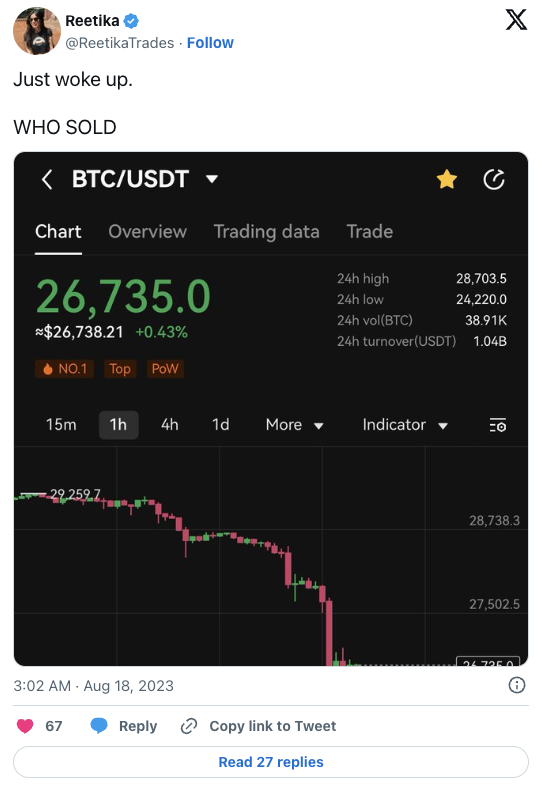

To quote one of my favorite movies: “I love the smell of napalm in the morning.” Most of you living stateside probably woke up to the charred remains of what was generally expected to be a crypto market on the verge of breaking out higher.

Despite clear warning signs over the past few days (i.e. price sliding lower and no buying interest) the sudden wipeout clearly caught a lot of people by surprise.

Of course this was to be expected, in fact over the past few weeks I had pointed to a possible revisit of the 27k mark on several occasions.

Did I expect a drop all the way down to $25k?

Not really, but anything can happen in low participation summer lull tape.

Anyway, before we dissect the situation, let’s address the big elephant in the room:

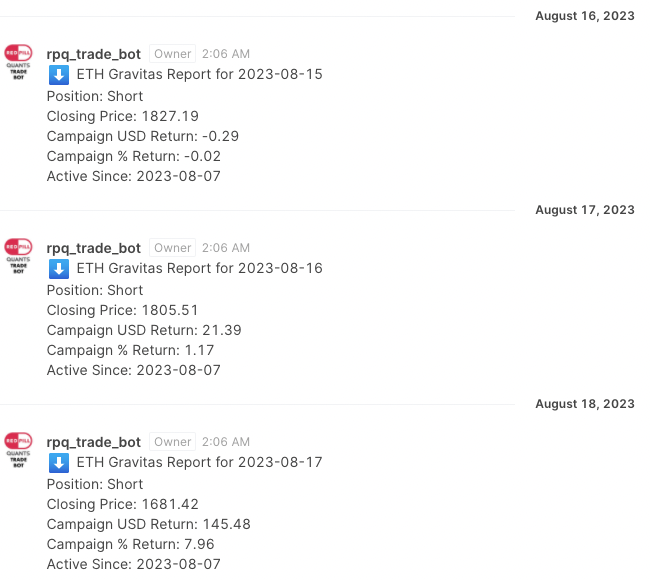

Yes, Gravitas did get caught up in the shuffle BUT came out the other end break/even:

BTC flipped positions at midnight – down 6.5%

ETH had already been short for a week plus and ended up at 7.96% in the plus.

So a tiny bit on the plus side between the two. I take it.

Given that we were looking at a flash crash based on a major price dislocation that’s the best anyone can hope for when it comes to LT trend trading systems.

Now, what happened?

