It’s finally official: Inflation is out of control with last week’s consumer price index (CPI) reporting a jump to a whopping 7.5%. This is the fastest surge in the past 40 years but let’s not kid ourselves, that is AFTER the numbers have been thoroughly massaged and finagled to look as rosy as possible. The truth is most likely much more dire. I personally would pin running inflation at 10% or perhaps as high as 14% simply judging by fuel prices as well as basic cost of living expenses which continue to explode higher.

Not surprisingly the Fed has scheduled an emergency FOMC meeting to take place today (Monday February 14). I’d really love to be a fly on the wall on that one as Powell and friends have basically has run out of politically convenient options at this point.

What remains simply is the inevitable – an obvious and necessary measure that should have been taken many years ago, but like the captain of the Titanic, for some reason eluded every single Fed chairperson over the past decade: A significant rate hike combined with an express willingness to maintain an elevated FFR against a crashing equities market.

While Powell and his colleagues at the FOMC are facing a tough morning today things couldn’t be any easier for us from a trading perspective. Our key levels on the SPX are:

4500 and above: The All Clear – if the FOMC somehow pulls yet another invisible rabbit out of its hat then we are most likely going to see a short squeeze of biblical proportions. 4600 is where we would get confirmation and a run to new ATHs. Odds are very very low for this one.

4211 until 4500: The Woodshed – where we currently find ourselves. It’s the perjury of pain where hope goes to die. Directional trading should be avoided at all cost.

4211 and below: Here Be Dragons – A drop to 4211 and especially a close below that level put us on course to 4000 and below.

