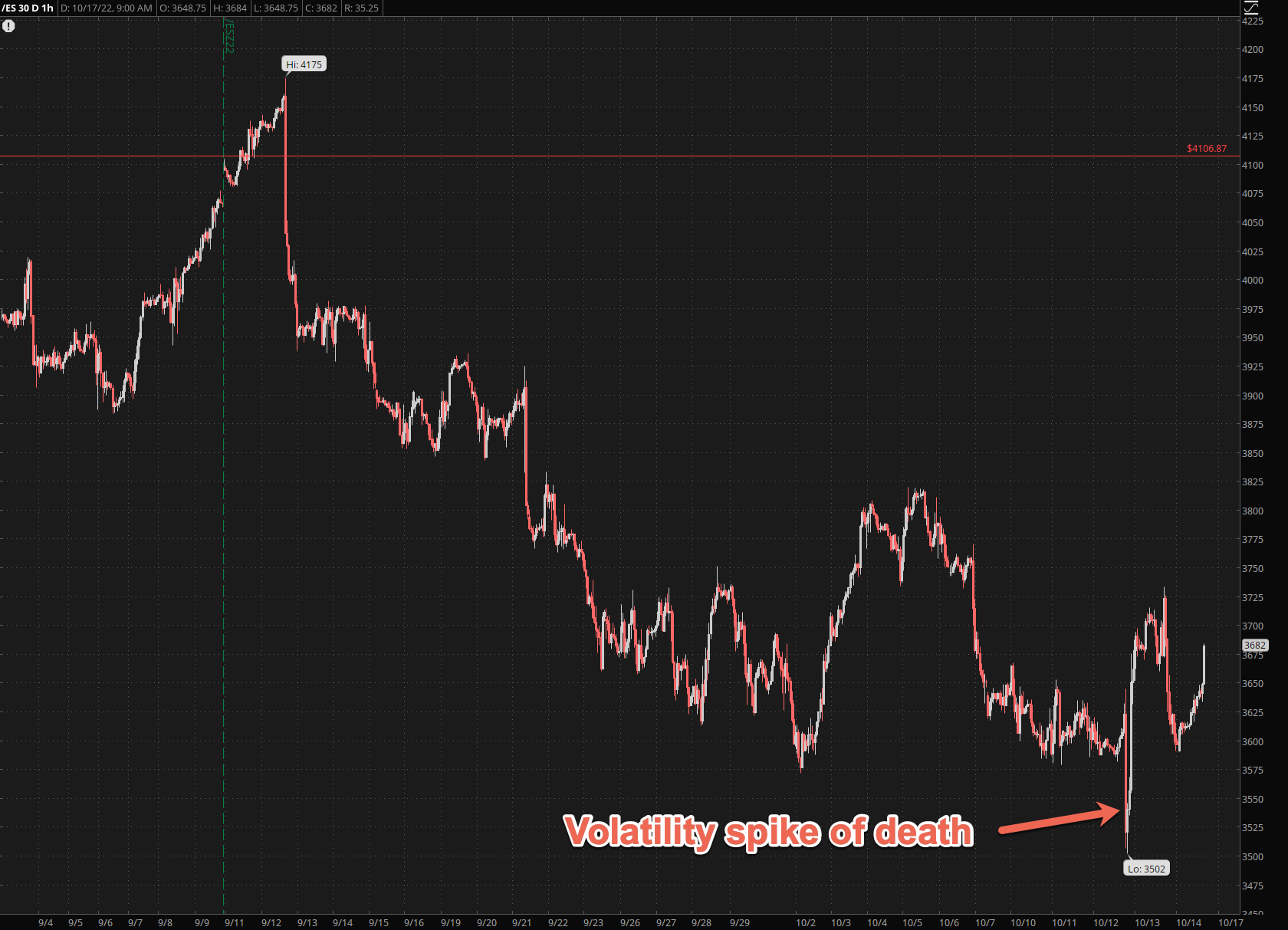

Friday was one of the ugliest stock market sessions in living memory. Everything got hammered…. just to bounce right back in the late session.

What you are looking at here is the proverbial volatility spike of death – or stick safe attempt #43,456 courtesy by Fed and friends.

How do you trade through something like this?

Or more accurately – how do you survive a market that is getting ready to kick volatility from 4th into 5th gear?

Good question. The past year has not been kind to traders – so how can anyone be profitable when markets oscillate between bullish irrational exuberance and utter panic?

Very simply – do what I do. Don’t trade market on direction.

