Okay let me give it to you straight: There is absolutely nothing to be done right now. Nope – this isn’t clickbait. There’s a reason I’m posting it just like this. Hear me out.

You may have noticed that I haven’t been saying much about crypto over the past two weeks.

Main reason: I hate to bore you with idle chatter and charts that are academic at best and serve no utility. We both have better things to do.

Second reason: We are stuck smack middle in the crypto lull and there simply isn’t much to be said or to be done.

Which actually seems to be a difficult idea to grasp for many people.

In my experience over the years – and after having talked to literally thousands of traders – one the hardest skills to learn for most is realizing when to just sit back and do absolutely nothing.

Look, evolution has wired our monkey brains wanting to take action and to affect our environment.

How often in your life have you heard someone say something along the line of: “This isn’t going my way – I have to do something!”

Well actually, maybe you don’t. Maybe the situation will resolve by itself without you meddling and potentially setting fire to the entire barn.

Always remember the #1 rule of how to achieve victory courtesy of Sun Tzu:

“He will win who knows when to fight and when not to fight.”

Maybe you won’t believe me but I hope you’ll pay attention to someone who perfected strategic warfare thousands of years before you and I were ever born.

Projecting this basic principle of subjugating your enemy into the realms of trading isn’t rocket science:

As opposed to forcing the issue and wasting time, energy, and resources, simply let the market come to you.

Which it has refused to do thus far. We got our anticipated retracement but then BTC was stopped right in its track near its psychologically important $30k mark.

The crypto sector as a whole seems to also have hit what I call the ‘great wall’. On the surface nothing seems to be going on.

Of course that’s not entirely true. What’s going on behind the scenes is what in the (trading) industry is referred to as ‘accumulation’.

Let me share an interesting statistic that may surprise you:

In Q2 2023 Coinbase’s total trading volume was comprised of $14 billion in retail and $78 billion in institutional trades.

Trading volume as a whole dropped by over 30% – which isn’t surprising for the summer.

But what stands out here is that retail checked out for the summer while institutional trading continues unabated.

