If you’re feeling a bit stumped right now by the current ramp higher you are not alone. In fact a lot of things in this market don’t make much sense to me at the moment. Which in turn led me to lower my exposure in equities weeks ago and that implicitly means I am not just talking my book.

From a pure price perspective this market has been riding an ACME rocket into the stratosphere. We are counting one opening gap after the other on the SPX presumably on the wings of a slew of positive tech earnings.

Well if that’s the case then why is our synthetic Monsters Of Tech index still not getting out of the gate?

In fact it’s been finance that has been driving this entire advance and it continues to do so.

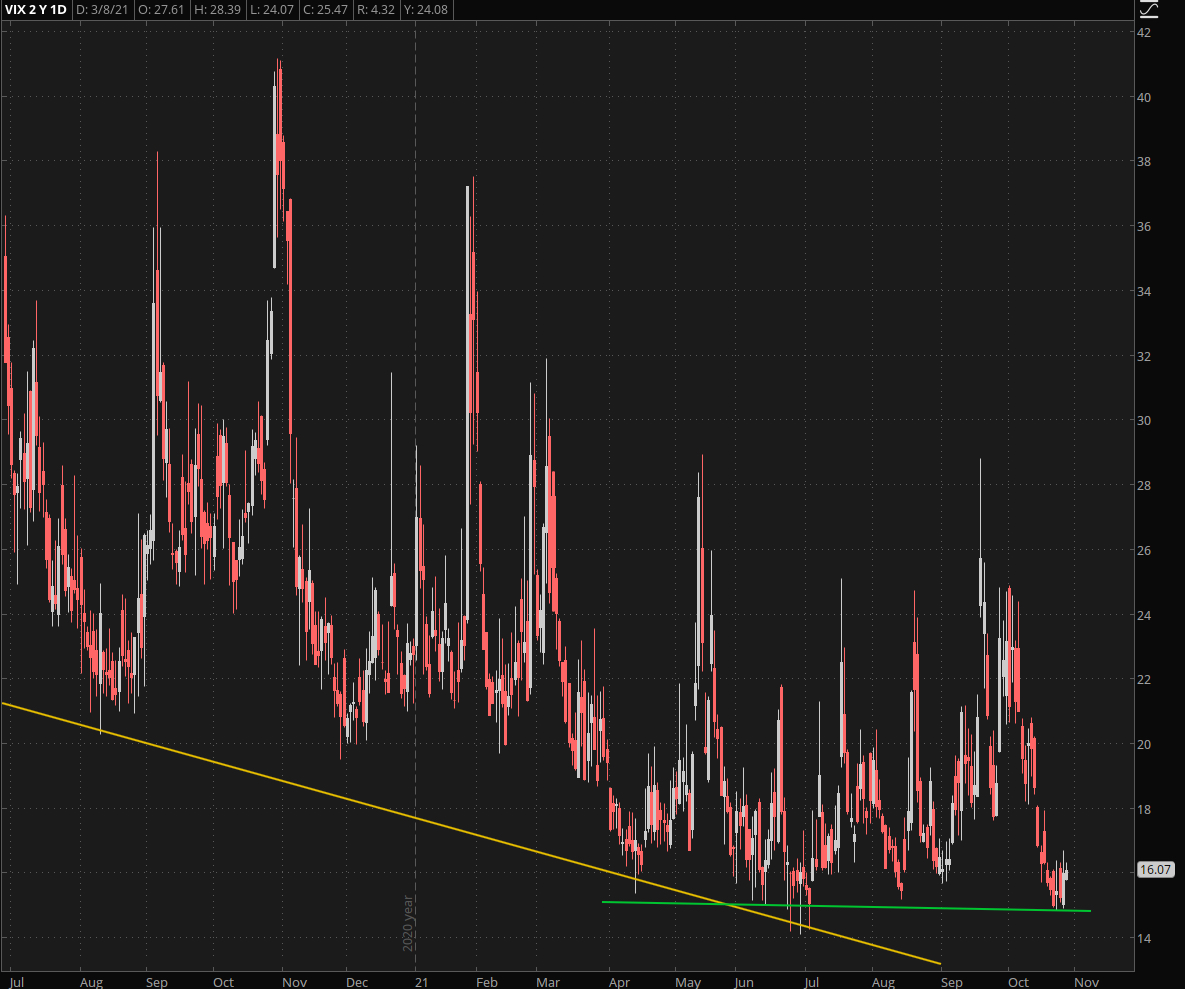

With the VIX now bouncing off its new baseline at 15 it remains to be seen if the current pace higher can be sustained.

