Chances are it hasn’t escaped your attention that we are living in pretty volatile and fast moving times. It’s by no means a new phenomenon, in fact I can trace back a gradual but consistent ramp up in general nuttiness all the way back to the 2008 financial crisis.

Since that time I have been one of many voices that continued to question the wisdom of pursuing an entirely new financial system mainly serving a diminishing group of benefactors.

A system based on ubiquitous bailouts, massive rounds of money printing, and unorthodox market machinations with the main goal of avoiding short term pain in exchange for long term sustainability.

Where I always differed from most other analysts however – and where I took a completely alternate approach – has been in regards to my ongoing trading activities.

In other words I’ve always drawn a very clear line beyond my beliefs regarding macro economics or financial policy and that of what works down in the trenches where the actual sausage gets made.

Or in more plain English: What ought to happen based on my perfectly reasonable stance on things continues to have very little bearing on what usually plays out in reality.

Or to put it even more plainly: If you attempt to trade based on what you feel ‘should happen’ you’re most likely going to get run over by a freight train.

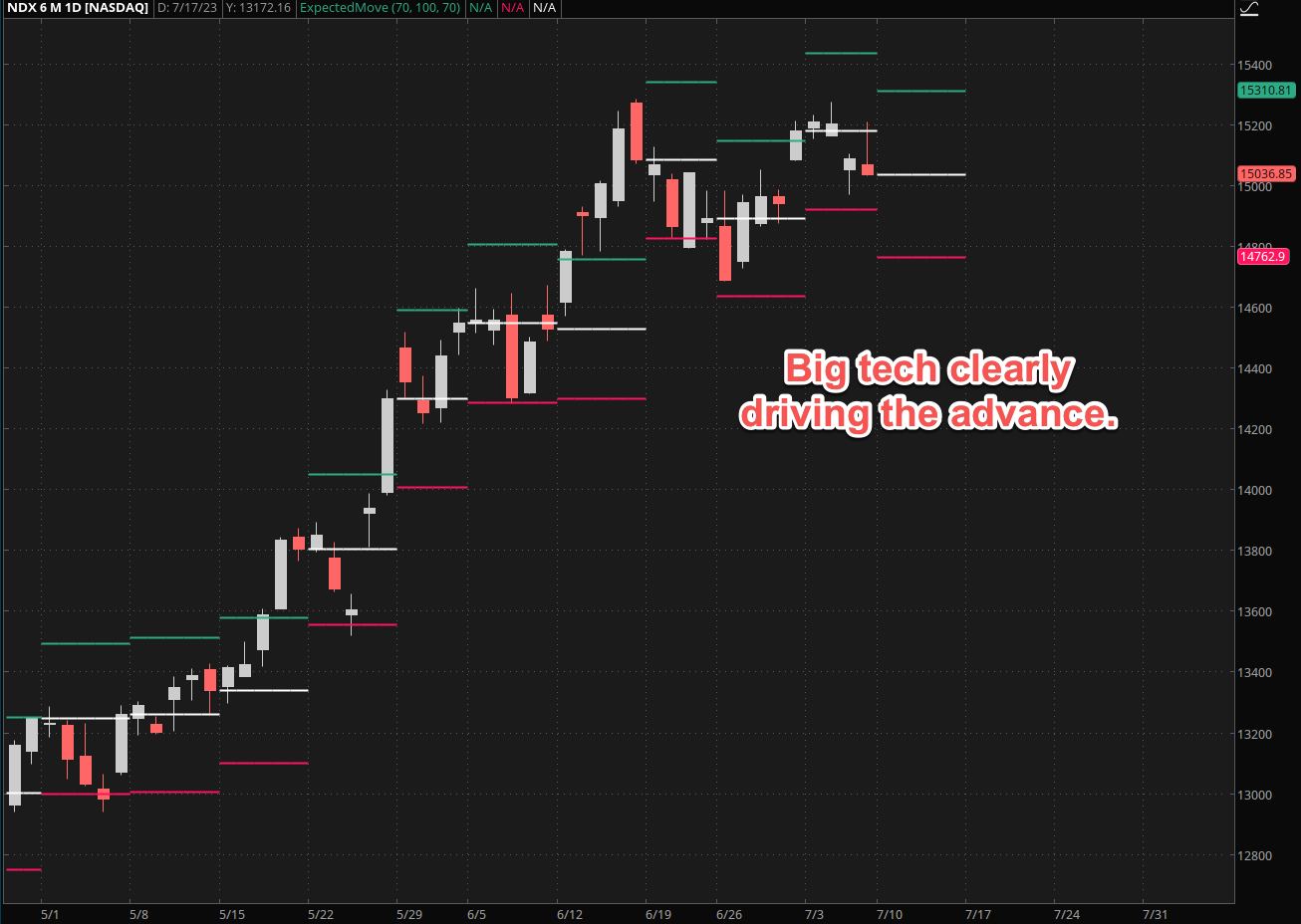

Case in point: The current advance in all things stocks and especially as it relates to big tech.

The SPX chart above points at all the weeks when risk apparently was handicapped incorrectly.

Since mid May I am counting six weeks where the weekly expected move (EM) was breached, several times by a whole standard deviation.

It’s no secret that big tech in particular is what has been driving most of this advance.

Strike it up to the sudden flurry of AI related projects and services, or just to the fact that the market simply wants it to happen as a good old fashioned short squeeze is super profitable for some people.

If you’ve been riding this gravy train over the past few weeks, then good on you and I would never tell anyone to play market contrarian and trade against the ongoing trend.

Which incidentally continues to be to the upside until a meaningful support cluster can be breached.

That said I consider it my duty as your humble host to make you at least aware of conditions that could put your portfolio at peril.

