Equities closed September solidly in the red, as was suggested by our monthly statistics that I posted here early in the month. Of course nothing is ever chiseled in stone in the world of trading. But the odds are the odds, and until my crystal ball is back from the shop that’s what we’ll have to content with.

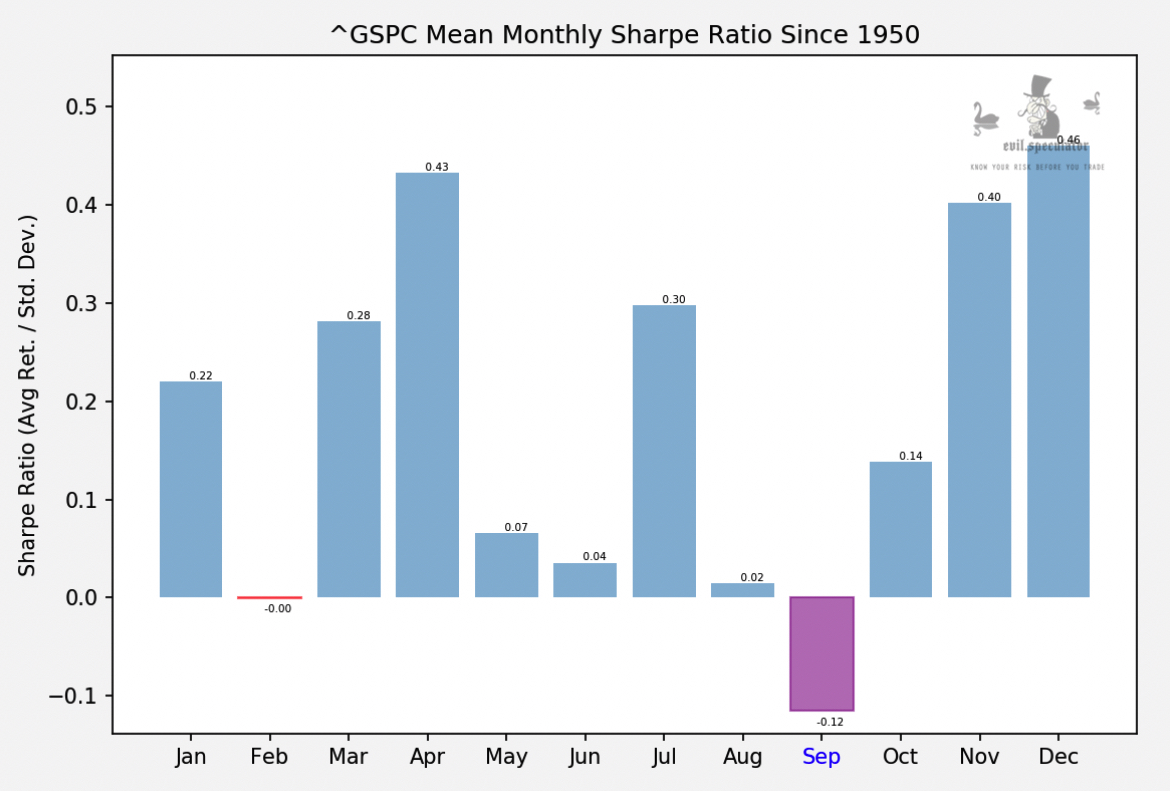

I find it quite compelling that the first negative month since January had to occur in September, especially given this:

As you can see January went against the monthly stats but September more than made up for it. I’ve often mused that September delivers what October promises but I simply could not resist the lure of a good headline 😉

