If nothing else J-Pow’s dovish cave yesterday has once and for all proven my point that trading on market direction has become a complete sucker play. We now live in a time when the slightest hint at slowing the pace of interest rate hikes is seen as an excuse to kick the market back into turbo mode and keep the Ponzi going for just a little longer.

Most interestingly at least 5% of all SPX call volume was produced by 0DTE (zero days till expiration) positions, with 40% comprising SPY calls.

If you’re not an option trader you’re forgiven for missing the deeper meaning here.

To buy a call option the day of its expiration is basically considered the Hail Mary of all trading strategies.

An option contract purchased on the day before expiration basically acts like a mini futures contract, which means it can be extremely profitable if there’s a significant jump in price.

The added advantage is that – unlike with real futures contracts – the downside is limited to the debit paid. Also no stop loss is necessary, either the option expires worthless or it makes you money. Simple.

However almost nobody trades this way as guessing direction on a particular day is difficult, but double so on Fed days. Large moves are required to make it worth your while.

Unless of course someone has inside knowledge. But that is considered insider trading, which would illegal, right?

But I’m sure everything here is completely above board 😉

You may have noticed that both the SPY and the QQQ jumped from the lower threshold of their respective weekly expected move (EM) to just below the upper threshold.

What happens here is extremely important as gamma risk is now starting to kick in.

It is here where institutional traders and liquidity providers are forced to start buying the market in order to hedge themselves against major losses by option contracts sold outside of that range.

In simple terms, those weekly thresholds can be seen as acceleration or inflection points, a breach above usually creates a more violent move higher and the inverse on the downside.

Take away: If we breach above SPY 411 and QQQ 293.5 it’s rocket man time.

XLF (financials) is in the process of breaking out above overhead resistance.

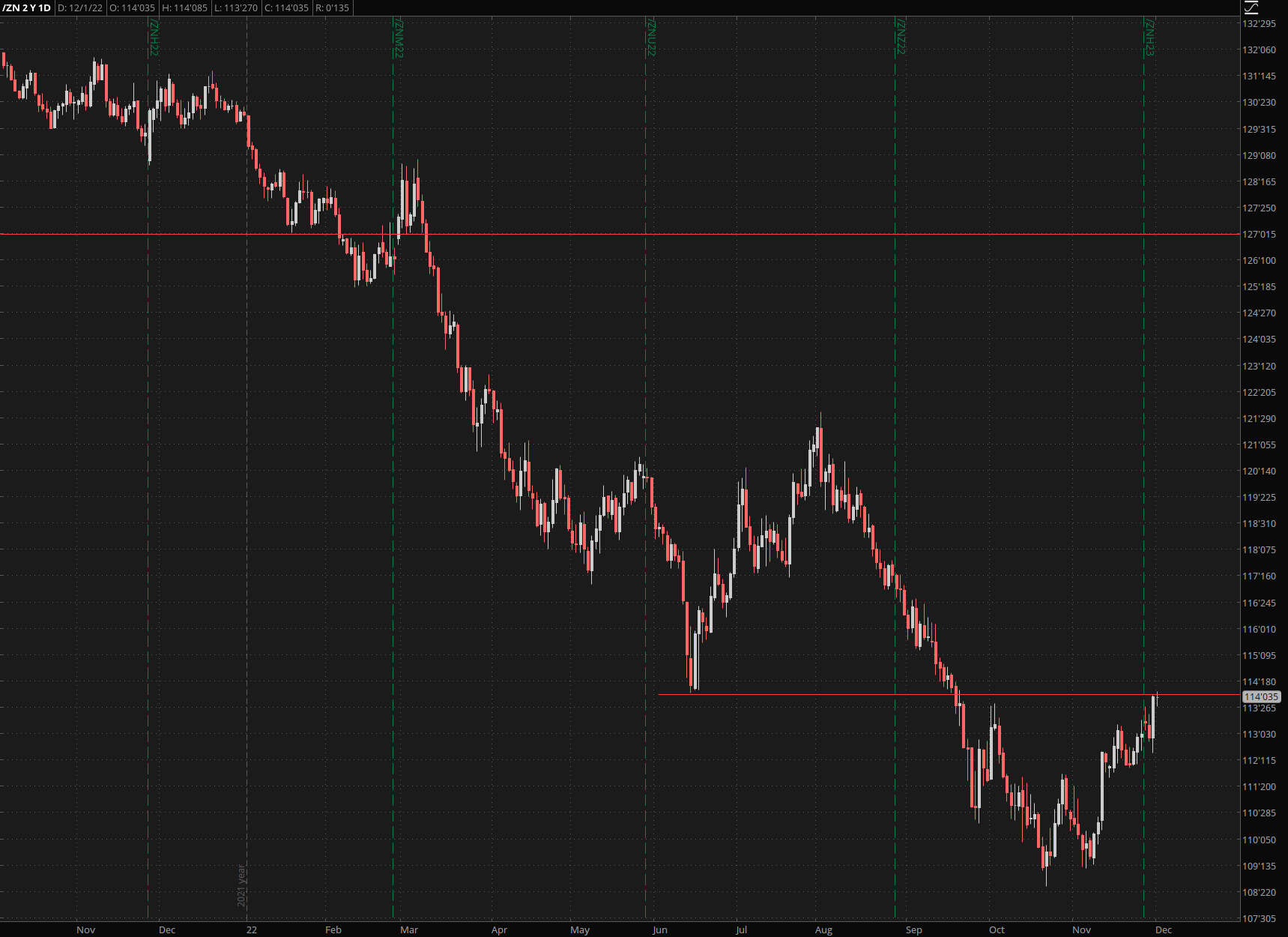

No surprise there as the ZN also appears to be on the brink of punching through an important inflection point which may result into a short squeeze.