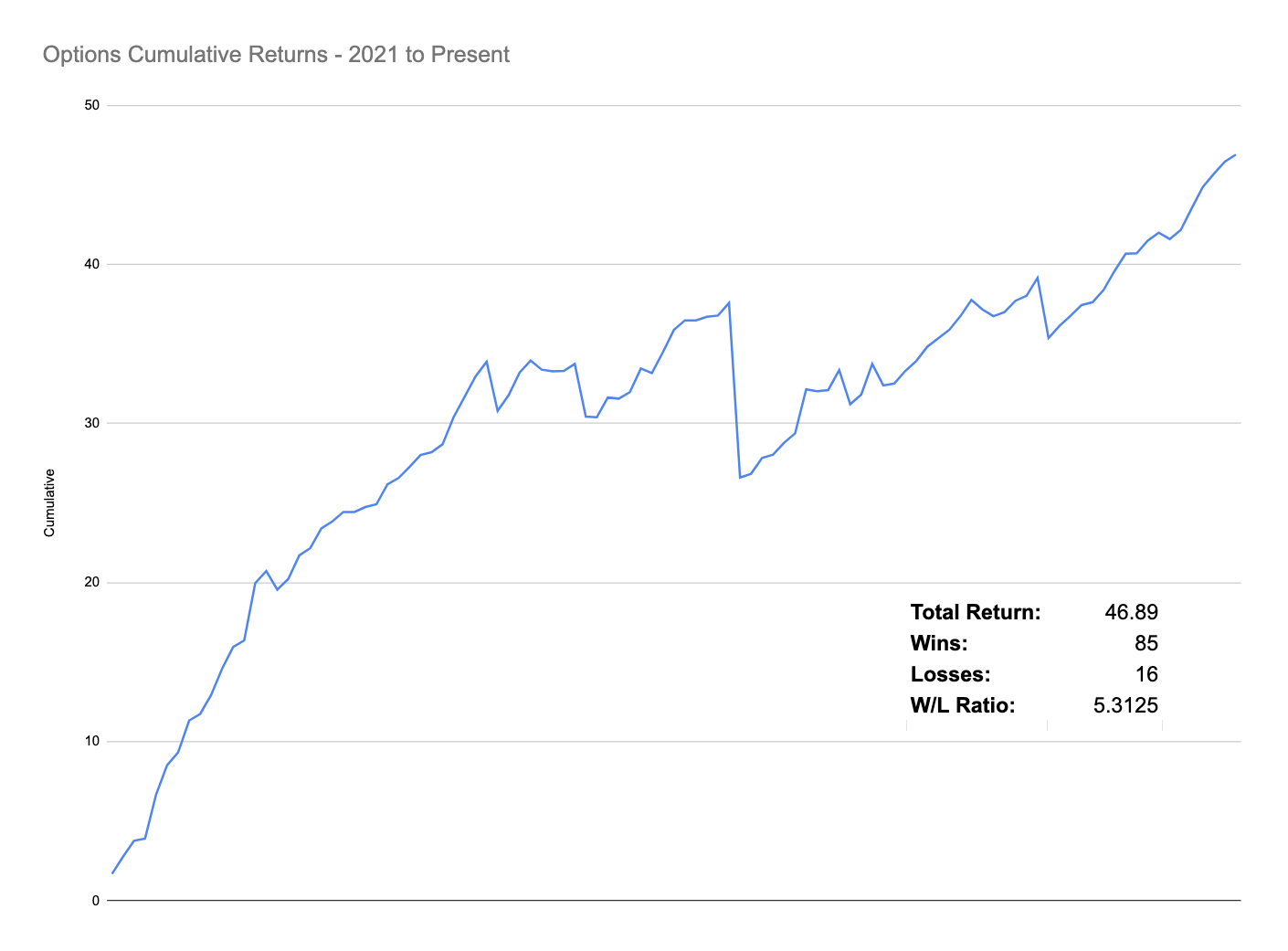

Above are my LIVE options trading results over the same period that I’ve framed in the previous chart.

Do you think I’ve printed coin like this guessing market direction?

If you do then I’ve got a bridge in Brooklyn to sell you.

Understand this.

Trading on direction has ALWAYS been a sucker game, even during the smoothest of bull markets.

You look at the 2021 EOY bull market and think – wow, things were so EASY back then.

Okay tough guy, then so how much money did you make during that time?

Unless that answer resembles the P&L shown above you’re doing it wrong, son.

Winning in this game – consistently – is not a sport of throwing darts on a chart and guessing on direction.

It’s about understanding what makes the market tick and how to manage your risk accordingly.

Take for example the current sideways churn in the Spiders. Most traders look at that and say – wow, it’s not going anywhere!

And that’s where you’re wrong. Dead wrong.

It’s going places for sure, in fact it’s wound up so tightly that whatever move comes next is almost guaranteed to wipe out a legion of traders who aren’t hedged for the open interest (o.i.) gamma time bomb that’s been ticking along for weeks now.