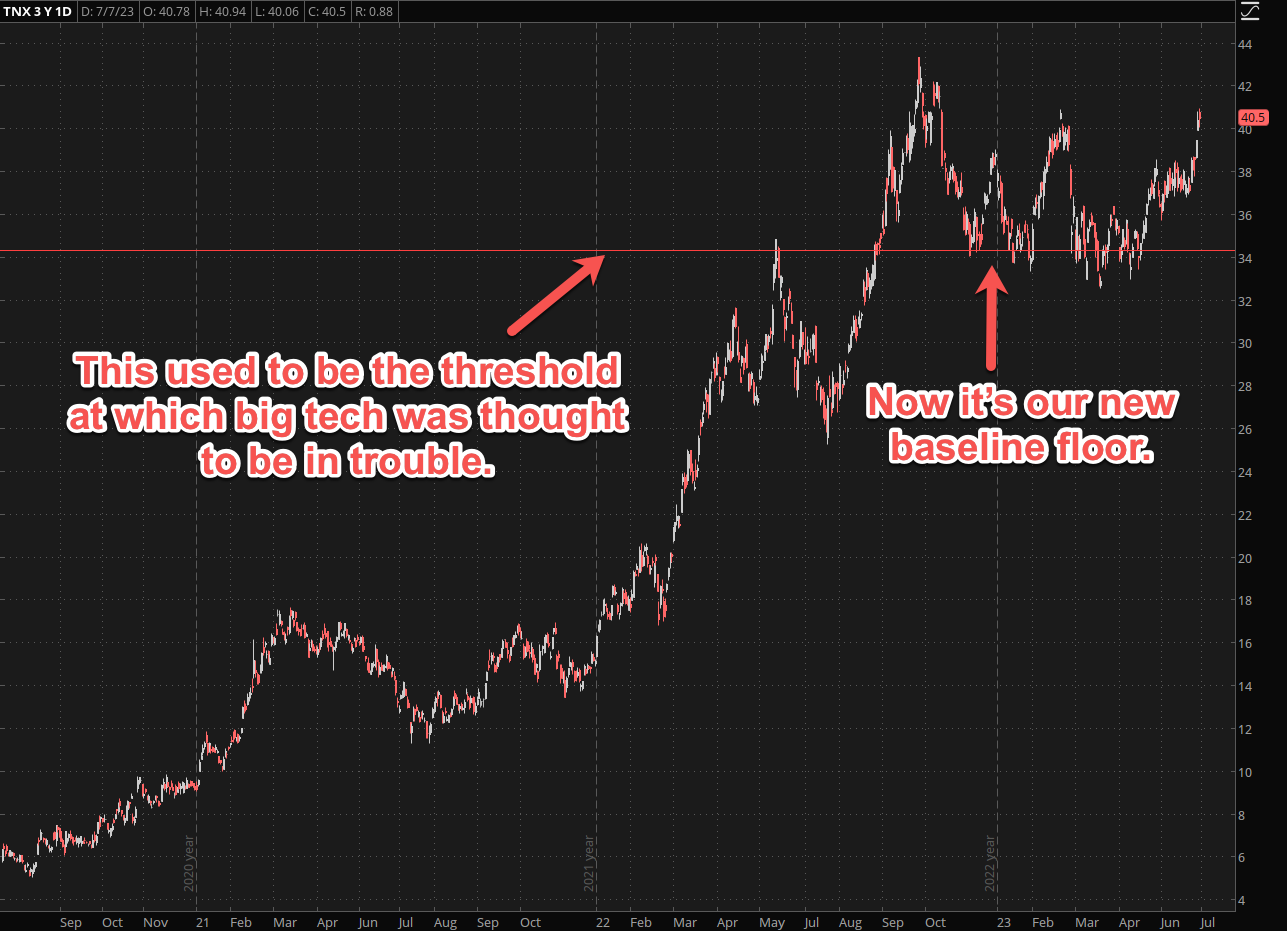

One chart that deserves to be highlighted beyond all is the TNX – or the ZN futures if you prefer to follow the horse that drives this particular apple cart.

I distinctly remember pointing at the 3.4% mark late last year, suggesting that this may be the point where big tech would start to find itself in a world of hurt.

Well we’re now approaching 4.1% (again) and it increasingly seems that high rates suddenly do not mean anything anymore.

Just like bad economic news over the course of the bad decade, which gradually metamorphosed into good news for the stock market.

Now I’m not pointing all this out to earn a PhD. in quetching (for which I admittedly have a natural talent) – in fact there’s a reason I’m bringing it up again at this point.

The long term chart above attempts to make my point. Which is that yields on 10-year t-notes have not been this high since all the way back during and right after the 2008 financial crisis.

But Mike – I hear you say – yields used to be a lot higher in the years leading into that financial crisis!

And yes, they were, but that was BEFORE we had trillions and trillions of debt obligations on the Fed’s books. Which someone has to pay interest on.

Yes, exactly – that someone is YOU. And I – and everyone else reading this post.

In fact real estate and car loans are already starting to suffer from rising rates as they may not be reflected in the financial markets but are clearly noticeable in the general economy.

Which is maybe why millennials are increasingly adopting the practice of dumpster diving to make ends meet.

