Strike it up to my Austrian upbringing but I absolutely love the month of December. Putting aside COVID epidemics and the current social upheaval across the West for a moment, it still ranks high on my favorites months of the year list, right after April and – of course – lovely May. And not just for the usual reasons like the Advent Season, the anticipation of Christmas Day, New Year’s Eve, batches of Glühwein (mulled wine), snuggly movie nights with the Mrs. in front of a crackling fire. It’s also my favorite month when it comes to my biggest passion, which of course is trading the markets.

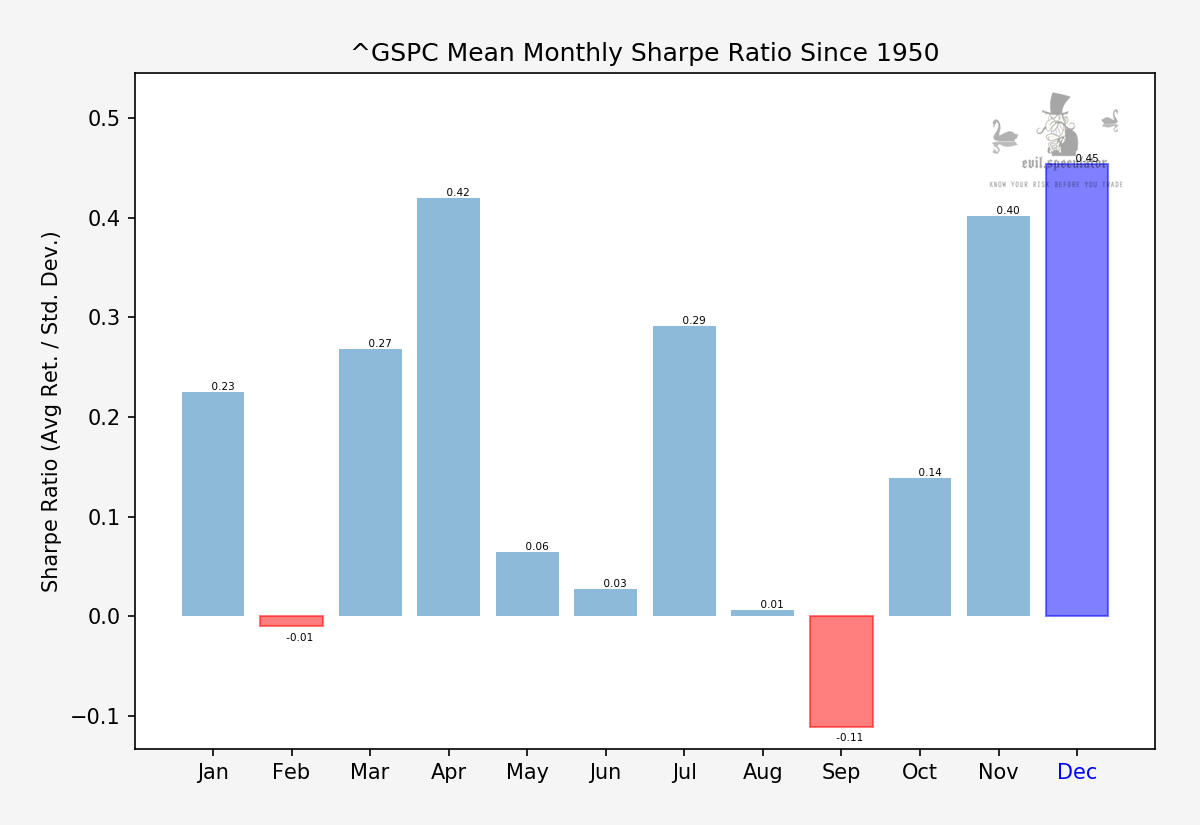

And to be honest, what’s not to love? Statistically December ranks as the #1 on our Sharpe ratio chart right after November and April.

