It’s Fed week and we’re looking at some possible fireworks on several fronts. First up earnings season is kicking off this week with reports from big banks and financial institutions including JPMorgan Chase, Wells Fargo, Citigroup, BlackRock, PNC Financial Services, among others.

This of course means that we won’t be trading any of those symbols because we value our sanity. If they somehow slipped into our weekly lineup (I’m doing my best to filter those out) be sure to avoid them.

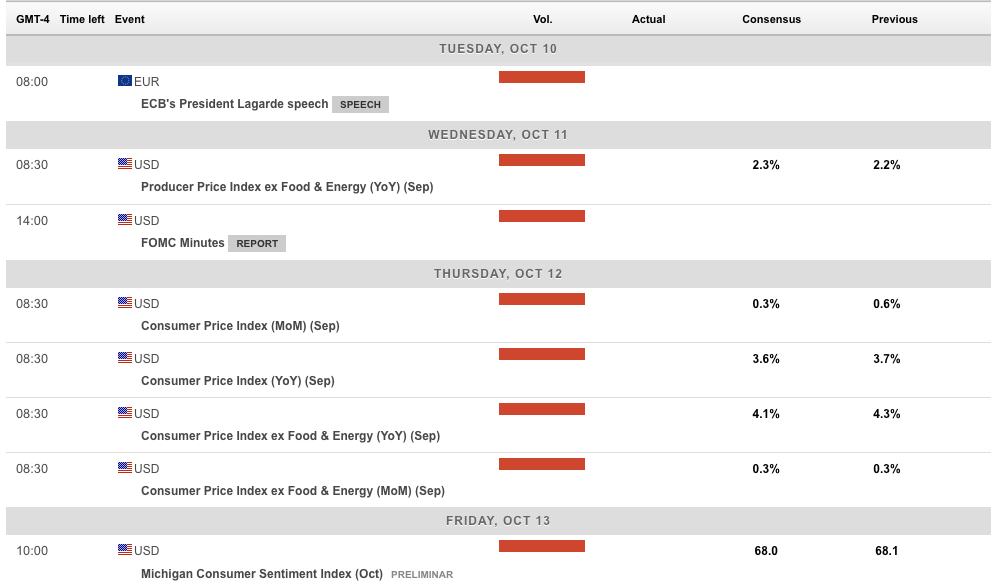

Our friends at the Fed will of course publish meeting minutes from its latest FOMC meeting, which we’re all awaiting with bated breath.

Last but not least the Labor Department will issue the latest musings on what they call consumer and producer prices.