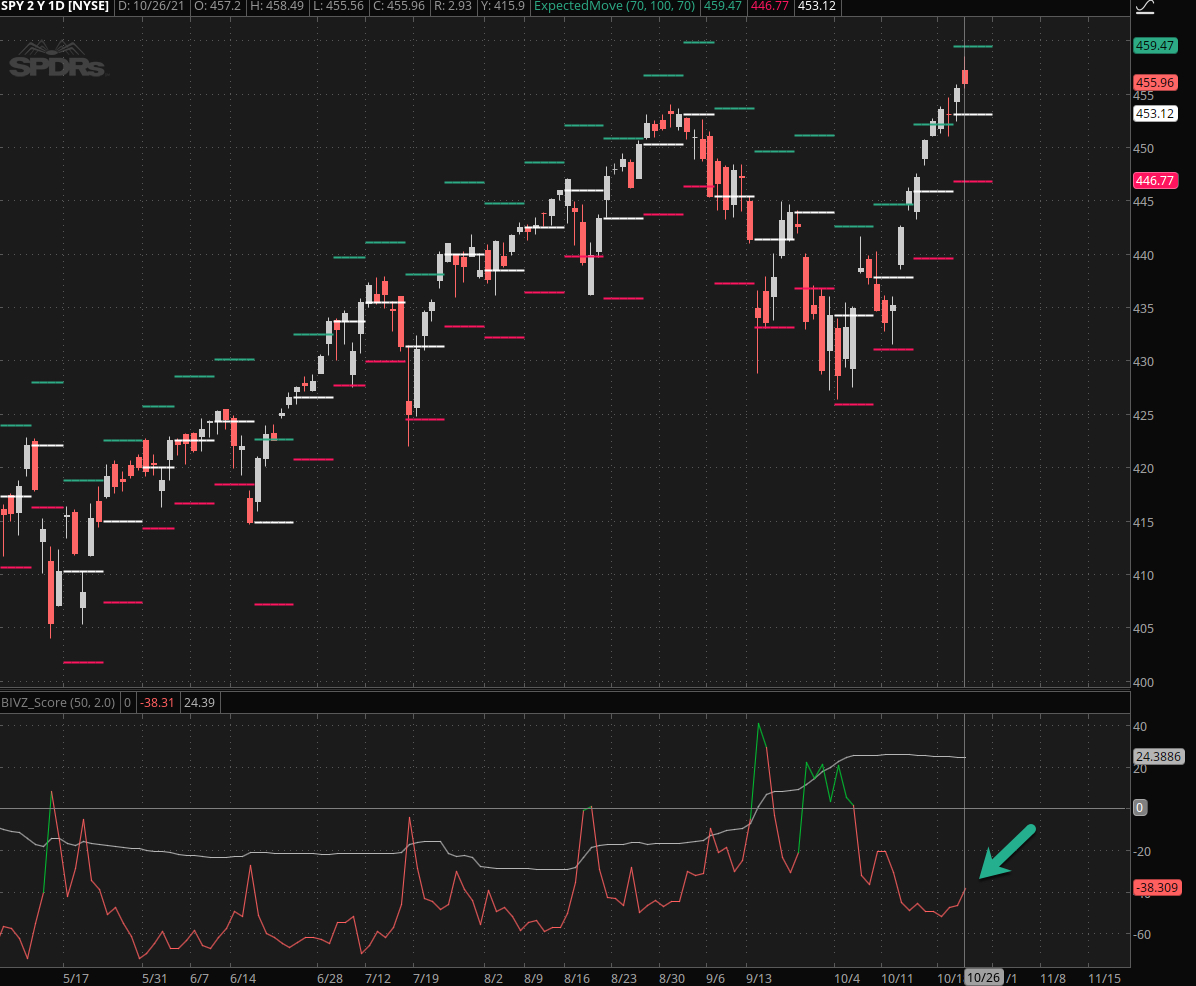

And the end may be nigh as options traders are already pricing in higher premiums as evidenced by this upswing on our implied volatility Z-Score graph.

