Self awareness is the key to improving all aspects of our life. Most of our demons lurk in the shadows and are invisible to us, otherwise they wouldn’t be demons.

The way this manifests for us is in the form of cognitive bias. I talk a lot about cognitive bias a lot as it relates to trading because it is probably the biggest handicap affecting most traders.

We don’t see our own self-destructive trading habits, yet they are glaringly obvious to us pros who’ve been around the block a few times and back. Not because we’re smarter or wiser, but because we’ve been there and had to develop the skills necessary to prevent cognitive bias from hampering our trading results.

At the extreme, our friends and families start noticing our self-destructive behaviors that hamper our lives. Yet we ourselves often don’t, because we’ve rationalized them with insanity inducing pretzel logic.

To those around it, that is on par with rationalizing that smoking two packs of Marlboros a day has no impact on our health. My father-in-law did just that and when warned about it he always assured us that he preferred to live in the here and now and not worry about future implications.

Of course when he eventually found himself on his deathbed hooked to an oxygen bottle at only 70 years old, he finally admitted deep regrets for not having made better choices when he had the chance.

This behavior is commonly referred to as cognitive dissonance, a term coined by the psychologist Leon Festinger. It’s been well proven by research that our brains have circuits that allow us to invest in delusional thinking in order to maintain our sanity.

As traders, we have to start by checking in with ourselves. How are you feeling right now? Were you up until 5am last night having a wild night out with some Tinder date and are you running on 3 hours of sleep? If so it would probably be wise to take the day off and return to trading once you’re back to normal.

Stressed out about your finances? This is probably the worst possible state to be trading in. The key here is to be brutally honest with yourself. If this is the case, you really need to take the day or even the week off.

Because if you’re in this frame of mind, you’re likely to be making horrible trading decisions. Yes, been there and done that. And I’m not going back.

When you’re stressed out about anything related to money, your trading decisions are going to come from a bad place. Trading needs to come from the space of mastering trading, not making trades because “you need to pay your bills this month.” Violating this rule is likely to work out very badly.

When I’m IN THE ZONE, I’m chilled, feeling good and I’m trading from a place of mastering the game. Some days that means I take my lumps of -2.5R and call it a day. Other days it means taking 7R out of the market and calling it a day.

You have to trade the market you have, not the one you want. My ideal market would be one where I wake up, and it just continually grinds up from the open until the close with no pull backs. All I have to do is enter some long trades and let the profits roll in.

There are days where that happens – albeit a lot more rarely in the past few years. But in the end it’s cosmic synchronicity and I can’t force that to happen. It just happens.

When am I *IN THE ZONE*? On days when I’m feeling good, relaxed and probably did some hard hitting exercise the evening before. When I’m relaxed, I’m more self aware. When I’m more self aware, I see things as they are and less subject to my own cognitive bias.

When we are stressed out, we are not operating from a place of self awareness. This is when our demons take over and start invading our decision making with all sorts of bad mojo. Which in turn leads to even worse trading decisions.

Again I’ve been there. It’s a vicious cycle and believe me when I tell you that it takes a lot of energy to bounce back from that.

Some people need the stress of a deadline to get things done, but this is a completely different type of affair. The type of stress you should face as a trader is more of a kick-in-the-ass to our own laziness to get things done.

It’s a form of eustress. When you get into the zone and realize you’re going to get things done, it puts you into a positive flow state. Or what I like to refer to as being IN THE ZONE.

Part of being a good trader is developing practices that improve your trading. Every time I start feeling the heat around the corner I know that it’s time to activate my ZERO F*KS GIVEN practice, or ZFG in short. Which in most cases means heading out for a nice ride or taking the day off and heading into nature for some adventure.

What is your ZFG practice? How do you battle your own inner demons? Feel free to share your own story.

Before you run: the new year is here and it’s time to put yourself on the fast track to building your own trading business.

With RPQ Unlimited, you’ll receive all the trading education you will ever need to be a successful trader.

We believe it is crucial to immediately start growing your trading account just like a professional: slowly and consistently.