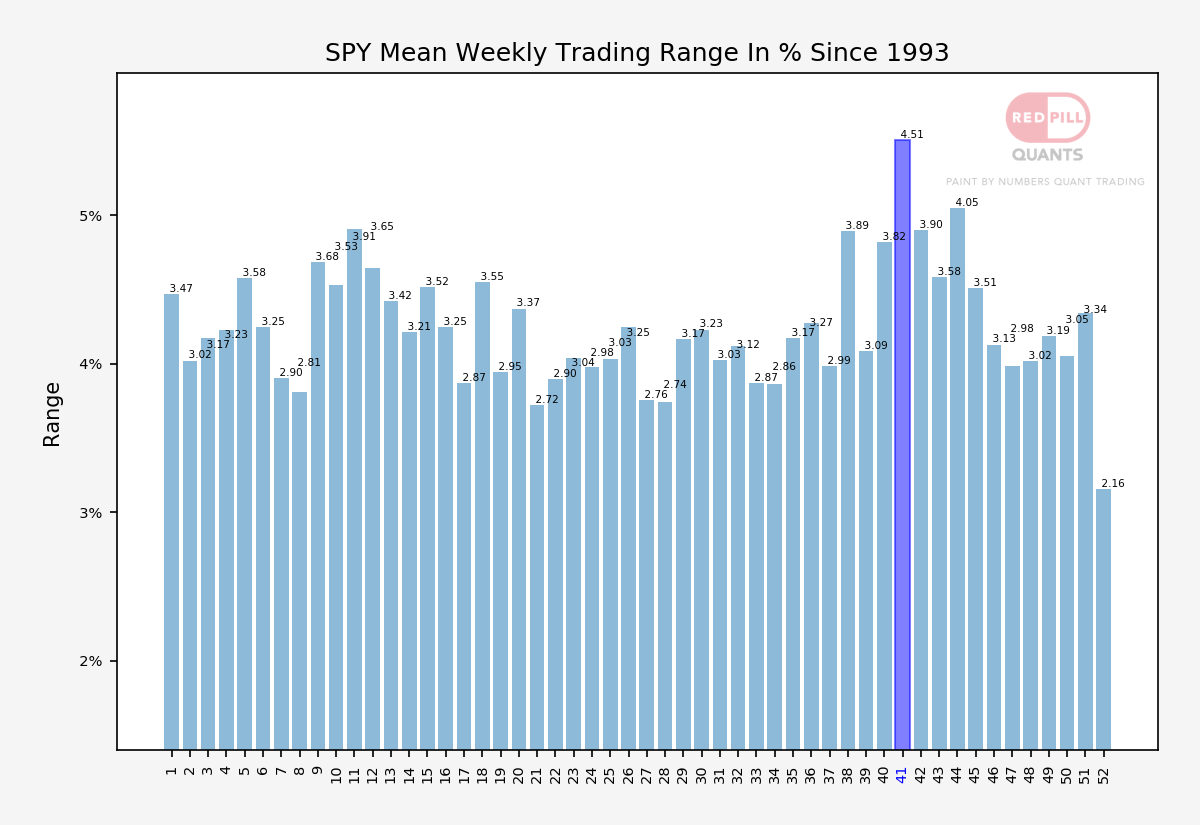

Worth noting is the average trading range for week #41 which is historically the biggest of the year.

