I woke up early this morning and as I opened my bedroom window I noticed a white unicorn in my yard crapping chocolate truffles. It looked up, gave me a big smile, and then rode off into the sky on a glittering rainbow. Not a bad way to start the day!

For breakfast I was served my favorite Austrian pancake by Wolfgang Puck in person who had decided to swing by to finally return my Ferrari 250 GTO he had borrowed a few weeks ago.

We had a great little chat about the small Austrian town we both grew up in, but unfortunately we got interrupted by an urgent phone call by Margot Robbie who insisted that I was the perfect candidate to take the role of Ken in her next Barbie sequel.

I politely declined and reminded her that I unfortunately already had a commitment to go on safari with Chris Hemsworth and Brad Pitt. We did however agree to meet for dinner very soon.

After breakfast I checked the news and was excited to learn that peace had spontaneously broken out all over the world.

The Israel/Palestine conflict had been finally settled, and miraculously both Putin and Zelenskyy had come to a peace agreement on the very same day.

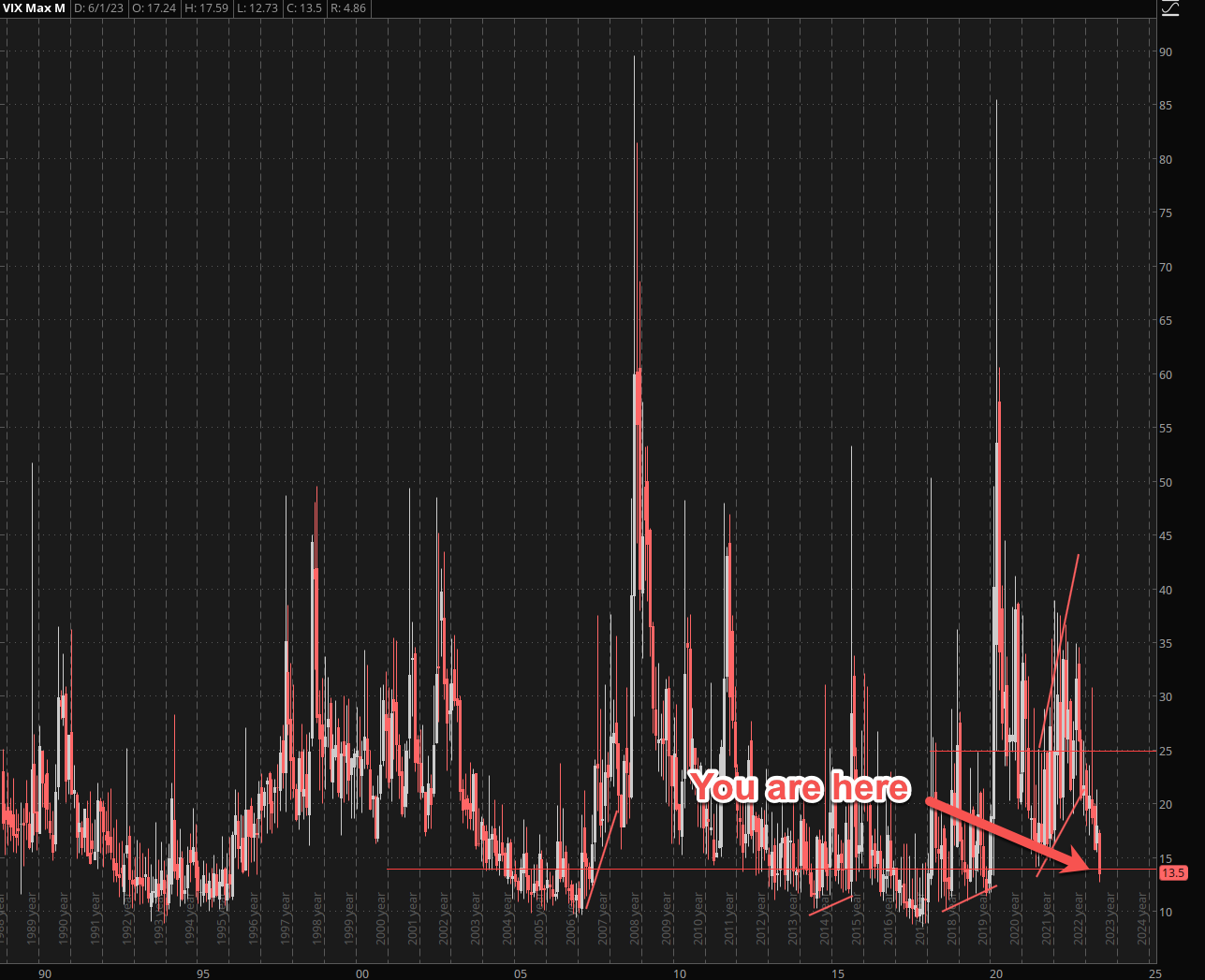

Later that morning I checked the stock market and found the SPX trading at new highs and the VIX at new historic lows.

Turns out that both Democrats and Republicans had finally agreed to settle their political differences. A resolution had been passed to bury the hatched, cross the isle, and return America to its former economic prosperity.

Oh and there appears to be a simple and safe cure for COVID now – just as a sidenote.

What a great time to be alive. America is back!

Okay, now from all the b.s. I just spouted above only one single claim is actually true.

Yes, I did in fact grow up in the same small Austrian town as Wolfgang Puck, but all the other stuff is completely made up.

Oh – except for my dinner date with Margot Robbie – that’s totally on!

Now given the short squeeze we’re currently seeing unfold in the stock market you’d think that at least half of the things I listed above had actually come true.

Over the past four months the SPX has rallied a whopping 600 handles, all while the news keeps reporting one economic disaster after another on both sides of the Atlantic.

The VIX is back below the 14 mark where it has absolutely no business being given the current macro economic and political situation.

Now if you’ve been following me for a while then you probably know that I’m not one to EVER trade contrary to price action. I may take out a hedge to guard my six but over 20 years of being a trader have taught me that price is always the ultimate arbiter of truth.

That said, in that time I’ve also learned to read the tea leafs of what really goes behind the shiny facade of green candles we’re being graced with on a daily basis.

