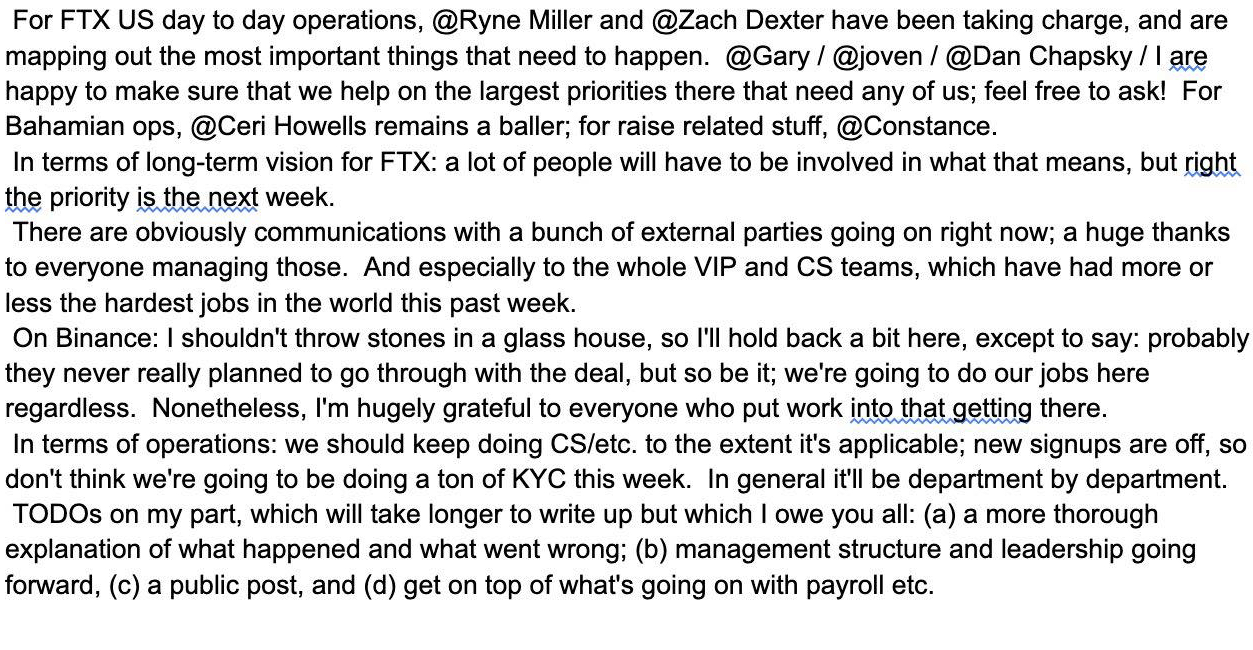

Also hard to believe is that our Crypto Salary System was not affected AT ALL throughout all this. In fact our cumulative P&L is once again near ATHs.

But honestly, that’s not a realistic plan.

Crypto can never be my ONLY path to wealth, and it can’t be yours either.

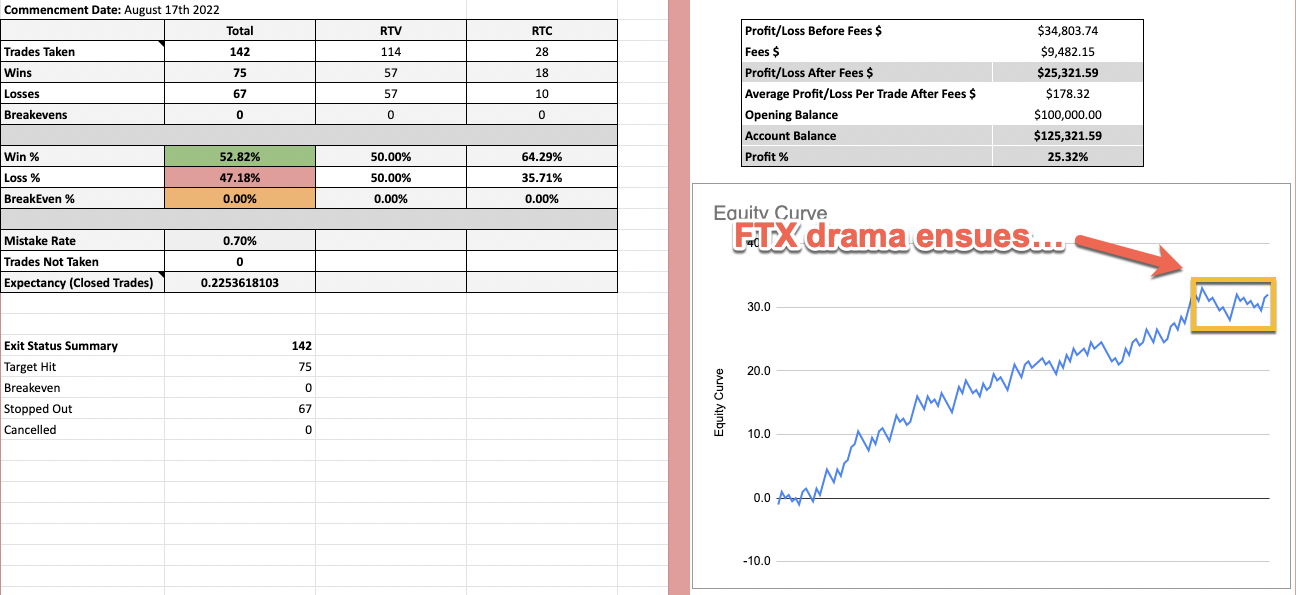

Case in point: here are the cumulative results of my options trades over the course of past year.