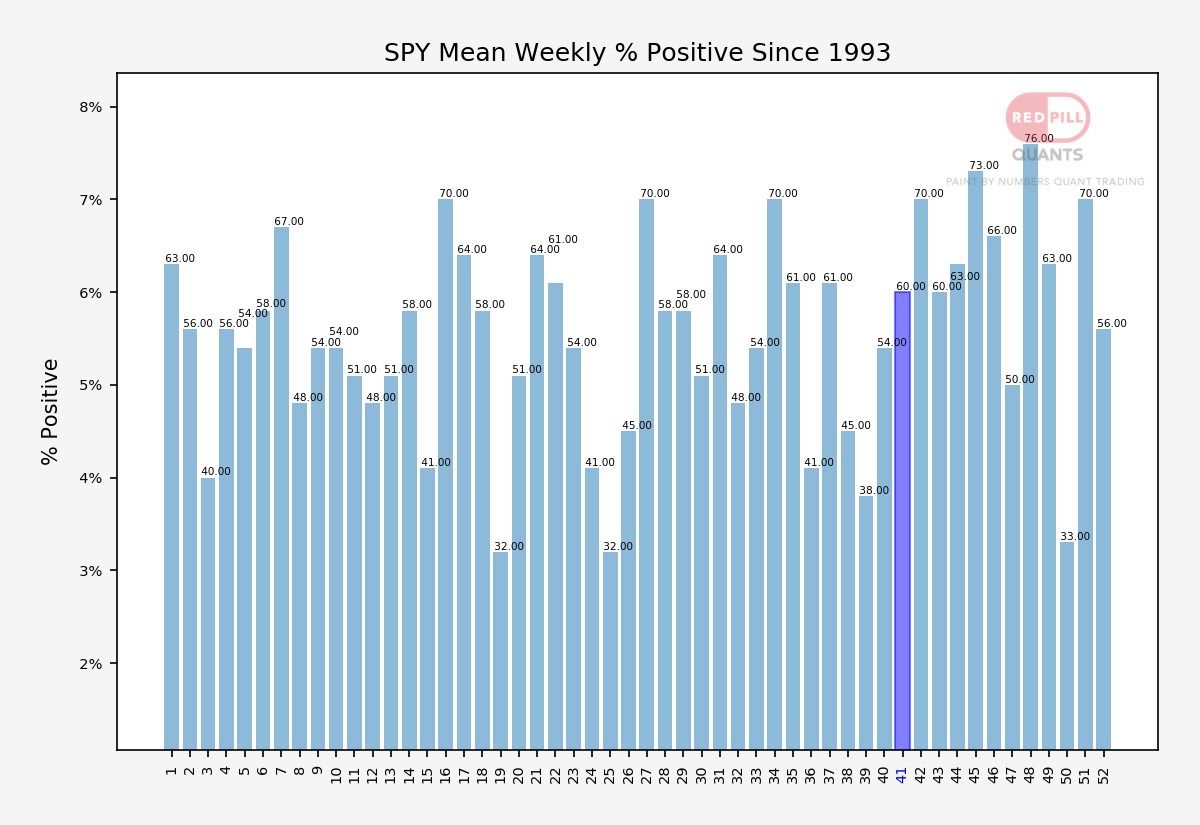

In terms of bullish odds we’re near the 60% mark which isn’t bad but it’s a volatile week so I don’t really care about the average here. Neither should you 😉