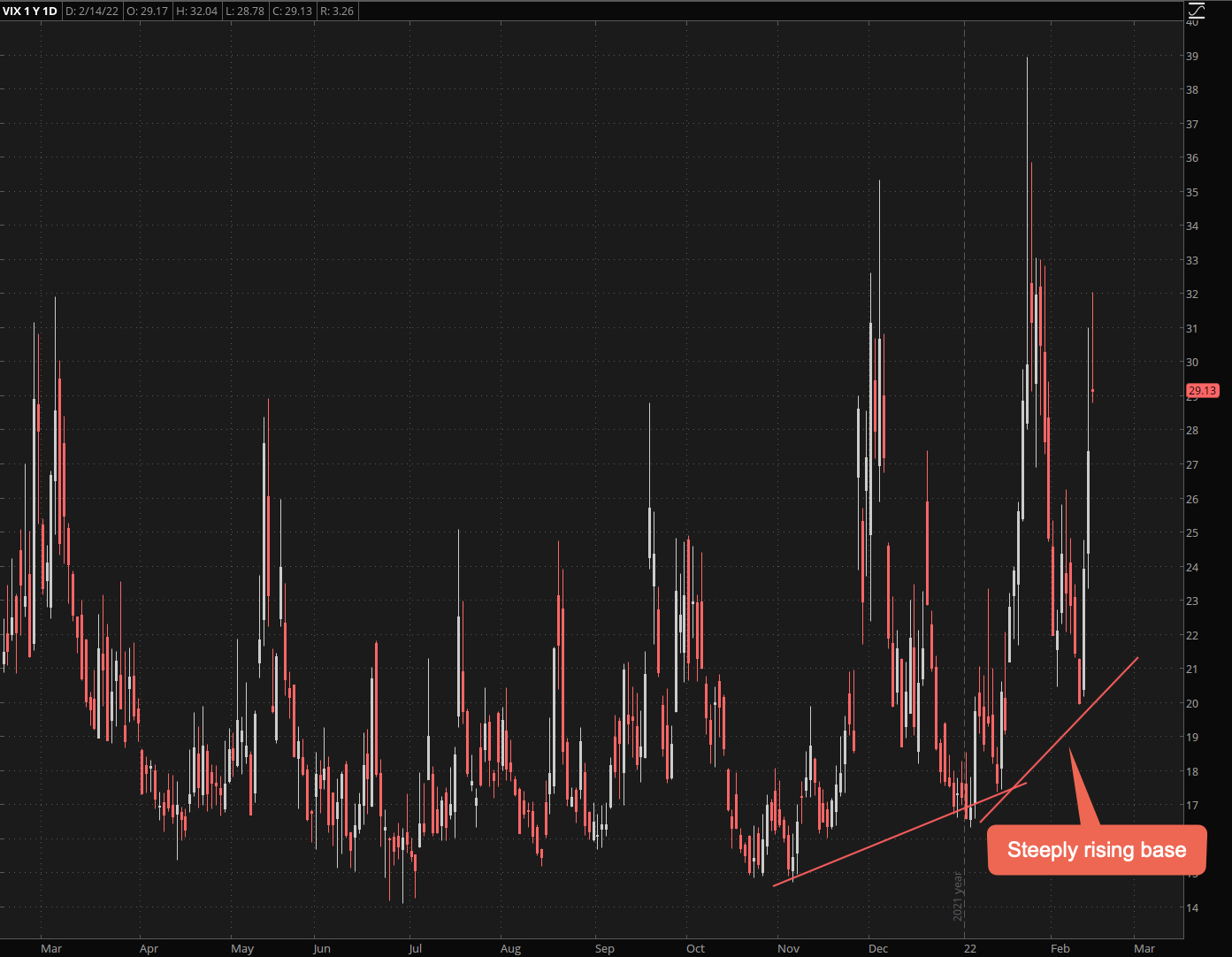

As I suspected the VIX continues to build its rising base which now extends up into 20 and above. If we keep holding this support line bad things will happen and that very soon.

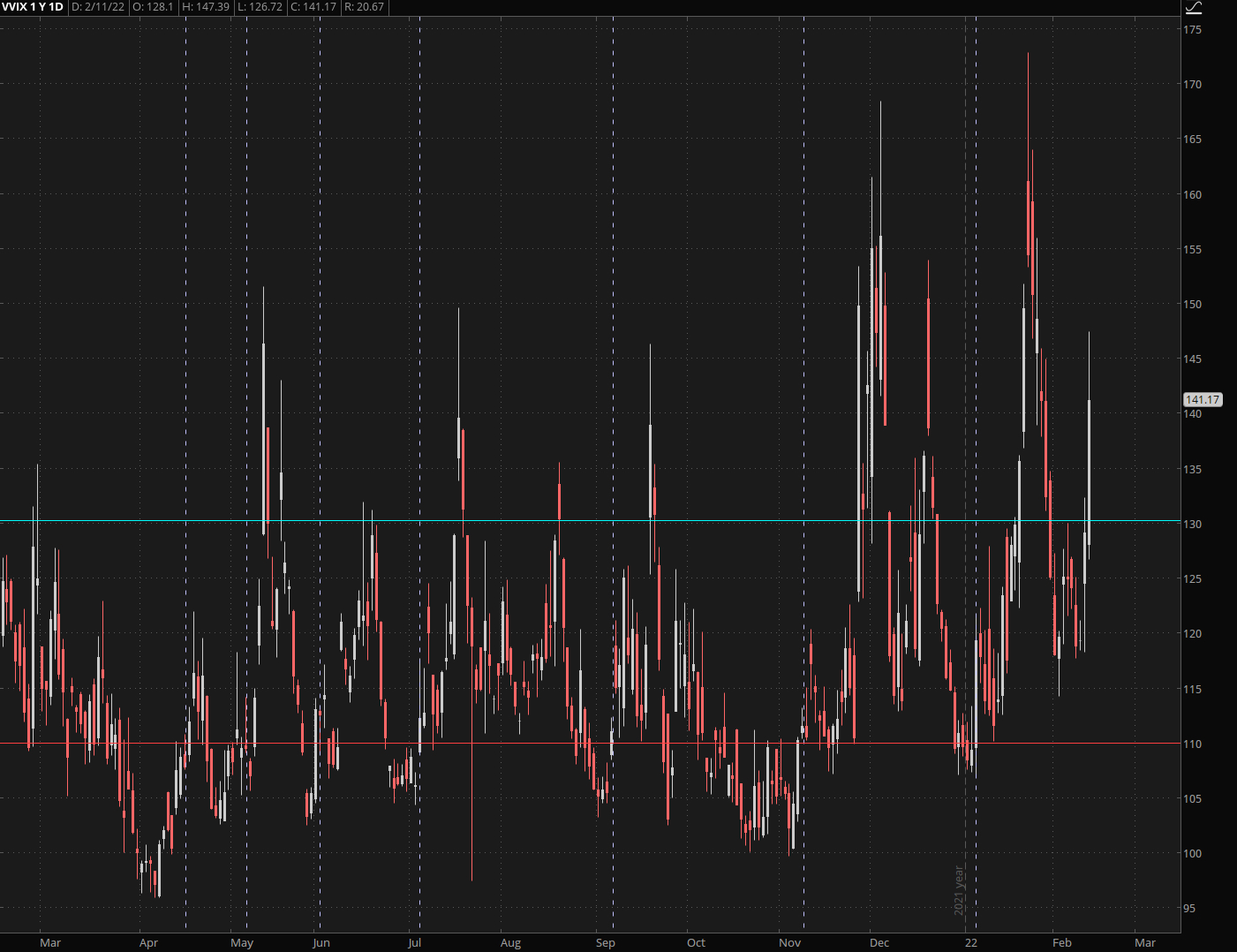

The VVIX (volatility of IV) is spiking hard and although we may see a bit of mean reversion post news here the direction appears to be clear. Also note that we have not descended below the vomma zone since early January.

