Once again the week started out with an attempt to ignore seasonal bias but then slowly degraded as time went on. Let’s be clear, the bulls had a perfect shot at recovering the ball and controlling the game again but then fumbled only yards from the end zone. Looking at the overall market it’s easy to assume we’re only looking at second dip buying opportunity but if we did a bit deeper things are looking a lot less optimistic.

This week’s expected move (EM) threshold once again proved to be an important inflection point. A push beyond it would have triggered a ton of margin covering activity. Especially since it lines up closely with a previous spike high (ES 3425) we painted on Wednesday of last week.

Which also means we now have a well established overhead resistance threshold that we can use to plan our future campaigns. If you’re short the Spiders or the SPX then a stop loss a little bit above that threshold is advisable.

I talked about ‘digging deeper’ and what I am referring to in particular is the theme I have been harping on about for the past two weeks: BIG TECH.

Well it’s failing and my ‘monsters of tech’ composite symbol comprised of FB, MSFT, AAPL, AMZN, and GOOGL is starting to look increasingly bearish.

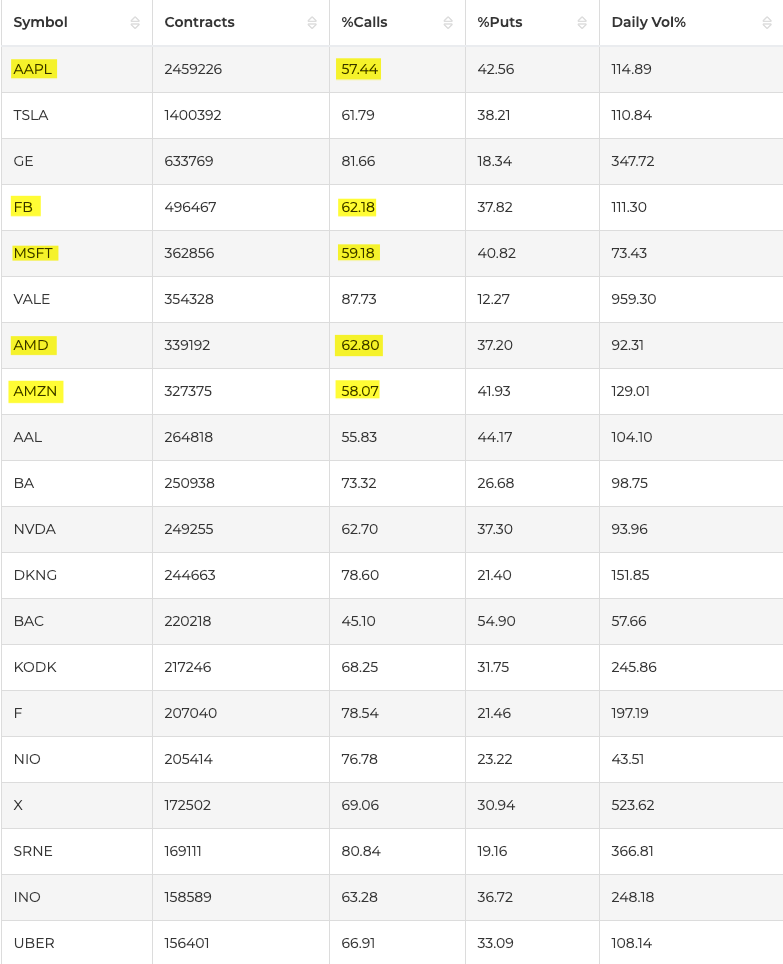

And once again it’s not for a lack of trying. I’ve posted this OCC list of the most active options contracts repeatedly over the past week or so. Every single time call volume across big tech outweighed put volume on average at a 3/2 ratio.

However as you can see that is slowly changing now as tech stocks across the board continue to slip. If you think about it however – this has huge implications as to what may happen next:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.