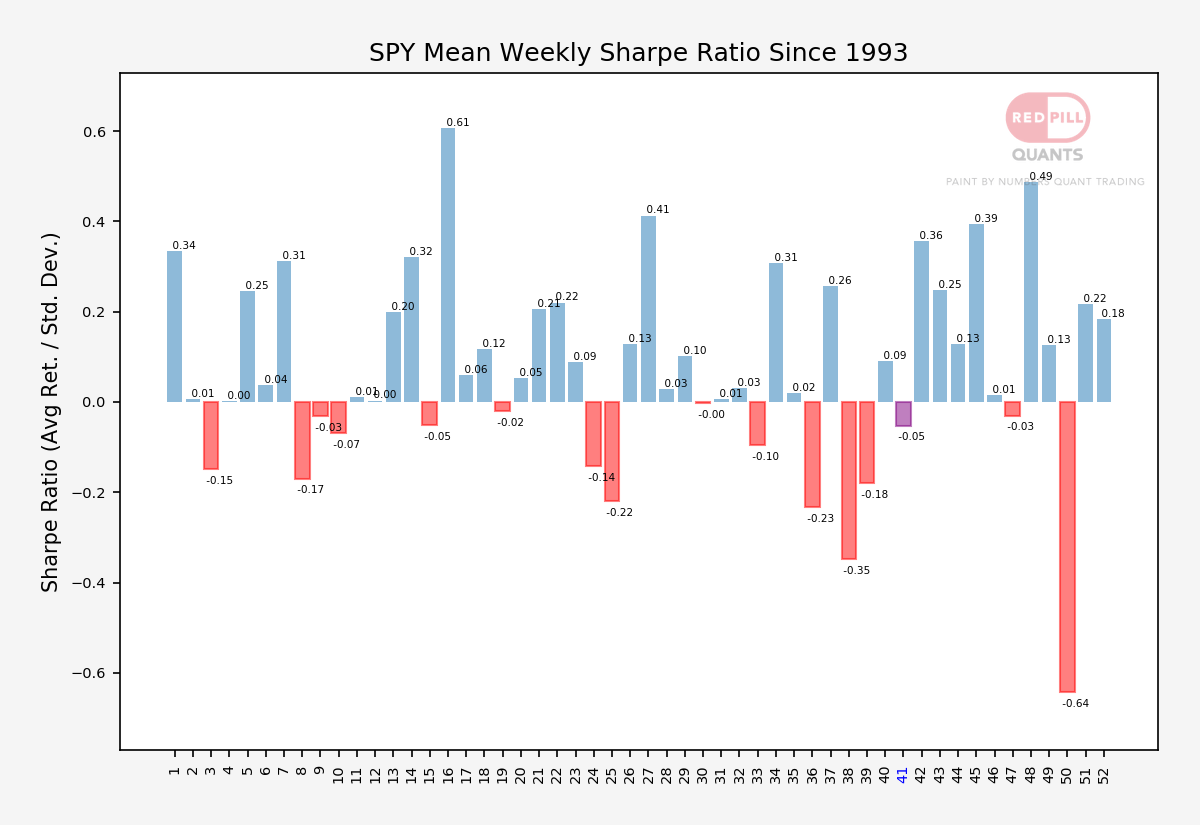

And this is why. The Sharpe for this week hovers slightly above coin flip territory.

So watch your six and don’t bet on one trading direction. Easy way to get hosed.

Okay let’s talk Payday Friday.

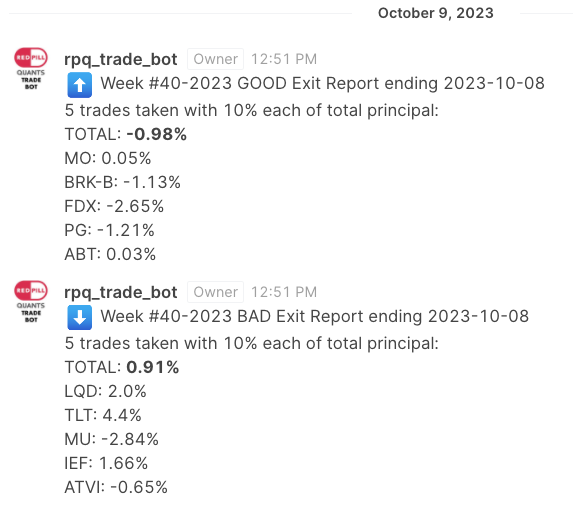

We ended up with a small loss (0.07%):

None of the first five bullish issues gapped, so we grabbed all of them. Unfortunately we saw a lot of volatility that mainly affected bullish stocks.

On the bearish side it was fairly smooth cruising, mainly due to TLT which has a strong week. Again we traded the first five in the lineup.

Here are this week’s entries:

Week #2023-41 GOOD Entry Report ending 2023-10-15

Three entry candidates:

1. AAPL – Rank: 3.59 – Friday Close: 177.49 – Entry Limit: 179.26

2. LRCX – Rank: 1.57 – Friday Close: 628.11 – Entry Limit: 634.39

3. WMT – Rank: 1.44 – Friday Close: 156.41 – Entry Limit: 157.97

We only take entries on Monday opens below their entry limits.

Week #2023-41 BAD Entry Report ending 2023-10-15

Four entry candidates:

1. IEF – Rank: 3.59 – Friday Close: 90.07 – Entry Limit: 89.17

2. TLT – Rank: 3.36 – Friday Close: 84.79 – Entry Limit: 83.94

3. REGN – Rank: 2.15 – Friday Close: 836.57 – Entry Limit: 828.2

4. DISH – Rank: 2.0 – Friday Close: 5.0 – Entry Limit: 4.95

We only take entries on Monday opens above their entry limits.

I was planning on XXXing out the first three entries after the first week but it’s still the beta, so I decided to be merciful 😉

