I hate to be the bearer of bad news but something is very rotten in the realm of Big Tech. What I’m talking about here is – gasp – fundamentals! Not exactly my go-to topic but hear me out.

Over the past decade of perpetual Fed machinations fundamental measures like P/E ratios have increasingly been viewed as antiquated concepts.

So much so that it’s probably considered an outdated academic term to anyone younger than 35.

And to be clear: I would be the first one to completely dismiss P/E ratios when it comes to my daily trading activities, specifically as it relates to my options trading.

However, in the context of my long term market analysis it’s something I most definitely keep a close eye on. Because fundamentals don’t really matter, until they do.

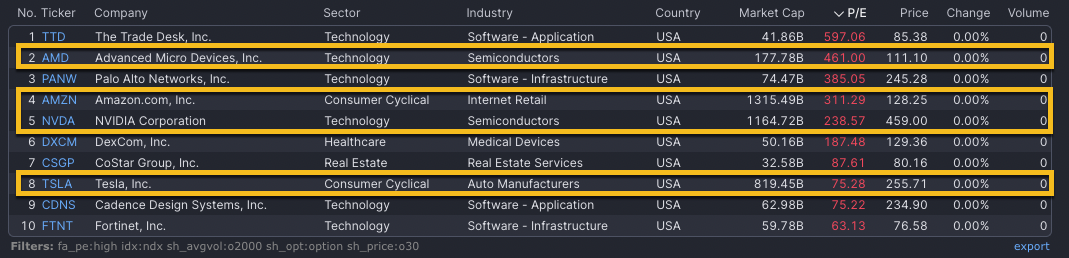

What you see posted above is what I call the ‘hall of P/E shame’.

If you want to generate it yourself head over to Finviz and use these: fa_pe:high idx:ndx sh_avgvol:o2000 sh_opt:option sh_price:o30

Now what stands out?

We don’t have to look long to see some of the leading issues in the Nasdaq 100. Here’s TSLA with a P/E ratio of 75.

If you think that’s bad then here’s NVIDA with a P/E ratio of 238!

Rest assured that Jeff Bezos is not going to be outdone by Jensen Huang.

Amazon’s P/E ratio currently stands at – drumrolls – a whopping 311.

As usual I kept the best for last – I give you AMD with a P/E ratio of 461.

I know what you’re thinking. “So P/E ratios are a bit effervescent Mike, what’s the big deal?”

The big deal IMNSHO is that a ‘normal’ P/E ratio used to be somewhere around 15 plus minus.

Which means we’re off by several orders of magnitude.

Based on what exactly?

Well the obvious go-to excuse for over hyped valuations these days is Artificial Intelligence. Any company or project involved with AI appears to be enjoying the much coveted ‘Chat GPT boost’.

But does that really justify a P/E ratio of 100x – let alone one of nearly 500x?

To answer that question let’s take a look at one company that I expect will end up leading the pack when it comes to actually delivering AI into the hands of end consumers.

And that is…

… exactly – Apple, which recently announced its Vision Pro VR/AR glasses.

While other companies are expected to become major players in that sector it’s actually Apple that has long been the default go-to source for anything even remotely related to consumer applications involving artificial intelligence.

How do you think SIRI is able to decipher your mumblings in crowded room?

Recognize your crappy handwriting?

Auto complete text?

Suggest apps and actions?

Or identify people, cats, and dogs in Apple Photos.

I could go on but I’m sure you can think of countless examples.

So what is the P/E ratio for AAPL at this time? A measly 33 which – albeit elevated and higher than a year ago – is nothing when compared to the rest of the Nasdaq rat pack.

Maybe the reason for that is that CEO Tim Cook has clearly de-emphasized the concept of AI in favor of usability and consumer utility.

In his latest presentation Tim spoke about Spatial Computing, Machine Learning, and Apple’s Neural Engine.

What he did NOT mention was AI. Why?

Simple – let me quote the man: “AI should enhance human intelligence rather than replace it, and AI should only be used for things that benefit humanity.”

Again, I’m not an Apple fan boy but that’s a perspective I definitely can get behind of **

Plus I do find AAPL’s P/E ratio less insulting than any of the ones posted in our ‘P/E hall of shame’.

I don’t know about you but I am investing accordingly.

BTW, if you enjoy my work and are looking for returns like the P&L above then shoot us an email and we’ll get you set up with our Unlimited signal service by the end of the day.

It’s fairly low frequency and only takes high probability trades with the aim of producing consistent and reliable side income.

Yes even in this crazy market.

** I for one welcome our new AI overlords!