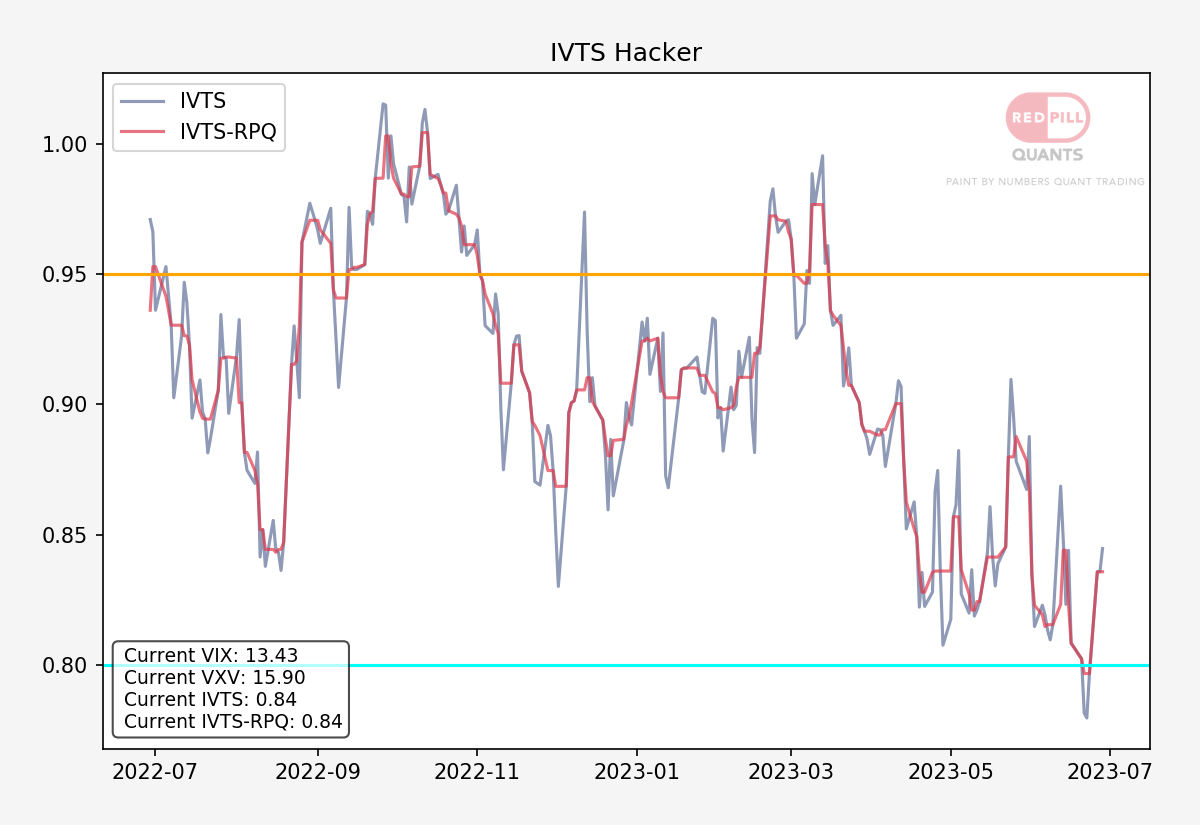

For example the implied volatility term structure (IVTS) which is created by calculating a delta between the VIX and VIX3M (previously VXV).

While both readings have been falling over the past few weeks we just saw a fast signal snapback as apparently IV on the 3-month VIX is picking up.

What that means in English is that option sellers are starting to price in more risk on longer term options.

And frankly speaking the only thing that surprises me is that it has taken so long. Here’s another ‘under the hood’ market measure that 99% of option traders don’t even know about or at least constantly ignore:

