Do you believe in miracles? Maybe you do and maybe you don’t. But when it comes to trading the financial markets, hoping for miracles is not a viable trading strategy.

Unless of course you are ‘somehow’ able to predict the Fed’s next funding rate decisions, but that’s a story for another day.

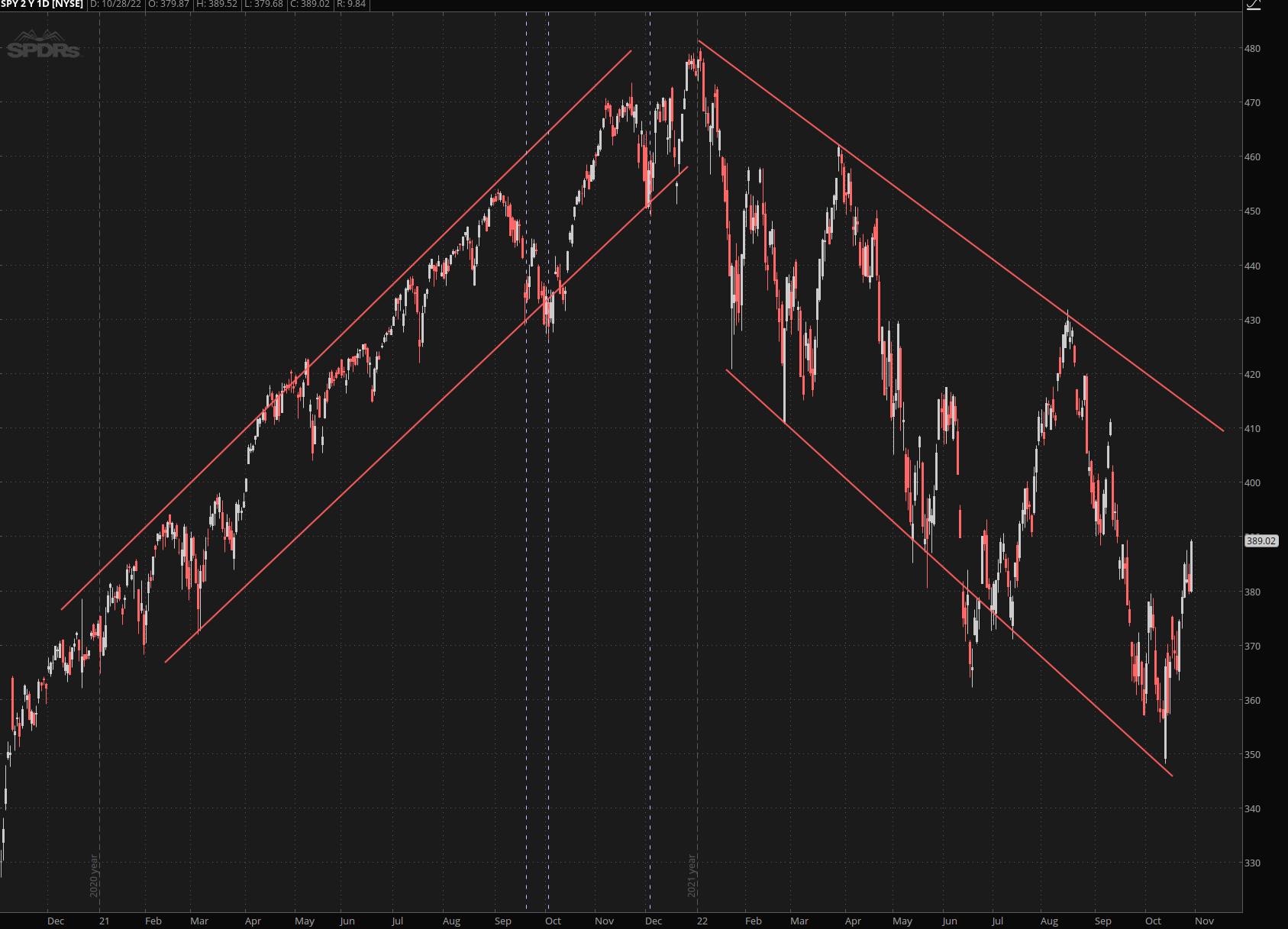

For the rest of us, cold hard statistical analysis is as good as it gets. And what that’s telling us right now is that this market has no business doing what it’s doing.

And by that I mean making a run higher and burning anyone caught short to a crisp.

Doesn’t mean it cannot or should not happen. Quite to the contrary.

