Given all the FUD, noise, rumors, and ‘angst’ in circulation it once befalls onto yours truly to dispense with all formalities and give it to you straight and to the point: Strap yourself in and watch out below because the Fed is coming in for a hard landing. Meaning we’re not just heading into an extended economic recession but most likely a full blown (and utterly self-inflicted) deflationary depression.

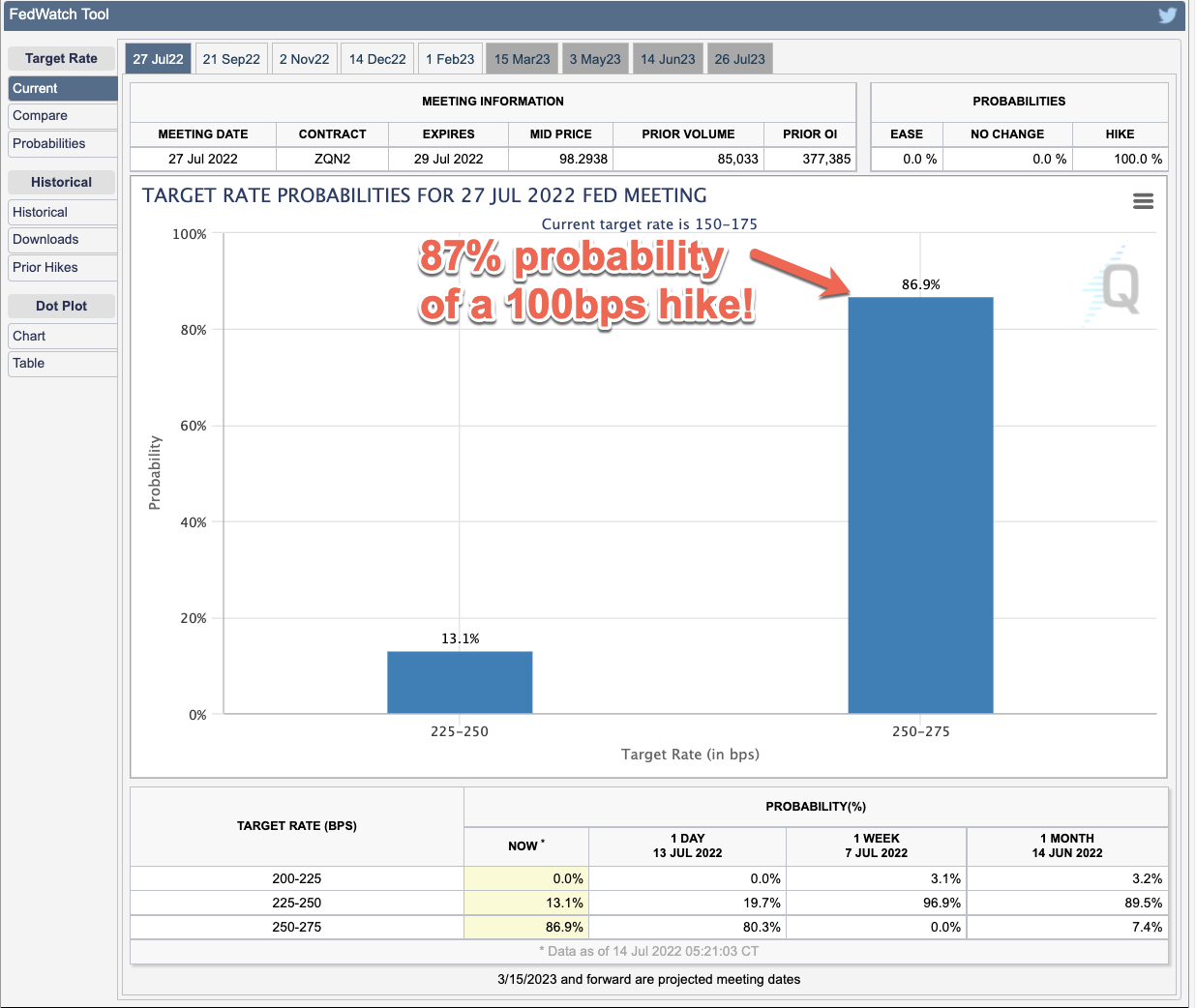

For a healthy dose of substance to back up my outlandish claims look no further than the CME FedWatch Tool, which currently shows us an 87% probability of a 100bps hike in the effective federal funds rate.

Given yesterday’s CPI print of 9.1% a hike to 2.5% or 2.75% falls far short of where it ought to be to make a real difference, but short of digging up Paul Volcker and going for double digits this shows us that the Fed is now determined to at least pretend to nip run-away inflation in the butt.

