October starts with a bang and a legion of misinformed retail traders assume that we’re heading straight into the next bear market. Not impossible of course given what’s going on but even IF we’re heading that way on a medium to long term basis (still doubtful) we are still going to see a bounce preceding it. Here’s why and how to take advantage:

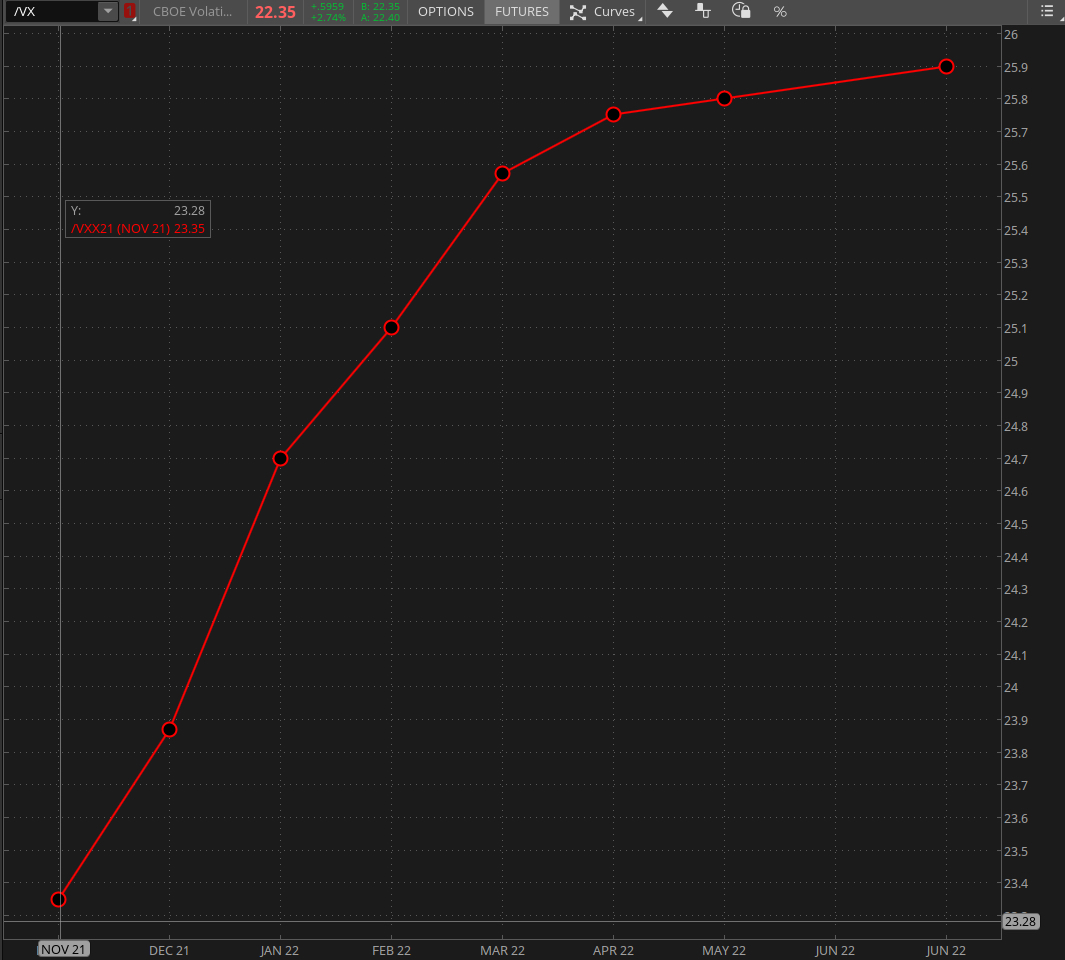

First up the VX term structure continues to steepen – and we rarely see a market crash when the IV futures are in contango. And this is contango central – meaning investors are not losing ANY sleep, at least pre-Christmas. January could get spicy.

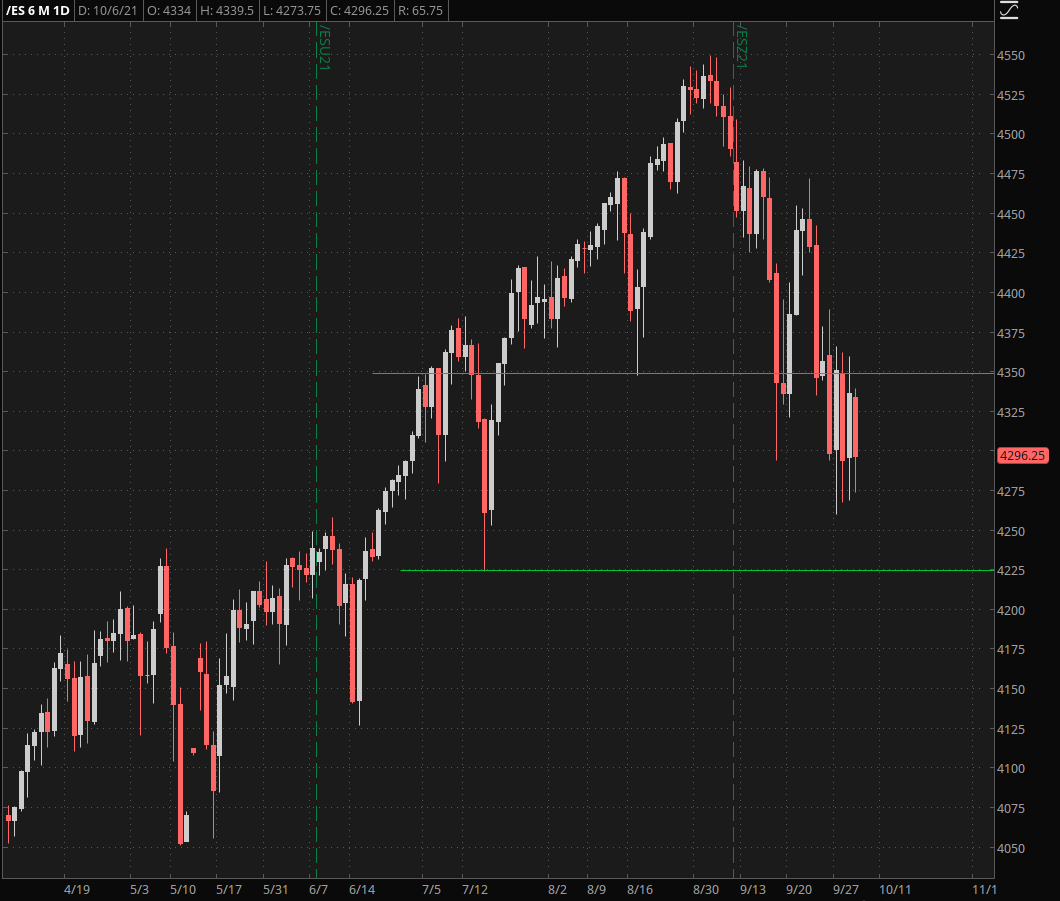

The VIX remains elevated however and if it pops back > the 25 mark and closes there we could see some short term fireworks. That’s actually the biggest fly in my ointment. Seeing this one drop over today’s session is key or we could be testing the next support levels on the SPX.

On the ES futures I’m specifically looking at ~4225 as the biggest line in the sand. If it blows through that say hello to ES 4000.

What has not escaped my attention of course is that the financial sector is basically sitting this one out.

Most of the damage that’s driving down the indices is due to a pretty nasty sell off in big tech. Those opening gaps I mentioned the other day weren’t lying!

So if there’s a bounce where should you find exposure?

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.