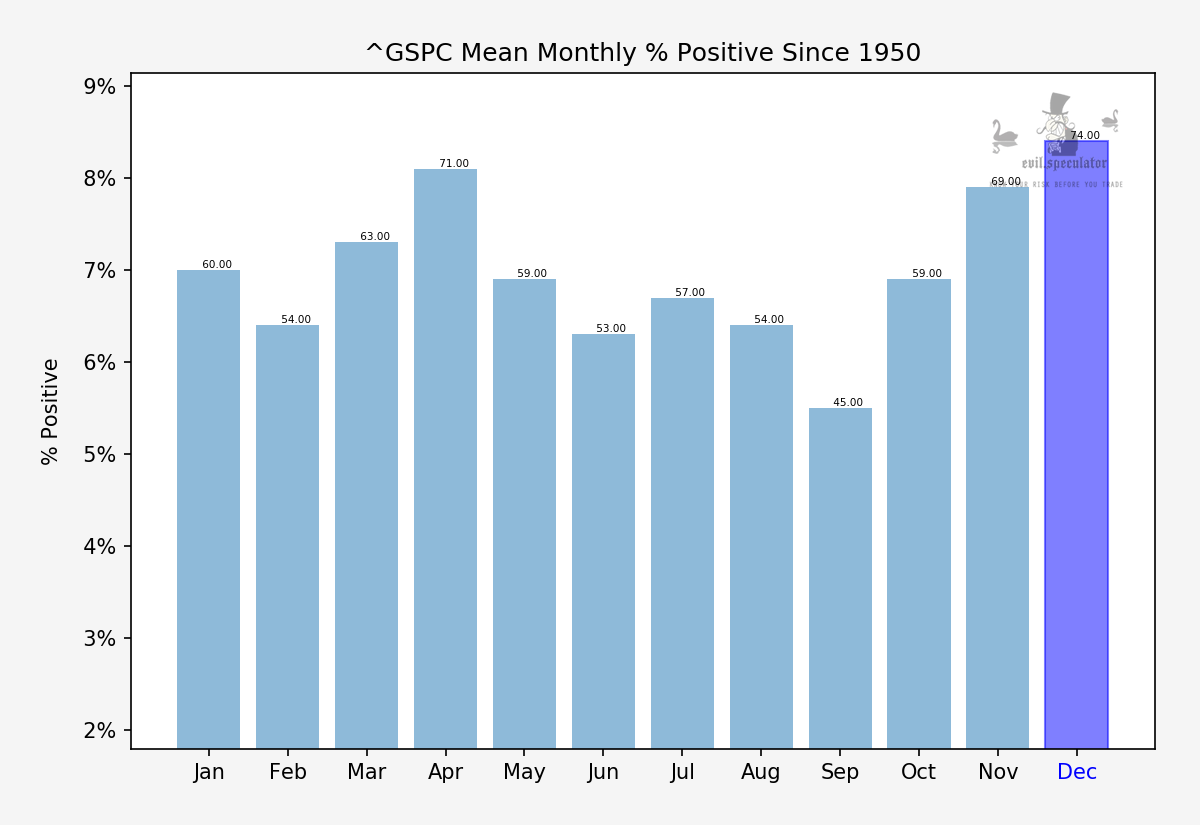

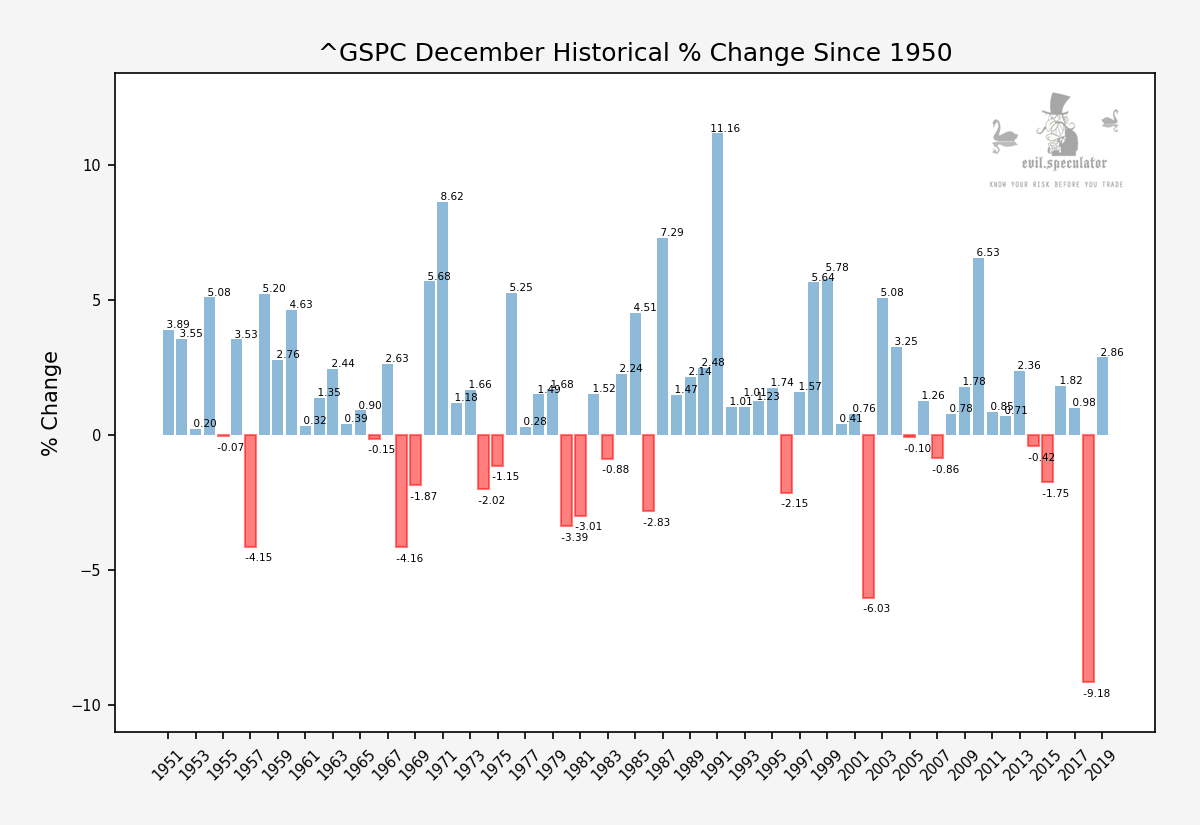

Percent positive stands at a whopping 74% – once again the best of all twelve months.

