This whole thing with FTX disgusts me. If only there was some sort of government body that regulated Securities and Exchanges. You know, some kind of commission than could find these problems before us regular folk got billions of dollars pilfered.

I mean what the heck – SEC, seriously?

It turns out Scam Brokeman-Fraud is a weirdo who can’t tie his own shoes and transferred 10 Billion dollars worth of customer money for his hedge fund to gamble on shitcoins.

Plus he ran a literal orgy house living with 10 other people who had all dated each other polyamorously at various times

Classy….

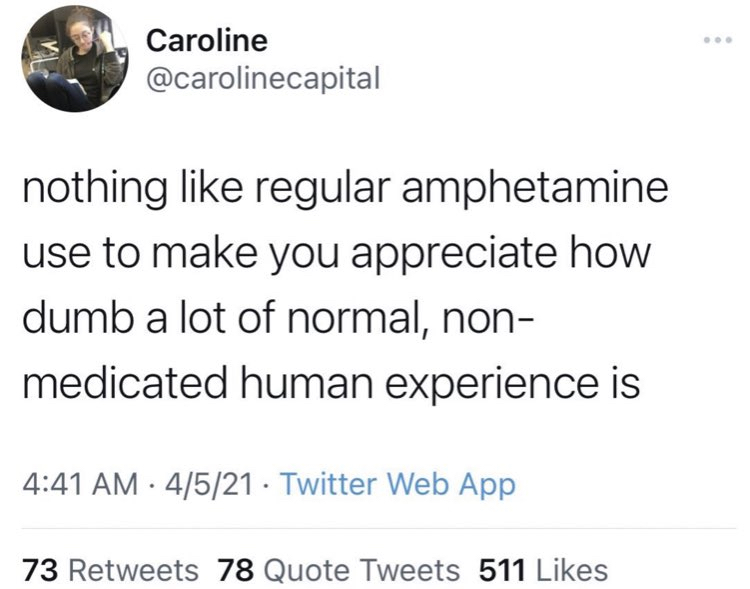

It gets better. They were ALL ON AMPHETAMINES

(this is from his COO and GF – don’t get me started on that one)

If you think that’s not weird enough – get this – THEY ARE ALL VEGANS!

Red flag after red flag…

Never trust a vegan with money – he’ll end up eating it.

And any vegans reading this – better stop eating my food’s food!

As a result the crypto markets continue to tear themselves apart today.

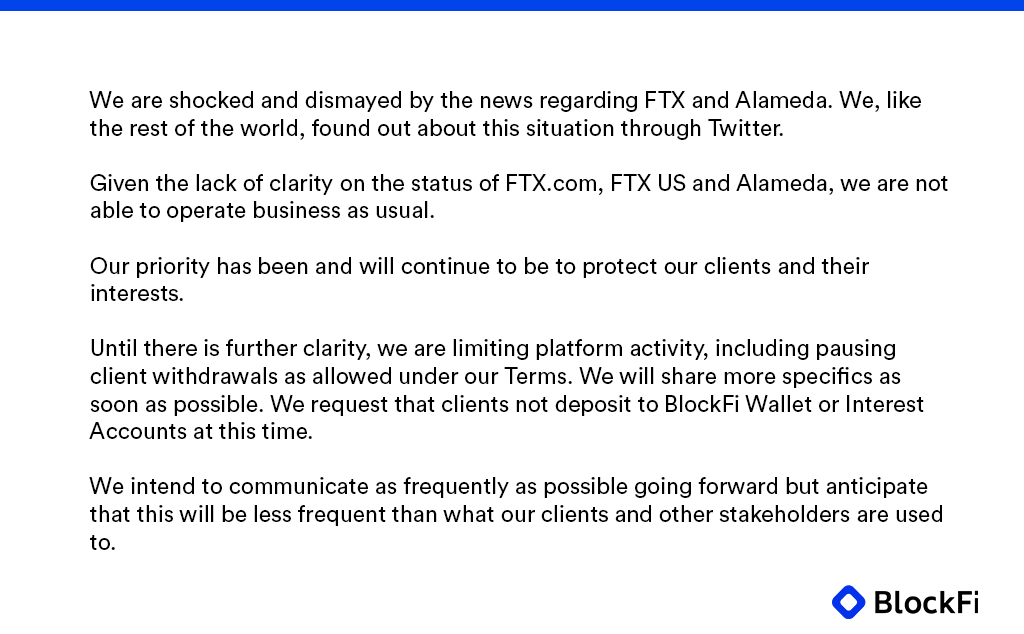

BlockFi (a big crypto lender) is admitting defeat.

My advice is to not trust this rally… a dead cat bounce followed by a retest of a breakout level is very common behavior and not at all bullish.

Mark my words… there are other shoes to drop. Massive volatility always begets more volatility.

I mean call me old fashioned, but back in my day Central American countries went broke from rampant hyperinflation and going communist…

But there is never just one cockroach, is there?

Keep in mind that market makers are either insolvent or licking their wounds. In any crash they are likely to stop playing the game.

It’s difficult to overstate how dangerous this is.

A market crashing into already thin liquidity with near bankrupt market makers unwilling to take risks.

Really surprisingly low stink bids are likely to be filled.

So get ready.

I know this may be hard to take in, but always remember Baron Rothschild’s time tested rule:

“The time to buy is when there’s blood in the streets.”

And what we’re looking at here is the crypto market’s equivalent of The Shining’s elevator of blood.

So if put your emotions aside and think about it, this is GOOD NEWS.

A new bull market can’t start until the old bear ends. Until the majority of participants have left in utter disgust.

And this is CLASSIC end of bear market stuff.

Fortunes will be made in the near future. Mark my words.

Crypto is going on sale this month, and I’ll tell you when I think it’s time to buy (and post my own screenshots so you know I have skin in the game).

And now on to what I really wanted to talk about today…

Did you ever wonder how every Boomer you know got so damn rich?

I mean every single one of my boomer friends back in the U.S. is worth 5-10 million easy!

Savings and wise investments my foot!

The reason those guys had it so easy is because the rules were fairly simple.

You went to university, got a career, bought a house and then an investment property and a few stocks… 30 years later congratulations you won the game of life!

The system was designed for stability.

Interest rates kept dropping lower.

Boomers were in their prime earning and taxing years.

Tax rates kept going down.

And globalization was a once-in-a-lifetime boon for corporate profits (not so great for the middle class but screw’em, right?)

(If you haven’t checked your emails and posts the last few days – you’re missing out, so catch up HERE )

These megatrends haven’t all just stopped, but REVERSED.

And you need to understand how the rules have changed, and what the NEW PLAN is.

I’ve invited all the very best traders I know for our Wealth Creation Summit next Thursday.

We’ll be fleshing out these thorny issues and giving you a plan to move forward in the next decade with confidence.