Just ask the Fed and the answer should be ‘how many trillion would you need’? Which why it’s a bit puzzling that the old greenback actually seems to be bottoming out right now and may even be getting ready to put the squeeze on all those degenerate Euro fanboyz. As you can imagine the thought of not being taunted by my local ATM anymore fills me with much glee. But in the context of the overall market situation we’ve got a few charts to review. Let’s get to work.

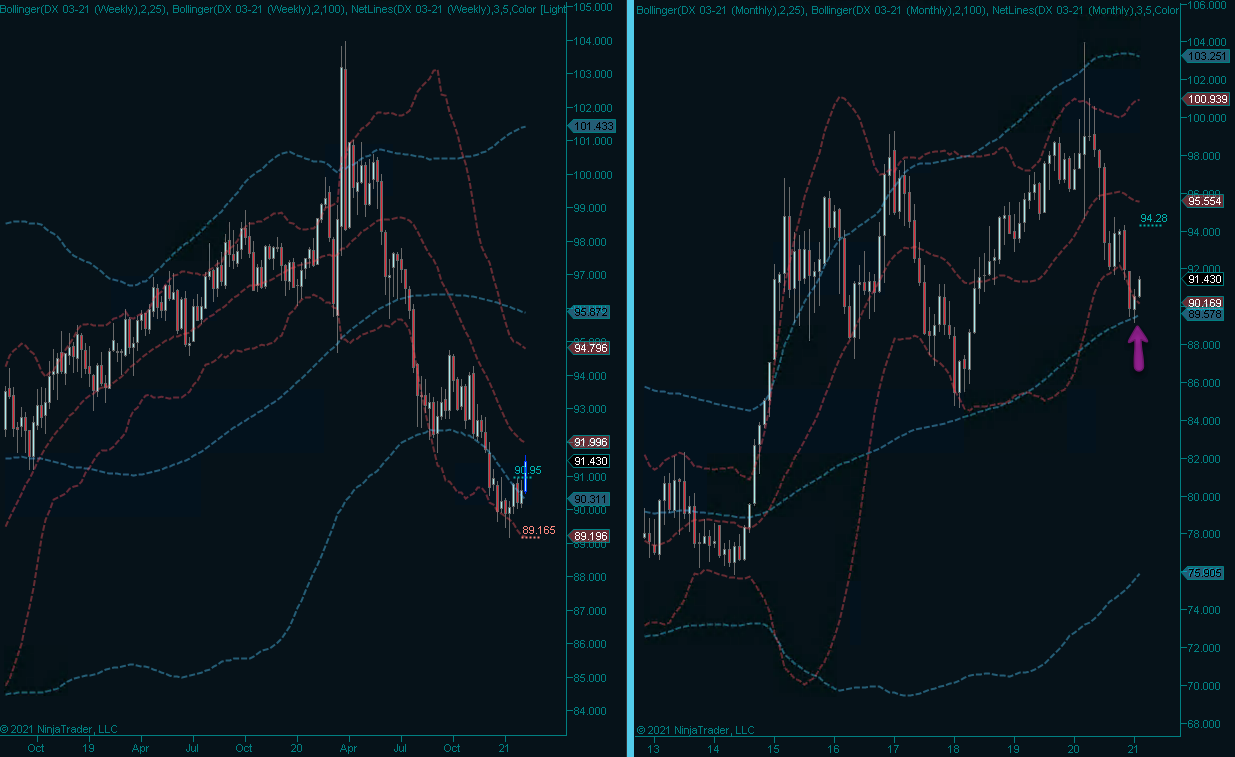

I’ve zoomed all the way out into the weekly and monthly panels to give you all a wider perspective. As you can see the Dollar slapdown over the past year has been brutal and relentless. I have been eying that 100-month SMA with much trepidation and was quite elated when it actually started to provide a bit of support.

We’re far from being out of the woods but this is a good start. What you need to understand about trading currencies is that they move like oil tankers not like speedboats. Meaning that once they get going in a particular direction it’s difficult to turn them around.