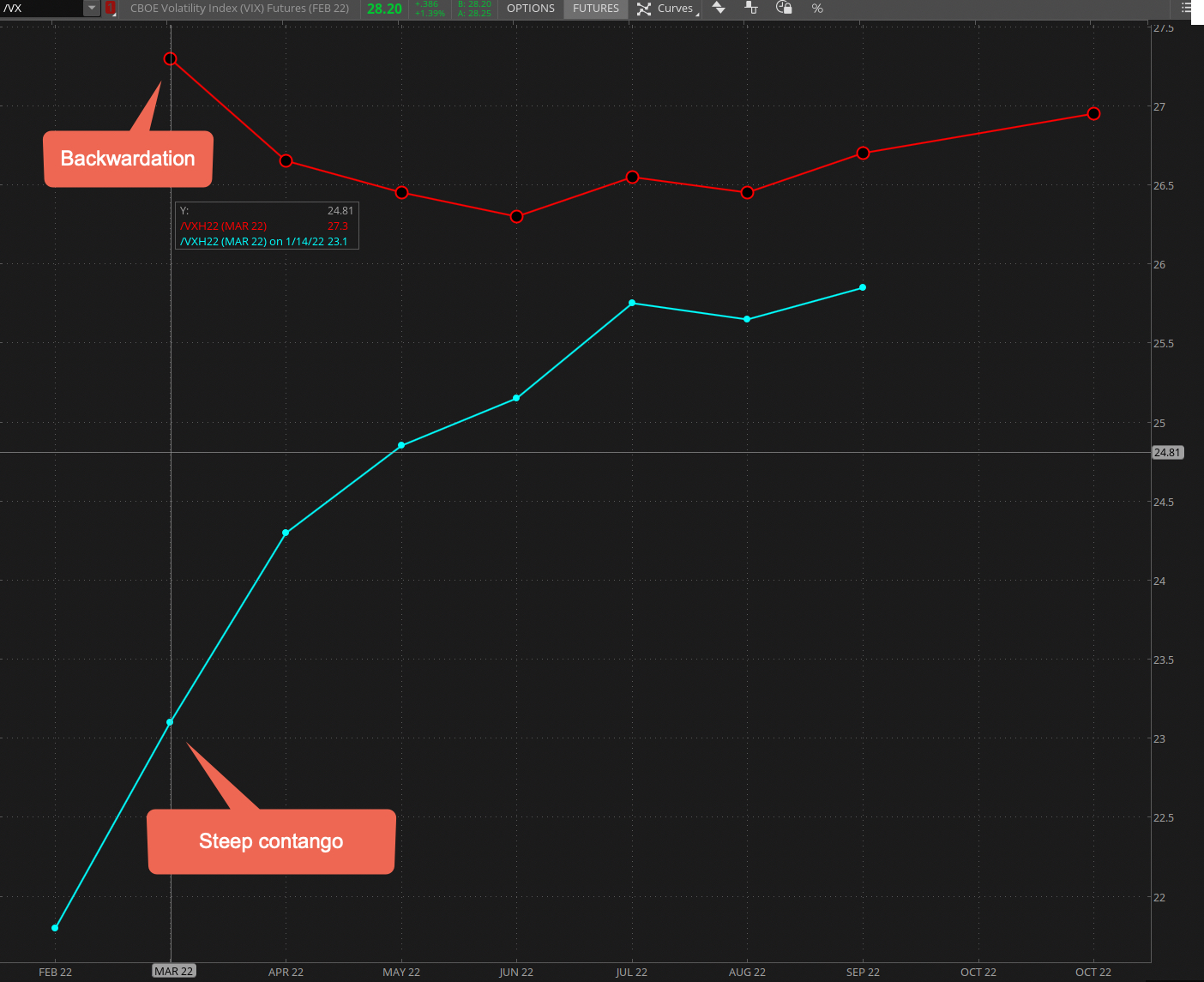

Backwardation in the VX futures is back with a vengeance. Compare that with the steep contango wee observed exactly one month ago on Jan 14. It didn’t make sense to me then and clearly my concerns were proven right only a few weeks later.

The TNX (i.e. 10-year treasury yields) continues to explode higher and as it’s now threatening the important 2.2% threshold the Fed most likely won’t have much of a choice but act. And by act I mean take measures that actually bring down inflation as opposed to boosting it.

Now that you understand the seriousness of the situation let me show you how to prosper while everyone else is running around with their hair on fire:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.