Having suffered a bit of whiplash, a growing number of economists and so called ‘ financial experts’ have started whinging that the Fed is moving too forcefully in slowing the economy in attempt to overcorrect for past mistakes. My take on that: Boohooo – cry me a river…

For over a decade now markets have been enjoying a steady drip of easy money courtesy of every Fed chairman (or chairwoman) since Alan Greenspan.

It was fun while it lasted. But we’ve finally reached the end of the road and all that’s left is a giant heap of debt that nobody really knows how to get rid of.

Two ugly options are on offer at this point:

- Crash the economy and try to save what’s left of the U.S. Dollar hegemony, and trigger inflation in Europe, South America, and to some extent Asia.

- Keep on printing money, kill the U.S. Dollar, lose institutional credibility/relevance, and trigger global hyperinflation.

Tough choice but I know what I’d do if I was in J-Pow’s shoes, and it’s exactly the course of action he has been pursing aggressively since March.

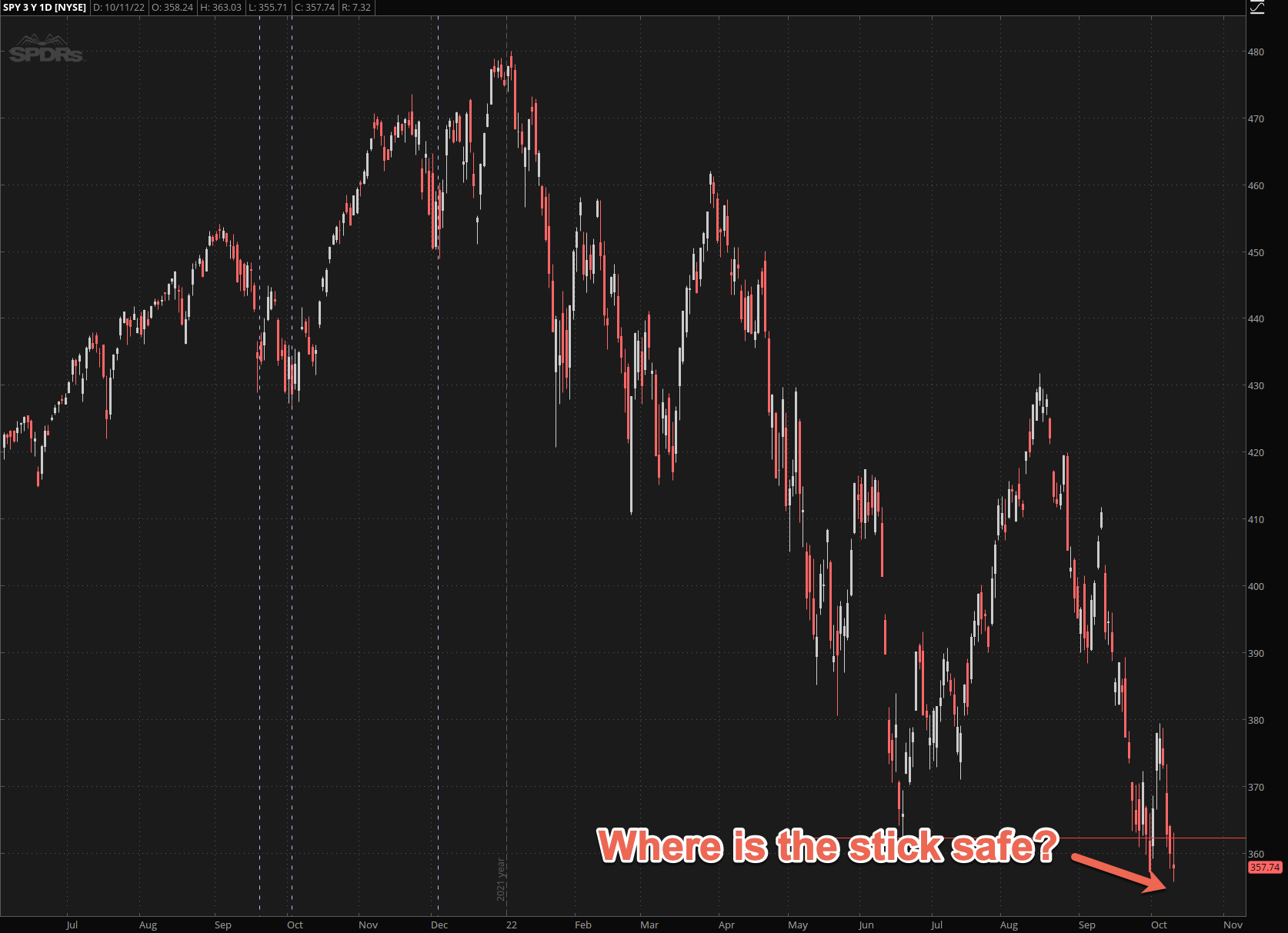

Which may explain why there hasn’t been any attempt of a stick safe near recent support levels.