Speaking of trigger points – gold doesn’t want to be left behind and if we see it breach > GC 1820 the gold bugs will eat stuffed turkey for dinner.

Unless there’s another bird flu panic – we seem to be getting a lot of those recently.

The only chart that doesn’t seem to lag behind is of course – drumrolls – bitcorn, which experienced a little wiggle higher but nothing to write home about.

I kept the best for last: The Dollar seems to have completely reversed course and is literally crashing to the downside. Yet another chart sitting on an important inflection point as a drop < DXY 105 will most likely drop us back to 102 or even lower.

The implications of this are serious and a lot more long lived than the brief spurt of euphoria everyone enjoyed yesterday.

Effectively the Fed has now lost whatever may have remained of its credibility. Case in point: J-Pow’s attempts today to slap an over-exuberant market with a bit of hawkish talk was completely ignored.

In other words – the market is now cherry picking whatever the Fed spouts do bang the tape where it hurts the most participants. Which in yesterday’s case were the shorts who had to be carried out on a stretcher.

So what does all this mean for you?

First up, if you still insist on trading on market direction, you’re doing it wrong, son.

Unless you’re a pro trading market direction during bear markets is like playing Russian Roulette – it’s just a matter of time until your trading account is being invaded.

Second learn how to leverage volatility to your advantage. The best way to do this is to trade options – and to do it right.

Third learn how to leverage time – as big market swings significantly increase the ‘probability of touching’ a particular price point. If you have not watched my butterfly class then you’re missing out big.

As a Red Pill Quants Unlimited member you will not only get access to an entire library of educational content. Of which there’s a TON…

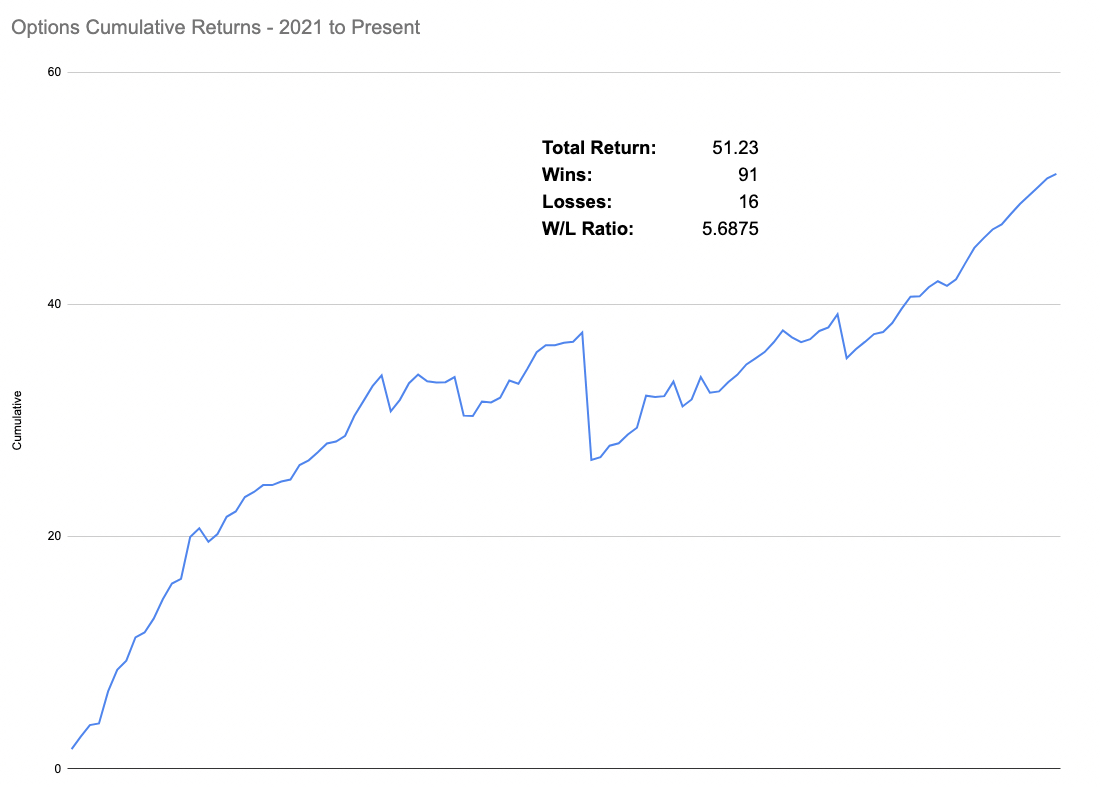

But what most of you really want is to learn by DOING while you bank coin. And nothing beats our signal service which has literally been printing money over the past year.

RPQ Unlimited usually runs you a pittance of $149 per month but we just launched our EOY special offer with two choices:

1) $599 for a six month membership (a 33% discount)

2) $997 for a 12 month membership (a 45% discount!)

I know – I must have completely lost my mind, so I recommend you grab your seat before I regain my sanity (sort of).

If you prefer to a month to month subscription you can join us here.