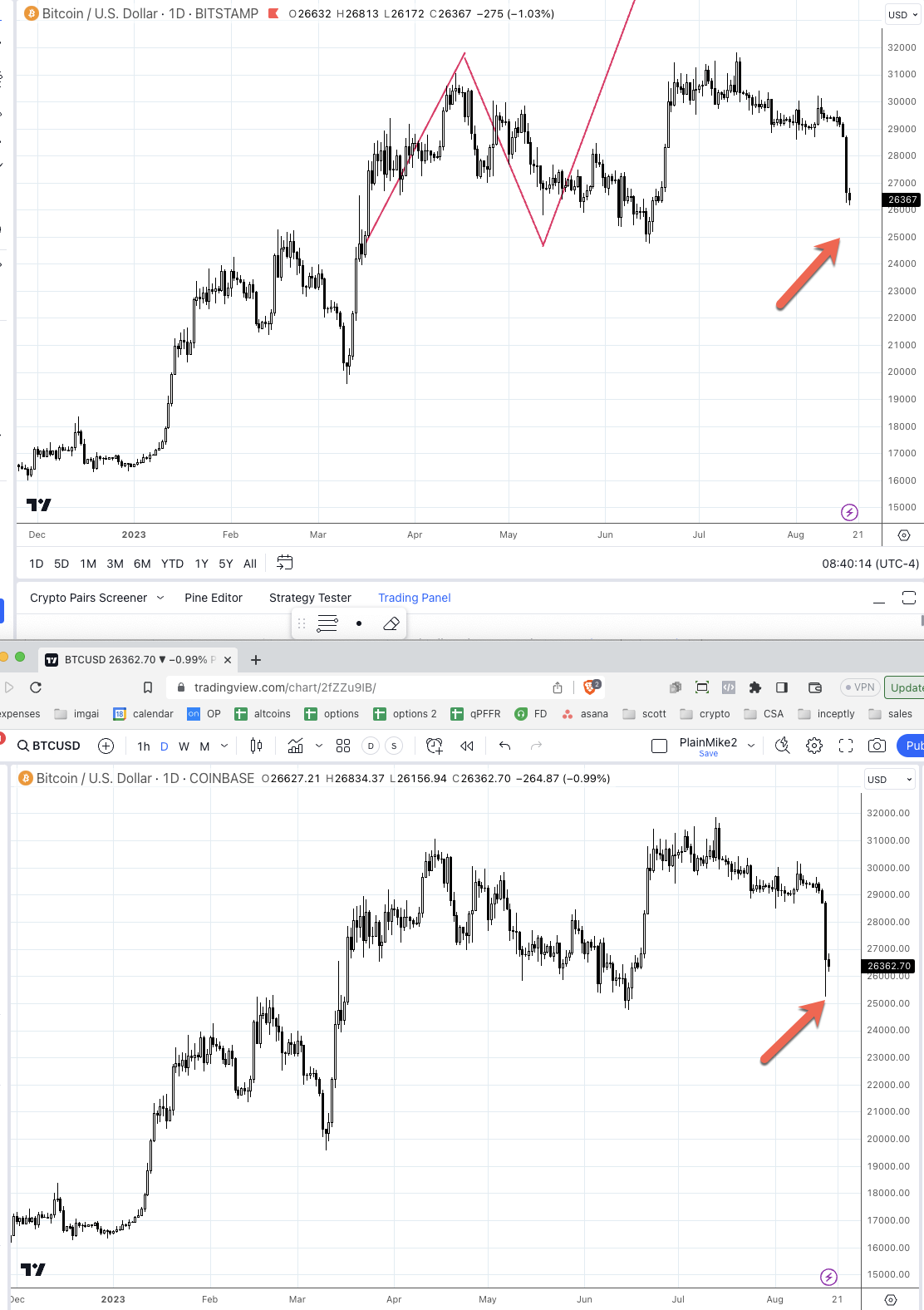

Nobody really knows but it seems like forced liquidation in BTC temporarily overwhelmed available liquidity and dragged the entire crypto market down into LT support.

The lines I drew are intentionally thick – my old trading mentor always insisted that support and resistance clusters should be drawn with a crayon instead of a pen.

Clearly he was aware of my artistic talents, but that’s a different story.

Based on what I’m seeing on both charts there was almost instant rejection near the $25k when massive algo selling adrenaline boosted BTC back to > $26k.

