After a decade plus of blue balling the bears to the max it appears that the days of reckoning may have finally arrived. Of course we here at Red Pill Quants always knew that it would happen eventually. Even as far back as 2009 when the Federal Reserve panicked and first embarked on its quest to single handedly change the laws of finance and in the process managed to enrich a small group of connected insiders as an unexpected bonus. What we of course didn’t realize back then was how long it would actually take for the bubble to burst.

Of course all good things must eventually come to an end and after a decade plus of complex machinations the Fed has basically painted itself into a corner it won’t be able to get out of without (financial) blood shed. Either the market dies or so does the Dollar – pick your poison.

Whilst in the past it increasingly seemed that Fed & Friends were able to pull an almost infinite amount of rabbits out of their collective hat, a perfect geopolitical storm in combination with a hyper-inflating Fed balance sheet finally forced bond vigilantes to do what the Fed repeatedly has proven incapable of doing.

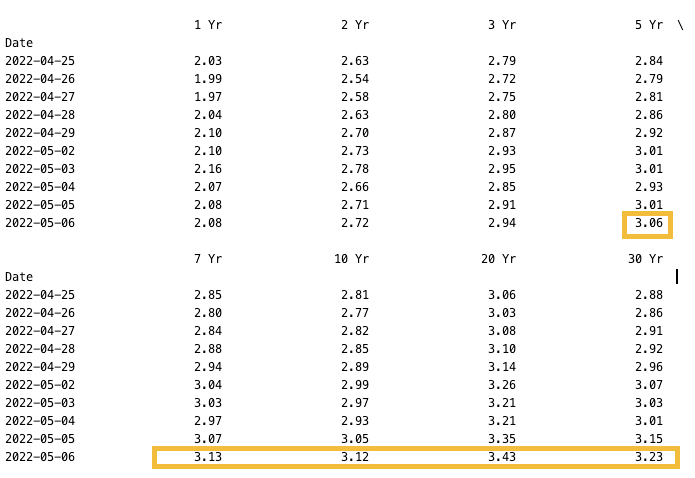

With bonds effectively crashing we are seeing yields across the board into the upper stratosphere.

As you can see rates are now > 3% above the 5-year term with the 3-year rapidly catching up.

Here’s a LT view of the TNX which has effectively DOUBLED in the course of five months. Keep in mind that as of 2021, the size of the bond market (total debt outstanding) is estimated to be at $119 trillion worldwide and $46 trillion for the US market alone according to SIFMA. Which means it’s YUGE – and it’s effectively in melt down mode.

Also worth watching is the 3.25% threshold on the TNX which is exactly where the Fed panicked in 2018 and reversed course on tightening and its initiatives to reduce is then already bloated balance sheet. Since that time it added trillions of additional Dollars on top of what was already the biggest debt bubble in financial history.

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.