First things first. If you missed last night’s wealth creation summit then i suggest you take advantage of the replay I just posted HERE. I hope you’ll all enjoy it.

Since everyone else on the panel is based out of Asia I actually had to stay up until 3:00am which is way way past my bedtime. And as you can tell from my videos, I desperately need my beauty sleep.

But seriously, I was surprised I was capable of stringing two bloody sentences together and contribute to what turned out a profound analysis of the current state of affairs in the world’s financial system and the changes that loom ahead.

So if you ever wanted to watch me drool in front of a camera and make an utter fool of myself in front of an acclaimed group of consumate peers then here’s your chance – j/K 😉

And yes there’s a special ‘Better Than Black Friday’ offer that I tacked on below the video. If you’re curious click on it and if you have questions you know where to find me.

Alright, so – take aways…. where do I start?

I really enjoyed the opportunity for a productive debate with highly accomplished professionals in their respective trading domains.

And unlike all the other doom & gloom or hate/fear p0rn you’ll find these days the discussion was aimed at identifying many of problems we all face these days and then to offer solutions.

If nothing else that is what we all share in common. Times are tough for a lot of people out there but feeling or acting like a victim is not going to get us anywhere, quite to the contrary, that’s loser talk.

When Scott suggested doing the bootcamp along with him and some of our friends I immediately decided to participate because I felt that a single-pronged strategy, or to continue doing what may have worked in the past would most likely be doomed in the face of the unfolding chaos and accelerating changes we see unfolding all around us.

So this was not about simply throwing a kitchen sink of products into a bundle ahead of Black Friday.

We worked hard to provide value across a range of crucial verticals: trading, maintaining cash flow during the coming economic stagflation, long term investing in a highly volatile market environment, and generaly keeping ahead of the curve by understanding what’s really going on.

The 8-week bootcamp alone is aimed at making sure you’re on track of taking advantage of several key megatrends that we all agree should be on the forefront of your investment and trading strategies.

But I digress a little. There’s something that has been rolling around in my mind over the past few weeks in particular and after some consideration I thought the best way was to bring it straight out into the open.

Let’s be honest: Crypto is effed right now, and among all the drama of the past year I consider the FTX affair to be the most salient event that historians will refer to as the ‘big crypto shake out of 2022’.

Does that mean the entire crypto market is going bye bye? I really doubt that but Laurent said something very crucial last night: While people are still looking for a bottom odds have it we still have more downside ahead of us.

Which of course re-emphasizes what many a traders in history had to learn the hard way. A new secular bull market can only form once the vast majority of participants have walked away in disgust.

Are we there yet? I feel we’re close but there’s probably still space to run.

But honestly that’s the least of our problems right now. Diversification is always been my motto, and as you may know I’ve done extremely well trading options (in equities) over the past year, so it’s not that I bet the farm on crypto.

But throughout this year it’s been painful to watch one case of corruption and blatant criminality unfold after the other.

If nothing else the crypto market is going through an important cleansing right now. One from which I believe it will arise stronger and more resilient.

Whether DeFi and a move away from CEX or more stringent government regulations is the answer remains to be seen. Most likely it’ll be a little bit of both.

In the interim I feel discussing crypto and keeping an eye on buying the final dip is appropriate. However I would be foolish not to sense the level of exhaustion that’s eminating wherever the topic of crypto currencies is being discussed.

Also what I should always ask myself is the following:

- How can I best serve my trading community and connect with peers in my field?

- Do I provide true value to my readers and clients?

- Important but often neglected by yours truly: Am I truly enjoying what I do right now?

You may hold differing opinions about the first two (I bet) but I can give you a straight answer to the final one:

NO! Not at all.

In fact the past 11 months in particular have been extremely difficult on my end mentally and emotionally speaking.

Not a week passed in which there wan’t another scandal was rattling the crypto market or another news headline or misguided tweet caused yet another corrective leg down.

