Last week I posted a quick poll aimed at getting a better idea of what type of content and which type of services would best serve my audience moving into 2023. I’m happy to report that no Dominion voting systems were smashed in the process.

So far we got over 100 responses (it’s still open – so please cast your vote if you haven’t yet) which is acceptable given that it was a holiday week.

Here are the results along with some of my thoughts:

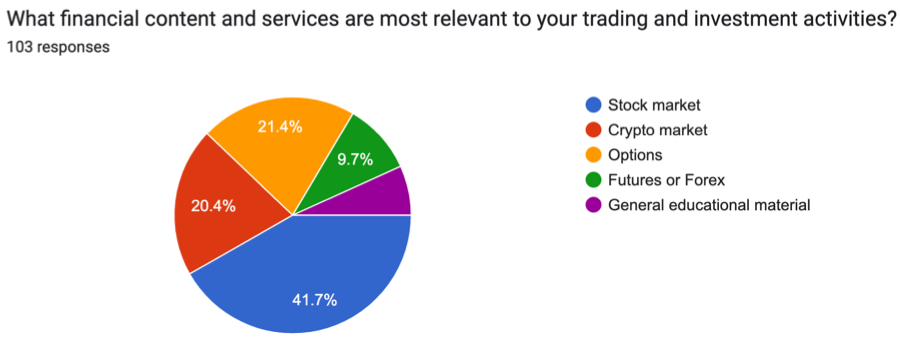

Honestly that one surprised me a little. The poll started out with crypto far behind both stocks and options but it steadily caught up.

The general stock market – much to my surprise – seems to still command a large amount of interest. I do talk about specific stocks occasionally but in terms of trading activity ‘stock options’ are my main focus.

I used to cover both futures and forex extensively up until a few years ago. But it never really took hold, so I sort of gave up on writing about those topics.

Take away: Honestly this puts me a bit in a pickle. I’m surprised that crypto ranks almost equally with options, especially given that we are in the midst of a crypto bear market.

My original plan had been to de-emphasize crypto for the time being, at least until both BTC and ETH have painted a LT floor. But it seems a good portion of people still want to be kept in the loop.

Since my options trading has been very solid over the past year I feel more pertinent posts and educational content are warranted. It’s a lot of work, so if you agree make sure to tick options when voting.

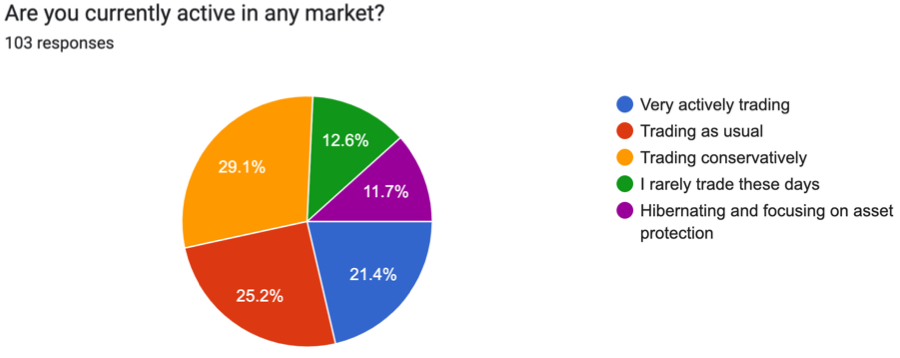

Again very interesting results. We seem to have an almost equal distribution in regards to people’s trading activity at the current time.

Take away: A little under 50% of my audience is either trading very actively or is trading as usual. 30% is trading conservatively and the rest is in hibernation mode. Makes sense in a bear market.

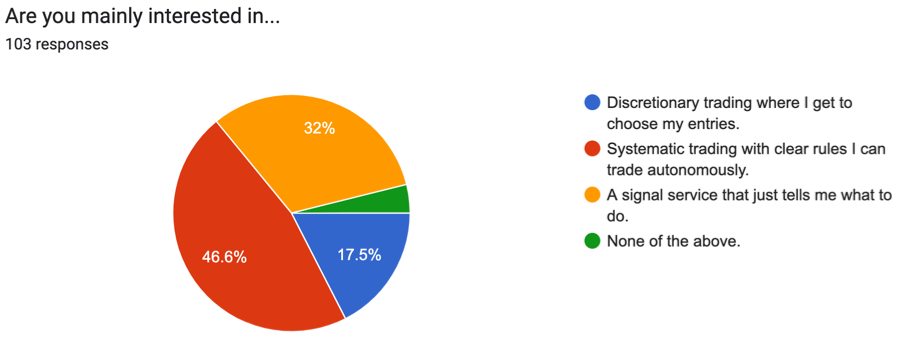

Not surprisingly a significant portion of my audience is mainly interest in systematic rule based trading or a signal service. That’s been my M.O. for over a decade now.

Fewer than 20% are interested in trading on a discretionary basis. I call that progress as that is considered the most difficult type of trading activity, especially for retail.

Take away: Systematic trading is where it’s at, and a good portion of people seem to also be interested in a signal service. However that does not correlate well with the type of financial content most people stated to be interested in.

Outside of institutional funds stocks are rarely traded via trading systems – in most cases it’s limited to a small number of ETFs, e.g. SPY, QQQ, UVXY, VXX, etc.

I feel that more empasis on trading options systematically my bridge that gap, which is what I’m doing with my current signal service.

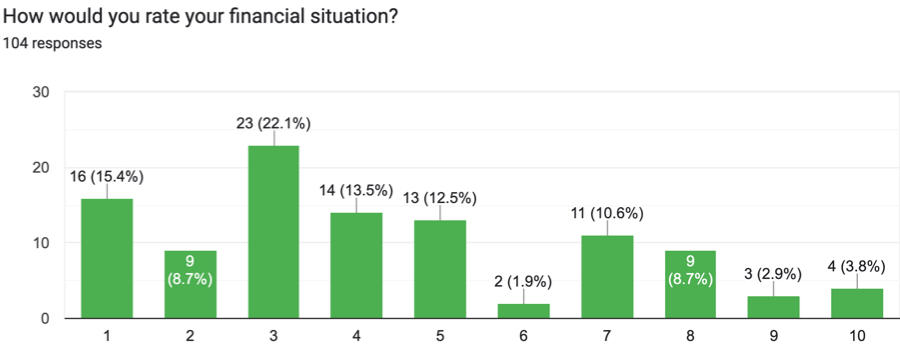

1 = Comfortable

10 = Challenging

I kept this question intentionally subjective in order to understand how people personally rate their specific financial situation.

After all someone may have hundreds of thousands in the bank but still experience difficulties based on various investments or financial obligations.

Take away: I’m happy to see a strong distribution between ‘comfortable’ and neutral in the center. A little under 25% of people seem to be experiencing financial pressures.

Honestly that’s a lot better than I had anticipated given what’s going on out there.

Looks like I need to increase my fees! Just kidding 😉