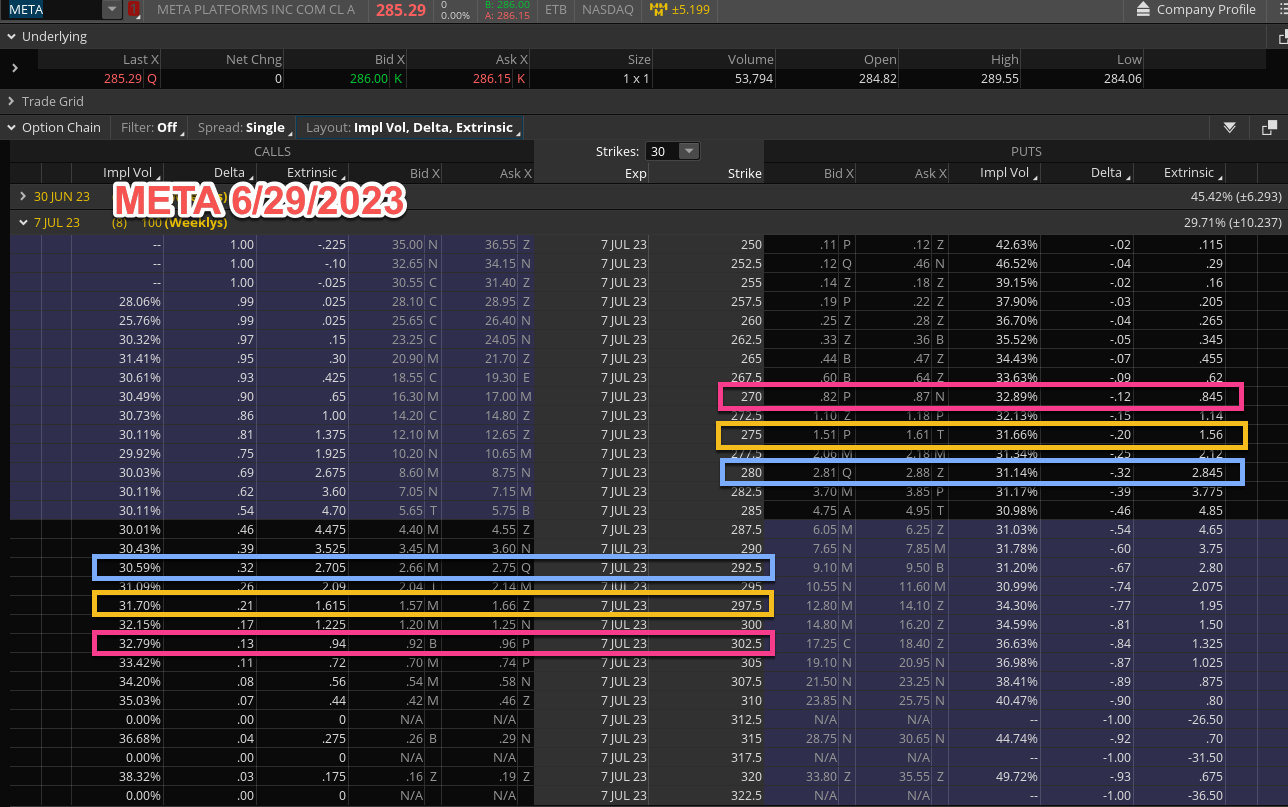

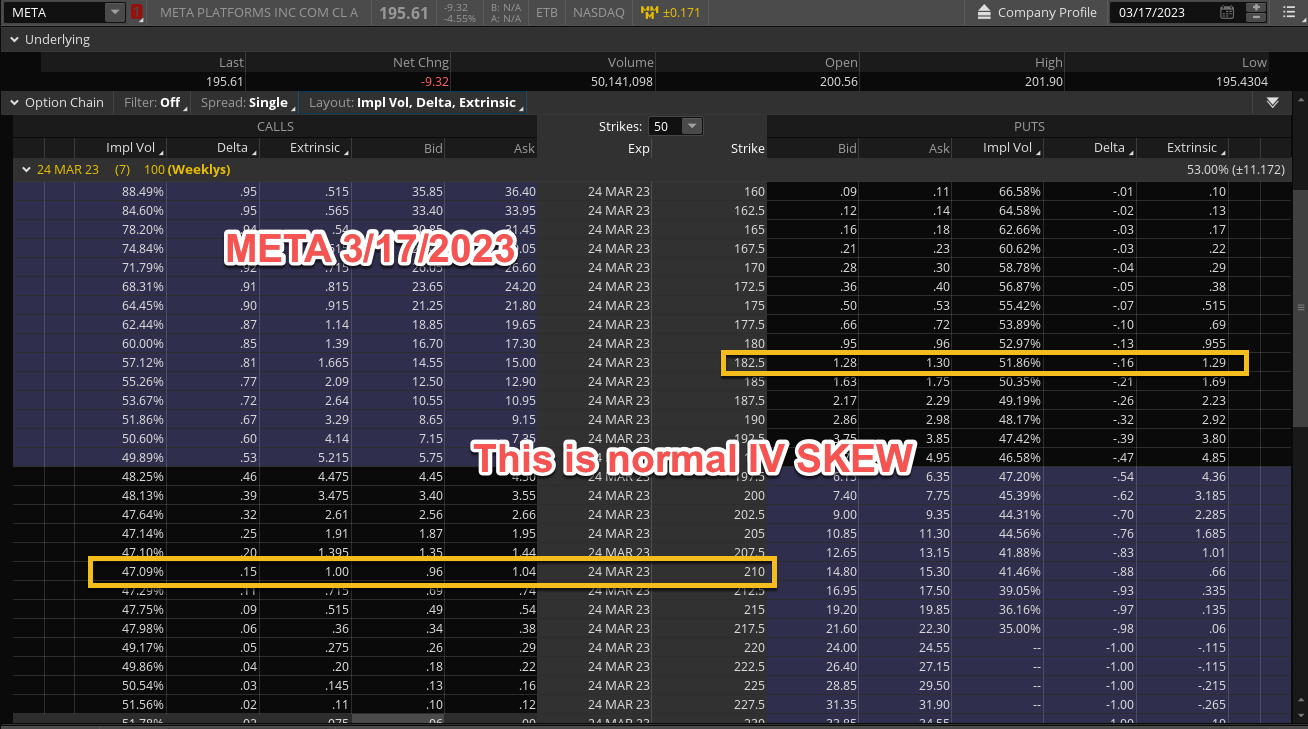

What you are looking at is an options chain of META from last March.

I’ve highlighted two strikes – one 182.5 put and one 210 call. Both of them were on track to expire 7 days later.

What these two strikes had in common was that they share a very similar delta – 16 on the put and 15 on the call.

