Bear market short squeezes have a deserved reputation for being a brutal affair. Simple reason being that anyone with a firing neuron can clearly see the writing on the wall. But if you happen to fall prey to common sense or logical thinking you’re very likely to have your account taken to the wood shed.

This may be a difficult concept to grasp but in essence bear market rallies operate on a principle of collective disfunction.

Meaning: nothing makes sense and the more ugly economic reality is faded the more successful the participant.

The prime evidence of this has been posted here on numerous occasions. Clearly the market continues to do a HORRIBLE job at handicapping forward risk.

What does that mean?

Okay, let me make this very easy for you.

Meet ‘the Dude’ – your friendly next door contemporary.

He doesn’t know the first thing about how to trade the market, but one of his inebriated and slightly emotionally unstable buddies managed to somehow convince him that the stock market is about to circle the toilet.

So the Dude goes on the Interwebs and starts a search for: “best and cheapest way to short the stock market.”

No sooner is he presented with a boatload of links that explain how to buy oneself a put on the Spiders in anticipation of untold riches in the event of a market wipeout.

Easy money!

Now on the other side of that trade we most likely have some hard nosed institutional trader. I could give him a name but you know the type.

His main job it is to sell you that put, full well knowing that 90% of all the options he writes usually expire worthless. Especially during bear market rallies.

So it’s a pretty profitable racket, but even then nobody is stupid enough to take the other side of a trade without a) charging you a juicy premium and b) hedging themselves – you know, just in case.

For the purposes of this post let’s just focus on a) – the premium you are asked to pay for that put you want to buy.

If you pay let’s say $3 for an at-the-money (ATM) put and the corresponding call for that same strike also costs $3 then the assumption is that the Spiders are going to move $6 over the course of the next week, month, quarter, or whatever expiration date you chose.

That is called ‘expected move’ or EM for short.

The sheer act of pricing options is what in turn produces an expectation of forward risk, which can be expressed by volatility in percentage points.

That’s what all those flickering numbers on your option chain are trying to tell you.

The screenshot above shows you the July 21 option contract on the SPX at the close last Friday.

What we learn is that market expects the SPX to remain within a 53.5 handle window starting today until July 21st. That’s 5.35 SPY handles.

Now having set the stage let me ask you a simple question.

How is that in any way realistic given that we have repeatedly breached the weekly expected move over the course of the past month – sometimes by as much as an entire standard deviation?

It makes no sense whatsoever because what it tells us is that option sellers are repeatedly pricing puts and calls too cheaply.

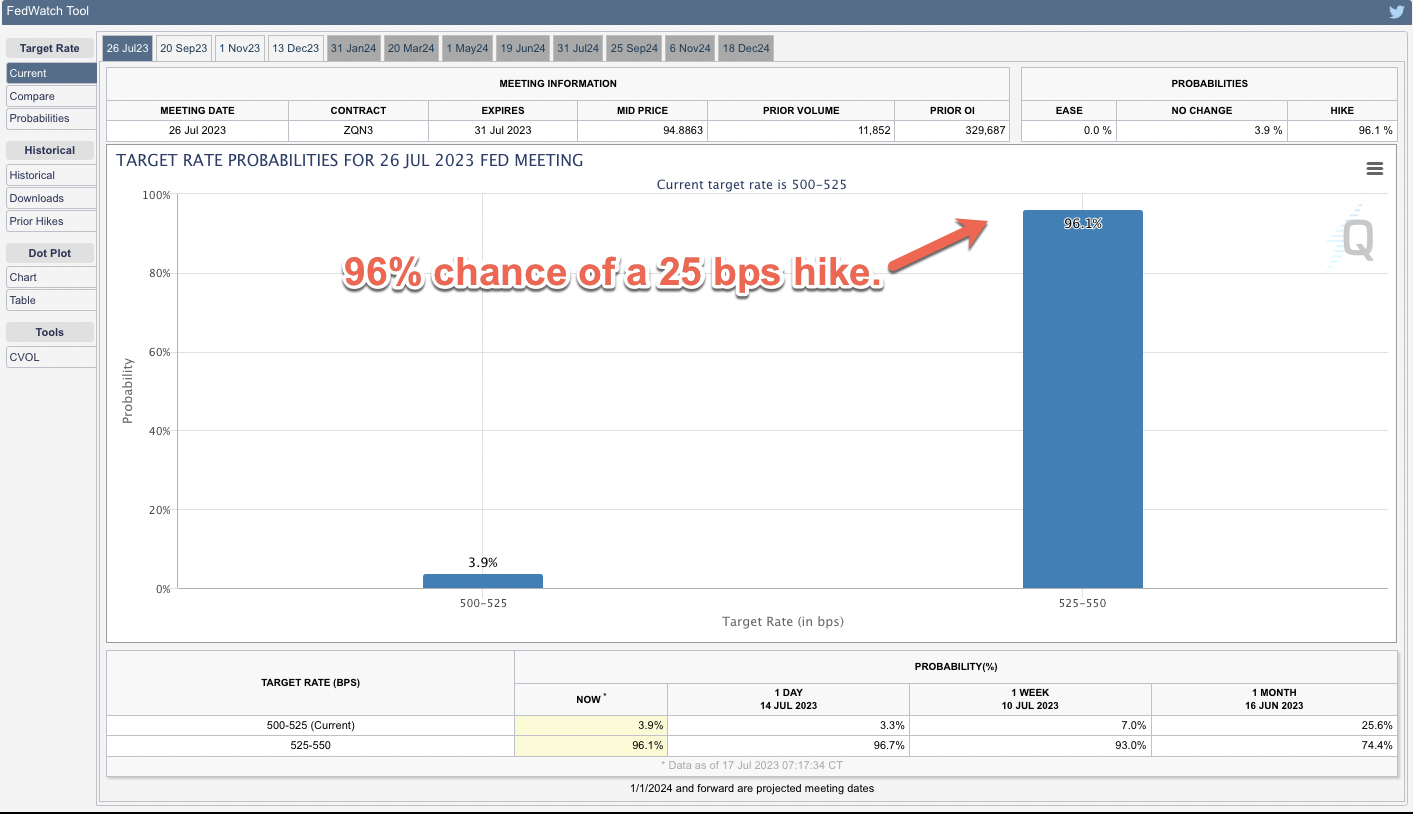

It makes even less sense given the fact that the odds for a 25 bps rate hike at the next Fed meeting now stand at 96%.

