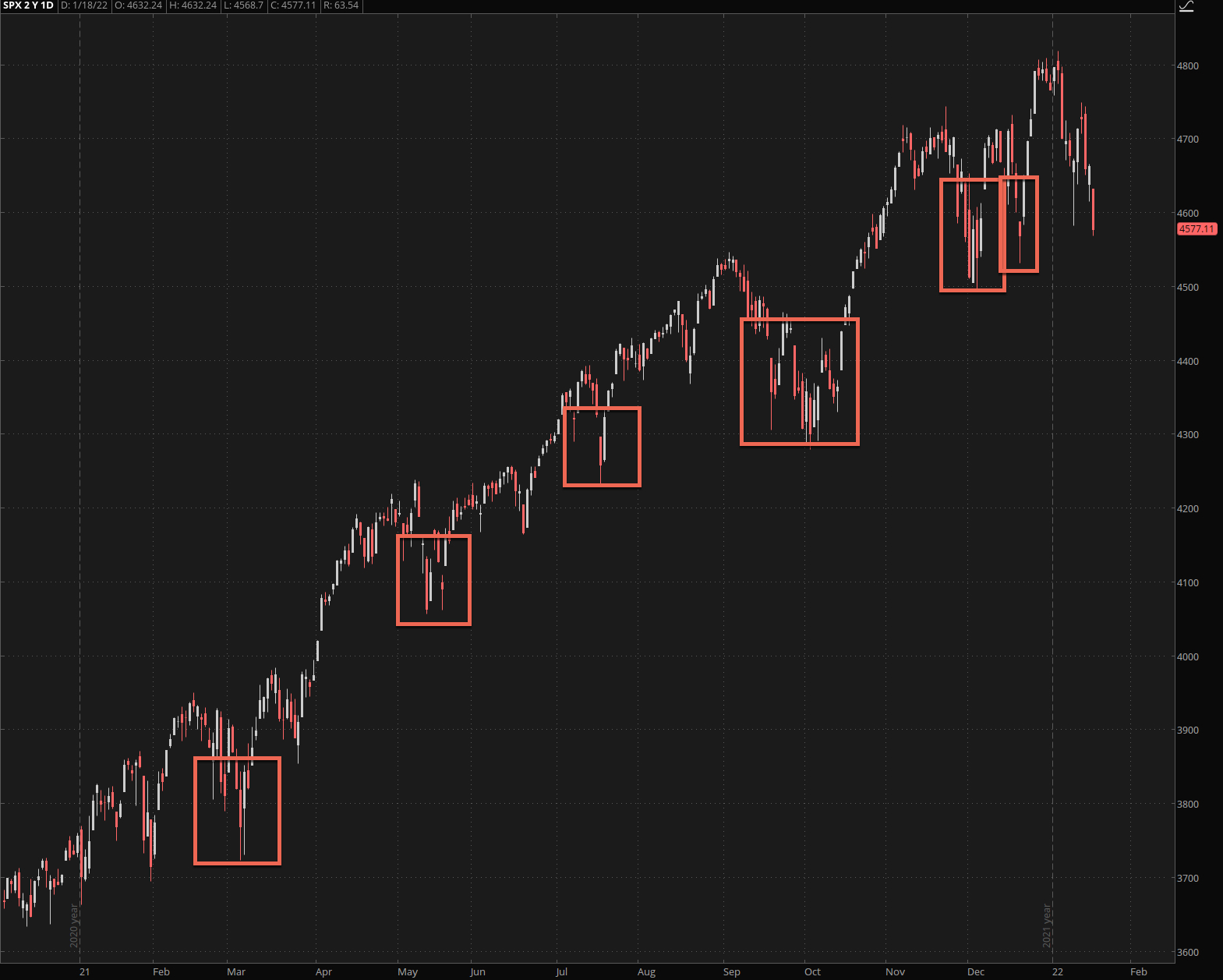

Since early November equities have been stuck in what seems to resemble Lucy Van Pelt’s purgatory of pain. Alongside a marked increase in volatility the SPX managed to heave its battered carcass to new ATHs on January 4th, only to immediately fall back and paint what is now increasingly looking like a topping pattern. The situation is looking serious but I cannot help but think that we’ve all seen this same type of setup all too often over the course of the past two years.

In case you wonder – this is what I’m talking about. Stick saves galore and every time the market appeared to be on the brink the ‘mysterious buyer’ showed up and banged the tape in the proper and comity approved direction.

Which is exactly why I took out a few lottery ticket BFs near the SPY 466 mark yesterday – albeit a wee bit too early and I could have grabbed them for 2c as opposed to 4c.