This is EXACTLY what happens during early stages of a secular bear market.

And what are you are seeing is neither a miracle nor the start of a new bull market.

Bull markets don’t start during a global economic meltdown bundled with a failing supply chain, and the bonus threat of nuclear war.

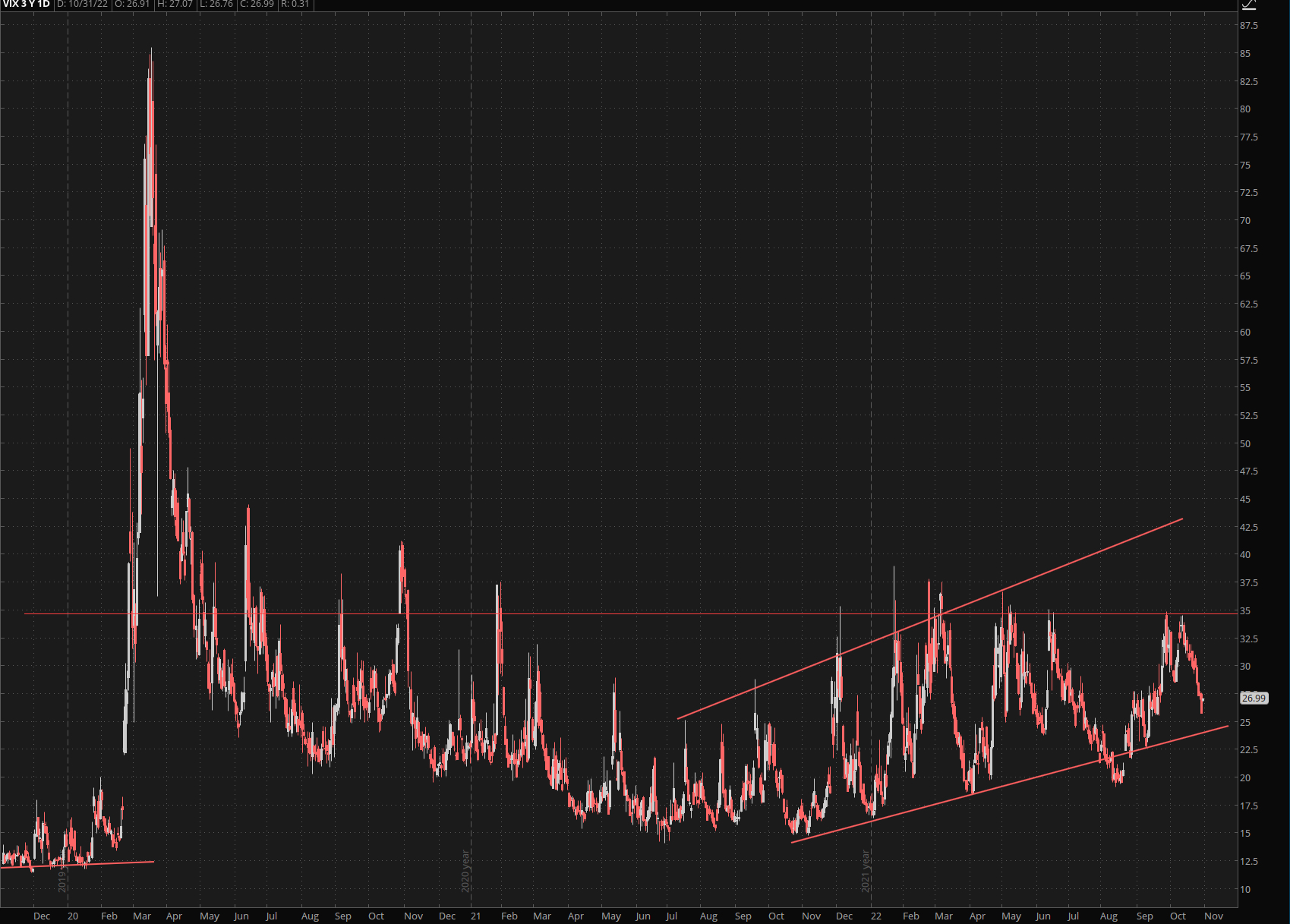

Maybe that’s why the VIX hasn’t dropped below the 20 mark since all the way back in April.

In fact it’s building a solid base that’s now terminating somewhere around the 24 mark.