In fact, when you compare the Coinbase chart with the Bitstamp chart you’ll see that the latter never even descended down to $25k and change.

That’s how quickly the reversal happened, several exchanges didn’t even catch up.

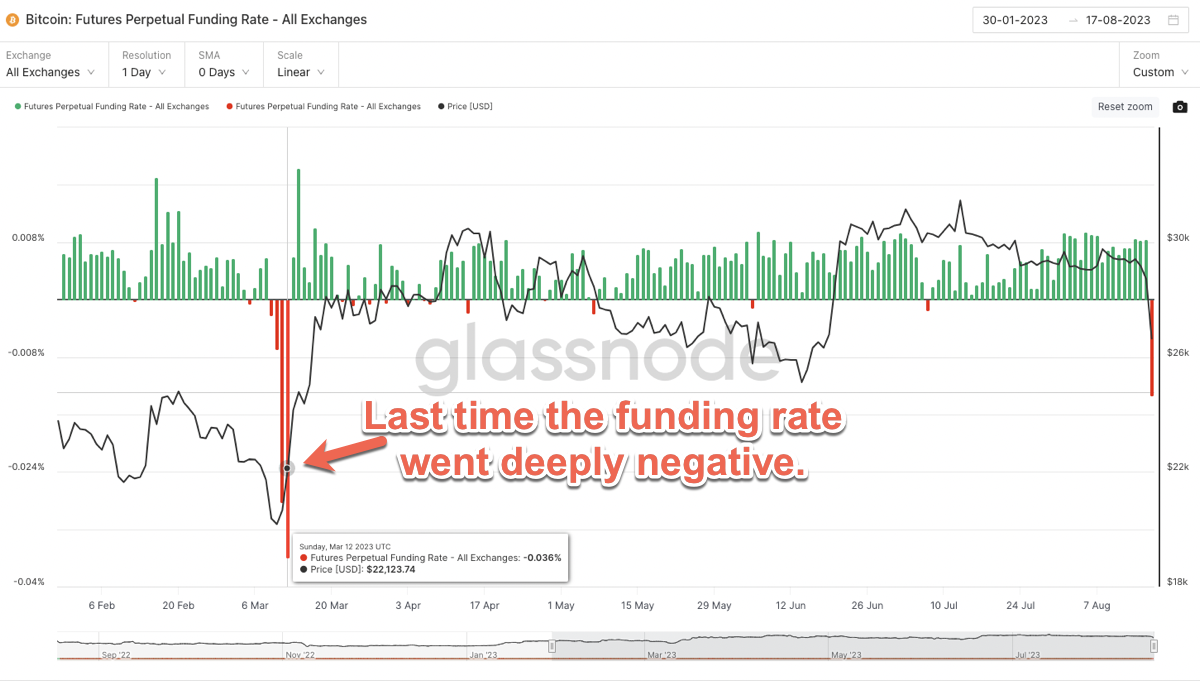

Now this is interesting. The funding rate you see above is set by exchanges for the perpetual BTC futures contracts.

When the rate is positive, long positions pay short positions. Conversely, when the rate is negative, short positions pay long positions.

Basically it’s a way to prevent the cash and the futures price from diverging too much.

The last time we saw the funding rate drop into extremely negative territory was in mid March. The entire affair only lasted a few days but the initial slide was followed up by more selling the next day.

In this case we are seeing a much more defined rejection (at least on Coinbase) so it’s possible that we’ve already seen the worst of this slide.

However as always it all depends on the follow up: The next 24 hours really matter and if we are still trading > $26k by Monday we should be out of woodwork, otherwise more pain may be on the horizon.

So much drama!

Which is exactly why I built a long term trend trading signal that is impervious to minor market cycles and continues to keep me on the right side of the tape.

Remember, the whole idea behind trading the greater trend isn’t to pick tops or bottoms. It’s about remaining on the right side of the tape when it matters the most.

And that’s what Gravitas is really good at. Plus it’s a long term signal, at the very most you take action once per month on average. Perfect for the busy operator.

Besides, the results speak for themselves, so if you’re interested shoot us a message today and we’ll get you set up just in time before the next leg higher.

Happy trading.