Now this is important:

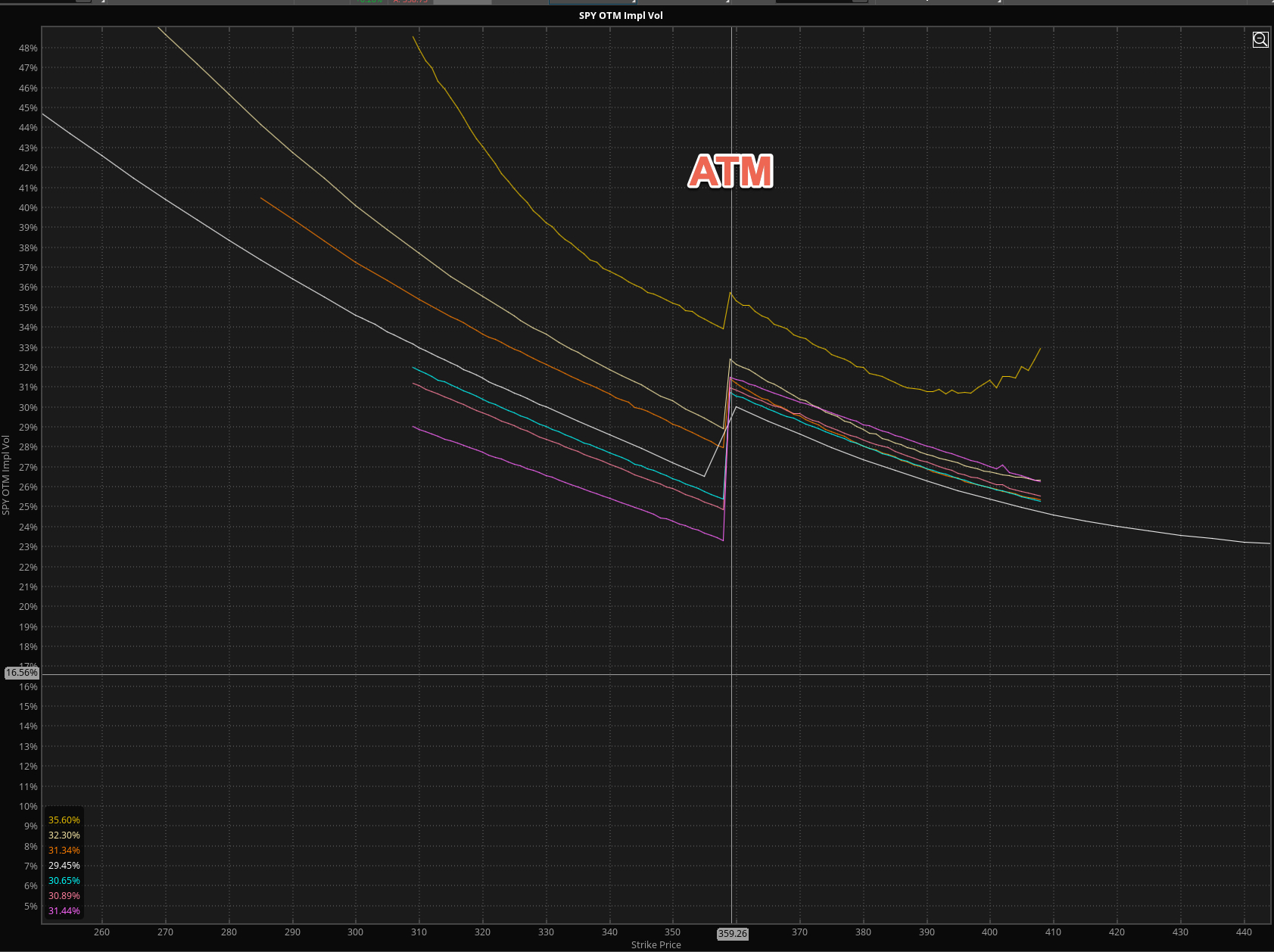

Implied volatility is punching higher despite a fairly lackluster week thus far – we haven’t even touched the lower range of a suspiciously small expected move range.

What does this tell us?

Monkey business is afoot – that’s what.

A quick snap higher would surely wipe out a ton of hobby bears who just backed up the truck on short term (quickly depleting) put positions.