Which – should it take place – is guaranteed to put yet another damper on any allusions that inflation is finally under control.

Which it clearly isn’t. Just to make that point the Dollar finally breached long term support at 100 and may soon find itself at 98 or lower.

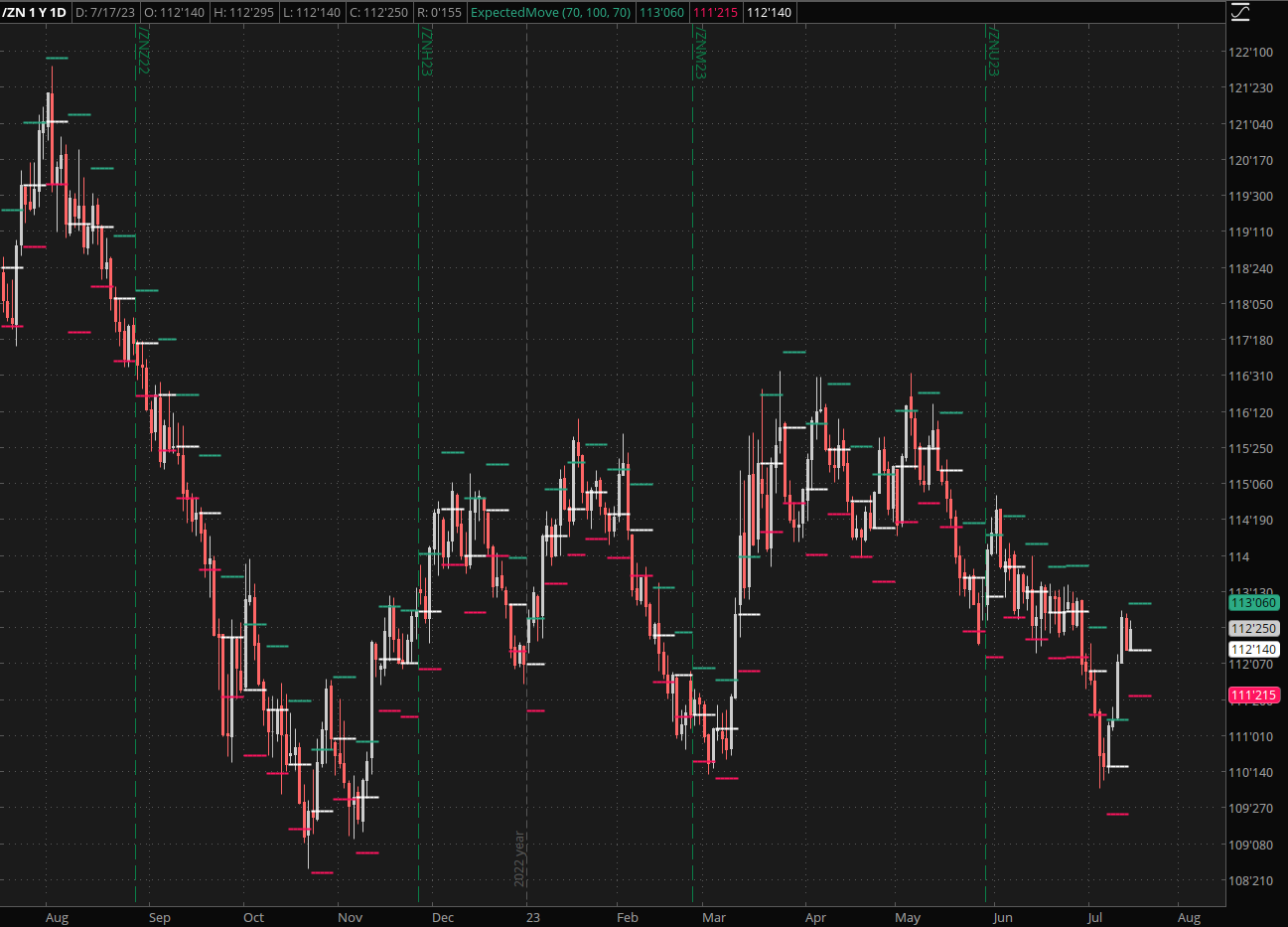

Bonds meanwhile are back en vogue with the ZN jumping back to 112 and holding strong.

At the same time the VIX continues to haplessly scrape the bottom of the current trading range. One again making my point about the discounted handicapping of forward risk.

And let me tell you this: A reading of 13 +/- isn’t exactly representative of a market on the cusp of going up in flames, should for example NVDIA or TSLA experience a bad hair day.

The take away from all this is fairly simple: Equities are going to keep melting higher on fumes, bad news, and low market breadth as long as the algos are able to find suckers on the other side of their trades.

That bad hair day may be mere days, weeks, or perhaps even months away. But when it finally happens, watch out below.

Trade accordingly.

BTW, if you enjoy this type of analysis and are looking for returns like the P&L above then shoot me an email and we’ll get you set up with our Unlimited signal service in no time.

It’s fairly low frequency and only takes high probability trades with the aim of producing consistent and reliable side income.

And that’s nothing to shake a stick at in today’s volatile times