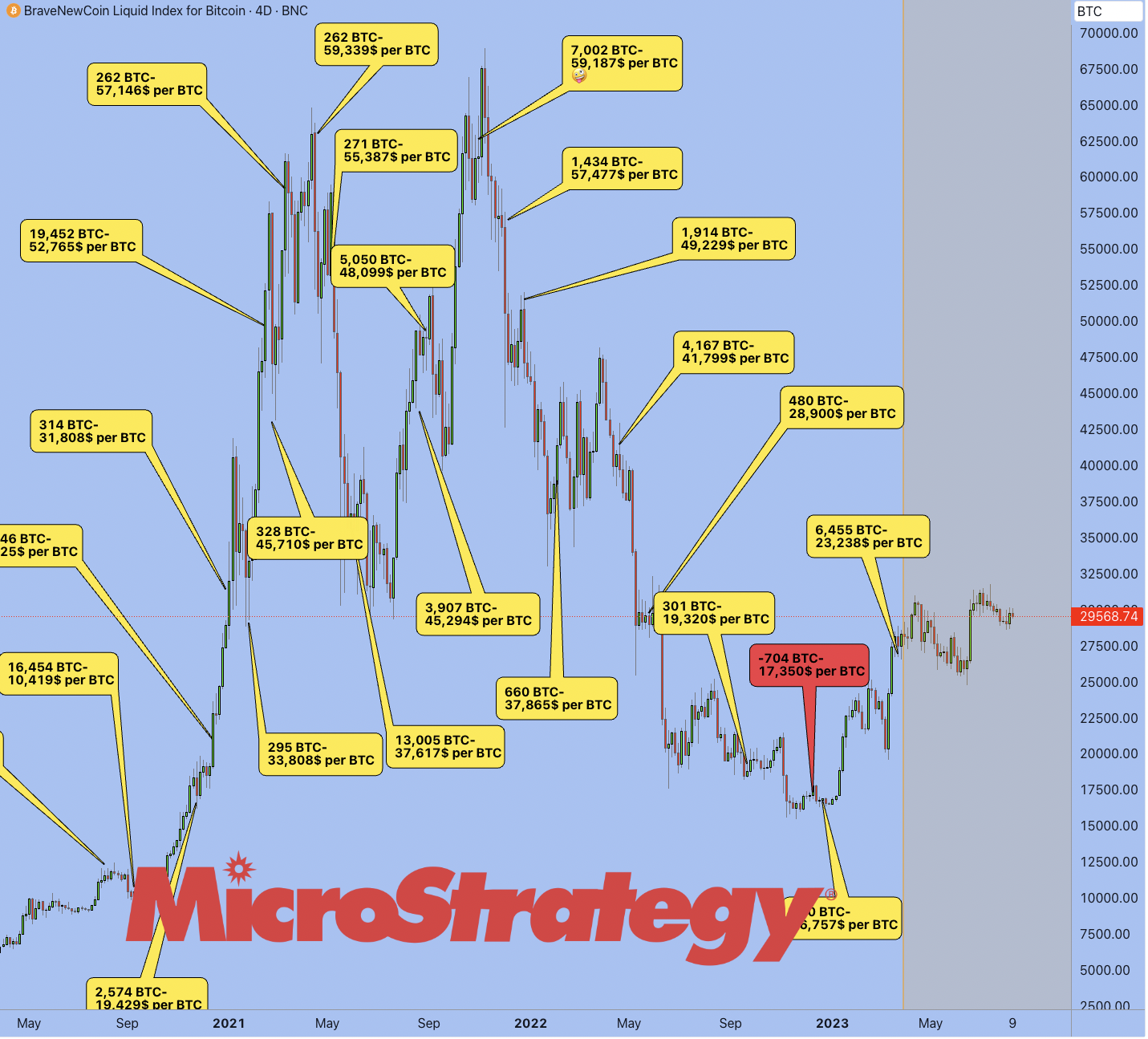

And they aren’t selling either. In fact MicroStrategy just bought another $347 Million worth of BTC in late June (not shown on the chart above yet).

Let’s face it – the whales are usually ahead of the curve when it comes to major tops and bottoms.

Based on this on-chain metric the whales weren’t just the first ones out shortly after the $67k ATHs, they also have been accumulating steadily since the $16k lows.