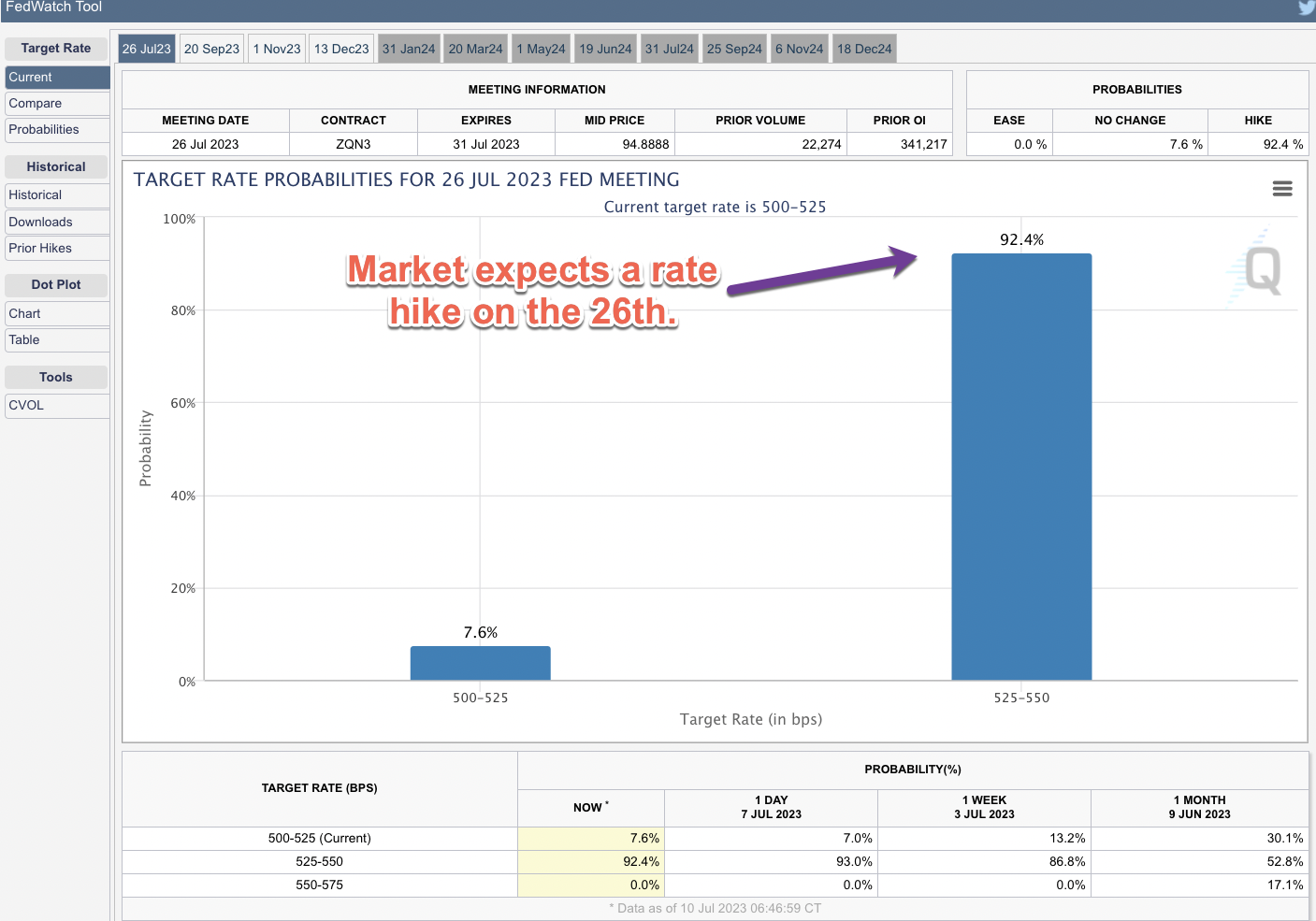

And then there’s this…

Either way you spin it – at some point something will have to give. I don’t know when that moment will arrive, and neither do you.

Which is the reason why I have permanently shifted my trading approach into being market direction agnostic.

Meaning I only take trades that are market range based instead of whether or not it’ll go up/down/sideways over the course of the next x weeks.

BTW, if you enjoy this type of analysis and are looking for returns like the P&L above then shoot me an email and we’ll get you set up with our Unlimited signal service in no time.

It’s fairly low frequency and only takes high probability trades with the aim of producing consistent and reliable side income.

And that’s nothing to shake a stick at in today’s volatile times