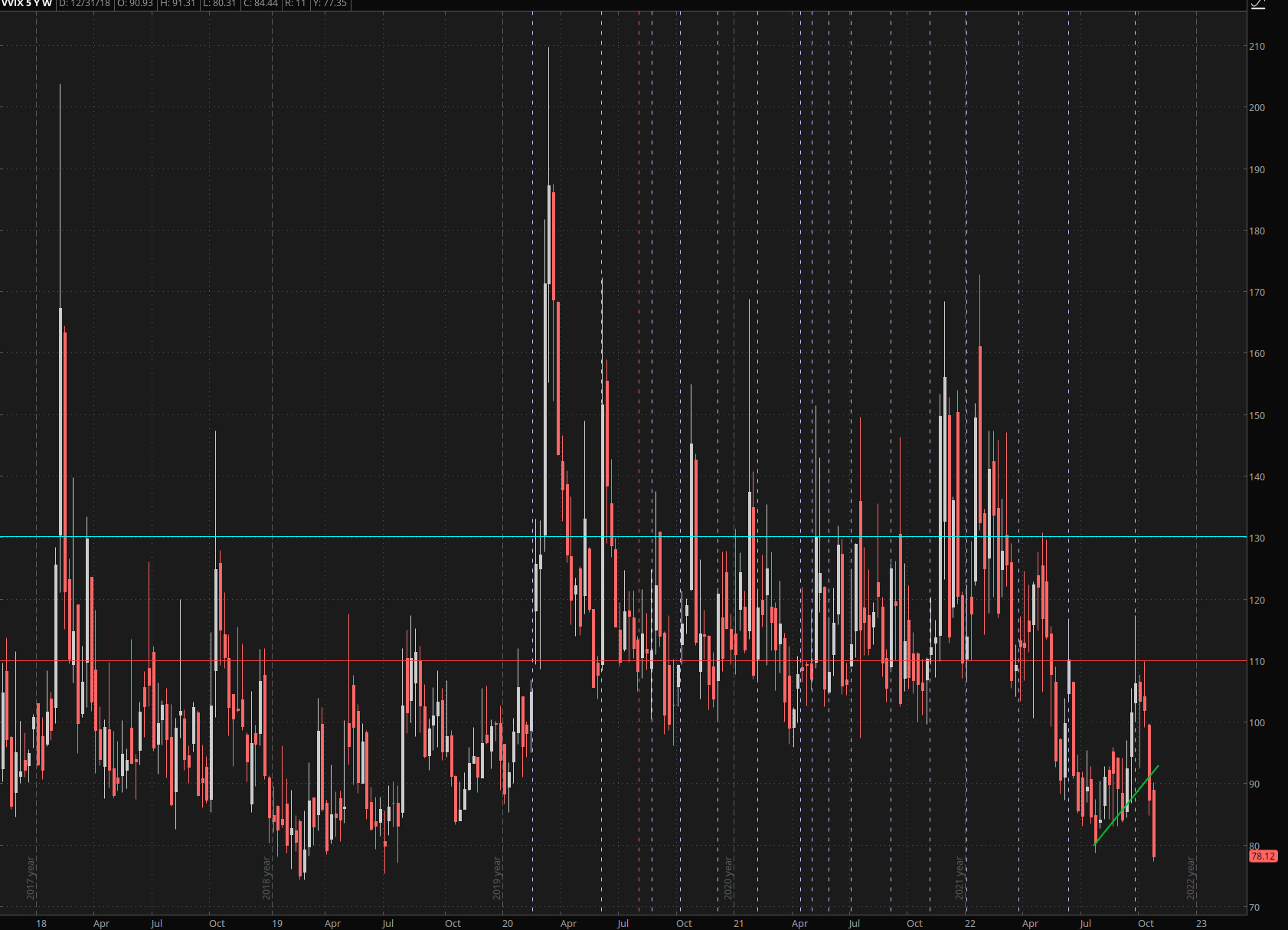

Something else to pay close attention to is a signal most retail rats ever even heard of – the VVIX.

Basically the VVIX tells us about the ‘volatility’ of implied volatility.

Yup, you read that right – while the VIX attempts to measure market volatility, the VVIX shows us how volatile the VIX is.

Kind of a mind bender, but bear with me, because this is important.

The VVIX has been dropping like a rock since exactly April when the VIX last dropped < its 20 mark.

In fact it’s been falling so hard that it’s at historically low readings now – tendency: FALLING.

What does that mean?

Is it good?

No grasshopper – quite the contrary in fact. This is BAD.

Because once the VVIX finds a floor – which it will – what follows is a jump in how volatile the VIX is.

