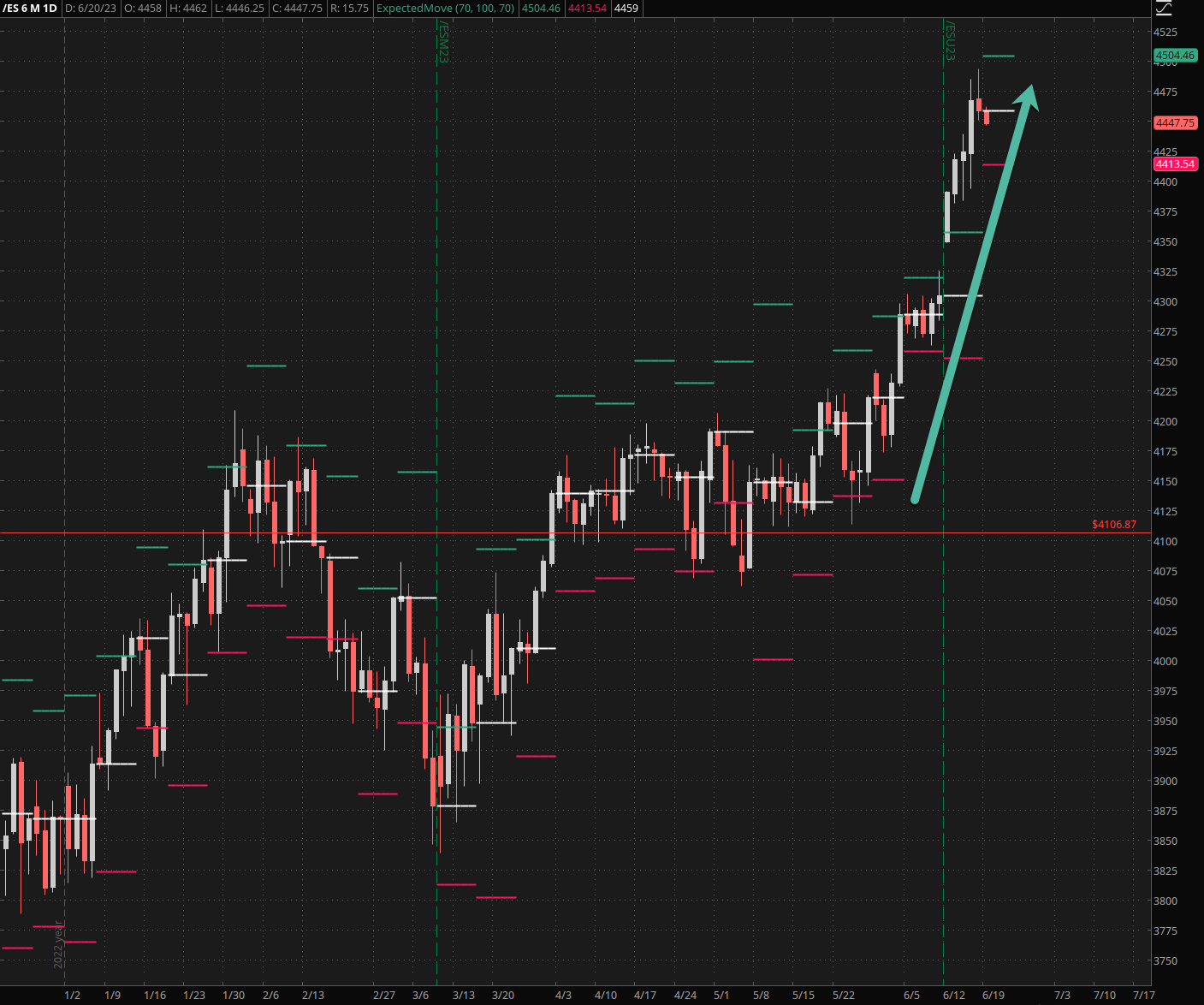

Last Friday morning I promised you a shortsqueeze and we didn’t have to wait long for the market to deliver. What was supposed to be a mere 50 SPX handle week (based on the weekly expected move) turned into a 110 handle rocket launch.

Now here’s one of the many reasons why I keep telling anyone willing to listen that they should learn the basics about trading options even if they never intend to touch them.