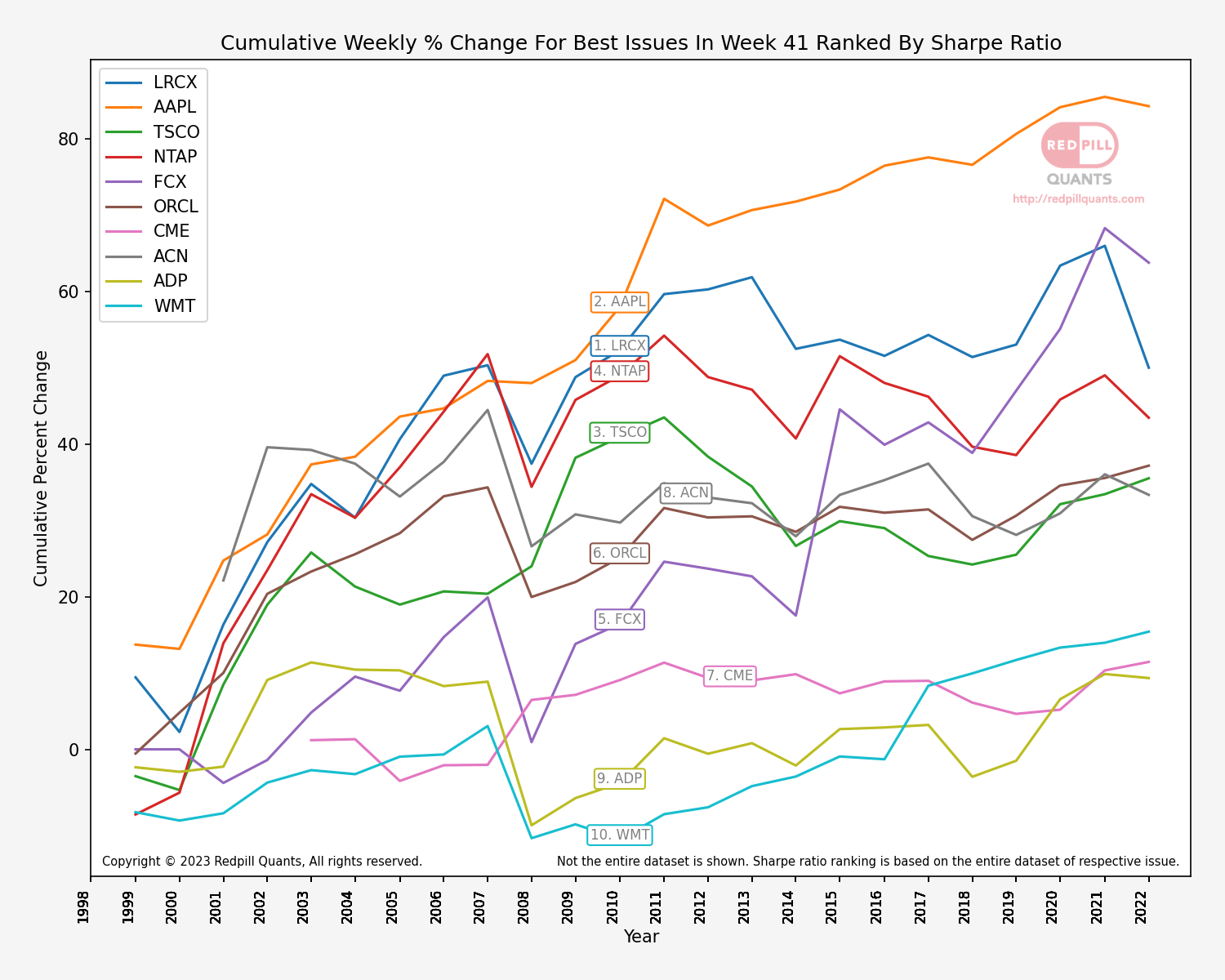

Before I let you run here’s something cool I whipped up over the weekend.

Part of my incentive was to kick up my X (Twitter) game up by a notch or two.

So this is what I came up with:

It’s really cool to see top ranked issues plotted like this.

In case it’s not clear what you’re looking at – imagine you would have only bought AAPL in week #41 of each year starting in 1998 (25 years ago).

Then you would have dumped it at the EOM. The graphs you see is what you would have produced.