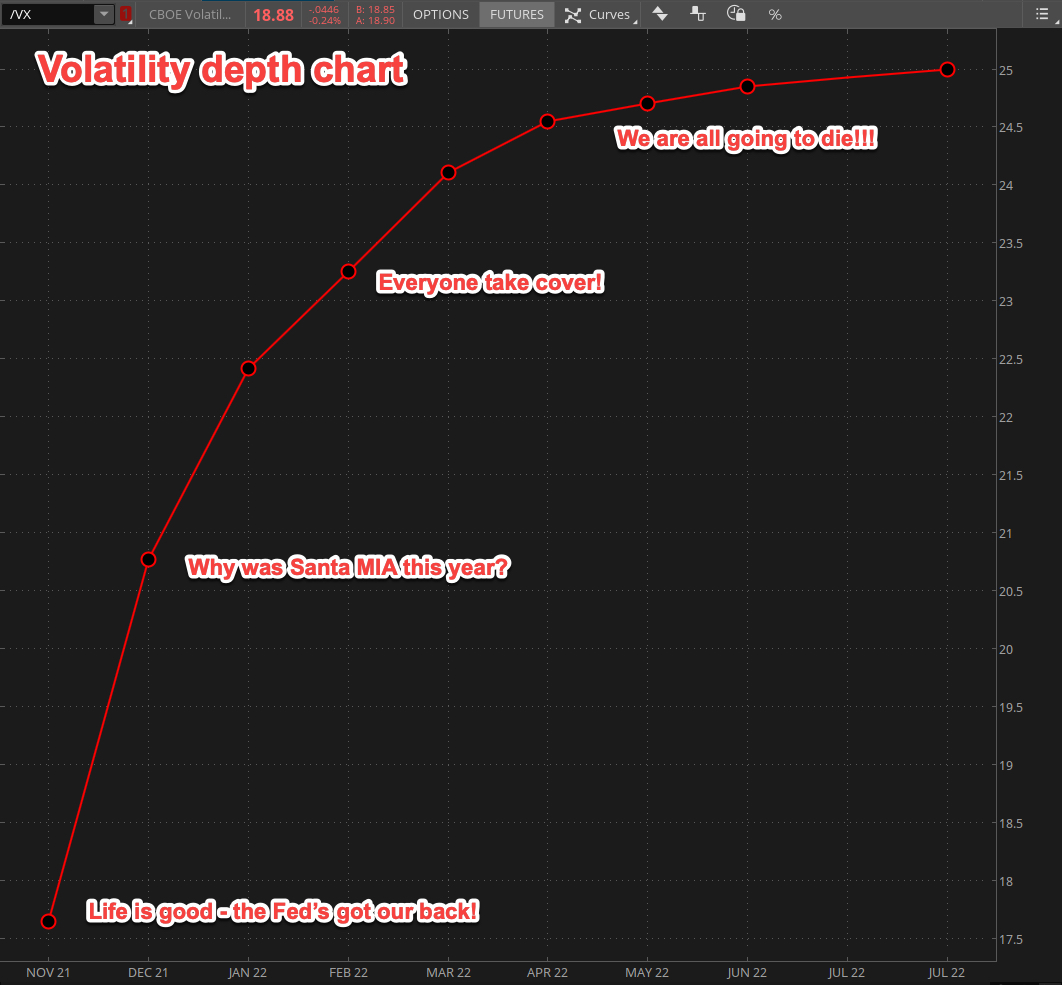

What irks me even more however continues to be the same chart that has been the fly in my ointment for almost an entire year now. The VX futures are on one hand in an extreme state of contango. But on the other hand the reading on the current front month contract consistently leads at least one or two handles ahead. It was 15 on the VIX vs. 19 on the VX the other day in fact.

It seems to me that we are all now trapped in a perpetual state of manic depressive optimism. Everyone knows where this ends eventually but after over a decade of monetary machinations nobody has any appetite for questioning the status quo.

Now all this of course is easily explained by the following two charts:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.