That may sound some like some cryptic Zen riddle until you realize that a vast majority of what happens in the stock markets since about 2013 is now driven by options.

That’s right – like it or not, these days it’s the derivatives that drive what happens in the underlying.

And given last week’s hypersonic launch there are only two possible scenarios here:

Either J-Pow’s Byzantine remarks completely surprised the market, or that option sellers are really bad at handicapping risk right now.

My money in this case is on the former as the weekly EM ranges recently had been observed.

Now try to follow along my train of thought here:

All that price action invariably has produced a ton of call selling, right?

Who’s selling those calls?

Market makers, that’s who!

And they are more than happy to sell you all the calls you want, for a juicy premium (click in the chart to zoom in) of course.

Noticed the slight premiums on the call side as we move further OTM and even on the ATM strike?

For the uninitiated: traditionally the put side holds a slight premium as sell offs are expected to be more fast paced than rallies.

Meaning the option smile is usually crooked but right now it is skewed toward the call side.

And why would that be the case? Because market makers are seeing an increasingly lop sided marketplace and they command an extra premium to take on tall hat risk.

But is that enough?

Of course not. And the way MMs hedge against all that negative delta they just sold to hapless retail rats is by buying positive delta.

A very simple and effective way of getting positive delta is by buying the ES futures, because there is no underlying in the SPX (admittedly there is in the SPY).

So what happens when MMs start buying up a ton of ES futures?

Exactly. It starts pushing higher and you may have noticed that it was actually leading the Spiders, approaching a 2 sigma weekly move.

Now you know why. And it has all the hallmarks of a gamma squeeze (we’ll cover that another day).

Which is what we recently observed in leading issues like NVDA, MSFT, or TSLA, producing exponential moves in big tech.

But now we’re seeing the same happening across the entire SPX, and that spells danger Will Robinson!

So if you’re at a party and someone asks you ‘who TF is buying TSLA at these levels’ you’re able to impress your date by smirking and replying: ‘It’s a simple gamma squeeze caused by massive call buying’.

You’re lucky I don’t charge extra for dating advice.

Anyway, the VIX is now back below 14, which is fertile ground for accumulating more of my famous CYA spread I’ve already introduced to my subs.

In a nutshell the spread acts just like a naked far OTM put but without the massive theta (time) burn that is known to slowly drain the trading accounts of most retail option traders.

Now the question you’re probably asking yourself is this:

WHEN is all of this going to end?

Answer – whenever the market is ready to turn. Not what you want to hear but timing the finale of a short squeeze is tantamount to trying to take down a Russian Kinzhal with a slingshot and a potato.

Meaning it ain’t going to happen. Besides, the focus here should NOT be on lottery tickets anyway. It should be on downside protection.

If you have any skin in the game (i.e. stock holdings, 401k, IRA, etc.) you want to be positioned for the potential of a violent reversal.

And that’s nothing exotic – just some good old hedging of your portfolio.

In other words: When things go a bit too loco you want to be insured.

But if you just want my off the cuff guess on when gravity finally sets in: Probably after the summer.

Meaning, you’ve got time.

Before I run here’s potentially HUGE news from the crypto front:

Fidelity Investments, the world’s third-largest asset manager, is reportedly planning to make an offer to acquire Grayscale and apply for a Bitcoin exchange-traded fund (ETF) in the near future.

You know – Fidelity, which holds over 1% of Blackrock (doesn’t sound much but it’s massive).

Turns out Fidelity has been active in the crypto market through its subsidiary, Fidelity Digital Assets, which operates its digital asset operations.

Grayscale has been in operation since 2013 and manages over $50 billion in assets.

The announcement comes on the heels of BlackRock recently applied for a Bitcoin ETF, the approval of which I personally believe is pretty much baked in the cake.

Fidelity’s previous involvement in the crypto market, including launching its Ethereum trading service for institutional clients, further supports the possibility of Fidelity pursuing a Bitcoin ETF.

Keep on stacking those coins, boys and girls!

And if you are looking for a top notch BTC/ETH trend signal then look no further than Gravitas, which continues to kick a$$ and take numbers.

Shoot us a message here and we’ll get you set up right away.