For the purposes of this discussion you don’t really need to understand what that means, but in a nutshell delta describes the sensitivity of an options premium to price movements in the underlying stock (in this case META).

So for example if META had risen by $1 back in March then the 210 call I highlighted would have increased by 16c. Easy peezy lemon squeezy.

If you want to compare puts with calls then you always want to look at similar or identical delta (based on the offering).

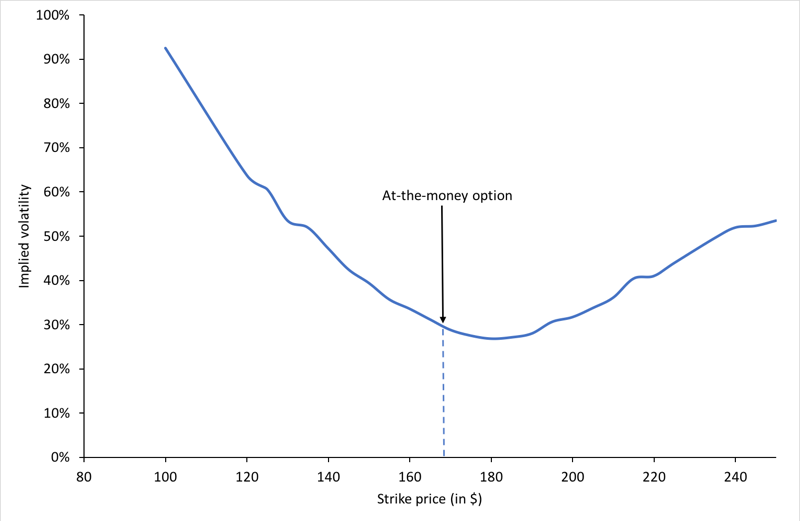

Now if you look at the ‘Impl. Vol’ column and you’ll notice that implied volatility increases as you move further away from the money.

(normal IV smile)

That’s completely normal and something you’ll see almost everywhere.

What’s also normal is that IV on a put strike is always a bit higher than the IV on a comparable call strike.

There are many reasons for this but mainly it’s due to higher tail risk when it comes to selling put options vs. call options.

Now I know your eyes are about to glaze over, but hang in there because what comes next is very much worth all the suffering.

Here’s a very similar option chain from earlier this morning before the opening bell (meaning all this has probably changed quite a bit since).

Notice anything?

Look at the 275 put and compare it with the 297.5 call (the closest match I could find).

IV on the 275 put is 31.66% while it’s 31.7% on the 297.5 call. Yes they are almost identical.

The same inversion is happening on the 280 and 302.4 strikes. And no, that is NOT normal, in fact I’ve seen even more extreme readings during trading hours.

So what does this all mean?

Professional option traders call this phenomenon an ‘inverted SKEW’ and it refers to the fact that the ‘volatility smile’ on a particular option contract is shifted toward the call side.

And that ONLY happens in two scenarios:

1) The market has crossed prior all time highs.

2) The market is experiencing a bear market relief rally.

In both cases market makers assume increasing upside risk and for that reason they are forced to protect themselves.

One aspect of that is more hedging activity (i.e. buying stock or index futures) to offset the negative delta they just took on by selling you a call.

Another is by commanding a higher premium for a call option in anticipation of more upside due to a possible short squeeze. Higher premiums produce higher IV on those strikes.

And finally they do it because they CAN – excessive greed is always a profitable environment for option sellers.

In conclusion: The inversion of SKEW in option chains of leading products (e.g. META, MSFT, NVDA, etc.) strongly suggests that the market has more violent upside potential, but at the same time the rise in the 3-month VIX against the 30-day VIX tells us that MMs are also pricing in the possibility of a significant market correction over the next quarter.

Plan your trades accordingly.

Shameless Plug: If you’re into trading options and also happen to enjoy consistent long term returns then look no further than my Options Unlimited membership.

The current win/loss ratio has remained steady at over 80%, meaning out of 5 trades 4 have been winners during the past 2 years.

If you’re interested in joining as a member, then let us know and we’ll set you up with our signal service by the end of the day.

Public Service Announcement: this will be my last post until after Independence Day – meaning I’ll be back on Wednesday. Wishing all of my readers a wonderful and relaxing early summer weekend.