So far so good. The first set of bank earnings reports that were released last Friday looked positive, but war clouds are clearly dampening what is traditionally considered a bullish season.

JPMorgan Chase’s Jamie Dimon seemed particularly gloomy about the possible implications of the unfolding Israel-Hamas conflict.

“This may be the most dangerous time the world has seen in decades”, he said “While we hope for the best, we prepare the firm for a broad range of outcomes.”

Whatever that means. Are they pulling up the mattresses? Have they picked a consiglieri?

Alas, color me skeptical.

Look, I’ve been following these types of statements literally for over two decades now.

And the reality is that I was never able to identify ANY correlation between the public statements of renowned financial U.S. figures and the behavior of stock markets after the fact.

It’s all just noise for the masses. Let’s just leave it at that 😉

Anyway, earnings season is expected to pick up its pace this week with most of the remaining big US banks due to report in the coming days.

Also reporting this week will be Tesla, Netflix and TSM. That ought to be good for some fireworks.

Which of course also means that any issues reporting this week will be kept out of rotation.

In terms of event risk I would point straight at Wednesday and Thursday as both Lagarde and Powell are scheduled to deliver a spicy bowl of word salad.

Okay let’s get to Payday Friday.

Week #41 ended up with a small win of 0.13%. Not much to write home about but I take it.

None of the three bullish issues gapped, so we were able to trade all of them.

On the bearish side we also traded three issues as DISH gapped below our 1% Monday entry threshold. Rules are rules, plus it actually managed to end the week slightly in the plus despite gapping lower.

Here are this week’s entries:

Week #2023-42 GOOD Entry Report ending 2023-10-22

Ten entry candidates:

1. CNC – Rank: 6.11 – Friday Close: 71.07 – Entry Limit: 71.78

2. UPS – Rank: 5.08 – Friday Close: 155.08 – Entry Limit: 156.63

3. BRK-B – Rank: 4.51 – Friday Close: 345.09 – Entry Limit: 348.54

4. ADBE – Rank: 3.91 – Friday Close: 548.76 – Entry Limit: 554.25

5. UNH – Rank: 3.75 – Friday Close: 539.4 – Entry Limit: 544.79

6. ILMN – Rank: 3.55 – Friday Close: 129.11 – Entry Limit: 130.4

7. XLP – Rank: 3.5 – Friday Close: 66.8 – Entry Limit: 67.47

8. INTU – Rank: 3.2 – Friday Close: 533.05 – Entry Limit: 538.38

9. GS – Rank: 3.06 – Friday Close: 309.3 – Entry Limit: 312.39

10. BLK – Rank: 2.97 – Friday Close: 627.66 – Entry Limit: 633.94

We only take the first 5 highest ranked entries with Monday opens below their entry limits.

Week #2023-42 BAD Entry Report ending 2023-10-22

There are no highly ranked short candidates this week.

No short positions will be taken.

That second one may surprise some of you but it’s not that unusual to see weeks where there simply isn’t a clear edge on one side of the equation or the other.

Let’s wrap things up with our stats goodies:

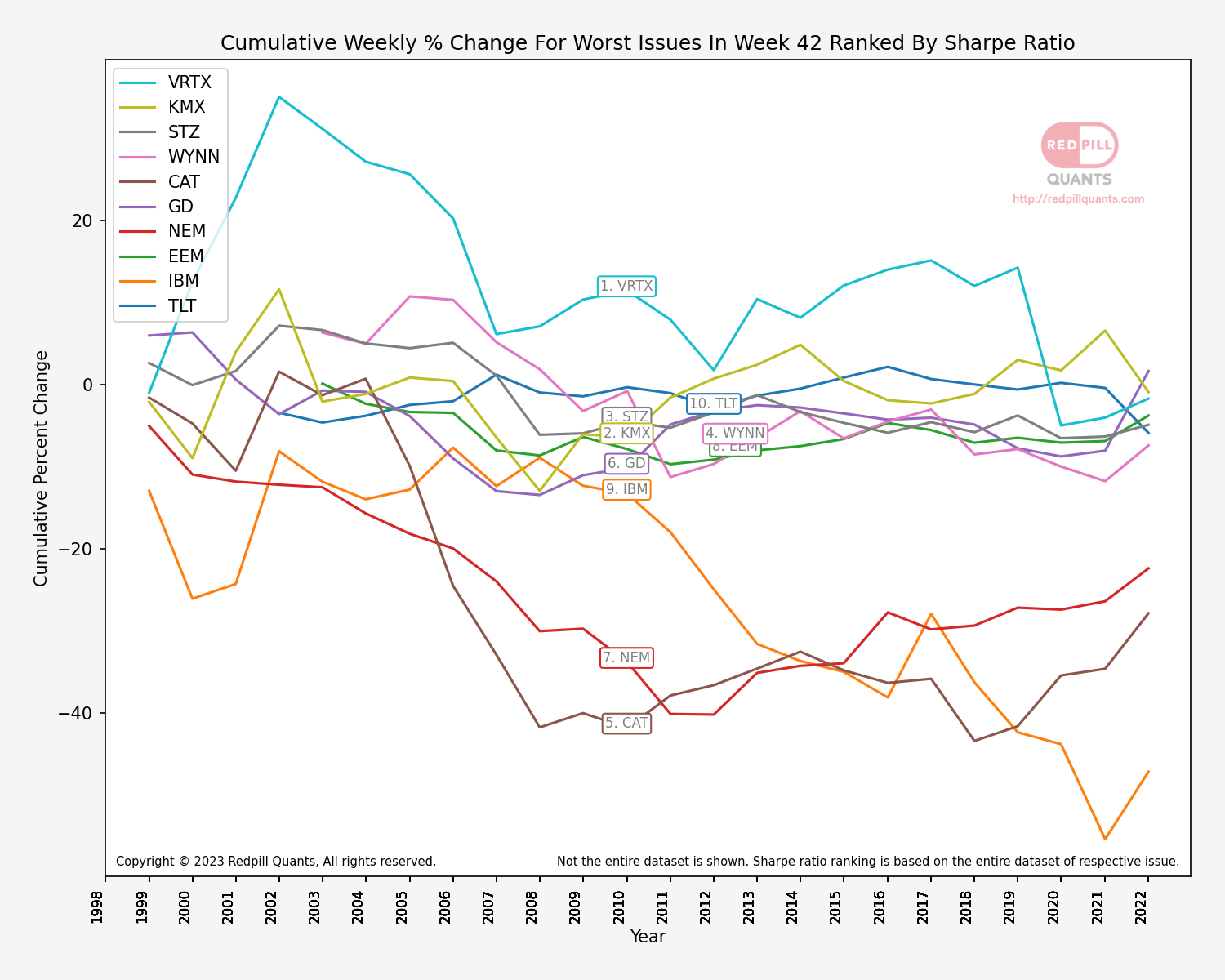

Measured by lifetime Sharpe ratio we have ADBE and INTU ranking the highest in week #42.

Here are the bad boys. That graph once again may confuse some of you until you take a glance at the little note in the bottom right.

When building these graphs I realized that some of them ran all the way back to the 1980s, some even further.

Plotting them along others with less history looked a bit messy so I clipped it all at the 25-year mark.

Anyway, I was shooting from the hip here I would probably pick some in the center like KMX or WYNN which look like great candidates for selling an OTM strangle or iron condor.

Alright, that wraps it up for now – happy trading but keep it frosty.

Mike