It’s been a busy time in the trading lair for (good) reasons I plan to share in the very near future. Of course the market waits for no man (or woman) and given that market sentiment has swung decisively fatalistic it’s time to look for early signs of a bounce.

I posted this snapshot of the Zero indicator two days ago (on the 24th) and at least as of this writing we are seeing clear signs of an attempt to foment a floor and as a result trigger a good old fashioned BTFD shindig.

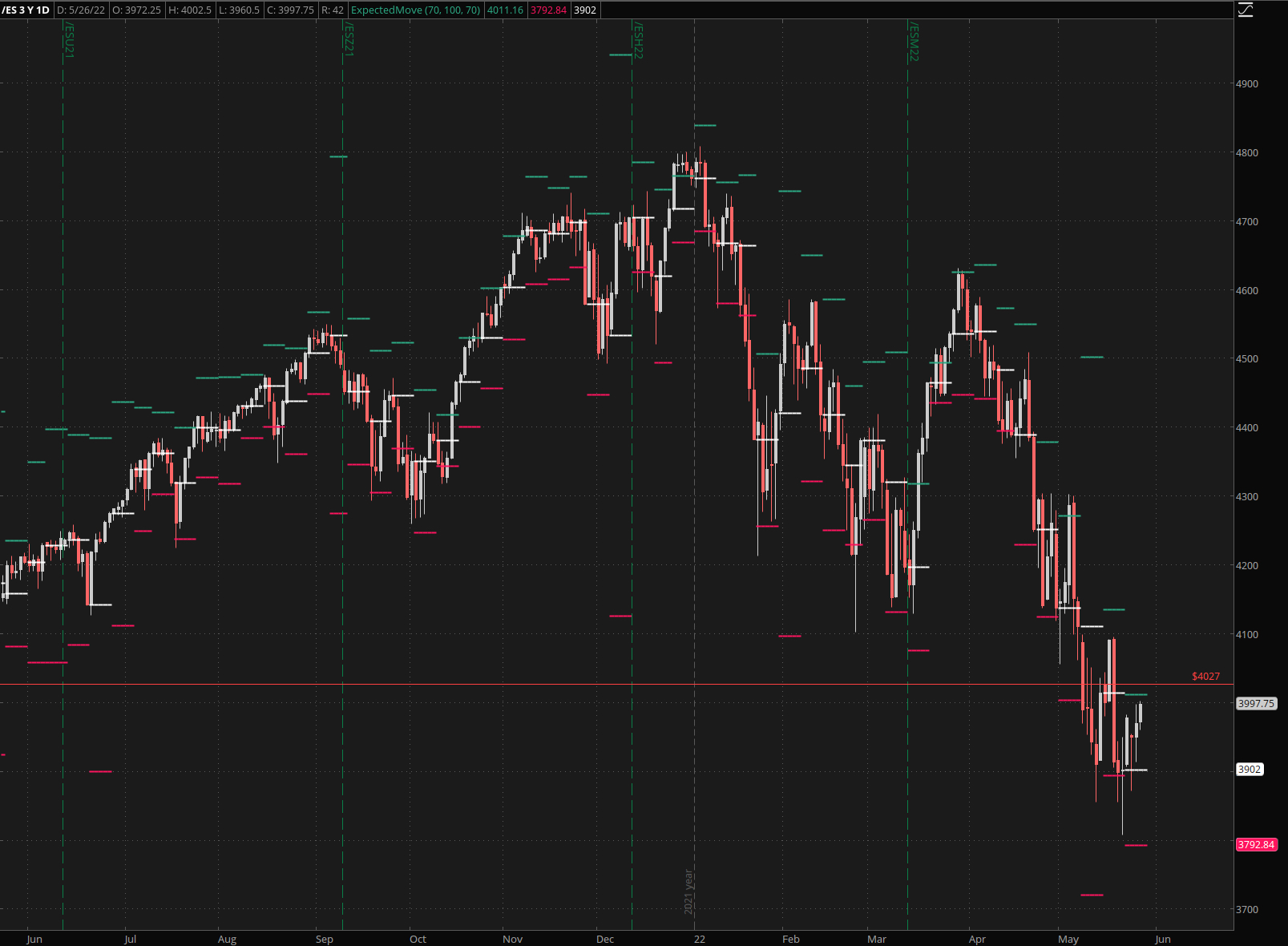

On the ES futures price is heading higher this morning and is now but a bagel throw away from the upper range of this week’s expected move threshold, which also happens to be very close to the coveted 4k mark. A recapture would most likely lift animal spirits across the board and invite a revisit of the 4100 cluster where much resistance awaits.