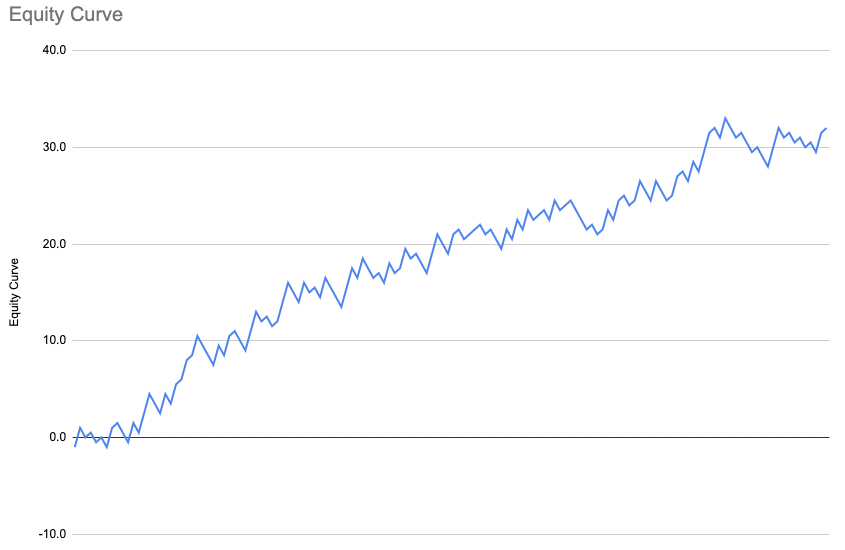

I attempted to compensate by creating the CSS – the crypto salary system – which much to my surprise continues to knock it out of the park to this day.

But that’s not much of a consolation to most people if they mistrust the crypto space in general.

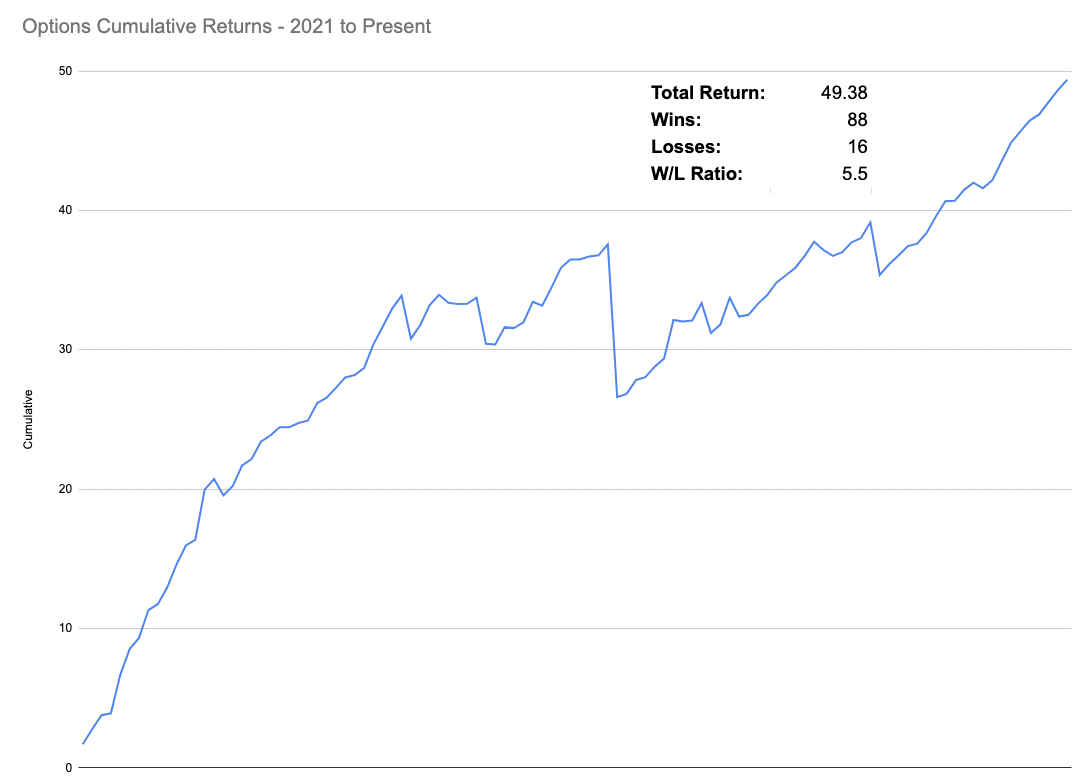

Per the first two points I feel that I am best served to return back to the basics and re-focus on talking about equities and in particular trading options.

First up I’m really good at it – see the cumulative results over the past year.

Second, trading options has one important aspect that differentiates it from all other trading styles out there: It’s market direction agnostic.

Meaning: it can make money no matter where the market goes, up, down, or sideways.

And once the smoke clears – after the final low is in place, maybe sometime in the course of the next year, an extended period of sideways tape is exactly what we may be looking at.

V-shape recoveries after large scale bear markets are possible but rare.

Which is a great trading opportunty if you know how to take advantage.

But I may be completely off the mark so I decided to open up the dialog and let you guys chime in.

Instead of guessing around I put together a quick poll of 4 questions I encourage you all to take.

The poll will give me a better idea of where I should be focusing my efforts in the coming year, and how to stay relevant and provide maximum value to my trading community.

Thanks in advance,

Michael