You know what’s going to be the king of kings in the New Economy? Energy. Dirty coal, clean nuclear, classic crude, natgas…

And you know what’s about to hit the junk heap of failed government sponsored experiments?

‘Sustainable energy’. Just ask your average German but make sure to bring a thick coat and a pack of tissues.

The coming winter (and the next one in particular) will prove without a shadow of doubt that no matter how much virtue signaling to the contrary Western society won’t stop burning oil or using electricity.

It was the number one industry back in Rockerfeller’s day and it will still be number one next year. And ten years from now. Deal with it.

Play stupid games – win stupid prices. And a decade or two of short sighted energy policies have a nasty habit of changing the status quo.

Which means we are heading into a new era that nobody under the age of 60 has traded through.

Yup even old crusty dinosaurs like me.

That’s XLE telling you to take your bloody Tesla and shove it where the sun don’t shine. Pun intended because solar is on the out as well.

Meanwhile traditional energy resources has been in a bull market since COVID wiped out any vestiges of normal life.

Given the histerical headlines I see on a daily basis I expect this trend to continue.

Still looking for the next bull market in tech stocks? You’re doing it wrong son – ENERGY is where it’s at.

Which is why nobody else is telling you about it. Pay no attention to that man behind the curtain, right?

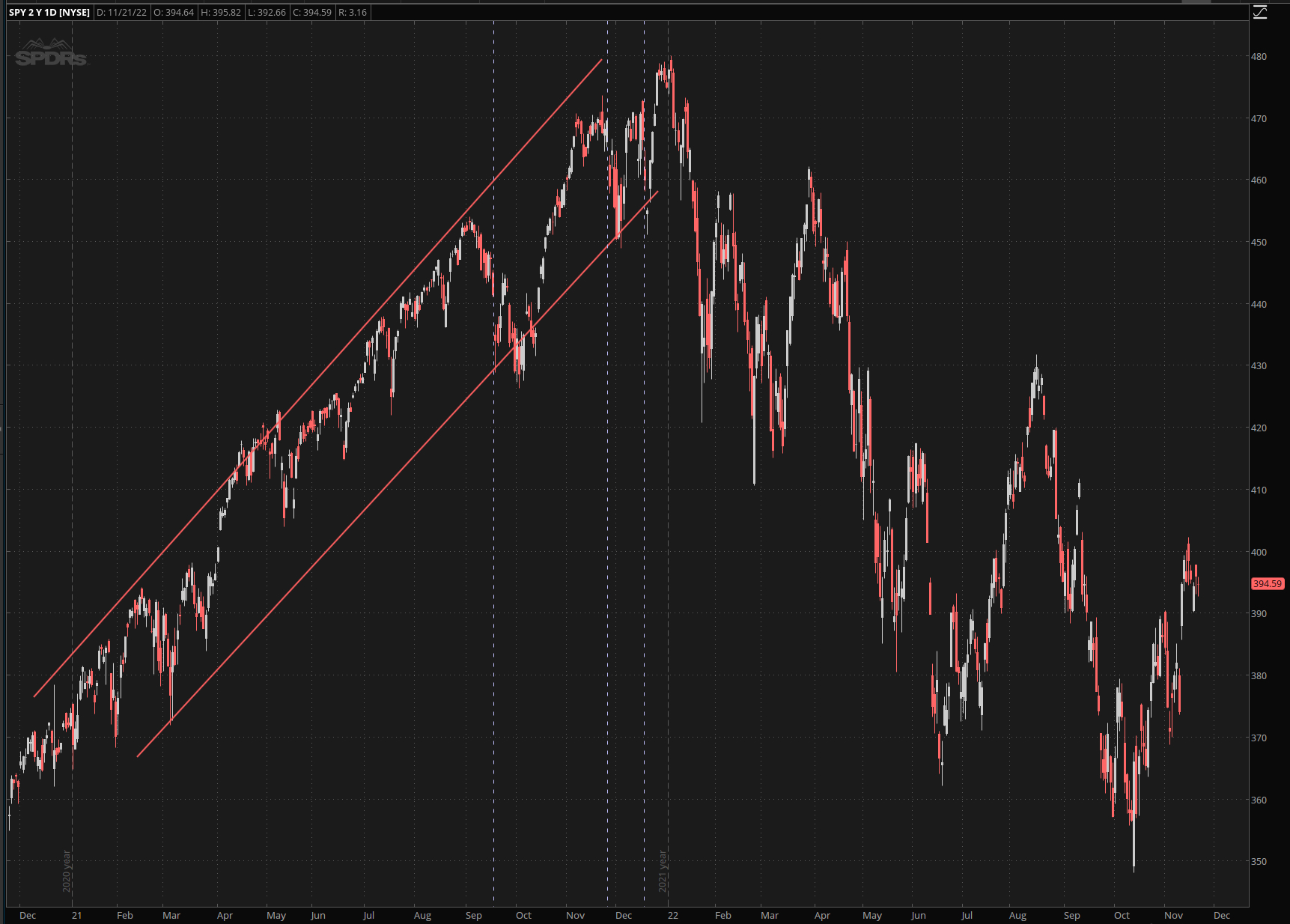

Compare that with the stock market over the past year. Yuk – not fun unless you’re a pro.

