The market recovery over the past two months has been nothing short of miraculous. I’ve looked at a lot of historical wipe outs in my time and none of them even come close in regards to recovering lost territory and more importantly when it comes to the normalization of implied volatility.

The reason why IV is so important is because it is based on forward expectation and not on historical context. Of course what lies behind affects the future. You’ll probably never ever see the VIX spike to 50 – stay there for a month and then drop to 15 the week after.

What you usually get during massive sell offs is a massive spike > 50 followed a pullback as profit taking by sellers produces at least an intermediate floor. It’s quite typical however to see a few more fear spikes that follow in the weeks and months to come.

What you don’t ever see – especially in the context of a worldwide epidemic that promises to affect international trade and travel for months and perhaps years to come – is a uni-directional reduction in fear and thus a normalization in forward expectation.

But that’s exactly what the VIX is currently signaling us – and I have to be honest in that it’s not something I would have ever expected. And it’s a bit of a shame as trading inflated IV over the past earnings season has been fun and profitable.

Now if you compare the SPX with the VIX then you may pick up on the fact that it’s a lot less bullish as we’re still stuck near the 60% mark. Not a bad situation at all and there isn’t much preventing it from pushing even higher, especially if/once the 3k mark has been cleared.

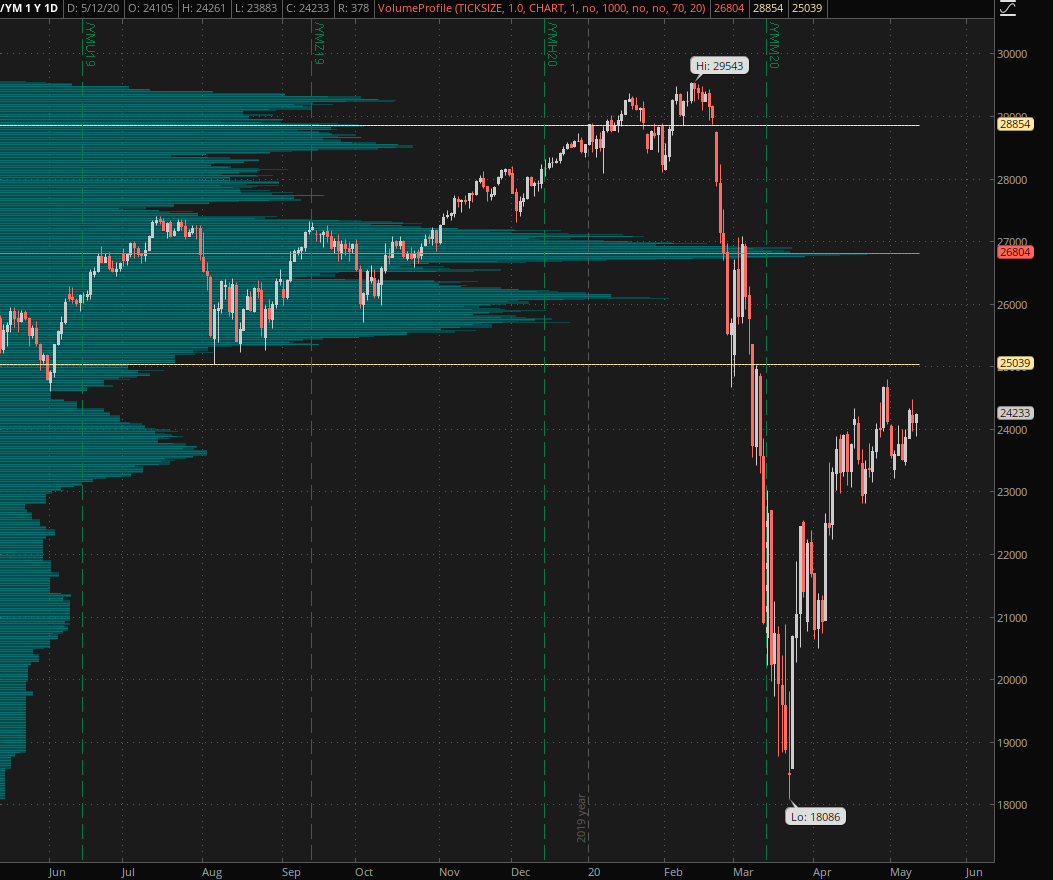

What however irks me a lot more are the divergences I see across equities. The Dow barely made it to the 50% mark and is clearly lagging behind the SPX.

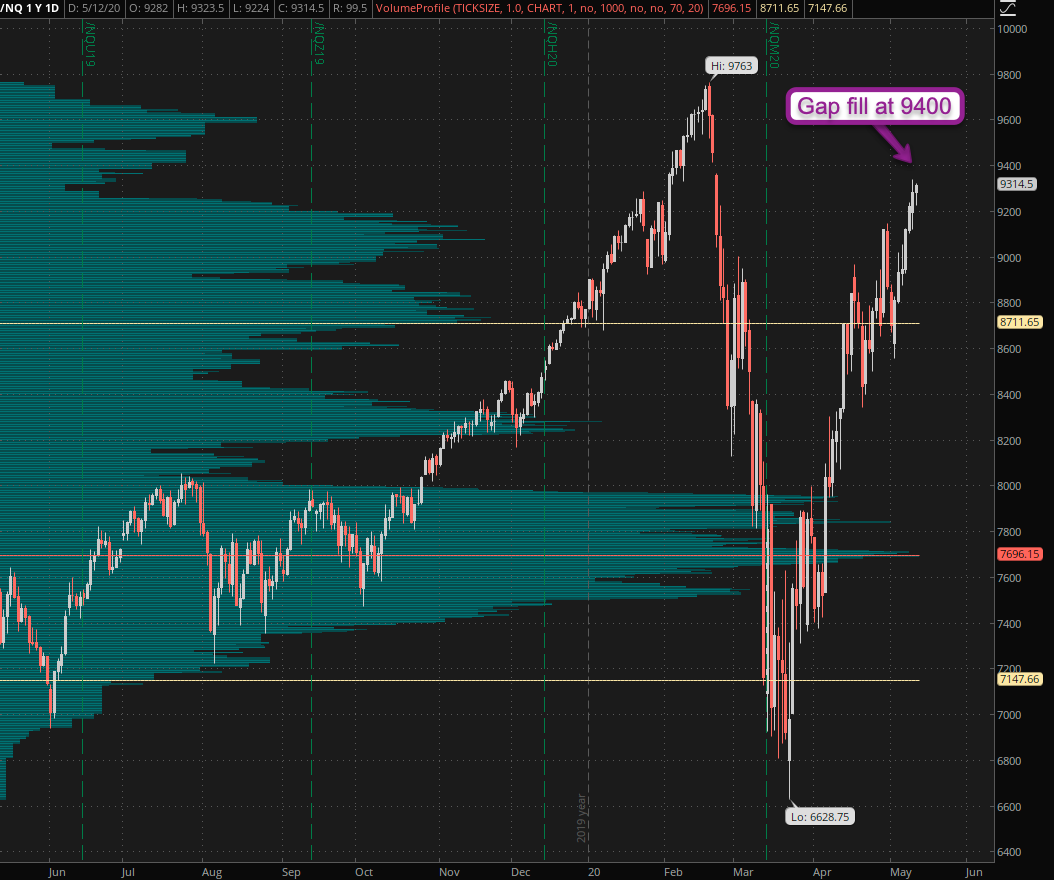

Meanwhile the NQ futures continue to rip higher and it’s the only index that seems to be in sync with the VIX. So one may wonder if tech perhaps is turning into an overly crowded trade?

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.