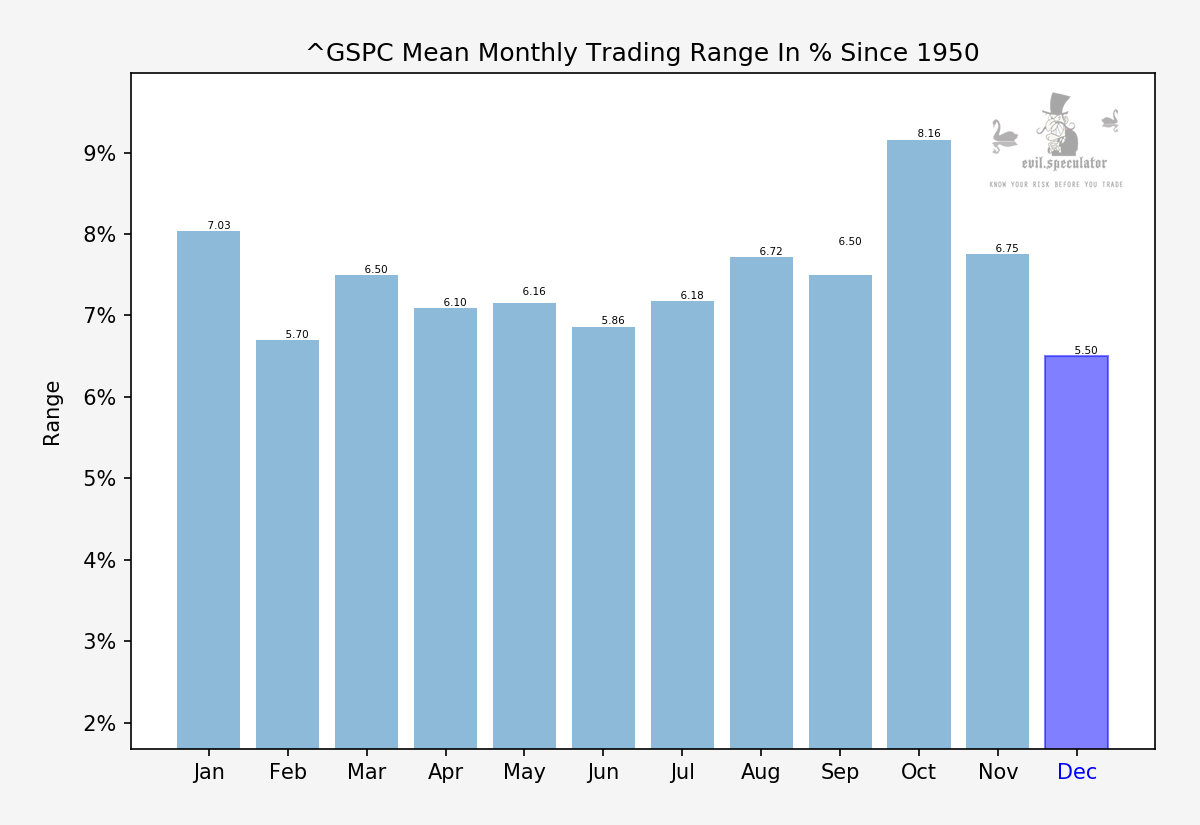

Trading range meanwhile is the smallest of the year. That’s how we like it!!

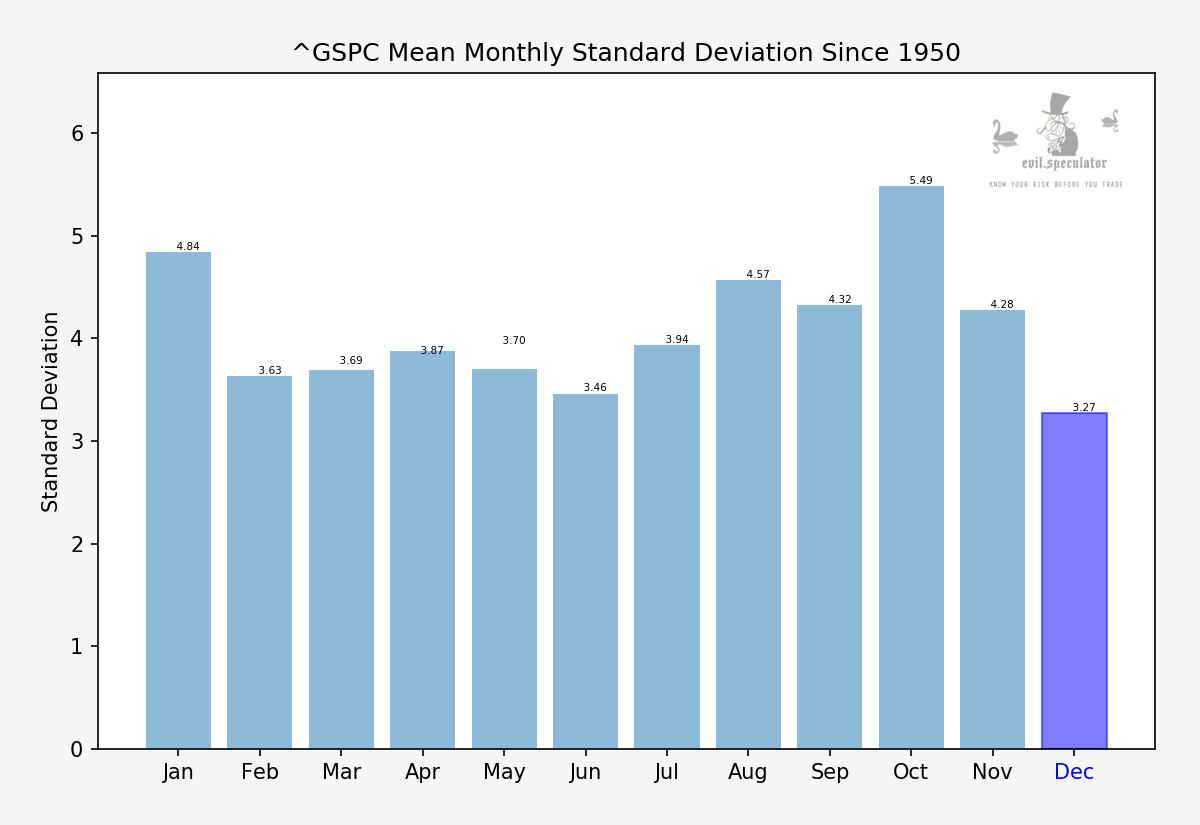

December is also ranking on the bottom when it comes to standard deviation, which expresses the variation inside a dataset. This points toward a cohesive, fairly ordered, sequence of returns.

