With the much touted January 10th due date looming investment firms, exchanges, and the SEC have been scrambling to put their final touches on several spot bitcoin ETF filings.

Multiple issuers said Friday they expect to receive official approval of S-1 filings by late Tuesday or Wednesday.

No matter what your take on the matter, we can all agree that an SEC approval would mark the culmination of a multi-year struggle to launch exchange traded funds (ETFs) backed by Bitcoin in the United States.

And long long overdue, if you ask me.

So why should you care?

Well in fact we all should, mainly because access to multiple Bitcoin ETFs will allow billions and billions to flow into the market via new financial routes.

Which means more capitalization and a broader, less volatile, marketplace.

The real benefit of these ETFs however is going to be a standardized fee structure, which will benefit anyone trading Bitcoin multiple times per year.

Crypto brokerages will now be forced to significantly up their game as charging fees in percent of the underlying are an insane rip off.

Take Coinbase for example, which is charging upwards of 0.3% per trade – straight up highway robbery in my book. That’s $135 of fees just to buy one BTC on Coinbase right now!

Very soon it’ll be likely to be very cheap, if not free, to buy ETFs for anyone.

Canadians for example already have access to BTC and ETH ETFs, and thus are able to hold them in their registered retirement account, contributions which are exempt from income tax.

If nothing else Bitcoin ETFs will allow everyone with a trading account to participate in the next crypto bull cycle.

Let’s not forget that the next BTC halving is expected to occur in April, and what usually follows is a secular bull market that produces significant gains.

Let me go on a limb here and assume that you probably want to grab a piece of that action, if you can. I for one plan on riding the next FOMO rally all the way to the top.

Alright, so let’s take a quick peek at what’s going on in the market:

As was to be expected Bitcoin has been circling in a waiting loop since about early December.

The bullish inflection point is around $45k and once that gives way it’s off to the races.

Ethereum has been a bit more lackluster and also got it harder in last week’s pullback.

Compared with Bitcoin it still seems to have issues getting out of the gate.

The entire crypto market combined is looking solid, but clearly it’s still early days after two years of burning in purgatory.

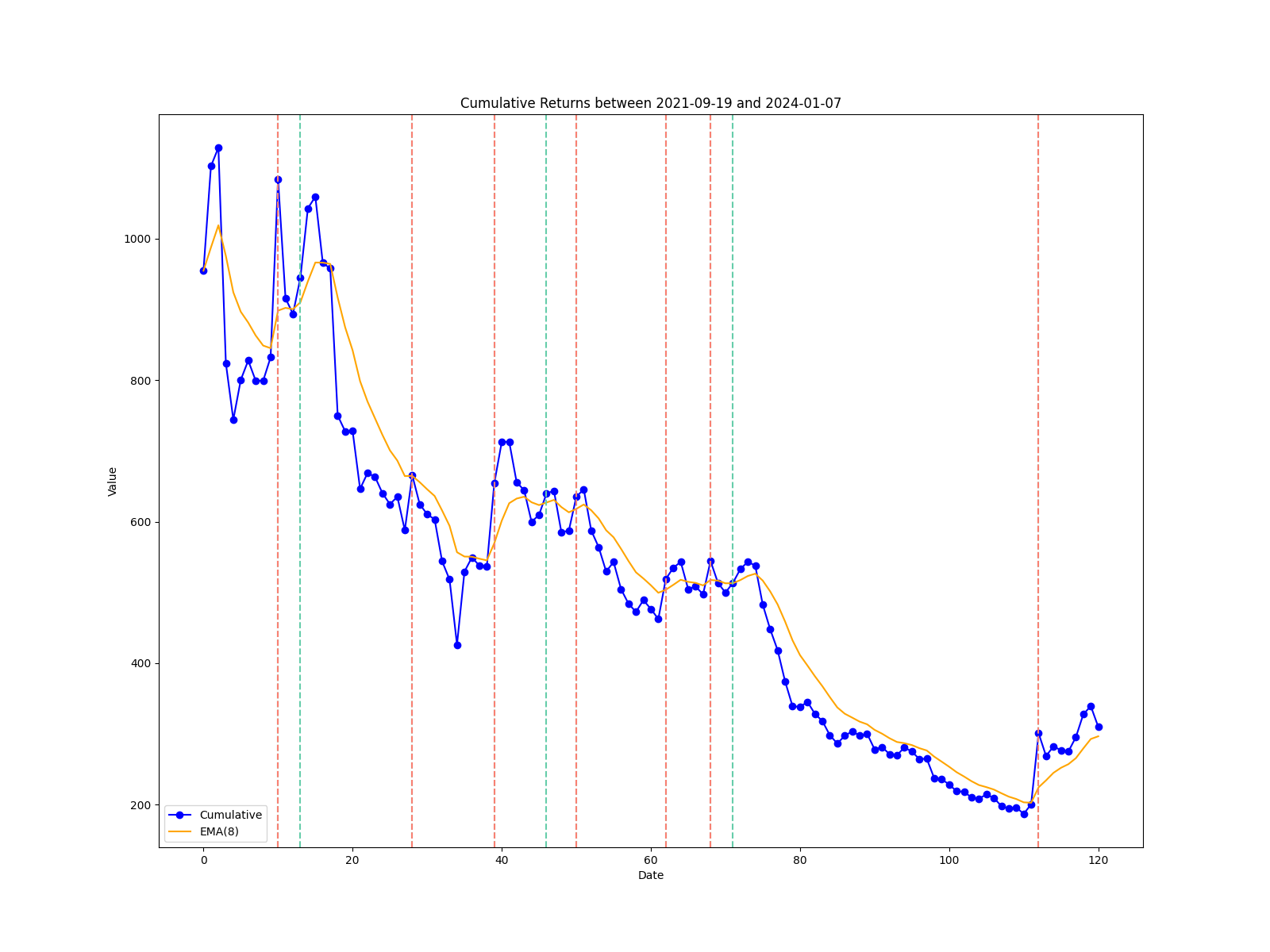

The graph above shows the returns of my altcoin scanner. The way it works is that it runs through the entire Kraken universe and then pulls out the top 5 altcoin candidates for any particular week.

The weekly returns of those 5 coins then are measured and plotted as above. It’s a rather simple approach that has been widely used among top performing trend traders.

Why resort to complicated indicators or exotic correlations when the actual performance of a market or a system tells you everything you need to know?

As you can see altcoins in general have been in the doghouse for nearly two years and are just now coming out of the gate.

So on paper we are in altcoin season (unless last week’s pullback extends lower) but I am withholding judgment until I see more upside progress here.

It’s still early days and one swallow does not summer make 😉