Implied volatility over the past few weeks has managed to blue-ball me worse than my first high school date. At least back then I finally got lucky on the third turn. But this attention whoring bitch tease of a market just keeps on making hot promises and then never puts out. That at least until yesterday afternoon when the FOMC – unexpectedly – put some fear of God into what has become a long term manic depressive but short term over complacent marketplace.

I’ve been rubbing this SKEW chart into your faces on multiple occasions lately. Unfortunately to no avail as most of you guys continue to draw silly lines on what by all intents and purposes are clearly trending equities charts.

So before you apply at Mensa in light of your radiant genius I am going to one more time attempt to drive this point across, as it is crucial:

The market is currently pricing in significant downside potential and if things become unglued – which admittedly is a heretic thought given the overall context – things could accelerate quickly.

So where does this leave us as traders? Unless you paid attention to the Mole in the past few weeks you just missed out on yet another golden opportunity to load up on affordable downside protection or to sell some FOTM put premium given that SKEW (first chart) is in record territory.

And speaking of implied volatility…

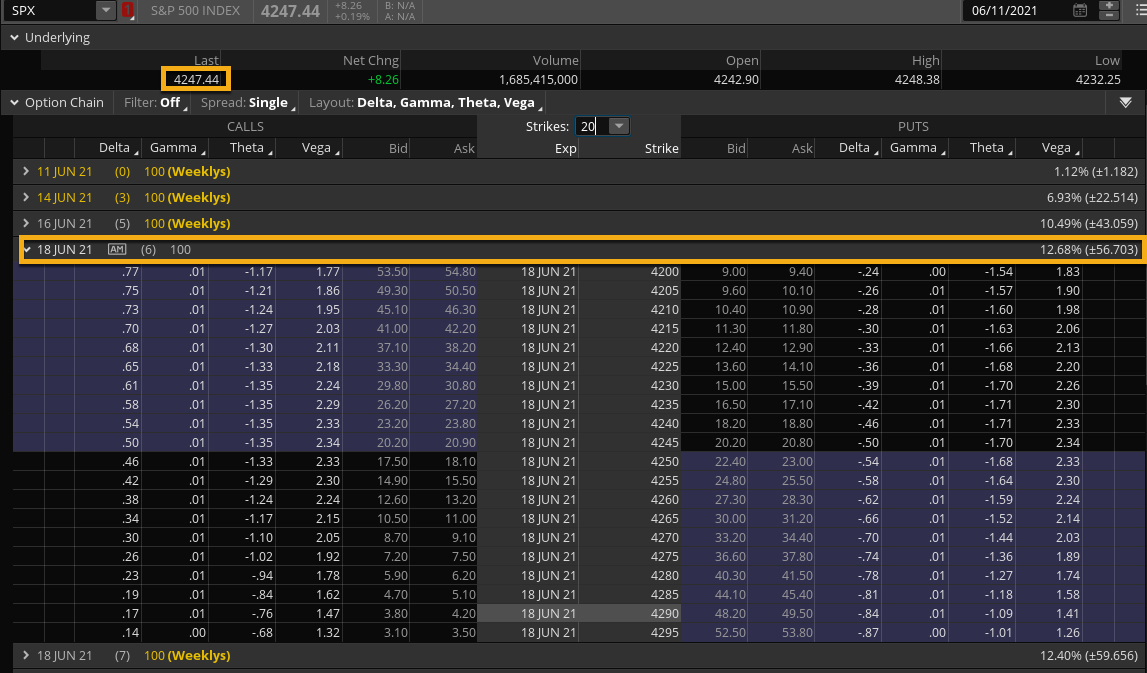

Here’s this Friday’s SPY contract at the close which was showing us IV near 12.7%. EM range: 56 handles.

Five days later it’s now HIGHER at 17.9% and an EM range of 45 handles.

Are you getting this?

Now if your mind has been all scrambled by the info-sewage being peddled in the financial clickbait media then you may be forgiven for not catching what’s actually happening here.

Which is that we are facing two possible scenarios – one boring and one rather profitable if played correctly.

A) Nothing happens – as it’s summer and nothing but an asteroid hitting earth seems to roil this cunt of a market.

Exhibit A: Once again price didn’t even touch the lower expected move. Let’s be honest about this. Even the thread of higher interest rates further down the line didn’t manage to spook price near any pain point.

B) The summer deluxe special surprise wipeout. Odds: 20% but IF it hits it’s going to be glorious. Meaning one of those days Godot will make an appearance and that with a vengeance. Thing Bruce Willies in his prime getting his hands on a case of napalm.

Take away: IV keeps teasing us but volatility is on the horizon, so stop slacking and get ready to deploy your A-game.

Now let me show you a juicy short term trading opportunity that you can’t pass up:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.