Here it is in all its glory. its worst year ever in fact was in 2018. Overall there’s a sea of positive returns interrupted by the occasional downer year.

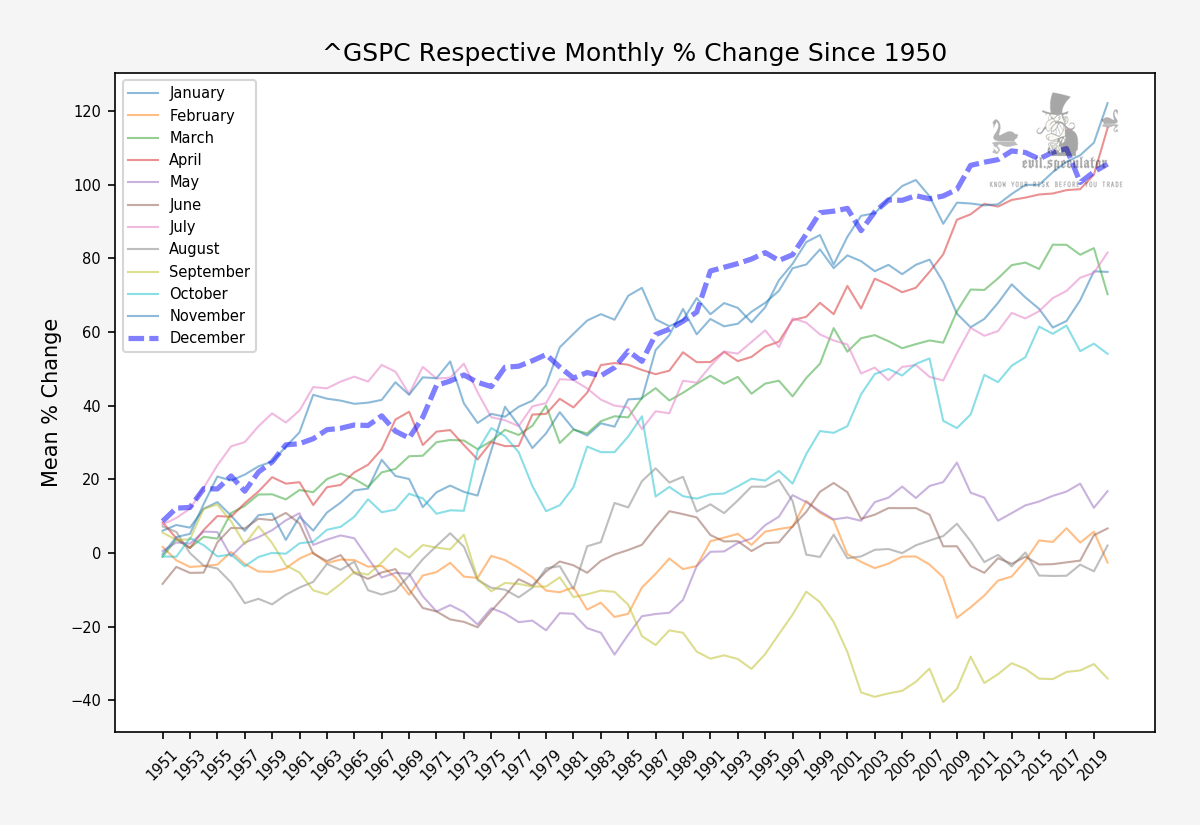

So it’s no surprise to see December as the best earning month when compared to all others. The graph shows the progression over time had you done nothing all year, only placed your bet on the first December session and cashed out on the last trading day of the year.

So is it time to back up the truck and load up? Well, not so fast. The devil – as usual – lurks in the details:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.