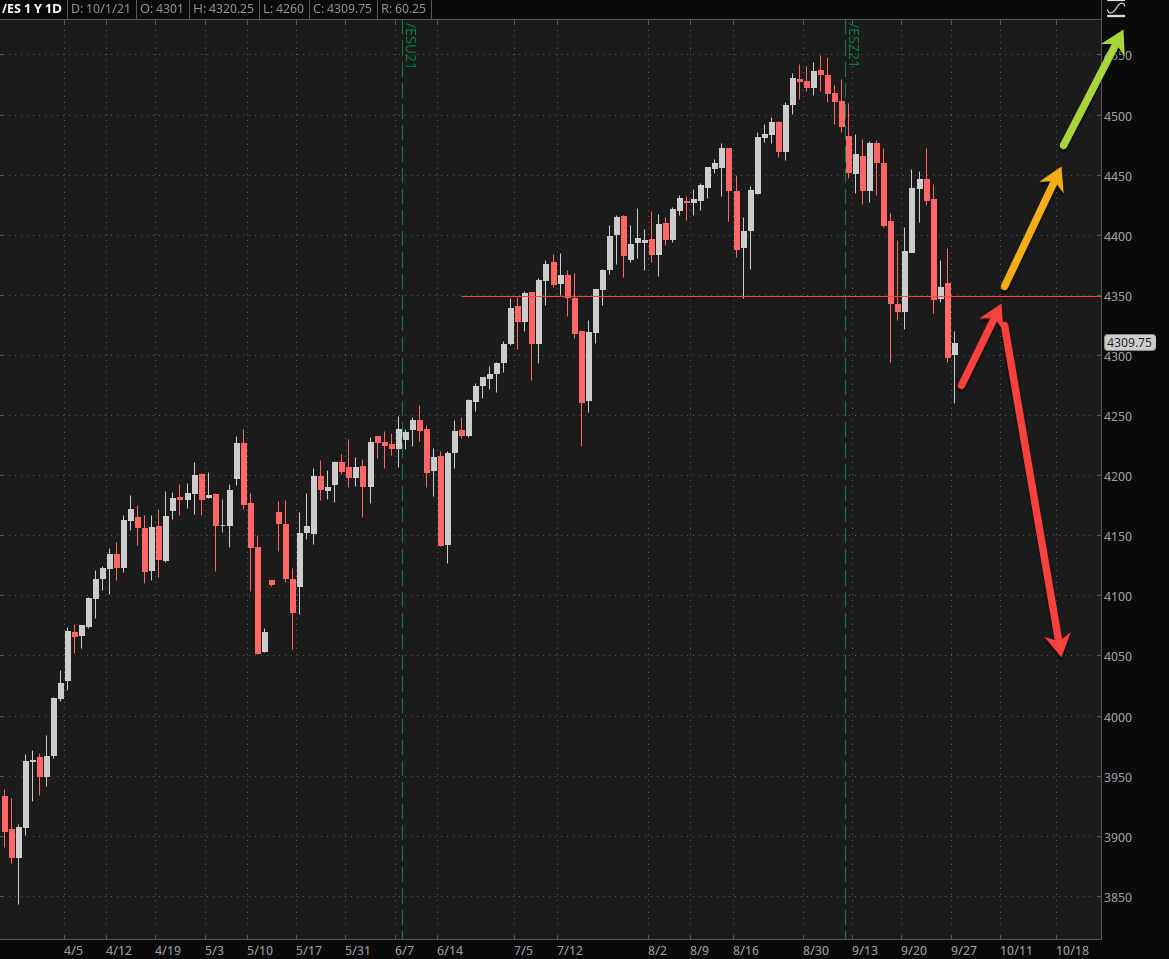

Alright, so let’s talk about what happens next. The futures are recovering a bit after an overnight excursion lower, so the question in everyone’s mind is whether or not we’re going straight down from here.

I personally have my doubts and am currently considering two high probability scenarios and one that’s in the 20 percentile max.

- We pop from here and keep on running higher.

- We pop a bit from here, retest ES 4350 and then fall back toward ES 4050 or perhaps 4000.

- We fall from here and don’t stop until the ES 4000 mark.

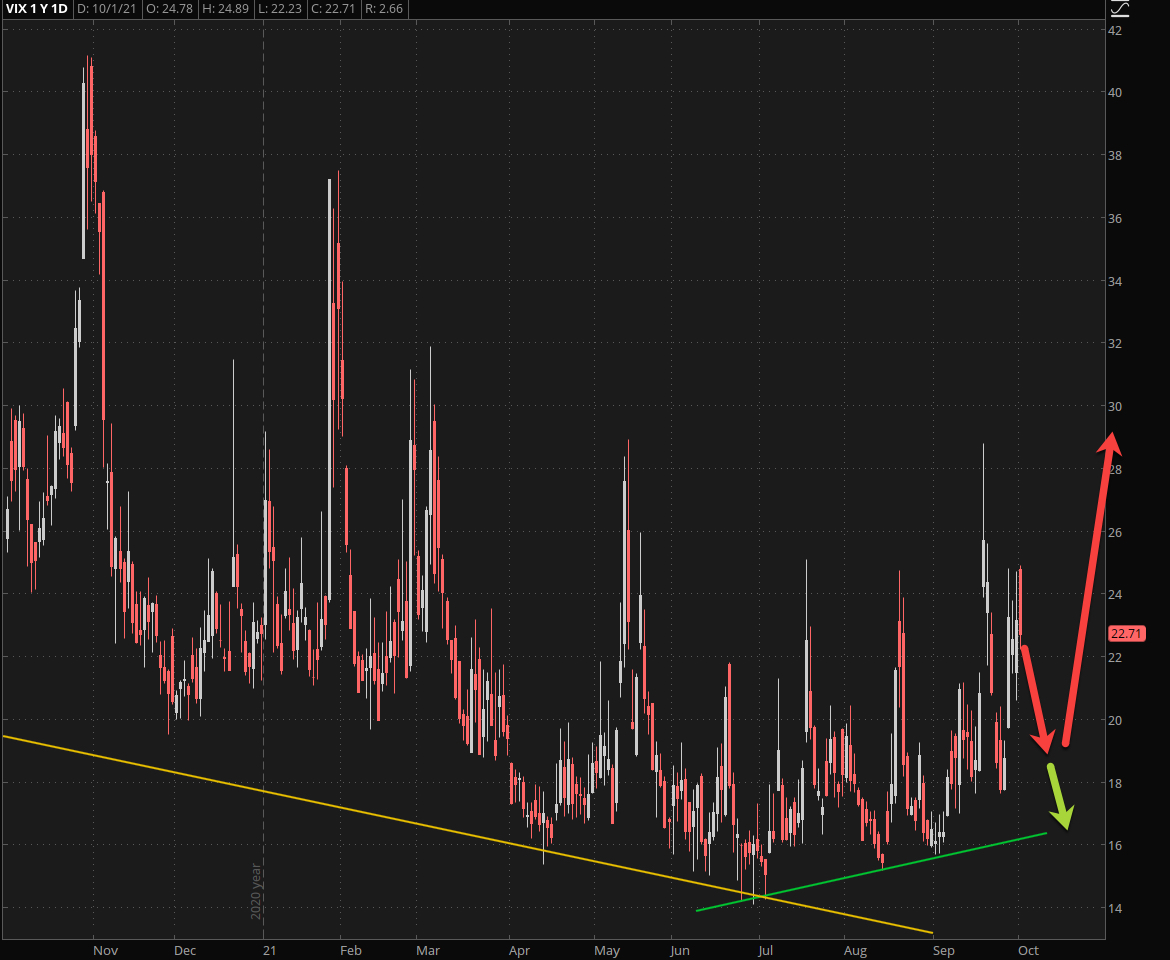

My reason for dismissing scenario 3 as having the lowest probability is mainly what I am seeing in implied volatility right now. The VIX fell all day yesterday plus there is this little monkey:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.