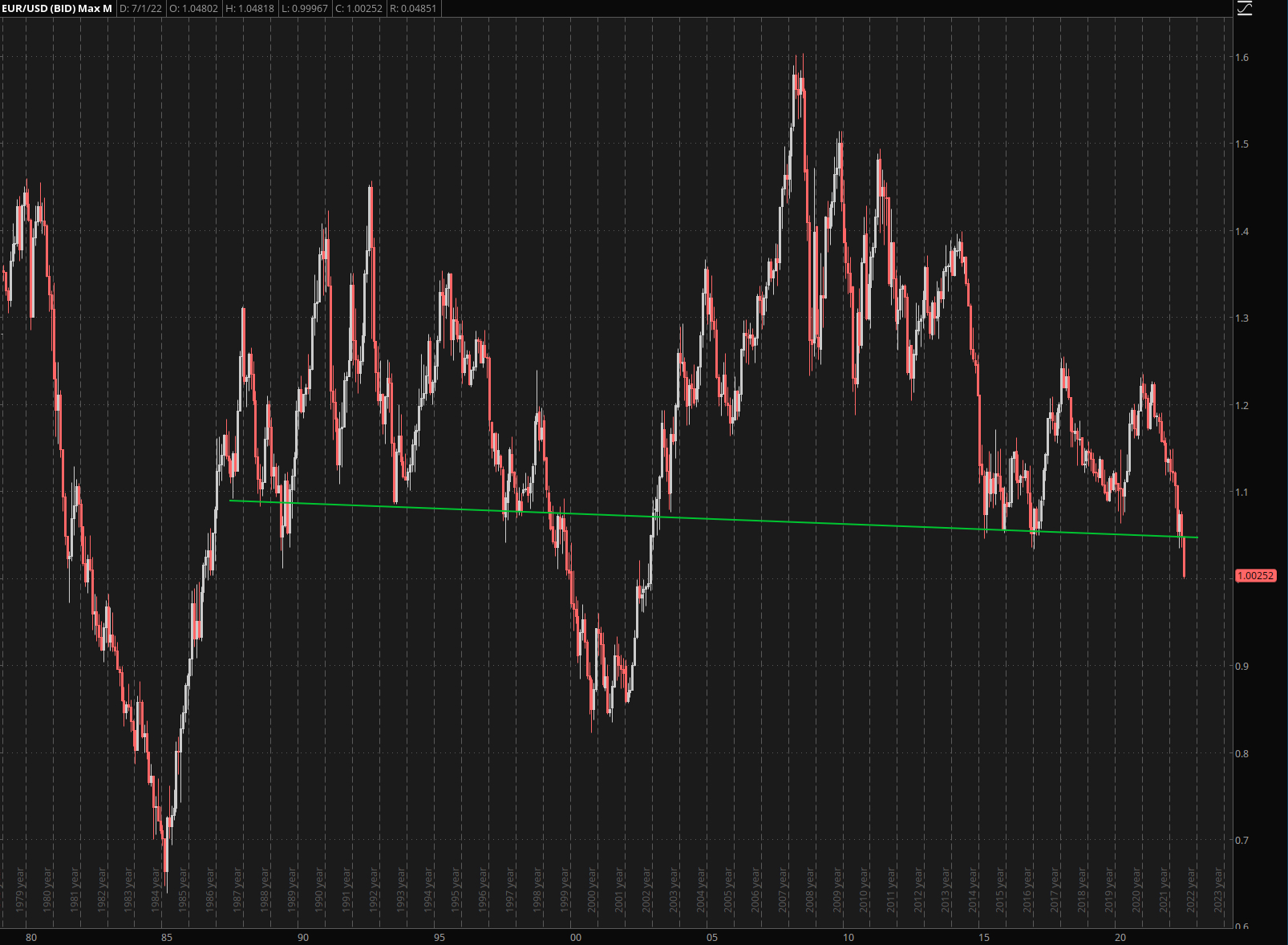

Meanwhile ECB’s president Christine Lagarde continues to talk about the necessity of raising rates, but thus appears to be unwilling to do so. No matter that the EUR/USD has rapidly fallen to its lowest reading in 20 years and is currently sitting at par to the Dollar.

I frankly have no idea what’s holding up equities at this point, plus I continue to be puzzled by how option sellers are repeatedly failing to properly handicap risk. A 94 handle weekly EM on the SPX contract expiring this Friday had very low odds of being respected, mid summer lull or not.

I don’t think that most market participants are even remotely aware of the giant downside risk that looms mere inches below us. Shown above are two Friday contracts – one expiring in the AM and one in the PM.

Now look a bit closer at the huge open interest right ATM on both contracts. These are literally billions of Dollars that are at stake here and continuation lower today or tomorrow has the potential to unleash massive gamma hedging activity.

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.