That’s been the revolving game play since about 2009 and it’s what many institutional players are clearly expecting.

How do I know that? Because near ATM options have jumped in premium due to inflated volatility (vega).

Worst thing you can do right now actually is to bulk up on near ATM calls only to watch them being manhandled once volatility drops like falling anvil.

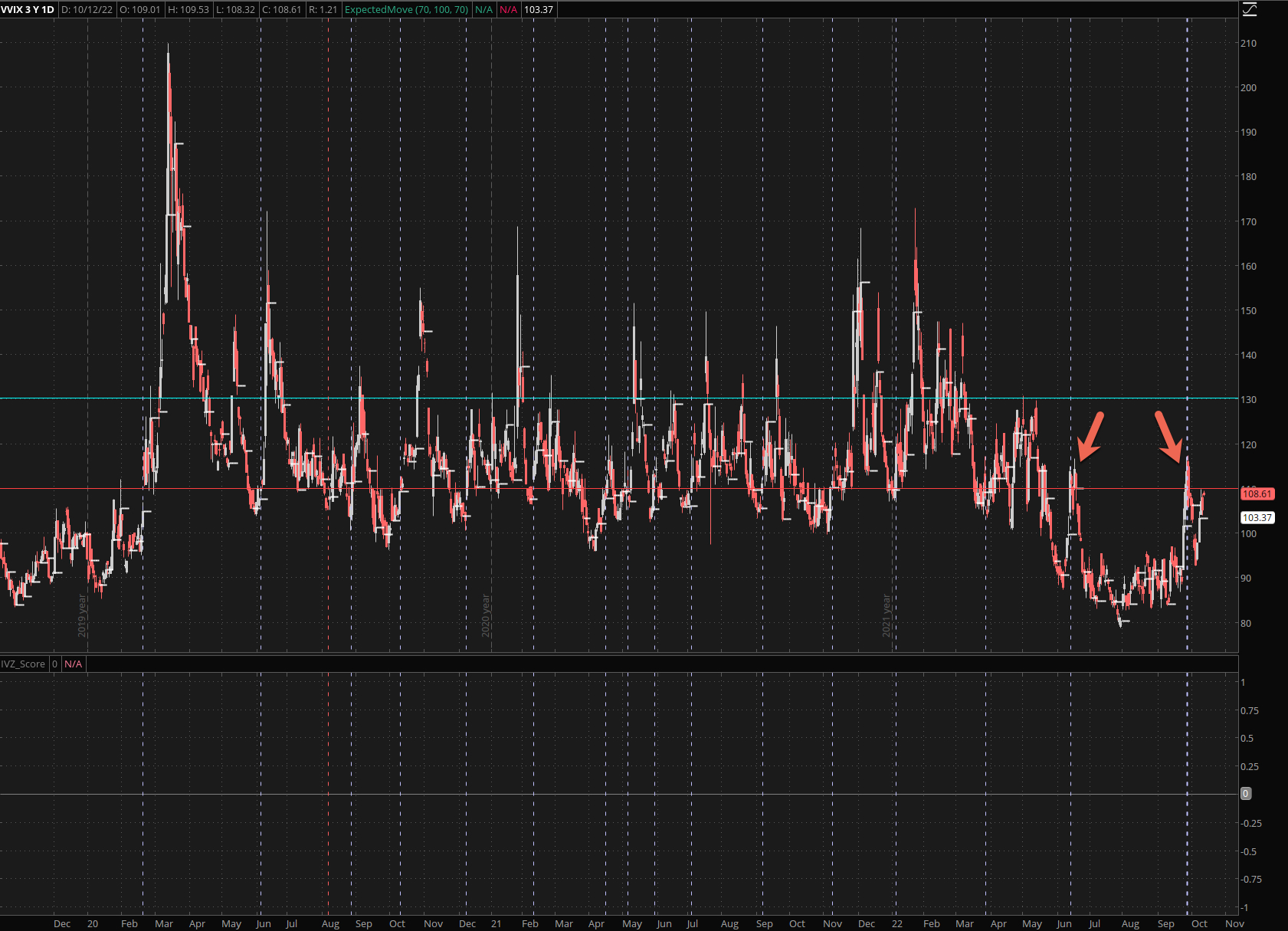

Which wouldn’t be overly surprising as the VIX is back near its crucial 35 mark.

Speaking of stick safes – there were two successful ones in June and one about a week ago.

The arrows indicate where the VVIX was pushing into its famed ‘vomma zone’.

Which is nerd quant speak for ‘the proverbial excrement is about the hit the fan zone’.

