Throughout my trading career I’ve never been much of a perma-bear, mainly because I have a basic understanding of math and statistical probability in particular. In case you are unaware of a few simple realities of life allow me to share a few salient data points for your general edification: In essence throughout your average trading career only about 11% of your time is spent in downside corrections, the rest is either sideways or advancing tape.

So if your trading approach revolves around the specter of a full fledged market crash then we are basically talking a fraction of a percentage point given all the trading days in which you’ll ever participate. Good luck with that.

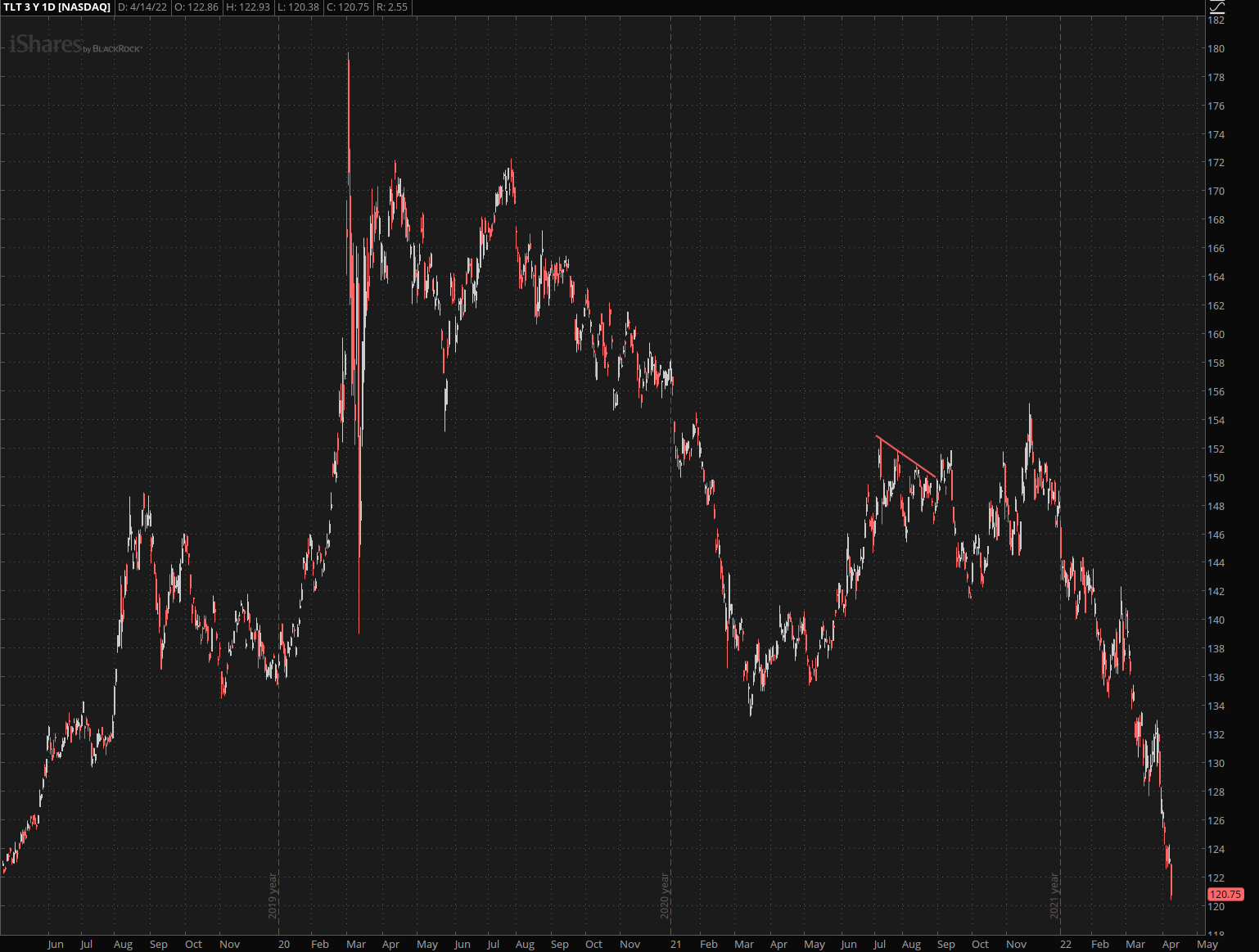

So with that in mind I must profess that even I am wondering at this point what exactly is holding up equities. It’s not the credit market for sure which effectively is in a bonafide crash situation with no bottom in sight. Remember, in open space nobody can hear you scream.

If you’re not an options trader then it’s probably difficult to appreciate the fact that implied volatility in the TLT at this point is exceeding that in the SPY or SPX. To dumb it down for you mere mortals: That is by no means what we ought to be seeing and it paints a pretty dismal future for anyone in the general blast radius of the fuse that may be ignited in equities in the near future.

While retail is usually focused on the 30-year and its yields institutional traders are more fond of following the 10-year. It’s currently making a b-line for the 3% mark and at some point something’s gotta give here. This is probably THE most massive increase in yields across the board we’ve ever witnessed.

But don’t take my word for it – simply put up a max chart of the TNX or FVX – if you squint your eyes a little you may actually see the giant middle finger the bond market is currently showing to the Fed.

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.