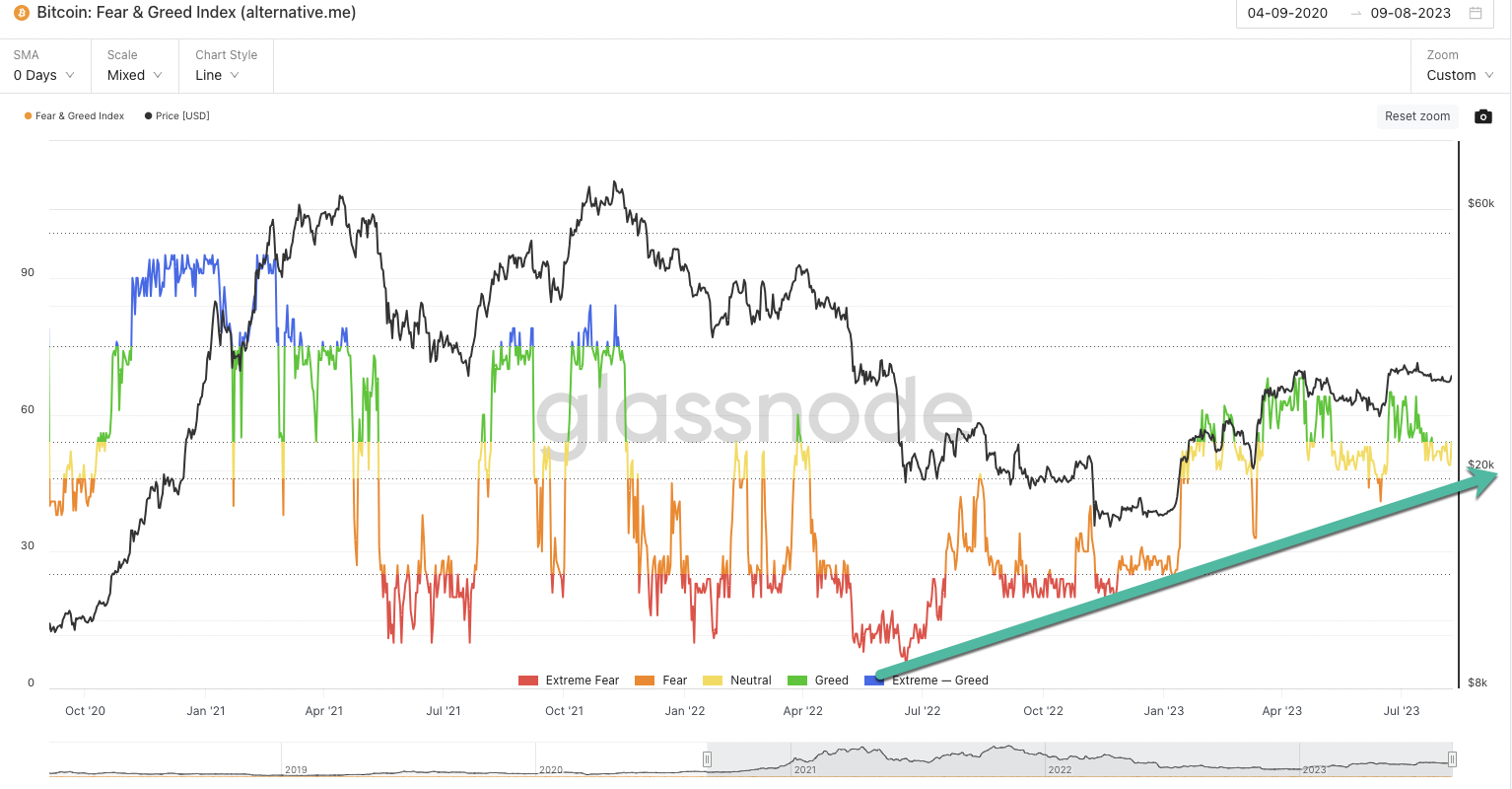

The fear & greed index is currently in neutral mode – basically nobody outside of institutions and the usual suspects really cares about crypto right now.

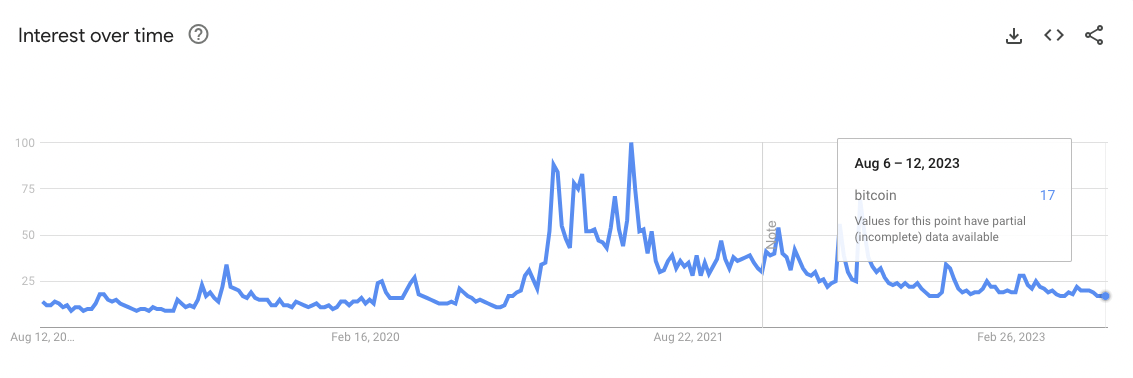

Google Trends for ‘bitcoin’ tells a very similar story. Based on correlating this signal with a daily BTC chart retail usually doesn’t wake up and/or get active until we’re approaching previous ATHs.

Don’t be that guy (or gal). Think strategic – think long term.

Of course figuring out when not to take action is probably as tricky as deciding when to actually pull the trigger.

In this manic depressive byatch of a market timing is everything.