As you can see the lower expected move threshold was not only breached but the session decisively closed below it. Which in turn triggered quite a bit of stat-arb shuffling near the bell and I’m sure overnight.

Now the question of course is whether or not we’re going to see the same old ramp and camp that has held up the stock market numerous times over the past few years. Given that the futures are bouncing back right now that possibility certainly exists.

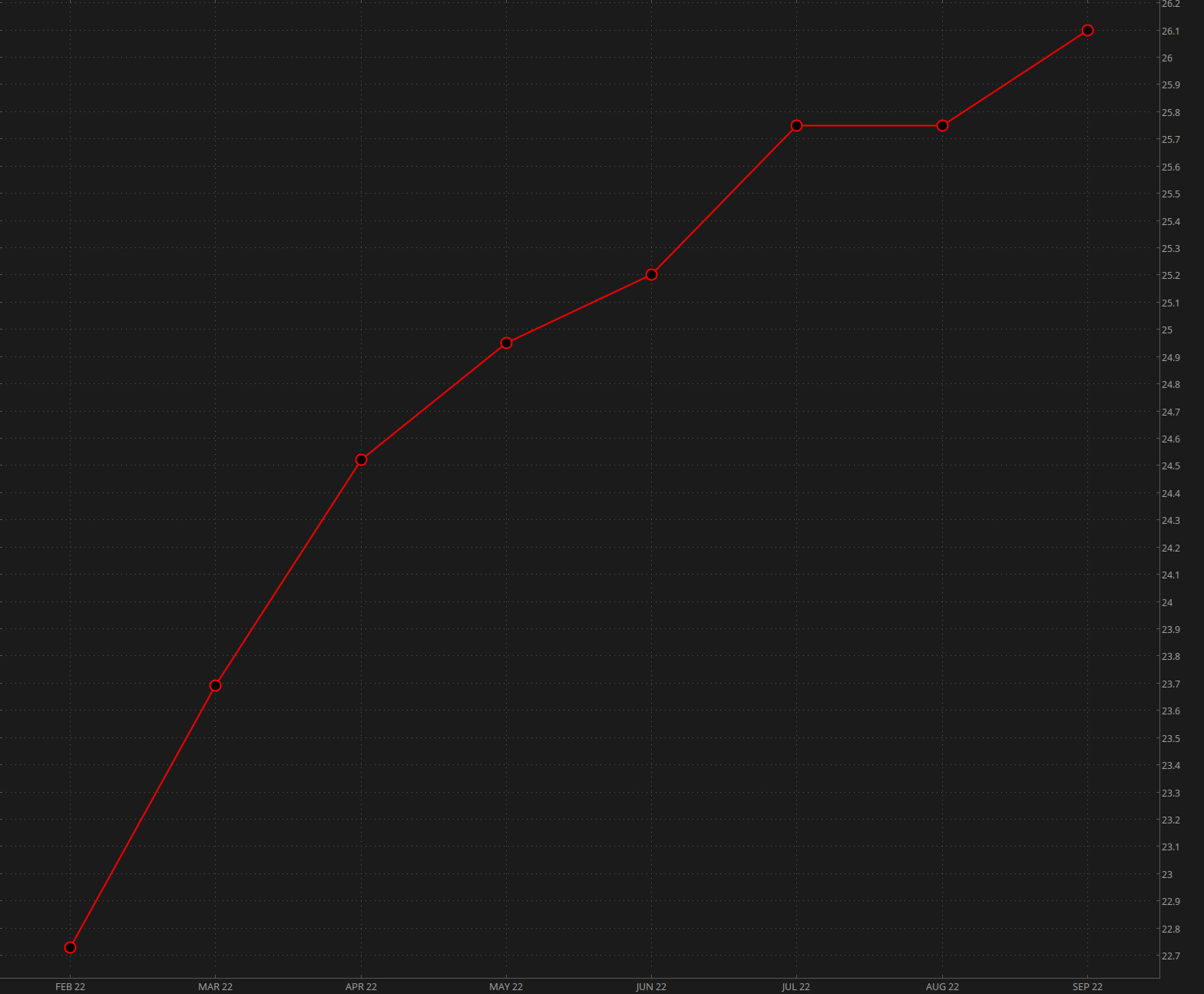

Also I can’t really take the medium to long term scenario serious as long as we continue to see this level of contango in the VX futures. So until proven wrong I continue to side with the medium term bullish scenario.

That of course does not preclude a short term stab lower over the course of this week. So if the ES futures drop below 4535.5 then the games are on and I suggest you sit tight and wait for a reasonably looking floor formation.

Should we hold the line after the bell I may however add a few more weekly call butterflies as they would be priced extremely attractively.

Happy hunting but keep it frosty.