A dam breach is considered a catastrophic event and when one occurs in this day and age you rarely ever hear the end of it. Everyone’s focus is suddenly on the underlying reason for the dam’s failure and of course who or what is responsible.

There is an analogy in the financial markets that we all have observed but that usually receives a lot less attention: sideways ranges which are eventually breached after weeks of churn and then suddenly lead to either a shortsqueeze higher or a deep correction to the downside.

This may sound like a trite attempt to sensationalize what most would consider regular price action but if I am hyperbolic then it’s only to a small degree.

Reason being that not all sideways ranges are cut from the same tree and as usual context is everything.

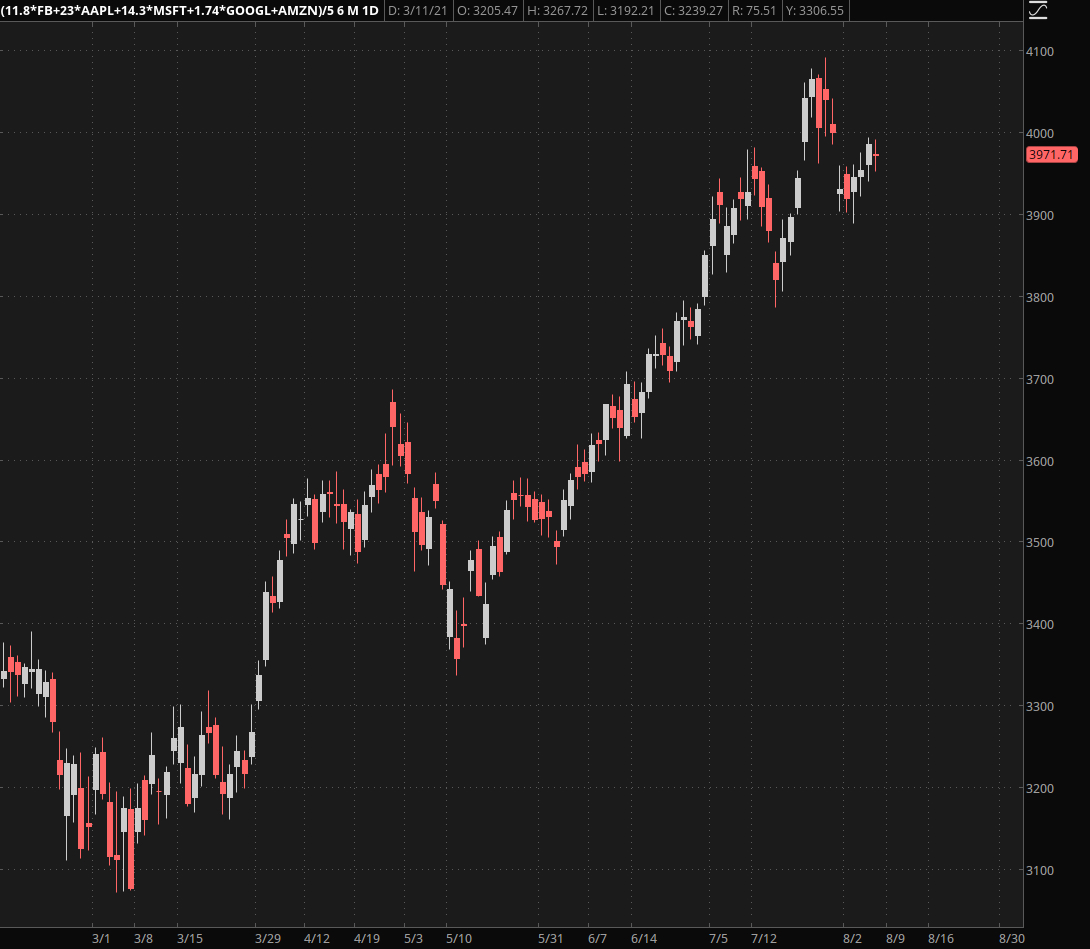

Over the past few weeks we’ve seen finance and technology – the two leading market sectors over the course of the past year – do absolutely nothing. The chart above shows my composite symbol comprised of various tech giants, i.e. FB, AAPL, MSFT, GOOGL, AMZN, and most recently TSLA.

What’s immediately apparent is that the sector is in an uptrend but it’s not doing anything right now. So what’s driving this advance?

And there’s your answer – finance is what’s lifting the entire index to new ATHs. Or so you would think.

Because you would be wrong. In fact you are looking at the tail here and not the dog who’s doing all the wagging.

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.