So unless you’re playing the swings (or are selling premium like yours truly) you’re wasting your time.

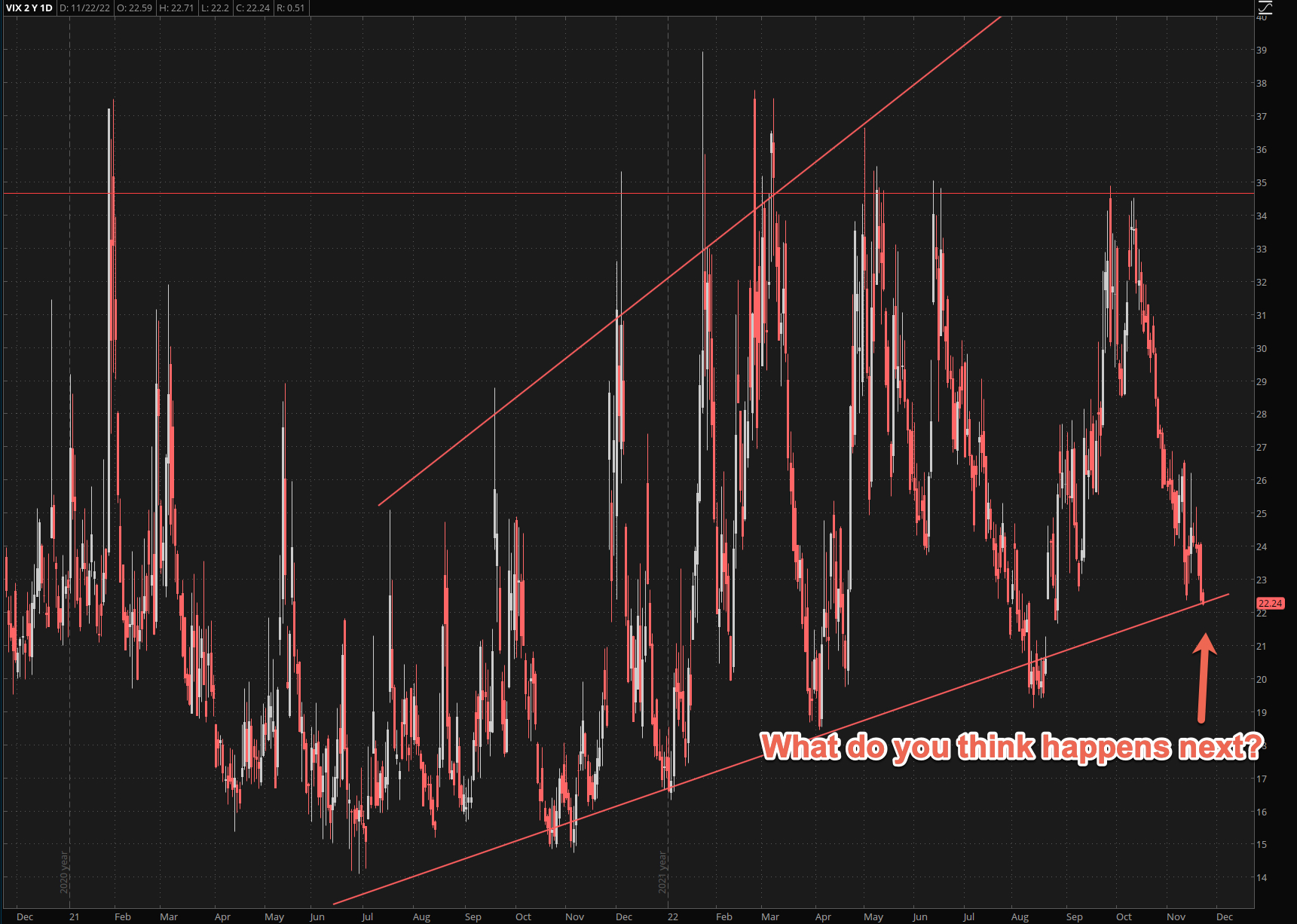

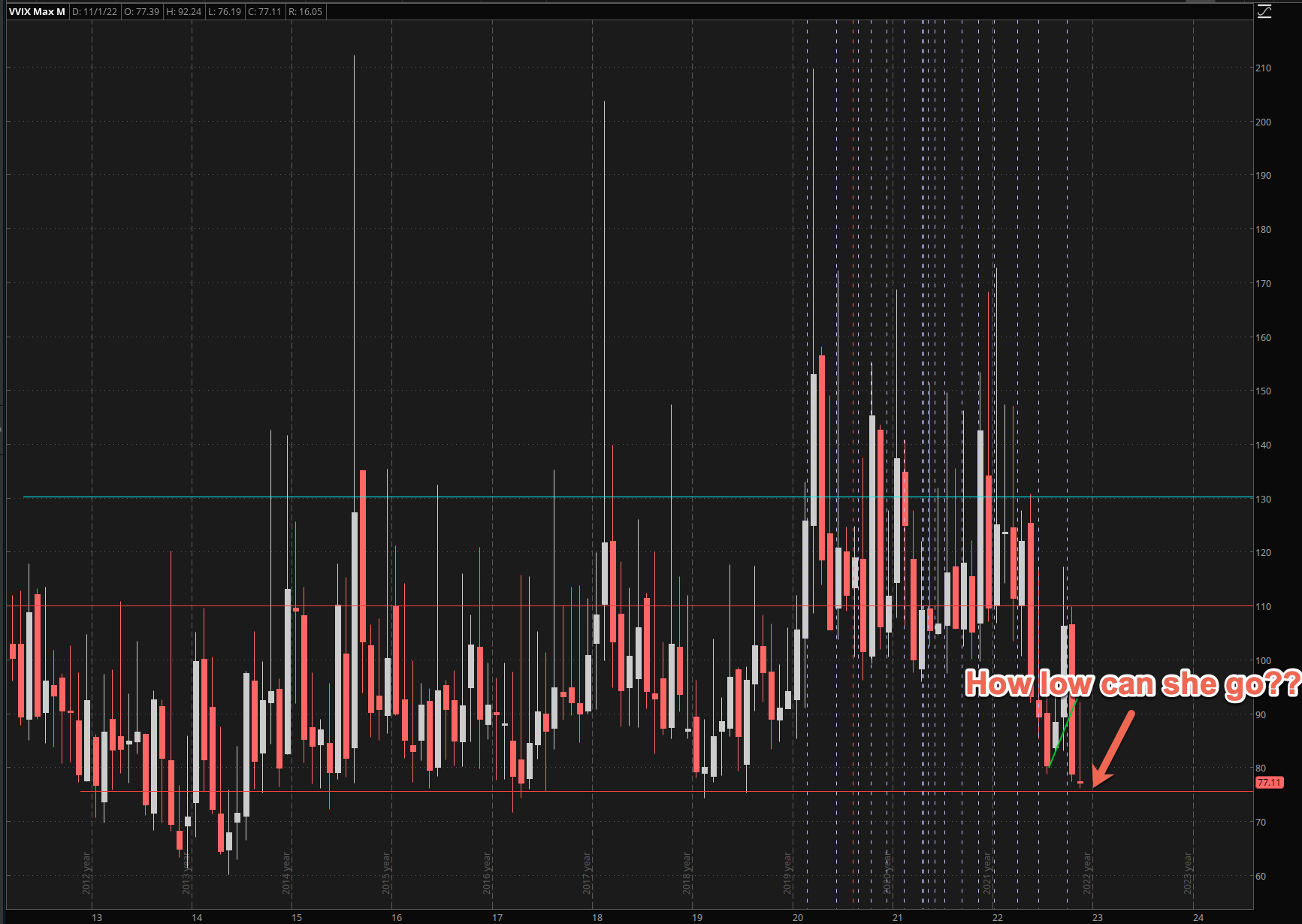

Speaking of selling premium – the VIX is in a very strange place right now:

What do you think will happen next once we paint a floor around the 22 mark?

Oh you no speaky volatility? Allow me to translate…

You see – implied volatility (IV) basically represents the ‘expectation of future risk’.

Makes sense – and the more time the more risk of something going bonkers.

IV happens when option traders are pricing options they sell to others It’s not something that’s being decided by committee or some complicated algorithm. Oh well, there is Black-Scholes and all that crap but that’s for math nerds – real traders focus on risk.

And implied volatility teaches us about risk perception among market participants.

NOT about real risk – it’s all about the expectation of future risk.