But once it happens it can trigger the most gorgeous squeezes (short or long) you can imagine.

Of course a strengthening Dollar suggests that market participants may be getting a wee bit concerned about their own irrational exuberance. The TNX (the 10-year t-note yields) has also been going strong and is currently painting a sideways correction.

Which in itself is a pretty bullish signal after the preceding ramp. If those weekly SMAs (left panel) catch up over the coming month or two and we see a bounce from there then the sky’s the limit!

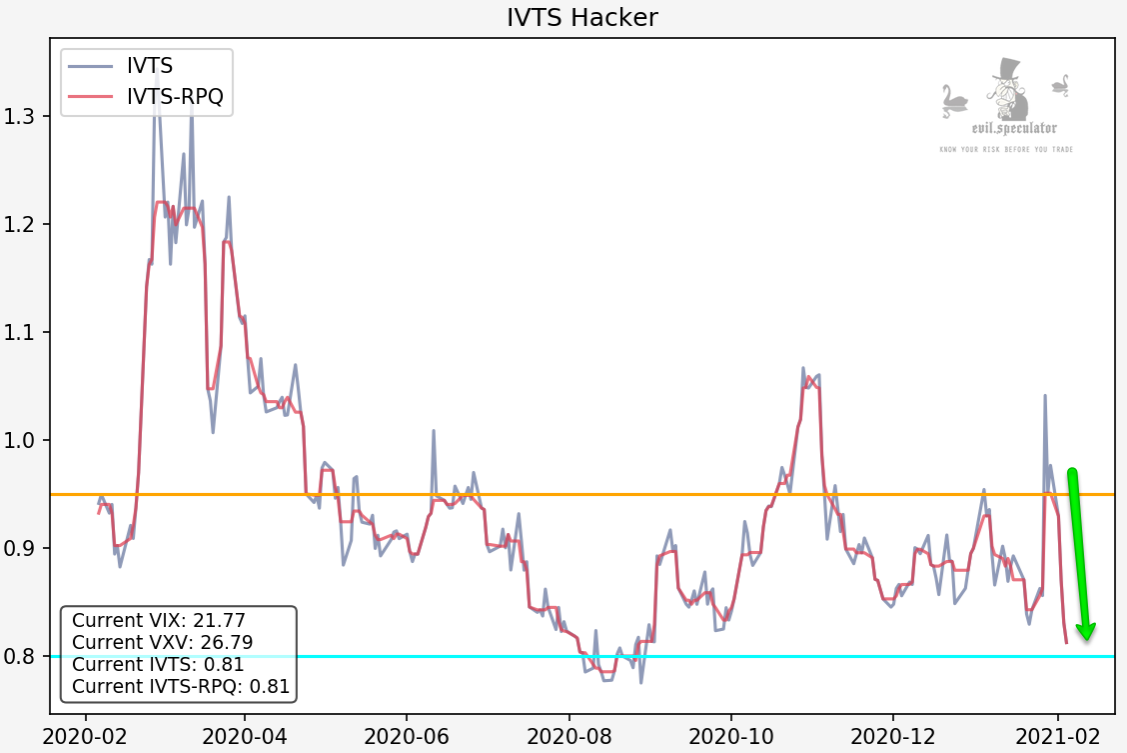

Now I already hinted that a few things aren’t lining up here and the VIX is by far the biggest offender. Meaning it’s not only dropping, it’s falling like an anvil Loony Tunes style.

But Mole, that’s pretty normal to see the VIX drop when the market pushes higher, duh!!

Yup – true that. And you would be right if it was just a 5% or 10% drop or so. But a 42% reduction is outright ridiculous given the amount of upside we’ve seen.

And it’s not just the VIX – the 3-month VIX3M (formerly VXV and that’s what I still call it damn it) has been dropping as well. But not as hard as the VIX and ergo the IVTS has been falling to a reading I have not seen since last summer.

Which of course is reflected in the implied volatility on the SPX and the SPY. And that my dear ladies and leeches, brings me to the good stuff – so perk up and pay attention:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.