Gamma risk is a thing and if you don’t understand that means then I suggest you either step up your game or get out of the way.

And I don’t mean that in a disparaging way, on the contrary.

There is no shame in not playing when the casino is going up in flames. Ccash (despite raging inflation) is always a position.

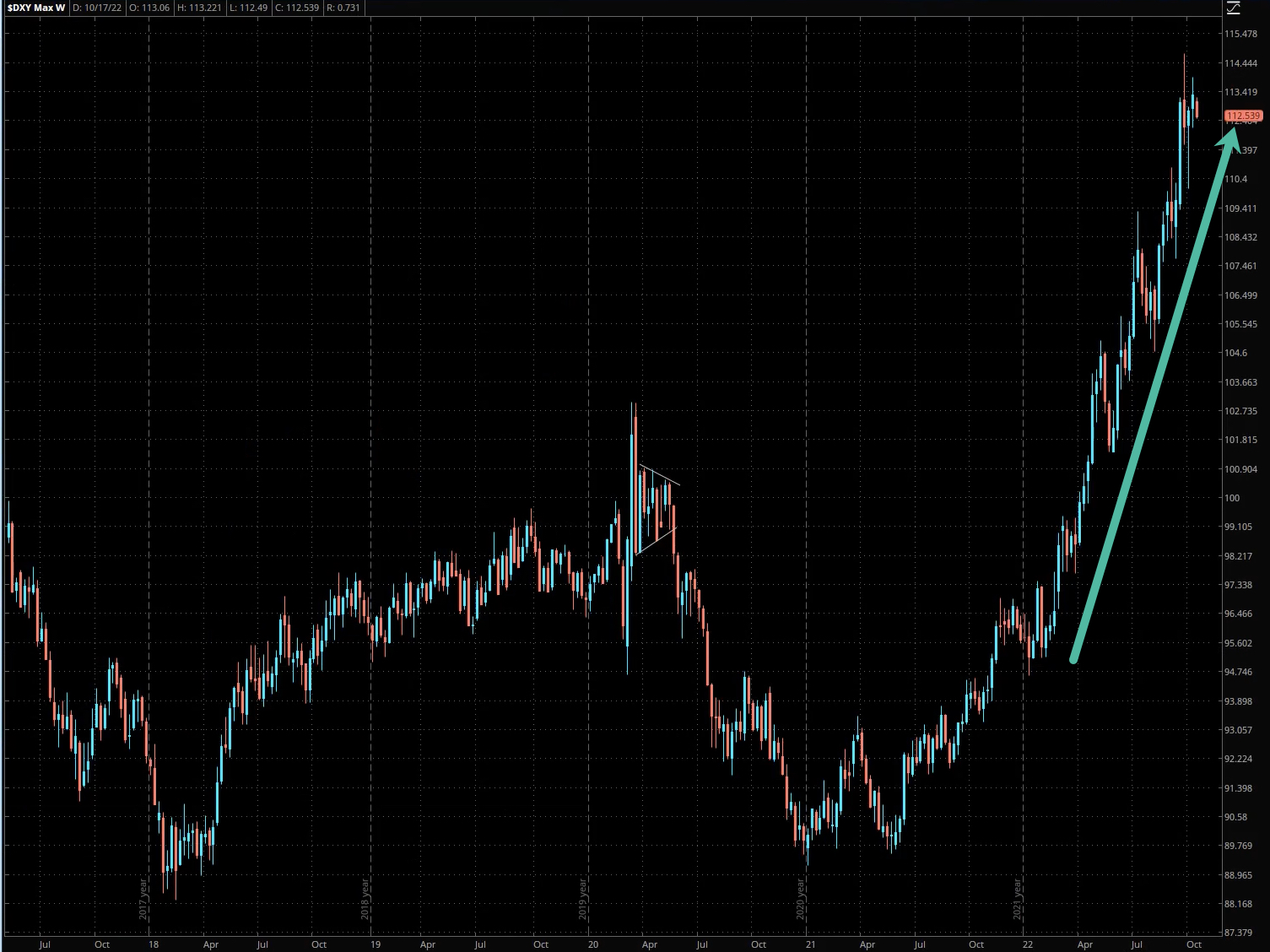

Especially if you’re holding Dollars while the DXY is about to embark on yet another short squeeze.

If you decide to throw your dog into the ring then at least make sure that you understand the rules of the game.

Also understand the overall context of the market and plan accordingly.

Short term exposure is one thing, but if you’re taking excessive LT risk when the entire bond market is literally falling off the plate you are effectively playing Russian roulette.

And there’s no blaming Putin if the gun goes off in your face.

If you want to get off the old merry-go-round of winning and then losing it all send me an email and let’s talk about putting you on the right track to turning a hobby into a full fledged (and profitable) trading business.

