I’m not one to commit myself to outlandish New Year’s resolutions as I’m more of a proponent of gradual but constant improvement throughout one’s life.

Looking back at 2023 I can see personal progress on several fronts, most importantly getting back in tip top shape with less than 8% body fat and even my sixpack showing again (it’s been a while).

Not an easy feat at my ‘advanced age’, that’s for sure :-))

On the business front I do however have one big resolution, in that I plan on being a lot more prolific in 2024, aided by a less cumbersome format which I recently implemented into Evil Speculator (my old financial blog).

Key to doing that was to finally get rid of those bloody featured images which frankly made it difficult to be quick and spontaneous.

Today’s market update is a great example of just that (see below). I really don’t want to have to spend an hour having to come up with some witty theme and then producing some visuals for it.

A new simple blog format was already present on Red Pill Quants, but since I am always cross posting over on ES those featured images continued to post a challenge.

Fortunately no longer, as I finally managed to change the site theme to using auto-generated images. I could probably have used stable diffusion for that. But hey why bother, right?

Anyway, without further ado, let’s get to the markets:

The current advance in the SPX that launched mid summer has frustrated a lot of the perma-bears, given that most of them were seduced by the constant flow of terrible news.

The final death knell to any meaningful correction however was served by the Fed’s sudden change in direction, hinting again at new easing and lower interest rates for the year to come.

An announcement that I expect to be revised again in the near term future as nothing Powell and friends said over the past few years had any bearing to what really transpired further down the line.

Expect them to remain consistent on that front.

But price is price and Miss Market shan’t be denied. In other words – always trade the market in front of you and not the one that you would like to have.

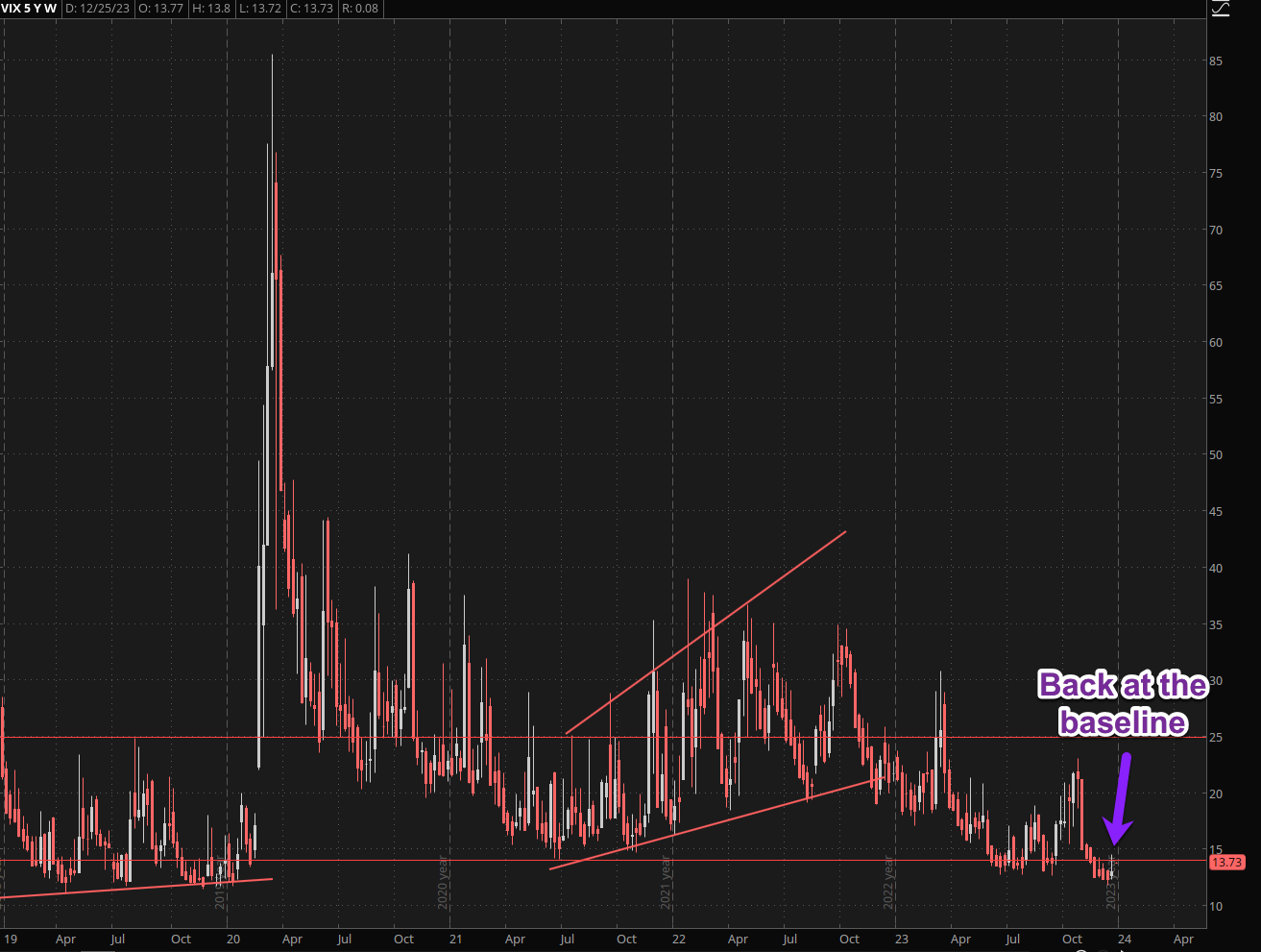

The VIX has descended to our current baseline just above the 13 mark and I expect it to spend a bit of time there throughout January until it’s time to shake out some of the pigs.

So what’s driving the current advance?

Finance has been recovering but it’s clearly lagging the overall market, at least thus far.

Lower interest rates used to throttle this sector but in this upside down world the prospect of more money printing and book cooking assures that many of the currently held shadow assets aren’t forced to go belly up.

Which incidentally is what we increasingly see happen over in Germany, but that’s a topic for another day.

Well the mystery is quickly solved when looking at the NDX which is clearly leading the current advance and is already tickling its ATHs.

Light trading volume in combination with such a juicy inflection point should be good for some fireworks.

But remember, nothing ever moves in a straight line, so if you are holding long positions here get ready to take at least partial profits once we see the final short squeeze higher.