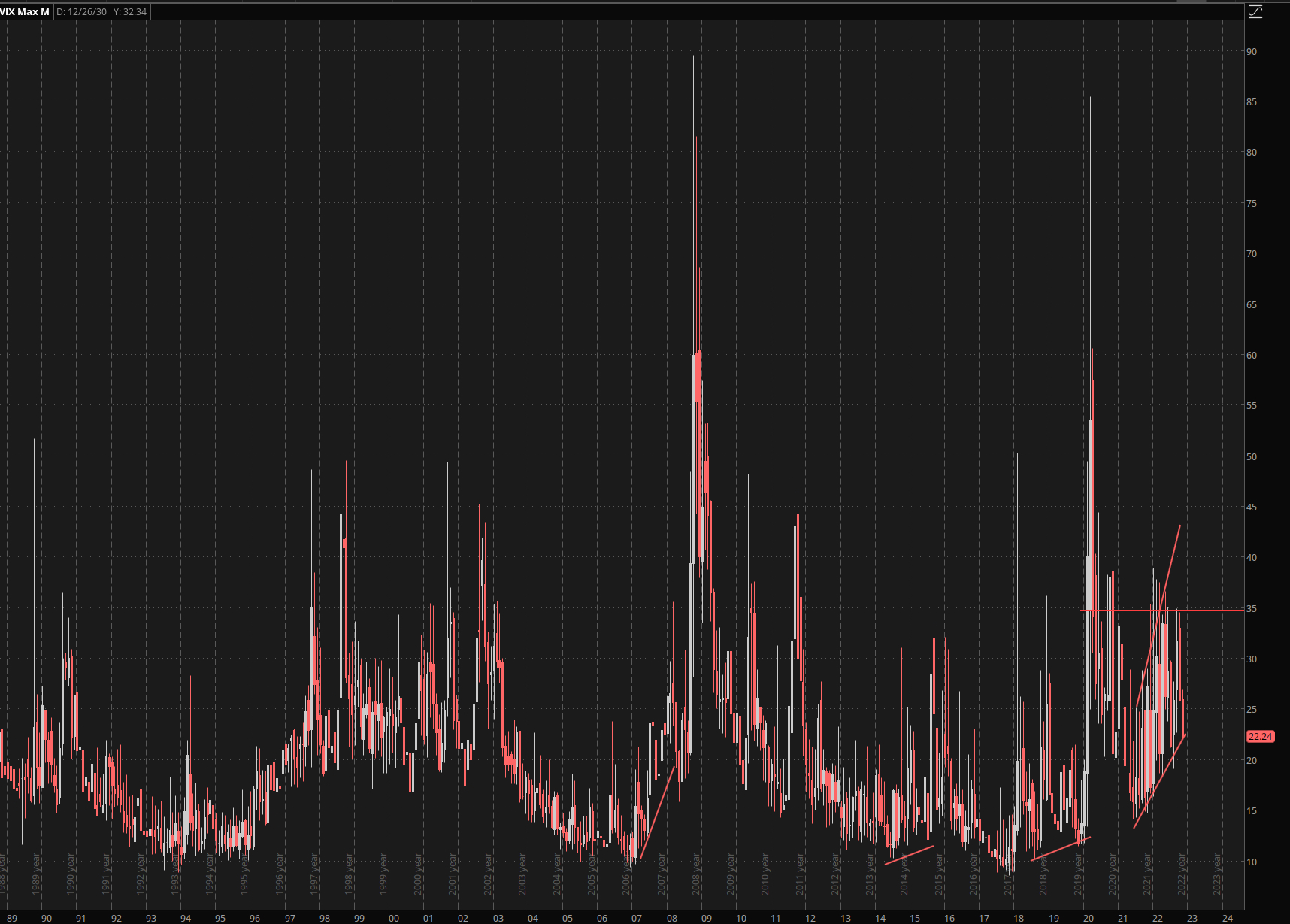

Now where has the VIX been over the past three years?

It hasn’t been < 15 since COVID threw the global economy out of kilter.

At the same time volatility of volatility (basically how wiggly the VIX and the VX futures are) has been near historic lows.

That’s a very strange phenomenon and not one I’ve ever observed in over 20 years of being a trader.

So strap yourselves in – it’s going to get wild in 2023.

Now the question you ‘should’ be asking is this:

“Hey Mike – praise be on you for enlightening us with your deep insights. How can I profit in a way that doesn’t leave me exposed to recessions, interest rate rises, trade wars and pesky plagues?”

Well I’m glad you asked, grasshopper!

The New Economy Bootcamp is an 8 week live event where I’ll be helping you craft a bulletproof wealth creation portfolio for the next decade.

You’ll end up with a rock solid understanding of the new megatrends and a portfolio to profit from them.

It’s all live (although you get the recordings to keep) and it’s all with my quant buddy and long term friend Scott and of course yours truly.

To sweeten the deal we’ve put together a package of the very best trading systems and tools you can imagine.

Everything you need to know is in this document.

When you are ready to buy, just click HERE.

This is only on sale until midnight on Monday next week (cyber monday) or when 100 places are filled

When it runs out it runs out, so get in quick.

Michael