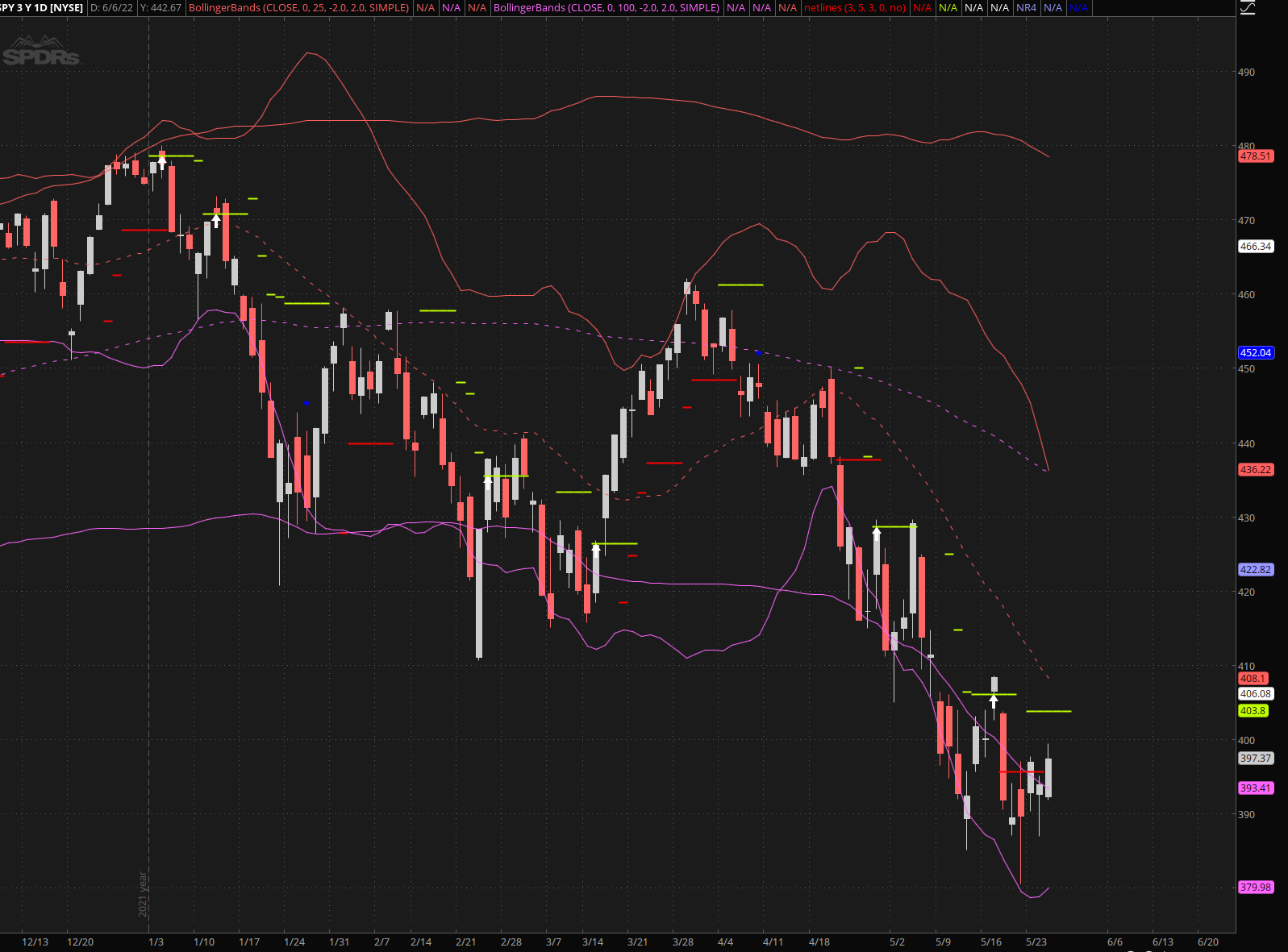

The Spiders show us a NLBL around 404 – a breach here would also heave us over the 50 SMA plus it gets us on the road to finally breaking a long series of lower highs and lower lows. No voodoo magic or complicated indicators here – just tried and true price action which is all we really need at this stage.

Once again it’s early days and there is no excessive need for a bounce right here and now as the LT panel above shows us. In fact a reversal near SPX 3800 would have made more sense, which perhaps is why we may see one right now.

Always remember, the market is a cruel mistress and given the collective drop in IQ points all across the Western hemisphere she’s in a very foul mood and all too happy to take a few of us back to the woodshed. So watch your six and keep your head down.