And the VIX never ever becomes volatile with stocks on the way up.

Given that we’ve been scraping the abyss near SPX 3300 recently that’s very very bad medicine.

So what does all that you mean for you and I?

Rule #1: Trading on direction is a fool’s errand. You WILL get taken to the wood shed.

Rule #2: Downside risk greatly outweighs upside opportunity. Act accordingly.

Rule #3: Find a way to benefit from increased market volatility.

But HOW?

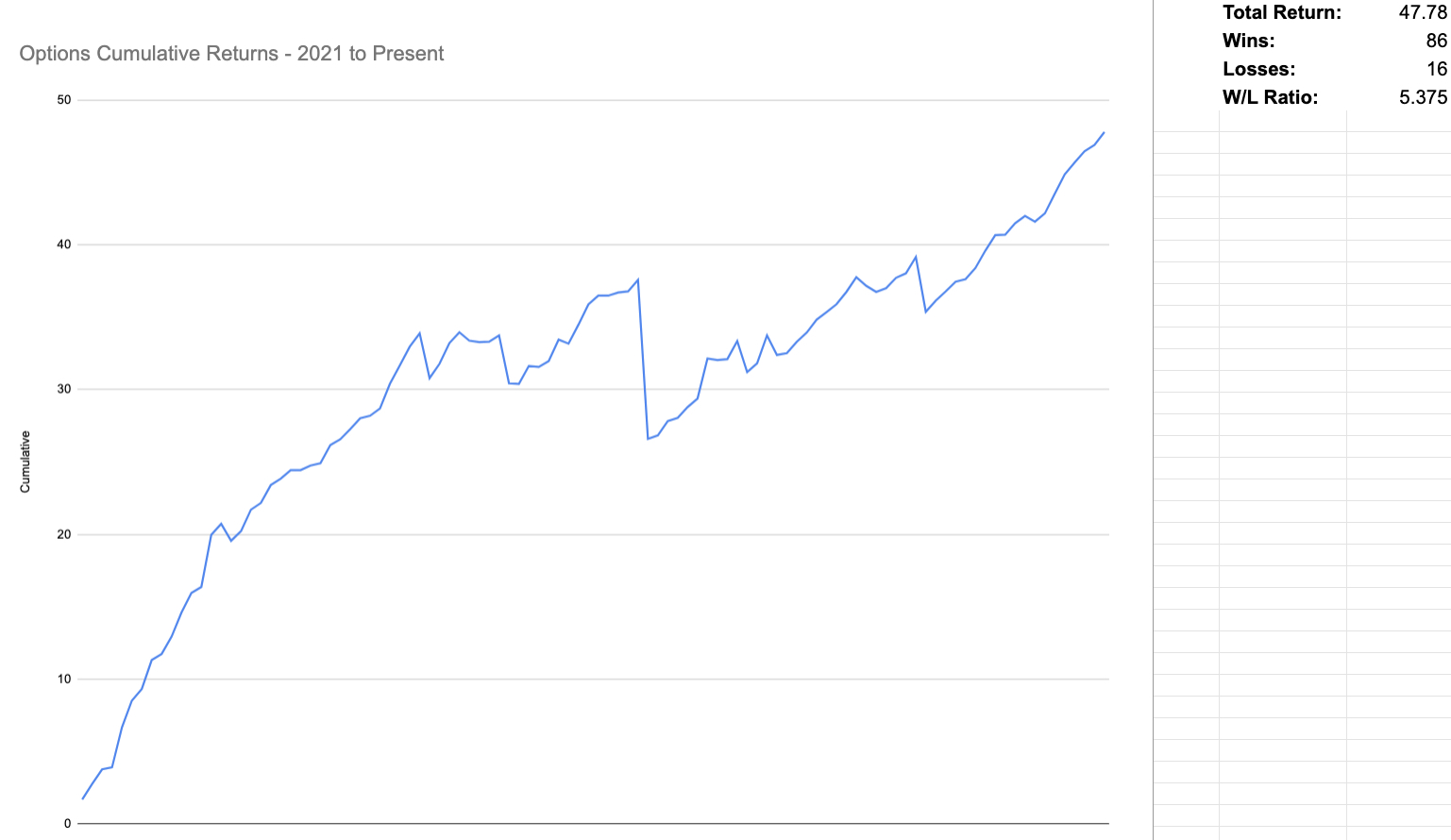

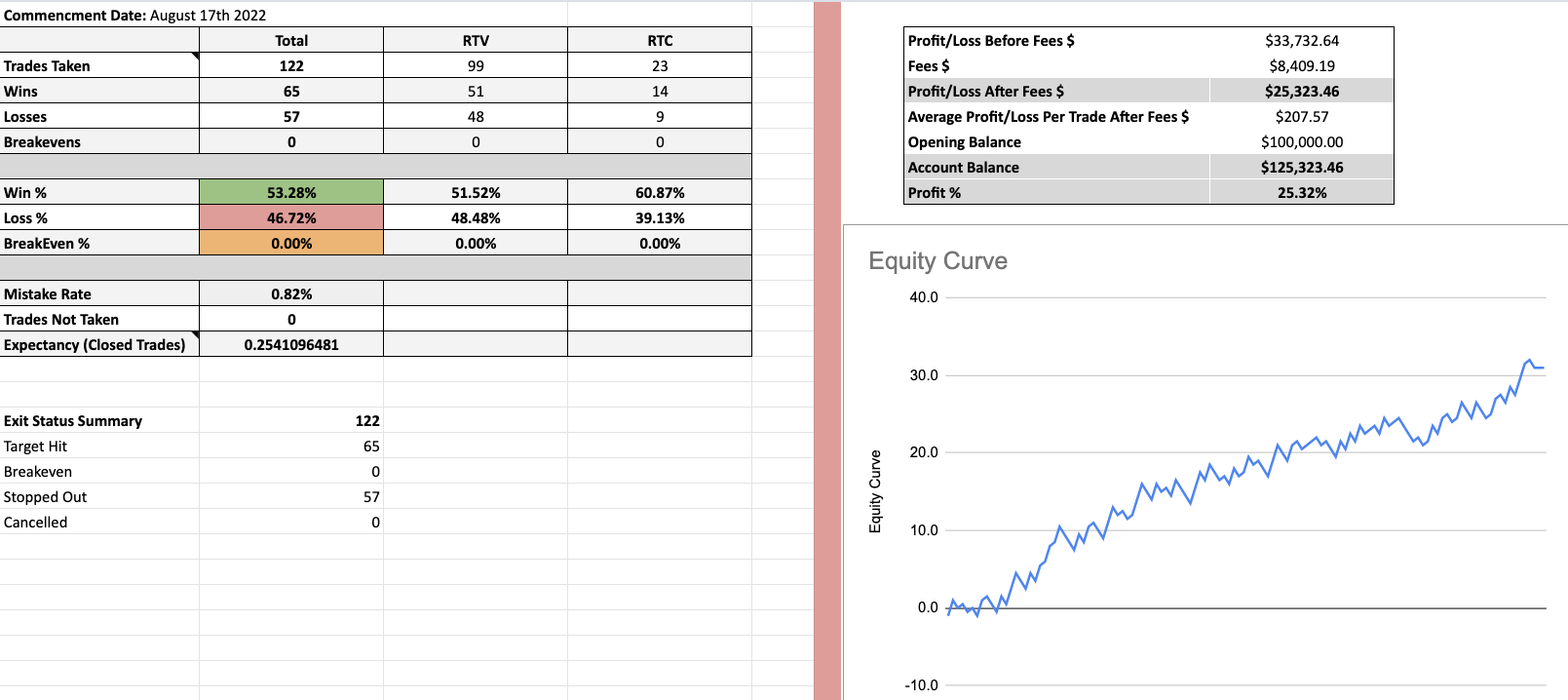

Here are my cumulative returns on trading options over the course of the past year.

86 winners and 16 losers.

So many sleepless nights…. NOT!

Seriously though, my style of trading options is boring AF but it keeps on printing money.

If you’re interested in tagging along you’re in luck – I’ve been offering a live signal in my online RPQ trading floor.

Shoot me a message about what your trading goals are and we’ll talk.

What else is on the menu?

Well you guessed it – the Crypto Salary System (CSS) which we launched live in mid August.

And thus far the results have been nothing short of breathtaking.

YES it involves taking trades in crypto – but what comes out the other side are Dollars, which is what we all use to pay our bills.

The CSS is the evolution of over 10 years of continuous development and I consider it my highest accomplishment (thus far).

I’ll be demonstrating the entire system on our regular weekly webinar on Wednesday evening

And if you are ready to join us and master the easiest and best trading system I’ve ever designed…

Click here to apply to get your first month’s trading funded by me.

THAT is how confident I am in the CSS and it’s potential.