Not backtested – mind you – but traded live on our online trading floor side by side with our RPQ Unlimited members. Detailed spreadsheet with all campaigns HERE.

But let’s put all that aside for a moment. We have to talk big picture.

In the last few days I’ve explained why the everything bubble in interest rates has enabled and emboldened speculation in every sector of the economy… and crypto has been a PRIME BENEFICIARY of this.

(If you missed my previous few posts on the future megatrends I strongly recommend you catch up HERE)

So if crypto benefited from these tailwinds (low interest rates, low taxes, massive globalization)… surely it might get hurt by the economic headwinds of recession and inflation, right?

YES. Sad, but true.

If we get a recession nobody’s buying monkey jpegs for a while.

Now here’s the thing.

Central banks talk a big game, but historically they have always printed their way out of real trouble.

It’s their ONE JOB… managing the money printer.

And when you only have a hammer, every problem looks like a nail.

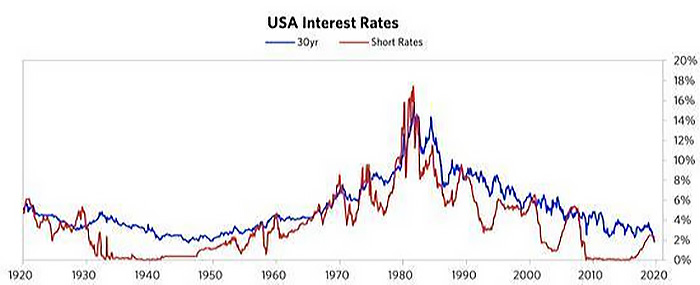

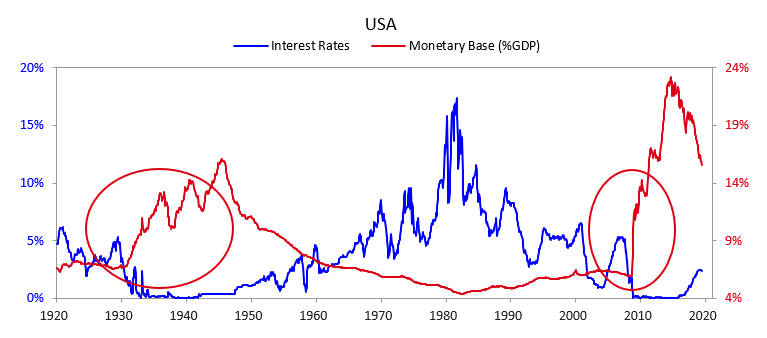

So we go back in history to the last time that looked like this (the 1930’s) and – sure enough – they lowered interest rates to zero then, too!

Ergo in my opinion, there is going to come a day when the Fed has to decide if controlling inflation is worth the cost of a depression (not just a recession).

And every single time this has happened before… they pussed out and we got currency debasement.

In fact, you can see that the 1930’s situation (lowered interest rates with huge increases in the monetary supply) is happening again right now!

And if all the big currencies in the world get flushed down the toilet… the big winners are hard assets.

And there’s no harder asset than Bitcoin. 21 million limited supply, forever.

And there’s no asset more immune to sanctions, trade wars, and capital controls.

Once people lose trust and faith in central banks they aren’t going to be in a hurry to trust again.

Crypto is potentially the biggest winner in history here.

A long shot that, if it comes off, is going to make us all very rich.

I’m positioned for it. You should be, too.

But here’s the thing.

There’s 10,000 cryptos, and 90% of them are going to be worthless in 10 years.

Think the hundreds of car companies in the early 20th century. All gone now.

But the few survivors are going to be worth TRILLIONS, with a T.

The same way that there used to be 20 search engines, and now there’s just google and a handful of tiny me-toos (oversimplification).

If you can work out the exact moment that the true winners emerge, there will be fortunes to be made.

That’s my plan.

But it’s not the only plan.

The current bear market in crypto has brought out the grinders who are hard at work uncovering the next generation of crypto gems.

Because we see, every time, that the winners of the next crypto bull market aren’t coins you know from the last one.

So it’s a research project.

And I’m not the guy.

But I know some guys who ARE.

I’m bringing them all into our Wealth Creation Summit on Thursday 17th at 6pm EST.

But that’s only part of the plan.

The real plan is a balanced and risk adjusted portfolio of ALL THE POTENTIAL BENEFICIARIES of our new economic reality.

And although there’s plenty of losers (you couldn’t pay me enough to hold commercial real estate in the zoom era)…

There will be plenty of winners.

More than enough winners. In crypto AND the real economy.

And in a time of such uncertainty the obvious thing is to drop all the things that aren’t going to work anymore and bet big on the things that will.

That’s where I can help

Because I love ya… and because I’m connected like lego… because I will go to the ends of the earth to see you become wealthy and gain financial independence….

So I went to the drawing board and called in all my smartest friends who know how to make BIG money off these emerging megatrends.

Register for our Wealth Creation Summit HERE and I’ll see you there.

Michael

P.s. We are going to launch a new, 8 week intensive on wealth creation that I’m thrilled to bits about. You can’t buy it yet (I’m waiting until Black Friday so I can offer a massive discount) but if it sounds interesting to you, just hit a reply to mikesneweconomybootcamp@gmail.com and I’ll give you a sneak preview

P.p.s This is the latest leaked internal memo from FTX. Take it for what it’s worth…