And for you math and option nerds: vomma is the rate at which the vega of an option will react to volatility in the market. Vomma is to vega what gamma is to delta.

If your brain just hit TILT don’t worry about it. Just know that a breach of 110 usually unleashes the bearish floodgates.

Frankly it’s a miracle this hasn’t already happened given what’s going on internationally.

But as the saying goes: Hope springs eternal.

Until it doesn’t.

Now I’ve got a question for you.

How would you like to check out of the revolving bad news matrix and instead see watch your trading account grow week after week, month after month?

Here’s the deal.

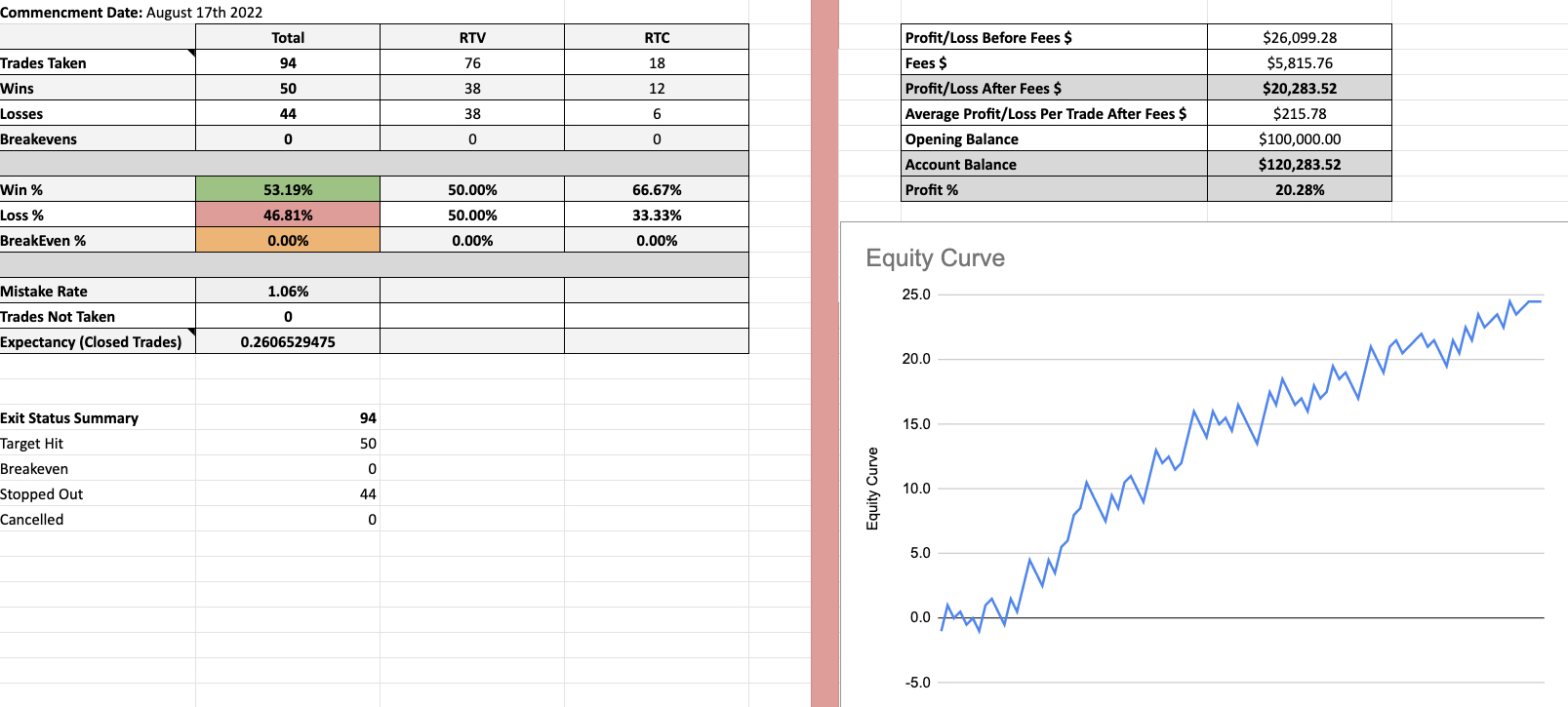

The Crypto Salary System we unleashed nearly two months ago continues to kick a$$ and take numbers.

How is that possible given that everything in sight seems to be going up in flames these days?

To find out join me in an hour from now at 12pm EST.

You can still register for the webinar HERE.

It’s one of my favorite topics, so expect me to geek out a bit.

See you there.

P.S. If you want to beat the rush and join the Crypto Salary System then apply HERE.