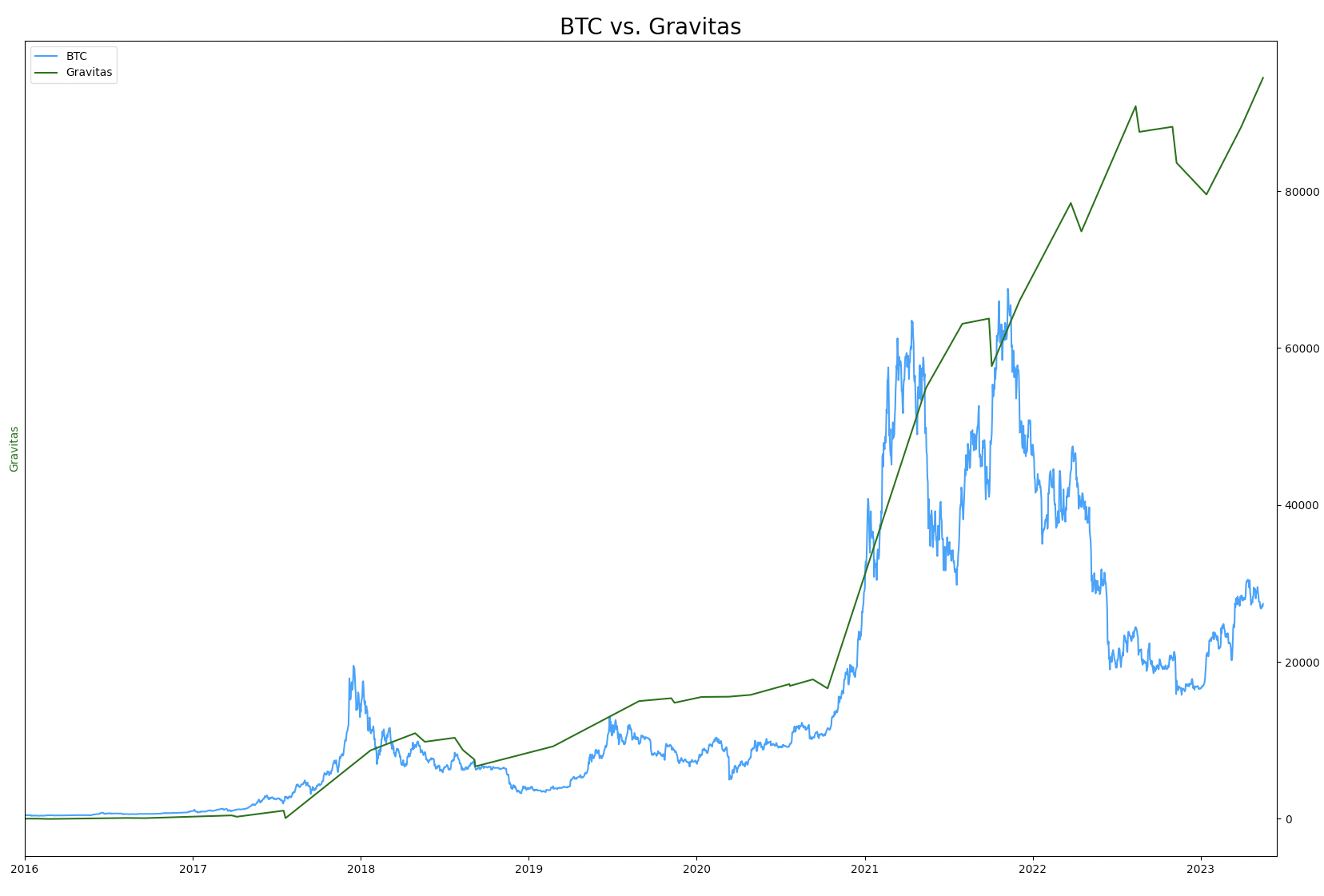

Which is why I built a long term trend trading signal that is impervious to minor market cycles and continues to keep me on the right side of the tape.

And it’s been holding up like a champ recently, keeping me positioned properly while not getting sucked into short term whipsaw.

Remember, the whole idea behind trading the greater trend isn’t to pick tops or bottoms. It’s about remaining on the right side of the tape when it matters the most.

And that’s what Gravitas is really good at. Plus it’s a long term signal, at the very most you take action once per month on average. Perfect for the busy operator.

Besides, the results speak for themselves, so if you’re interested shoot us a message today and we’ll get you set up just in time before the next leg higher.

Happy trading.

Cheers,

Michael