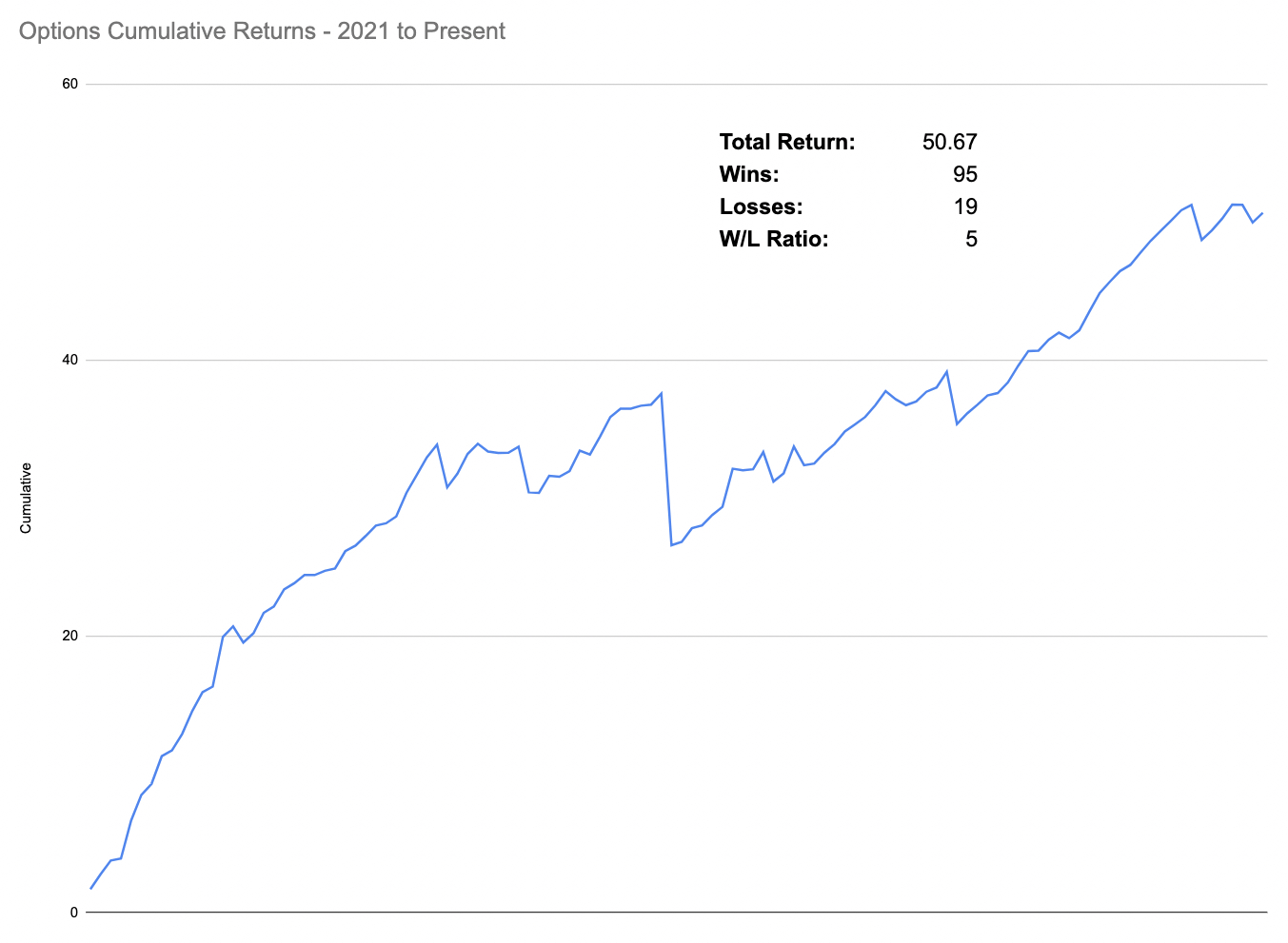

Which is why we’ll be spoon feeding you live quant trades that you’ll place alongside us. Trades from proven market specific strategies, with a proven track record that institutional firms keep under lock and key.

A LIVE cumulative P&L with all trades over the past year can be found here.

You can sign up right here.

See you on the other side.