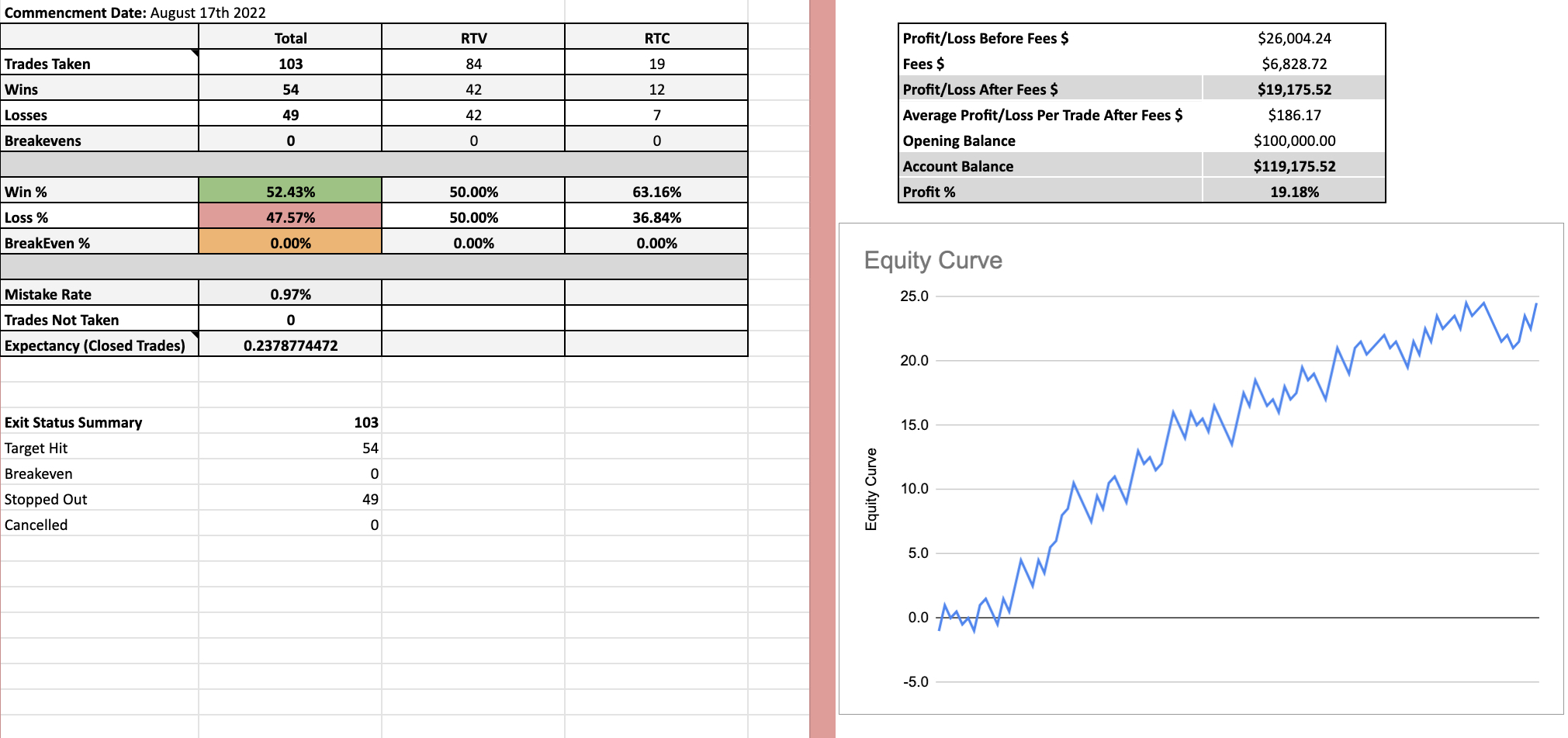

Speaking of which – I would be amiss to not mention (again) the amazing results our Crypto Salary System continuous to print week in and week out.

Last Friday we were actually in a bit of a draw-down – the P&L had dropped back to 22R.

Was I worried?

Nope – not the least. Because I trust the system and sure enough it did not disappoint. We’re right back at the top with 24.5R in exactly two months.

If you’re sick watching us print coin without you then make sure to join my LIVE webinar on Wednesday at 6:00pm Eastern when I’ll be teaching the entire system, no holds barred.

Which by the way is midnight on my end and I hate it. But too many of you wrote us and complained that noon was a crappy time slot in the U.S. to attend a webinar.

I should have known of course having done the 9-5 for over a decade over there.

Not anymore!

Tee-heeee 😉

Anyway, register HERE and I’ll teach you the entire system – for free.

See you there.