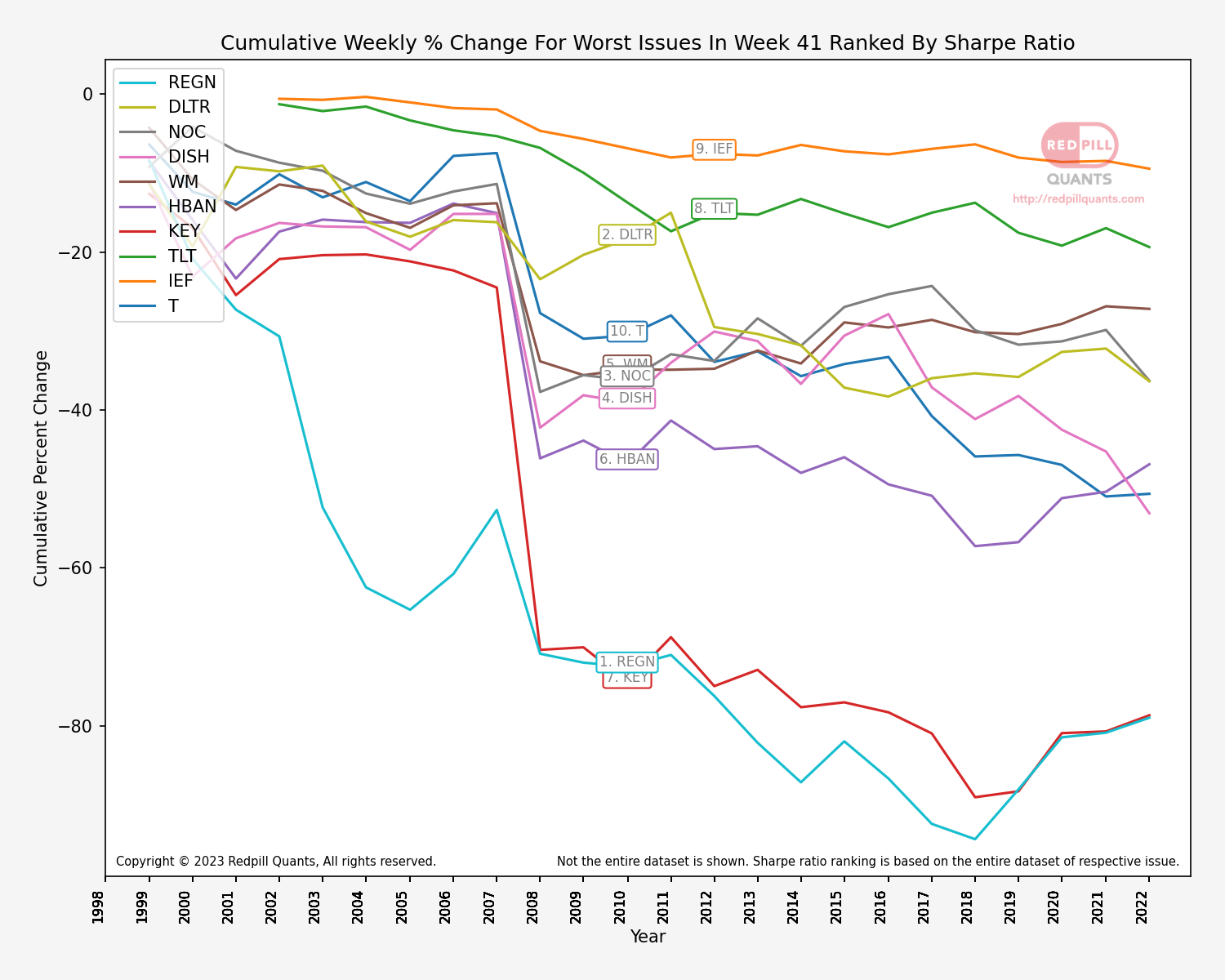

Of course as I said directional trading is probably dangerous this week, so I give you…

The anti-performers – basically the bad boys list for this week.

You’ll notice that these graphs differ somewhat from our Payday Friday lineup for this week.

The reason is that we’re using an improved way of ranking them.

How we’re doing it exactly? Well, I COULD tell you but a magician never spills his secrets.

Anyway, happy trading!