If you’ve ever been to Iceland then you may have come across this expression: There is no such thing as bad weather, just bad clothing. Well, if you happen to to hold any significant amount of Dollar assets these days – and as you are reading this blog I suspect you do – I recommend you better stock up on stormproof winter gear as conditions appear to be getting uglier by the day.

If there is one thing that is even worse than inflation it’s an inflationary depression, which refers to a period of severe economic contraction (i.e. a depression) that is accompanied by high inflation. And based on the Q2 figures released just yesterday the U.S. economy shrank a whopping 9.5% from April through June, the largest quarterly decline since the government began publishing data 70 years ago.

So is this it? Are we heading into a giant economic disaster, a perfect storm that is bound to trigger a teardown of the global U.S. Dollar hegemony?

Of course not. There is a narrative and then there is reality. First up everyone in the business worth their salt knew in advance that the Q2 numbers would be horrific. It doesn’t take a genius level IQ to figure that one out after we shut down the world’s economy for month’s on end. And second – if you truly believe that the Euro or the Renminbi are even remotely capable of replacing the Dollar’s status as a reserve currency then I have a bridge in Brooklyn to sell you.

Which brings me to the trillions assets being held in Euro Dollars across the planet. Believe me when I tell you that no one who truly matters wants the dollar to fail. And that includes the villain-du-jour, China. So yes, we are most definitely heading into a perfect storm but it is not one related to the US Dollar or any temporary self inflicted economic issues.

This sudden explosion in stories planted in the media is very suspicious and not surprisingly it is happening during a period of extreme Dollar weakness. Rather convenient to say the least and the supposed take away is that the U.S. is screwed and the EU has been saved. Mix in a ‘second wave’ of COVID-19, violent riots all over the country causing gun and ammunition sales to explode and you’ve got the perfect storm – in a tea cup.

To quote Warren Buffet: ‘If you’ve been playing poker for half an hour and you still don’t know who the patsy is, guess what you’re the patsy.’ Or in other words: Yes, the Dollar may be in a rut right now but it is still going to be around going strong long after the flowers have wilted on our all of our graves.

That doesn’t mean I am going to go long the Dollar right now right here. I’m glad I waited with long positions remembering the old rule to never step underneath a falling sword. So we bide our time and wait for the proper moment to strike.

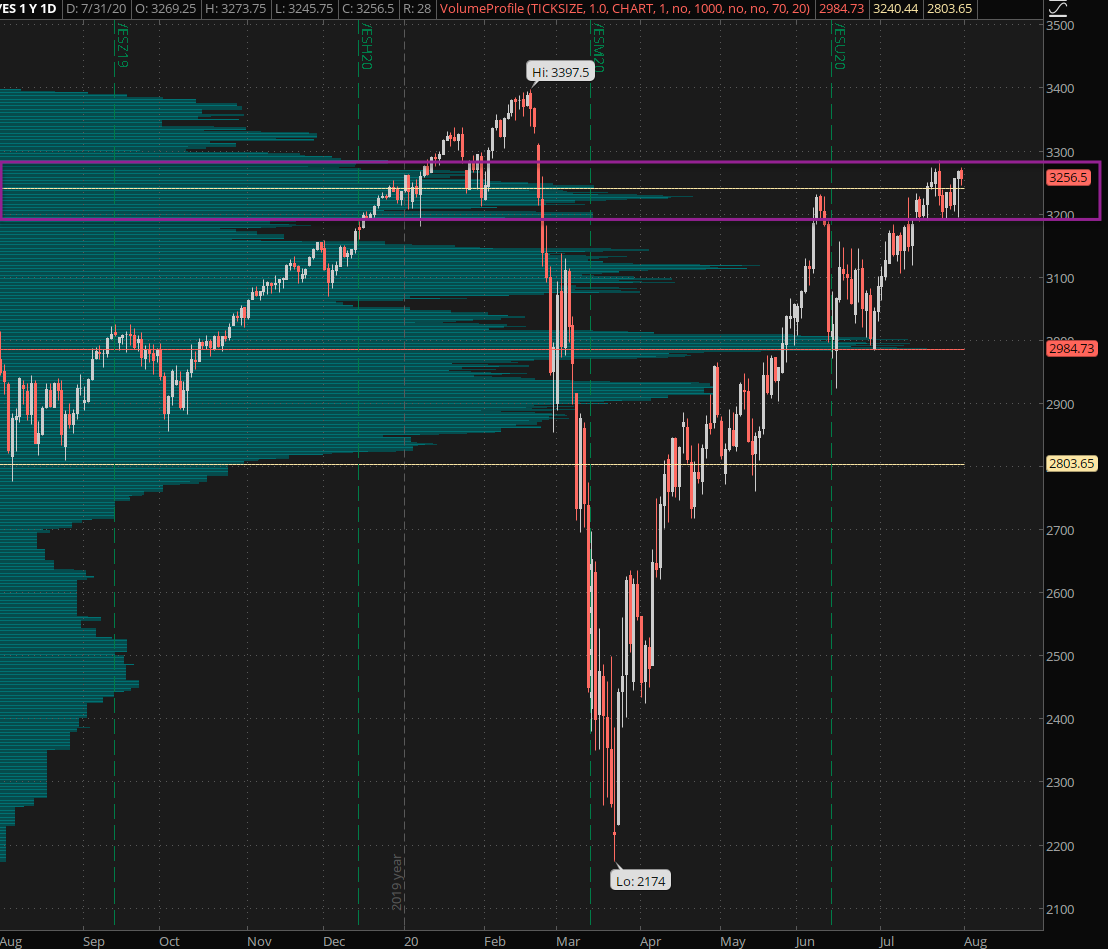

While the Dollar is swirling the proverbial toilet almost everything else is pushing higher. The SPX is now scraping the upper ranges of our current churn zone and the next real test will be the 1300 mark.

My ‘monsters of tech’ composite seems to have completed a successful retest and things are looking positive. If you are a subscriber I hope you took the hint and loaded up on a few long positions in the usual tech suspects.

Talking about good entries – here’s one for the wall. I suggested long positions in gold to my intrepid subs back on 6/22 and it’s been nothing but green candles ever since. If you’re still holding positions I suggest you start taking profits or at least trim down your trailing stop as exponential moves like these are not sustainable for long.

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.